Finance and Performance

Committee

28

April 2017

Order

Paper for the meeting to be held in the

Council

Chambers, 2nd Floor, 30 Laings Road, Lower Hutt,

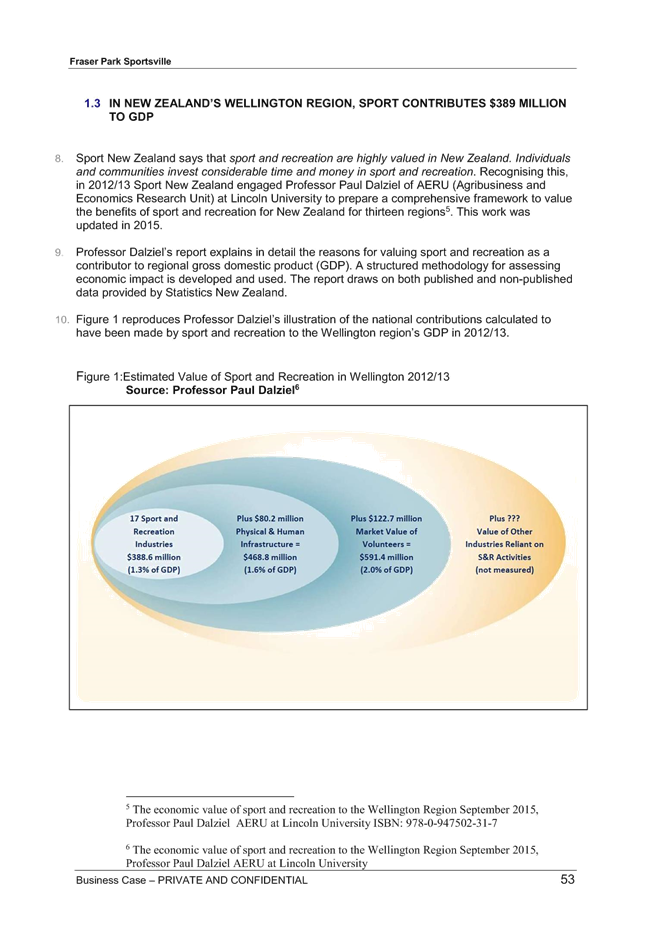

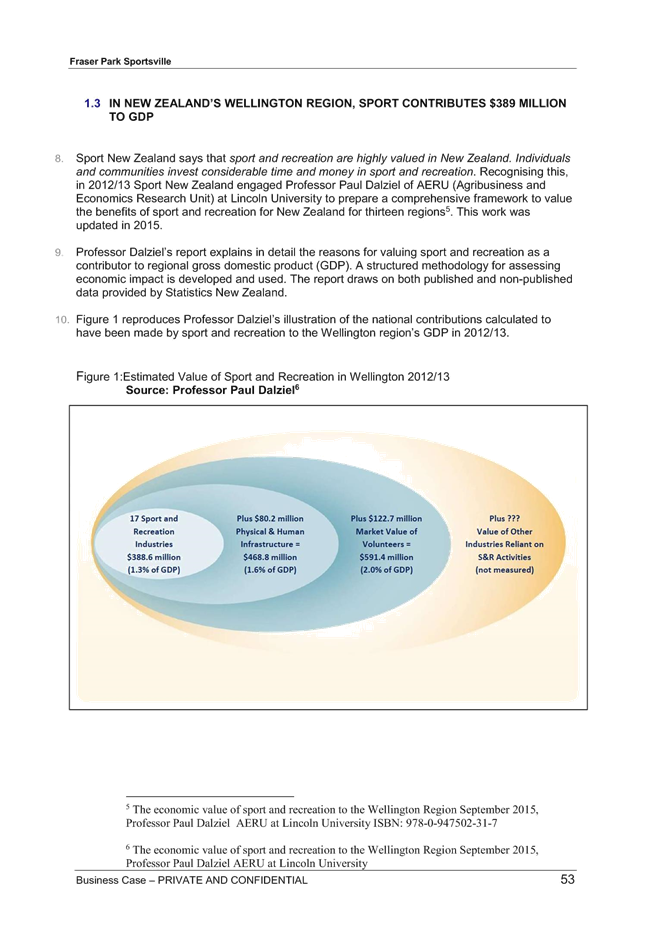

on:

Wednesday 3

May 2017 commencing at 5.30pm

Membership

Cr C

Milne (Chair)

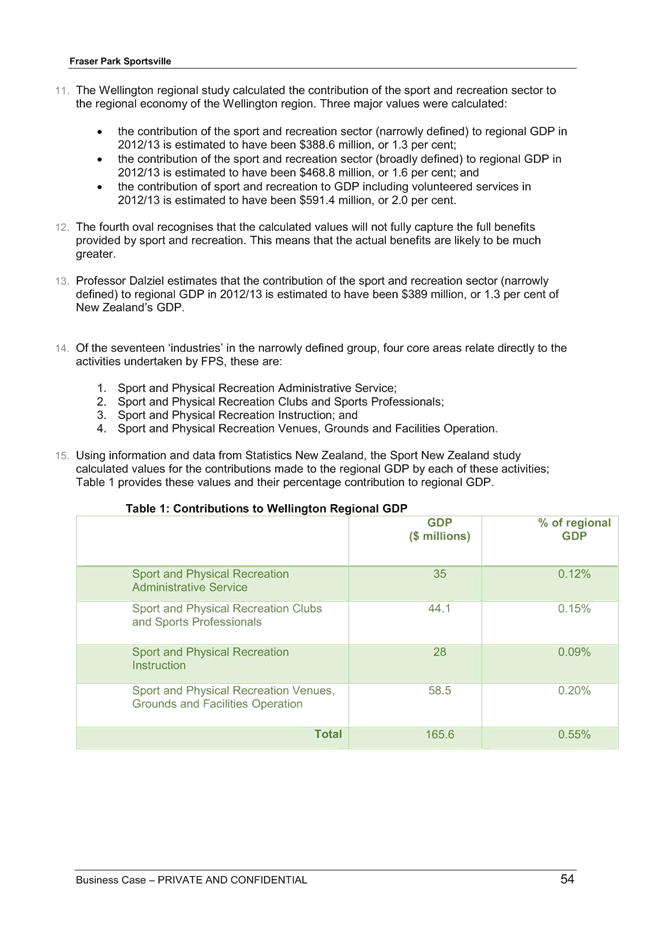

Cr C

Barry (Deputy Chair)

|

Deputy Mayor D Bassett

|

Cr G Barratt

|

|

Cr J Briggs

|

Cr M Cousins

|

|

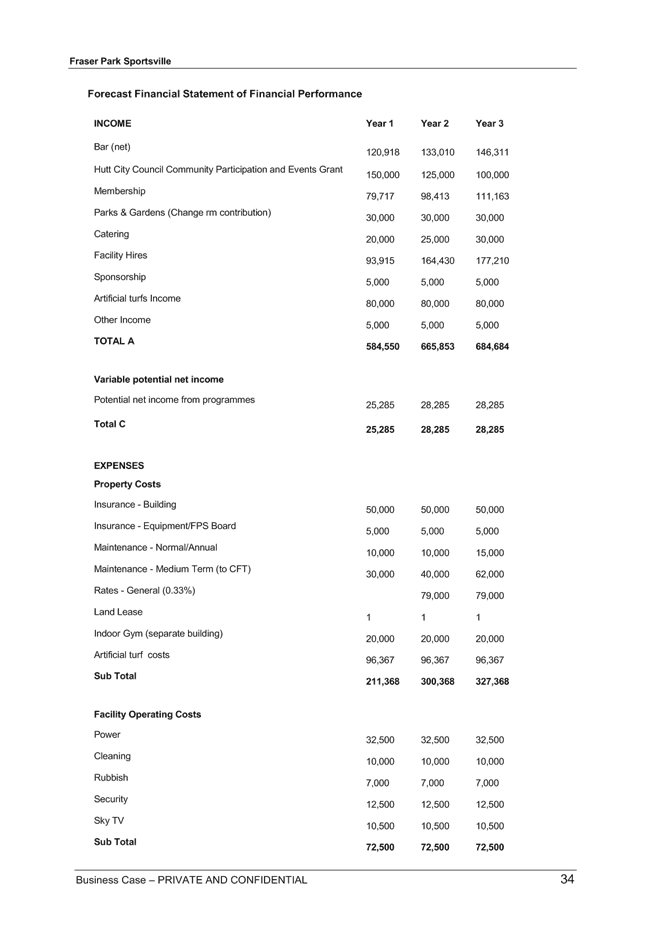

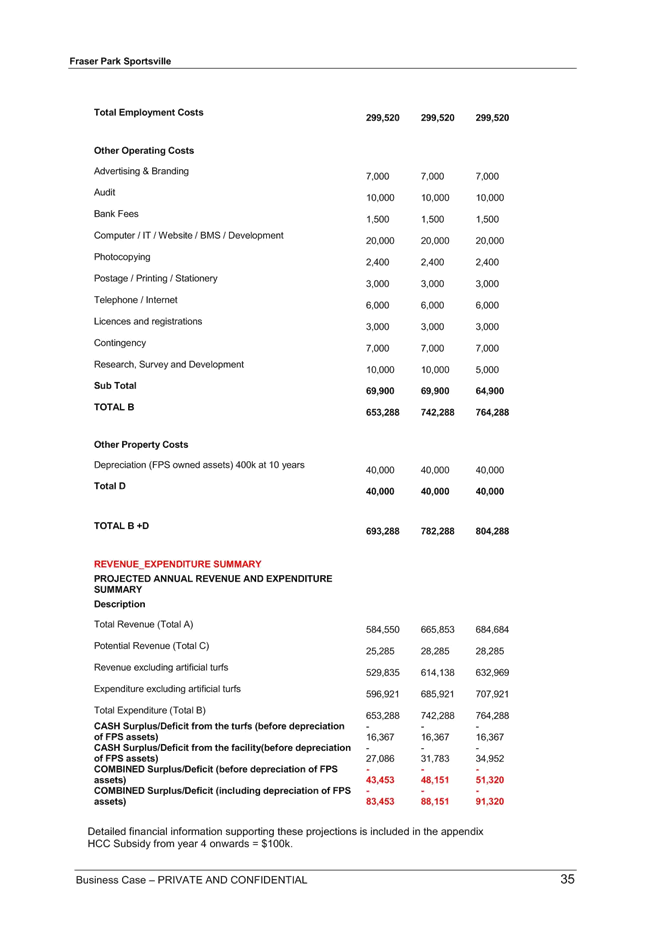

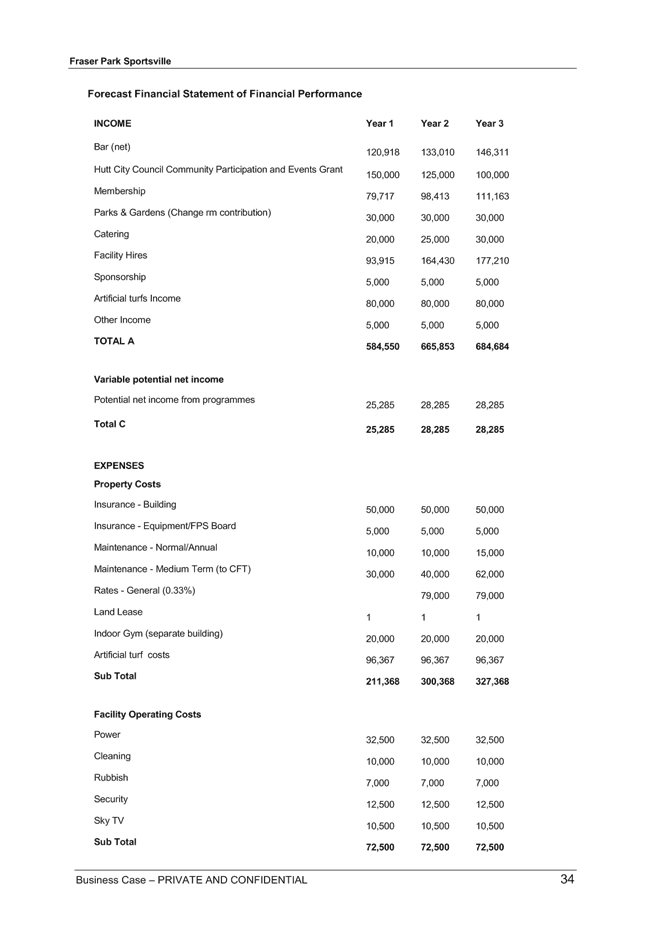

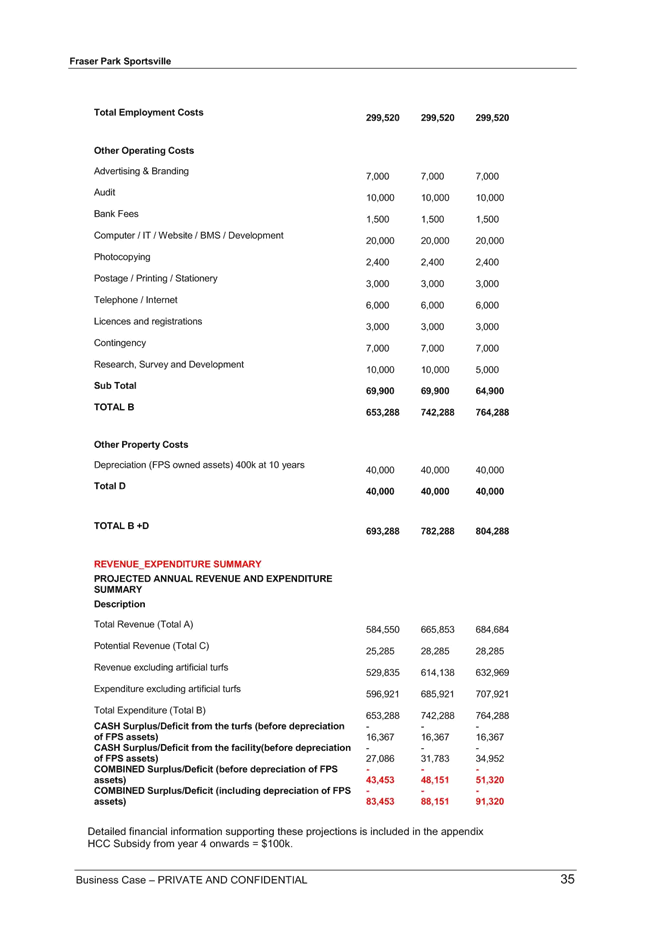

Cr S Edwards

|

Cr M Lulich

|

|

|

|

Cr L Sutton

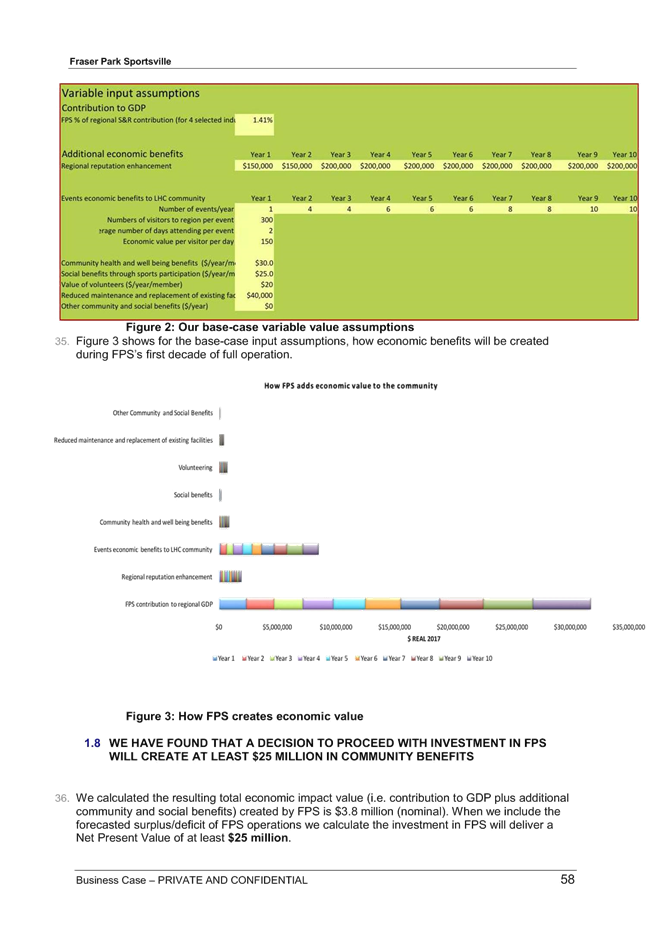

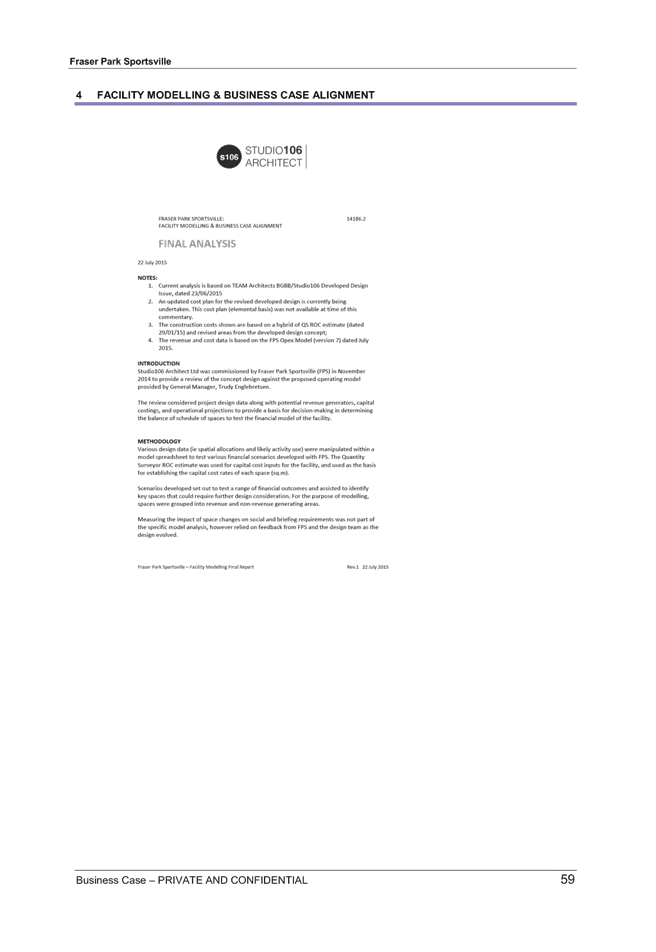

|

Mayor W R Wallace (ex-officio)

|

For

the dates and times of Council Meetings please visit www.huttcity.govt.nz

|

|

|

FINANCE AND PERFORMANCE COMMITTEE

|

|

Membership:

|

10

|

|

Meeting Cycle:

|

Meets on a six weekly basis, as required

or at the requisition of the Chair

|

|

Quorum:

|

Half of the members

|

|

Reports to:

|

Council

|

PURPOSE

To assist the Council

execute its financial and performance monitoring obligations and associated

risk, control and governance frameworks and processes.

Determine and monitor:

•

Maintain an overview of

work programmes carried out by the Council’s organisational activities

(excluding strategy and policy development).

•

Progress towards achievement of the

Council’s objectives as set out in the LTP and Annual Plans.

•

Revenue

and expenditure targets of key City Development Projects.

•

The effectiveness of the internal audit, risk

management and internal control processes and programmes for the Council for

each financial year.

•

The integrity of reported performance

information, both financial and non-financial information at the completion of

Council’s Annual Report and external accountability reporting

requirements.

•

Oversight of external auditor engagement and

outputs.

•

Compliance with Council’s Treasury Risk

Management Policy,

•

Requests for rates remissions.

•

Approval of overseas travel for both elected

members and officers.

•

Requests for loan guarantees from qualifying

community organisations where the applications are within the approved

guidelines and policy limits.

Consider

and make recommendations to Council:

•

The adoption of the budgetary parameters for the

LTP and Annual Plans.

•

The approval of The Statements of Intent for

Council Controlled Organisations, and Council Controlled Trading Organisations, and monitoring progress against the Statements of

Intent.

•

The adoption of the Council’s Annual

Report.

General:

•

Any other matters delegated to the Committee by

Council in accordance with approved policies and

bylaws.

•

Approval and forwarding of submissions on

matters related to the Committee’s area of

responsibility.

Finance and Performance Committee

Meeting

to be held in the Council Chambers,

2nd

Floor, 30 Laings Road, Lower Hutt on

Wednesday

3 May 2017 commencing at 5.30pm.

ORDER

PAPER

Public Business

1. APOLOGIES

2. PUBLIC

COMMENT

Generally up to

30 minutes is set aside for public comment (three minutes per speaker on items appearing on the agenda). Speakers may be

asked questions on the matters they raise.

3. CONFLICT

OF INTEREST DECLARATIONS

4. Recommendations to Council - 23 May

2017

a) Urban Plus

Limited - Amendment to Constitution (17/667)

Report

No. FPC2017/2/122 by the Portfolio Manager, Urban Plus 4

Chair’s Recommendation:

|

“That the recommendations contained

in the report be endorsed.”

|

b) Appointment

of Trustees to Hutt City Community Facilities Trust (17/549)

Report No.

FPC2017/2/103 by the General Manager Community Services 26

Chair’s

Recommendation:

|

“That the recommendations contained

in the report be endorsed.”

|

c) Response

to Fraser Park Business Case (17/603)

Report No.

FPC2017/2/121 by the General Manager Community Services 34

Chair’s

Recommendation:

|

“That recommendations (i) and (ii) contained

in the report be endorsed, and recommendation (iii) be amended as follows:

(iii) agrees that a condition of annual

funding will be, that FPS formally report to Council on a six monthly basis

within its annual report and in particular progress against the Business

Case.”

|

5. Finance Update

(17/602)

Report

No. FPC2017/2/104 by the Chief Financial Officer 109

Chair’s Recommendation:

|

“That the report be noted.”

|

6. Information Item

Finance and

Performance Work Programme 2017 (17/625)

Report

No. FPC2017/2/69 by the Committee Advisor 144

Chair’s Recommendation:

|

“That the report be noted.”

|

7. QUESTIONS

With reference to

section 32 of Standing Orders, before putting a question a member shall

endeavour to obtain the information. Questions shall be concise and in writing

and handed to the Chair prior to the commencement of the meeting.

8. EXCLUSION

OF THE PUBLIC

CHAIR'S

RECOMMENDATION:

“That the

public be excluded from the following parts of the proceedings of this meeting,

namely:

9. Response to Hutt City Community Facilities

Trust Funding Proposal (17/605)

The general subject of each matter to be considered while

the public is excluded, the reason for passing this resolution in relation to

each matter, and the specific grounds under section 48(1) of the Local

Government Official Information and Meetings Act 1987 for the passing of this

resolution are as follows:

|

(A)

|

(B)

|

(C)

|

|

|

|

|

|

General subject of the matter to be considered.

|

Reason for passing this resolution in relation to each

matter.

|

Ground under section 48(1) for the passing of this

resolution.

|

|

|

|

|

|

|

|

|

|

Response to Hutt City Community Facilities Trust Funding

Proposal.

|

The withholding of the information is necessary to enable

the local authority to carry out, without prejudice or disadvantage,

commercial activities (s7(2)(h)).

|

That the public conduct of the relevant part of the

proceedings of the meeting would be likely to result in the disclosure of

information for which good reason for withholding exist.

|

This resolution

is made in reliance on section 48(1) of the Local Government Official

Information and Meetings Act 1987 and the particular interest or interests

protected by section 6 or 7 of that Act which would be prejudiced by the

holding of the whole or the relevant part of the proceedings of the meeting in

public are as specified in Column (B) above.”

CHAIR’S RECOMMENDATION:

“That

Mr Alister Skene and Mr Peter Healy, of Hutt City Community Facilities Trust,

be permitted to remain after the public during consideration of item 9

-“Response to Hutt City Community Facilities Trust Funding

Proposal” as they have knowledge of the matter to be discussed that will

assist the Committee in relation to this item.”

Annie Doornebosch

COMMITTEE ADVISOR SECRETARIAT SERVICES

Finance

and Performance Committee

Finance

and Performance Committee

12 April 2017

File: (17/667)

Report

no: FPC2017/2/122

Urban Plus Limited -

Amendment to Constitution

Purpose

of Report

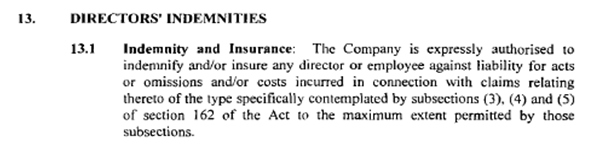

1. The

purpose of this report is to seek Council approval to amend the Constitution of

Urban Plus Limited (UPL), to enable its Directors to provide indemnity to

Directors and employees of its current and any future subsidiary companies

relating to potential liabilities arising from the performance of their duties

as directors.

|

Recommendations

That the Committee recommends

that Council:

(i) approves the amendment to the UPL Constitution attached as

Appendix 3 to the report, regarding the ability for Urban Plus Limited (UPL)

Directors to provide indemnity to Directors and employees of its current and

future subsidiary companies; and

(ii) notes that a Deed of Indemnity will also have to be entered into

as part of this proposal; and

(iii) notes

that the purpose is to provide indemnification to previous (retired), current

and future Directors and employees of UPL subsidiary companies.

|

Background

2. With

the approval from Hutt City Council’s Chief Executive, UPL has created a

subsidiary company Fairfield Waters Limited (FWL) via a Limited Partnership

structure - Fairfield Limited Partnership (FLP). The purpose of this

structure is to manage a residential housing development in Fairfield.

3. External

legal and tax advice was sought from Price Waterhouse Coopers (PWC) prior to

setting up the limited partnership structure, as well as to prepare and execute

the appropriate documentation with the Companies Office.

4. The

external (PWC) legal advice was also peer reviewed by Greenwood Roche.

5. At

the March 2017 Board Meeting, the UPL Chairman queried whether UPL Directors

had sufficient authority within the UPL Constitution to provide indemnity to

the Directors and employees of its subsidiary company FWL.

6. As

a result of 5. above, the UPL Chairman also requested that enquiries be made to

ascertain whether the indemnification covers previous (retired), current and

future directors and employees of these subsidiaries. If it did not, then

this should also be incorporated into the amendment actions.

7. A

subsequent review of UPL’s Constitution by Greenwood Roche has indicated

that the current Indemnity and Insurance clause is considered insufficient

(‘does not contain a broad enough power’) for this purpose as the

current Constitution does not expressly authorise this action, and that an

amendment would enable the indemnification issue to be resolved.

8. Further,

as per the Greenwood Roche advice, should the Indemnity and Insurance clause of

UPL’s Constitution be amended accordingly, a deed of indemnity could then

be entered into for the current and future subsidiaries.

Discussion

9. The

advice from Greenwood Roche outlines the issue and suggests that an amendment

be made to enable wider indemnity coverage for current and future subsidiary

companies of UPL – attached as Appendix 1 to the report.

10. The current

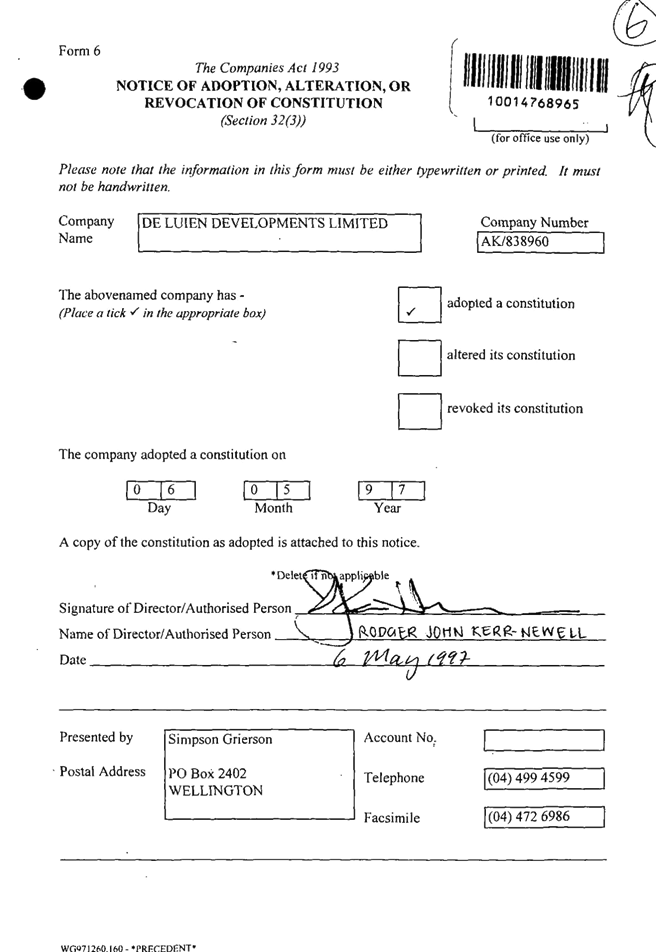

UPL Constitution is attached as Appendix 2 to the report. Note UPL was

originally known as De Luien Developments Limited.

11. Attached as

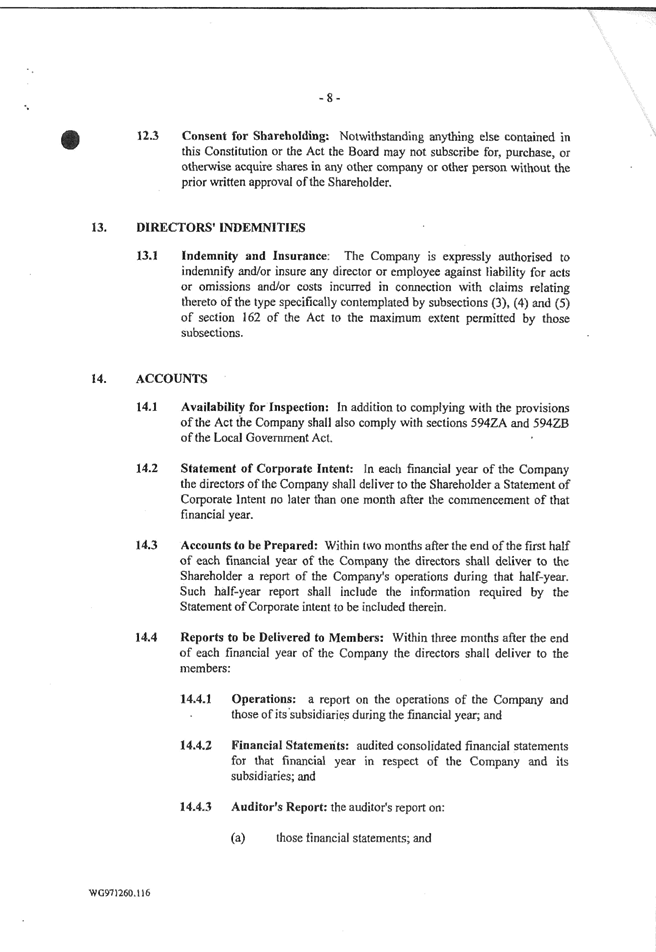

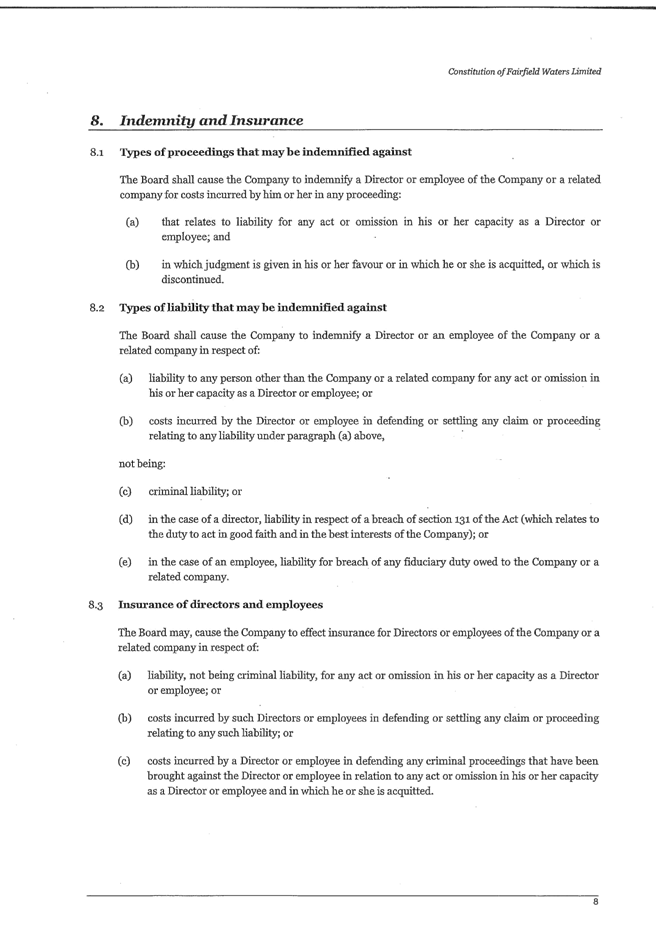

Appendix 3 to the report is the proposed wording to be inserted into the UPL Constitution.

Options

12. There are

two options open to Council: that is to either agree to amend UPL’s

Constitution or not. Council could ask for more information before

making this decision.

Consultation

13. UPL officers

have sought external legal advice including peer review assessments on several

occasions (PwC and Greenwood Roche), in the creation and setting up of the

subsidiary company structure, as well as seeking in-house (Council) legal

review prior to HCC approval to create FWL. The request to amend the

Constitution will not be publicly advertised or notified.

Legal

Considerations

14. External

legal advisors Greenwood Roche have provided advice (refer Appendix 1

attached), which considers Section 162 of the Companies Act 1993 and other relevant

legal aspects.

Financial Considerations

15. No financial

implications are anticipated.

Other

Considerations

16. In making

this recommendation, officers have sought external legal advice which has given

careful consideration to the Companies Act 1993 – specifically section

162. Officers believe that these recommendations support the intent of

these subsidiary companies, as well as provide prudent company management

powers to its Directors.

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Greenwood Roche Memorandum re Indemnification

of Directors

|

7

|

|

2⇩

|

UrbanPlus Limited (previously De

Luien Developments Limited) Constitution

|

12

|

|

3⇩

|

UrbanPlus Limited Constitution -

proposed amendment re Indemnity and Insurance Clause

|

24

|

Author: Daniel

Moriarty

Portfolio Manager, Urban Plus

Reviewed By: Brent Kibblewhite

Chief Financial Officer

Reviewed By: Joycelyn Raffills

General Manager, Governance and Regulatory

Approved By: Craig Walton

Chief Executive, Urban Plus

|

Attachment 1

|

Greenwood Roche Memorandum re Indemnification of

Directors

|

|

Attachment 2

|

UPL (previously De Luien Developments Limited)

Constitution

|

|

Attachment 3

|

UPL Constitution - proposed amendment re Indemnity

and Insurance Clause

|

Proposed

Amendment to Constitution: Indemnity and Insurance Clause

Current Clause:

Proposed Clause (numbering to merge accordingly if

accepted):

1.1 Types of

proceedings that may be indemnified against

The Board

shall cause the Company to indemnify a Director or employee of the Company or a

related company for costs incurred by him or her in any proceeding:

(a) that relates to

liability for any act or omission in his or her capacity as a Director or

employee; and

(b) in which judgment is

given in his or her favour or in which he or she is acquitted, or which is

discontinued.

1.2 Types of

liability that may be indemnified against

The Board

shall cause the Company to indemnify a Director or an employee of the Company

or a related company in respect of:

(a) liability

to any person other than the Company or a related company for any act or

omission in his or her capacity as a Director or employee; or

(b) costs

incurred by the Director or employee in defending or settling any claim or

proceeding relating to any liability under paragraph (a) above,

not being:

(c) criminal

liability; or

(d) in the

case of a director, liability in respect of a breach of section 131 of the Act

(which relates to the duty to act in good faith and in the best interests of

the Company); or

(e) in the

case of an employee, liability for breach of any fiduciary duty owed to the

Company or a related company.

1.3 Insurance

of directors and employees

The Board may,

cause the Company to effect insurance for Directors or employees of the Company

or a related company in respect of:

(a) liability,

not being criminal liability, for any act or omission in his or her capacity as

a Director or employee; or

(b) costs

incurred by such Directors or employees in defending or settling any claim or

proceeding relating to any such liability; or

(c) costs

incurred by a Director or employee in defending any criminal proceedings that

have been brought against the Director or employee in relation to any act or

omission in his or her capacity as a Director or employee and in which he or

she is acquitted.

1.4 Directors to

sign certificate

The Directors

who vote in favour of authorising the effecting of insurance under clause 1.3

must sign a certificate stating that, in their opinion, the cost of effecting

the insurance is fair to the Company.

1.5 Entry in the

Interests Register

The Board must

ensure that particulars of any indemnity given to, or insurance effected for,

any Director or employee of the Company or a related company are forthwith

entered in the interests register.

1.6 Definitions

For the

purpose of this clause 1, “Director” includes a former Director and

“employee” includes a former employee.

Finance and Performance Committee

Finance and Performance Committee

27 March 2017

File: (17/549)

Report

no: FPC2017/2/103

Appointment of

Trustees to Hutt City Community Facilities Trust

Purpose

of Report

1. This report seeks

Council’s approval to establish a selection panel to identify, assess and

recommend to Council up to three independent Trustees to be appointed to the

Hutt City Community Facilities Trust (CFT).

|

Recommendation

That the Committee recommends that Council:

(i) approves

the appointment of a selection panel consisting of the General Manager

Community Services, outgoing CFT Chair (subject to his agreement) and a

Councillor to identify, assess and approach potential candidates for the position

of up to three independent Trustees on the Hutt City Community Facilities

Trust (CFT), in accordance with the Council’s policy for the

Appointment of Directors; and

(ii) approves

this process for future appointments to the board of the CFT; and

(iii) delegates

to the selection panel the power to negotiate and decide an amount to be paid

as an honorarium for the new Chair up to the existing remuneration

level.

|

Background

2. Council

established the CFT as a Council Controlled Organisation (CCO) in 2012.

3. The

CFT will own and administer leisure and community facilities in Hutt City,

redevelop facilities in future in line with the integrated facilities model and

Integrated Facilities Plan, and help raise funds for the redevelopments. The

CFT is administered by a Trust Board made up of between three and seven

trustees (one of whom is a Councillors representative).

4. Current

Trustees are Alister Skene (Chair), Andy Leslie, David Butler, Kirsten

Patterson, Max Flowers and Cr Margaret Cousins.

Discussion

5. Sumati

Govind resigned as a Trustee in October 2016. At its October Board meeting the

CFT agreed to advise Council of the resignation but leave the matter of a

replacement Trustee to be considered in the new year.

6. At

the CFT meeting on 20 March 2017 the Trust discussed the resignation of the

Chair, Alister Skene (with effect from 30 June 2017) and the term of another

Trustee, Max Flowers, which is due to expire on 13 August 2017. In

addition, another Trustee, Andy Leslie, has recently resigned, with effect from

30 June 2017.

7. Council’s

policy on appointing trustees for CCOs is the same as the policy for the

appointment of Directors. This policy follows best practice for

governance appointments. This process involves appointing a selection

panel which will undertake a selection process. A copy of the policy is

attached as Appendix 1 to the report.

8. It

is suggested that the panel be made up of the General Manager Community

Services, the outgoing Chair (if he agrees) and a Councillor representative.

Consultation

9. No

consultation has been carried out in the drafting this report.

Policy Considerations

10. The Hutt City Community Facilities Trust Deed of Trust provides

that:

“9.2

Trustee Appointment and

Removal: Subject to clause 9.1, the

Council has the power at any time:

9.2.1 Appointment:

to appoint an additional Trustee or Trustees;

9.2.2 Reappointment:

to reappoint any retiring or retired Trustee as

a Trustee; and

9.2.3 Removal:

to remove a person from office as a Trustee;

and such appointment,

reappointment or removal must be notified in writing by the Council to the

Trustees.”

Other

Considerations

11. In making this

recommendation, officers have given careful

consideration to the purpose of local government in section 10 of the Local

Government Act 2002. Officers believe that this recommendation falls

within the purpose of the local government in that it supports the CFT which is

providing community services. It does this in a way that is cost-effective

because it is going through an internal process involving no additional costs.

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Hutt City Council - Appointment and

Remuneration of Directors Policy August 2013

|

29

|

Author: Matt

Reid

General Manager Community Services

Approved By: Joycelyn Raffills

General Manager, Governance and Regulatory

|

Attachment 1

|

Hutt City Council - Appointment and Remuneration of

Directors Policy August 2013

|

APPOINTMENT

AND REMUNERATION OF DIRECTORS POLICY

|

Division

|

General

Manager, Governance and Regulatory

|

|

Date

created

|

August

2008

|

|

Publication

date

|

August

2008

|

|

Review

period

|

August

2015

|

|

Owner

|

General

Manager, Governance and Regulatory

|

|

Approved

by

|

General

Manager, Governance and Regulatory

|

|

Version

|

Author

|

Date

|

Description

|

|

V 1.0

|

Joycelyn Foo

|

25/8/2008

|

Approved by Council

|

|

V 2.0

|

Joycelyn Foo

|

22/8/2013

|

Reviewed

|

Contents

1. Section

57 of the Local Government Act 2002 provides: 3

2. Appointment

of Directors. 3

3. Process

for making appointments. 3

3.1 Preparation

of a person specification. 3

3.2 Advertising

the position. 4

3.3 Assessment

of candidates. 4

3.4 Exceptions. 4

4. Tenure

and Reappointment 5

5. Conflicts

of interest 5

6. Remuneration

of directors. 5

7. Terms. 6

1.Section 57 of the Local Government Act 2002 provides:

(1) A local authority must adopt a

policy that sets out an objective and transparent process for---

(a) the

identification and consideration of the skills, knowledge, and experience

required of directors of a council organisation; and

(b) the

appointment of directors to a council organisation; and

(c) the

remuneration of directors of a council organisation.

(2) A

local authority may appoint a person to be a director of a council organisation

only if the person has, in the opinion of the local authority, the skills,

knowledge, or experience to---

(a) guide

the organisation, given the nature and scope of its activities; and

(b) contribute

to the achievement of the objectives of the organisation.

Note: The

term Director includes Trustee or Manager of a Council Organisation as per

section 6 of the Local Government Act 2002.

2. Appointment of Directors

The Council is empowered to make

appointments to a wide range of organisations.

In all cases the decision as to the

appointment will be made at a full Council meeting.

In each case, the Council will appoint a

person who the Council considers to show the following:

§ The

skills, knowledge and experience needed to undertake the relevant role;

§ Sound

judgement.

§ A

high standard of personal integrity.

§ An

understanding of the governance requirements for the type of organisation

concerned.

§ The

ability to work as part of a team.

3. Process for making appointments

Identifying skills, knowledge, and experience required of

directors

In each case, the selection and

assessment process will involve the following:

3.1 Preparation of a person specification

In each case a person specification will

be prepared setting out the skills, knowledge, and experience required of a

director/s. In preparing this person specification consideration will be given

to the following:

§ The

nature and scope of the council organisation, its future direction and

requirements in its constitutional documents.

§ The

objectives of the organisation and the attributes, skills, knowledge, and

experience required to contribute to the achievement of those objectives.

§ The

skills of any existing directors.

§ Outstanding

skills, knowledge, and experience required.

§ Any

future skills, knowledge, and experience required.

3.2 Advertising the position

In most cases, the position will be

advertised (at least in the local newspaper) and any potential candidates known

to Council may be approached and asked if they would consider applying for the

position.

3.3 Assessment of candidates

The assessment process will be as

follows:

§ All

applications will be assessed by a selection panel comprising an elected

member, senior officer/s and if appropriate relevant external people and HR expertise

(the panel). The panel will consider all applications received, shortlist,

interview and prepare a report on the candidates for Council’s

consideration. The panel may make a recommendation if it wishes to do so.

§ The

final appointment/s will be made in committee (thus protecting the privacy of

natural persons) by resolution of the full Council. Public announcement of the

appointment will be made as soon as practicable after the Council has made its

decision.

§ If

an elected member is under consideration to fill a particular vacancy, that

elected member cannot take part in the discussion or vote on their appointment

or on any other proposed appointees being considered for the same Board at the

same meeting.

3.4 Exceptions

Elected member appointments

In the case where Council is considering

the appointment of an elected member to a council organisation, there will be

no need to advertise the position. This is because the potential pool of

applicants for the position will be limited to elected members only. It will

remain necessary for the assessment process to be followed in relation to the

potential elected member candidates.

Existing pool of potential candidates

There may also be cases where, because

of a recent appointment process, Council has a number of potential applicants

for a position who have already submitted applications and who have agreed that

their personal details could be used for consideration for future appointments.

In such a case, the panel may elect not to advertise the position and may

recommend to Council a potential appointee from this group of potential

applicants. In such a case, the panel will include in its report to Council,

for Council’s consideration, an explanation of the reasons that the

advertising process was not followed. Where Council makes an appointment

without advertising the position, Council will record that fact and the reasons

for not advertising the position in the minutes of the relevant meeting.

Other situations where advertising not required

There may also be other situations where

it is considered appropriate not to follow a full public advertising process in

selecting potential applicants for appointment to Council organisations. In all

cases where the decision is made not to advertise the vacancy publicly, the

panel must include in its report to the Council the reasons that a public

advertising process was not followed. Where Council makes an appointment

without advertising the position, Council will record that fact and the reasons

for not advertising the position in the minutes of the relevant meeting.

4. Tenure and Reappointment

All appointments will specify the term

of the appointment. Council may decide that, to prevent unwanted vacancies

occurring during an election period, an appointment will be specified to extend

beyond the end of a local government triennium. In such a case, it is prudent

to specify that the appointment will last until the first ordinary meeting of

the new triennium.

Where an elected member is appointed to

a Board because one of the conditions is that the director be an elected

member, the term of the appointment will cease on the same date the elected

member ceases to be an elected member, if that date is prior to the expiry date

of the term of the appointment.

In relation to a Council Controlled

Organisation, directors may be reappointed to a Board for a second term and,

where there is a compelling reason, a director may be appointed for further

periods. Second and third terms are not automatic, and the Council will make

its decision based on the company’s business needs, the availability of

candidates for the role (including the incumbent), the incumbent’s

performance and the make-up of the Board.

If a reappointment is made without

having first completed the process outlined above, Council will record in the

minutes of the meeting at which the appointment is made the reasons for not

having followed that process.

5. Conflicts of interest

Hutt City Council expects that directors

of council organisations will avoid situations where their actions could give

rise to a conflict of interest. To minimise situations of conflict arising:

The council requires directors to be

guided by the Institute of Directors in New Zealand’s Ethics (2003/1)

and Conflicts of Interest (1996/3): Statements of Best Practice for New Zealand Directors.

Unless otherwise stated in the

organisation’s constitutional documents, all directors are appointed at

the pleasure of Council and may be dismissed for disregarding those guidelines.

6. Remuneration of directors

The remuneration of directors of a

council organisation will be determined by the nature of the business of the

organisation and the financial situation of the organisation.

Where Council is the sole shareholder in

a particular organisation the Council will set the directors’

remuneration either by resolution at the annual general meeting or resolution

of Council. The resolution will state whether the remuneration is set as a

fixed cap for Board remuneration, to be allocated by the Board, or specifying the

salaries to be paid for directors and the Chairperson.

Remuneration for directors of

council-controlled organisations will be determined by an analysis of market

rates for comparable positions at the commencement of every triennium.[1]

Remuneration for directors of other

council organisations (if any) will be determined on a case by case basis

taking into account the form and purpose of the organisation and any previous

level of fees paid by the shareholder.

7. Terms

The terms used in this policy have the meaning

set out in section 6 of the Local Government Act 2002.

Finance and Performance Committee

Finance and Performance Committee

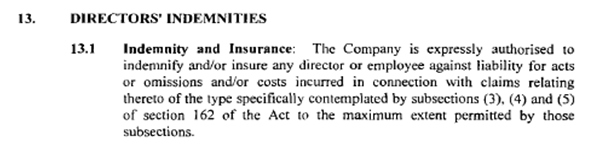

05 April 2017

File: (17/603)

Report

no: FPC2017/2/121

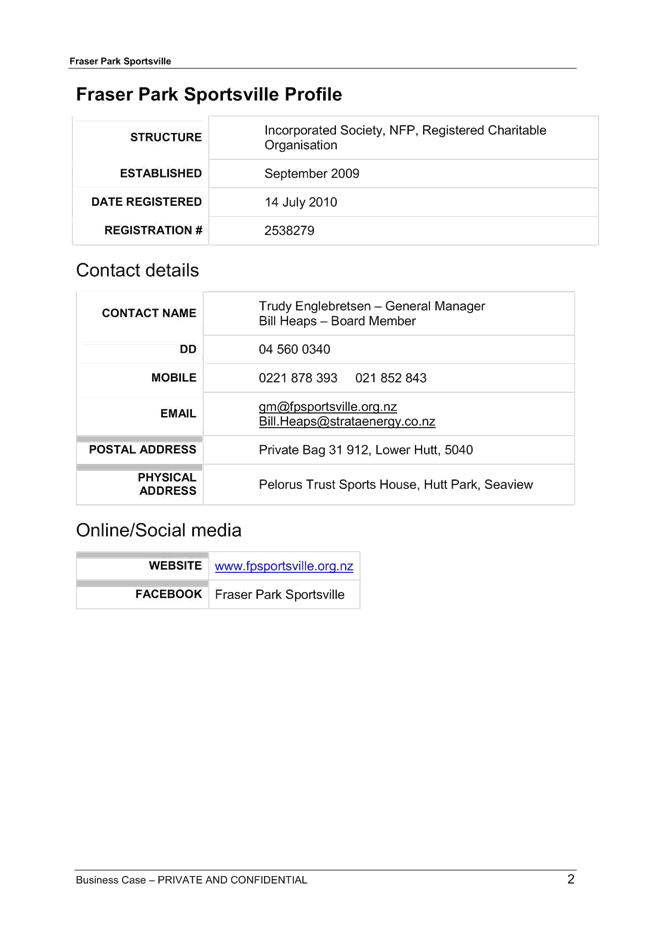

Response to Fraser

Park Business Case

Purpose

of Report

1. To provide the commentary, feedback and a

recommendation to Council regarding the Business Case presented by Fraser Park

Sportsville (FPS).

|

Recommendations

That the Committee recommends

that Council:-

(i) recommends to the Community Plan Committee, subject

to Council approval, an operating grant to Fraser Park Sportsville (FPS) of:

a) $150,000 for the first full year of operation;

b) $125,000 for the second year; and

c) $100,000 for every year thereafter; and

(ii) agrees for this operating grant to be reviewed after

three years of FPS operating; and

(iii) agrees that a condition of annual funding will be,

that FPS formally report to Council on an annual basis its annual report and

in particular progress against the Business

Case.

|

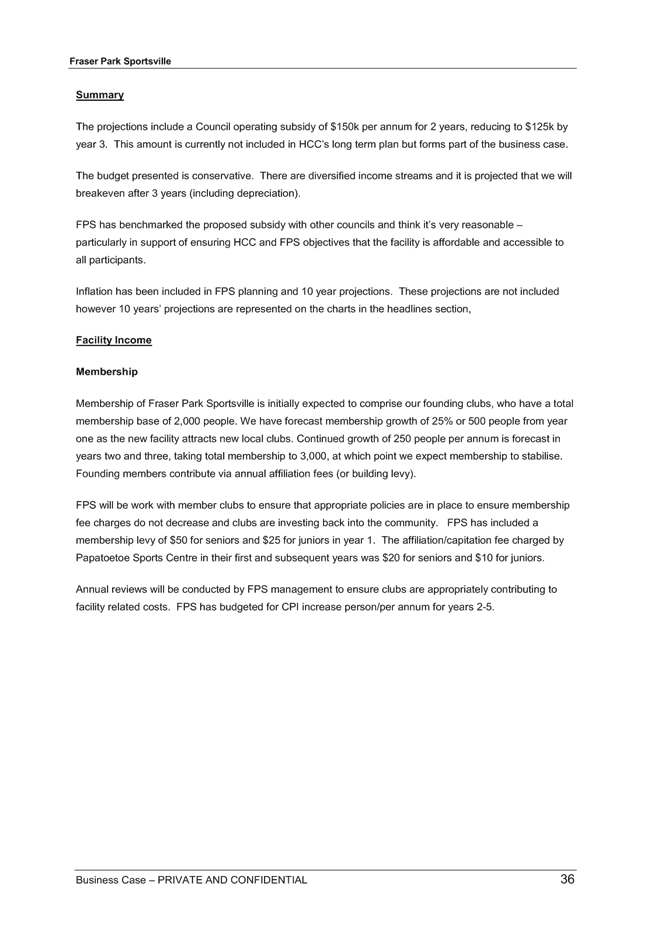

Report Headlines

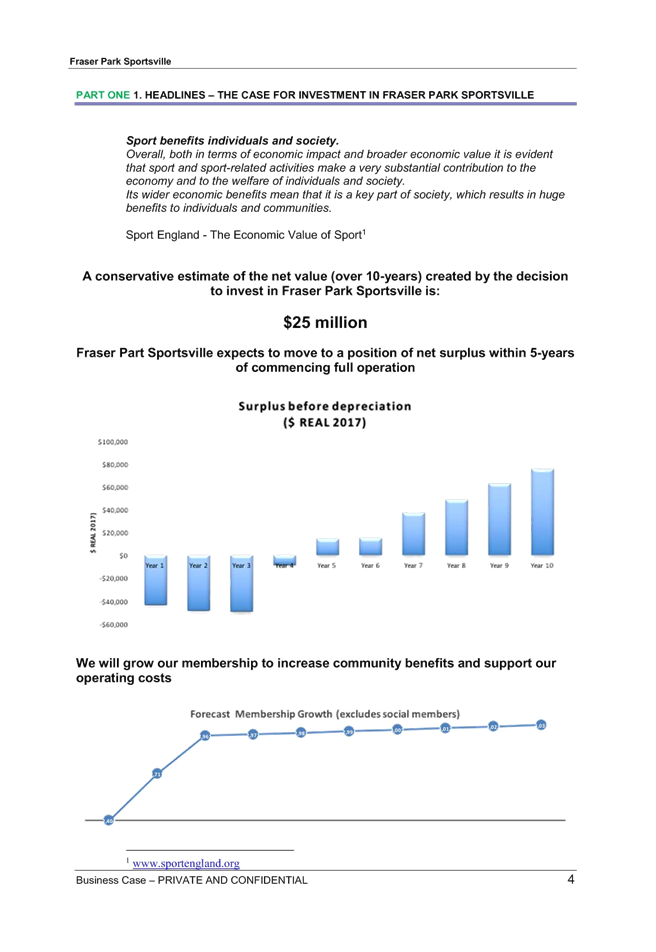

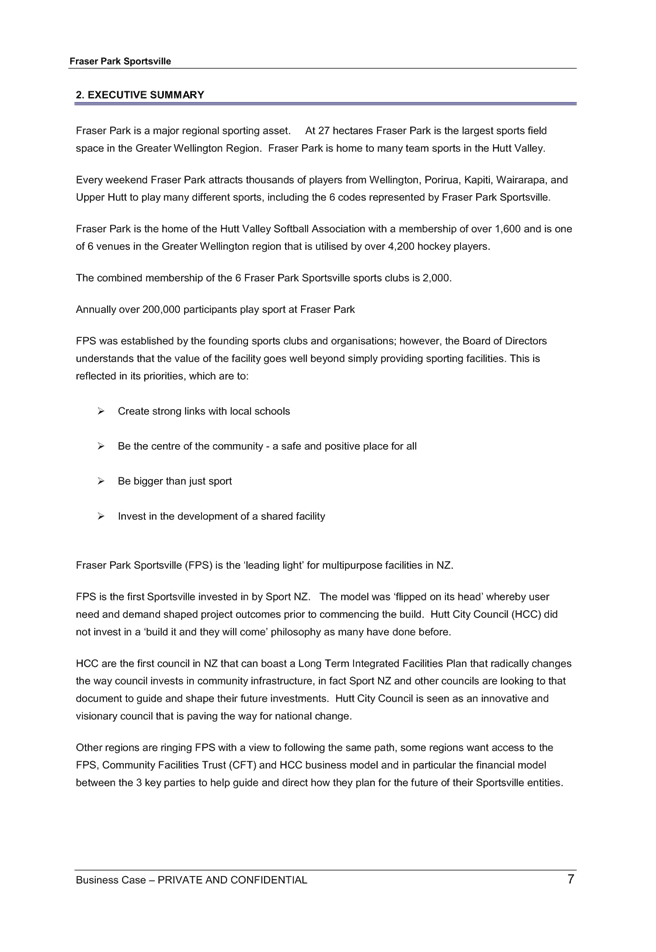

2. Fraser Park Sportsville (FPS) has submitted a business case to Hutt

City Council as a requirement of obtaining a capital funding

contribution. A copy of the business case is attached as Appendix 1 to

the report.

3. The business case presented is professional and to a high

standard. Information presented is supported by detailed data, analysis

and research.

4. Council’s Long Term Integrated Communities Facilities Plan

identifies Fraser Park as its major sport and recreation hub – offering

significant economic and social development opportunities.

5. Officers conclude the FPS business case financial projections,

whilst presenting some challenges, are ultimately achievable.

6. Officers support an annual Council financial contribution towards

operating costs – most specifically as a contribution towards increasing

community participation and running large regional, national and/or

international events.

7. When fully operational FPS will provide Hutt City with a sport and

recreational hub of regional and national importance, that will generate

significant social and economic benefits, and advance Hutt City as a great

place to live, work and play.

Background

8. Council has been proactively working with the Hutt City Community

Facilities Trust (CFT) and Fraser Park Sportsville for the last five years to

develop a significant sport and recreation hub on Fraser Park.

9. Sportsvilles originated from a Council led initiative in partnership

with Sport NZ, Sport Wellington, NZ Community Trust and Pelorus Trust.

10. Fraser Park Sportsville was launched in 2009. The FPS founding clubs

signed the Sportsville constitution in April 2010, signalling their commitment

to the partnership. In June 2010 an independent Board was appointed to

lead the new entity. FPS is an Incorporated Society and also registered

under the Charities Act.

11. FPS key responsibilities and work include driving and promoting

participation, club collaboration and facility rejuvenation.

12. In 2013 Council approved its Long Term Integrated Community

Facilities Strategic Plan that maps out Council’s vision and direction

regarding community facilities. Identified in the strategic plan are

several significant regional opportunities. These include the Fraser

Park/Taita Sport Zone – comprising Fraser Park Sportsville and the Walter

Nash Centre.

13. With 27 hectares of land, Fraser Park is Council’s largest

recreational ground. With the development of the Walter Nash Centre in

close proximity, this represents an excellent opportunity for the City and

region. As such Fraser Park was identified as a key strategic asset that will

not only support local community sport, but also play an important role in driving

participation as well as attracting significant regional, national and/or

international events.

14. Fraser Park Sportsville has been identified as a project of regional

importance and is the first Sportsville which Council committed capital funding

to. Capital funding levels currently allocated by Council are at comparable

levels with other Councils on similar projects around New Zealand. Fraser Park

Sportsville is Hutt City’s major sport and recreation hub. The same level

of Council funding should not be expected for other Sportsvilles.

15. Nationally this is a project of significance, with interest from

other Councils and Sport New Zealand on the process and end product.

16. FPS have clearly identified how this project aligns with the

strategic vision of Hutt City Council (Healthy Families NZ, North East focus,

rejuvenation of community facilities via hubbing), and notes that the plans for

Fraser Park are endorsed by the regional sports associations that have member

clubs on site.

17. No specific references to regional facility plan documents have been

noted, however officers recognise that Capital Football, Wellington Rugby

Football Union, Hutt Valley Softball Association, Wellington Hockey

Association, Cricket Wellington and Squash Wellington have all contributed to

the planning process undertaken by Fraser Park Sportsville.

18. Social outcomes that will be achieved through the high quality

delivery of services enabled by the business case are very difficult to

quantify in a dollar term, however it is imperative to note that social

benefits of participating in sport, recreation and other ancillary activities

have been proven to make significant positive impacts on communities.

19. There is clearly intention within the Fraser Park Sportsville board

and staff to ensure the facility is well utilised by non-sporting and informal

physical activity users. This provides opportunity to improve the wellbeing of

the local area using this facility as the driver for change.

20. All of these opportunities provide significant economic and social

benefits and enhance Hutt City as a great place to live, work and

play.

21. Given the opportunity that Fraser Park represents for the city,

Council allocated $12 million in its long term plan to FPS, of which

approximately $3 million was committed to the stage 1 development completed in

2015.

22. Stage 1 was the development of artificial turfs which the FPS team

has done an outstanding job managing and driving participation.

23. Council has thoroughly considered much earlier the many benefits of

the Sportsville model. This paper does not address these, rather relates

only to the Business Case presented by

FPS.

24. A key condition set by Council for the release of the majority of

stage 2 funding is the approval of the FPS business case. This has now

been presented. This paper has been drafted to provide officers’ response

and feedback to this business case.

Discussion

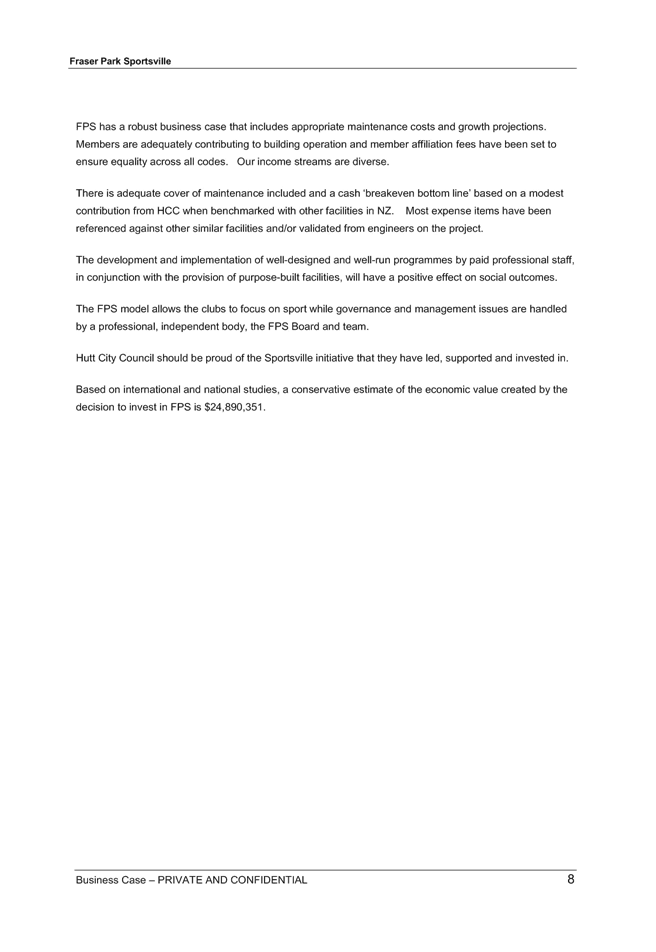

25. Overall FPS

has presented a thorough and very professional business case and should be

congratulated accordingly. They have assessed and analysed all forecast

revenue and expenditure in detail – supported by clear research and

assumptions.

26. Their

business case includes an economic impact assessment that concludes a

significant economic and social return to the City. Officers have

reviewed the assessment and conclude it to be robust, perhaps

conservative.

27. For the

purposes of this report we have focused our attention on the forecast income

and expenditure, including a request for annual Council funding support.

Summary of Forecast

Revenue and Expenditure

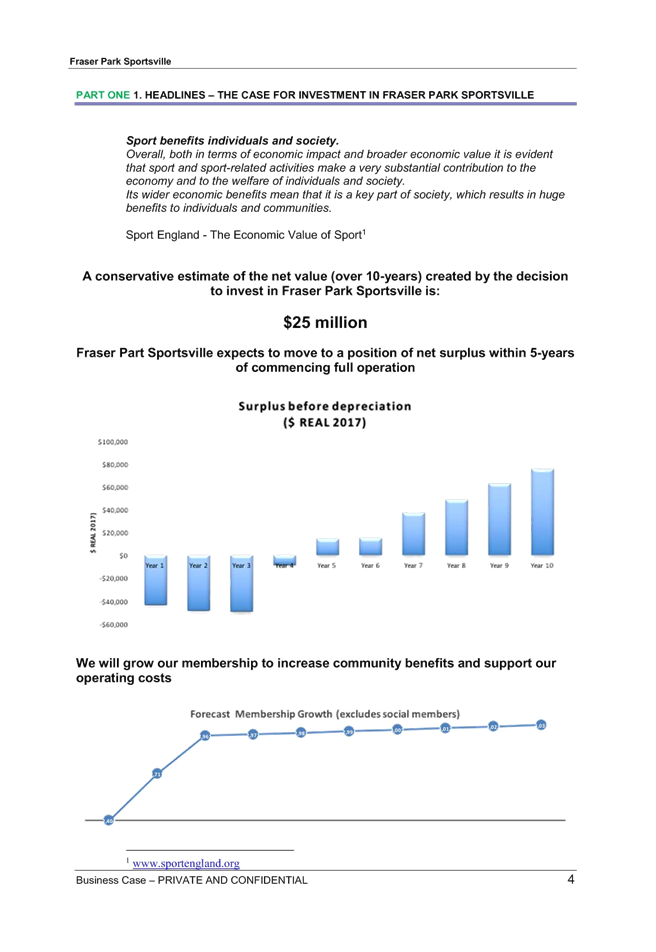

Ø 10 years forecast

Ø Cash deficits are forecast

for first four years – not exceeding $50k per annum.

Ø Including depreciation cost,

losses are forecast to year 7.

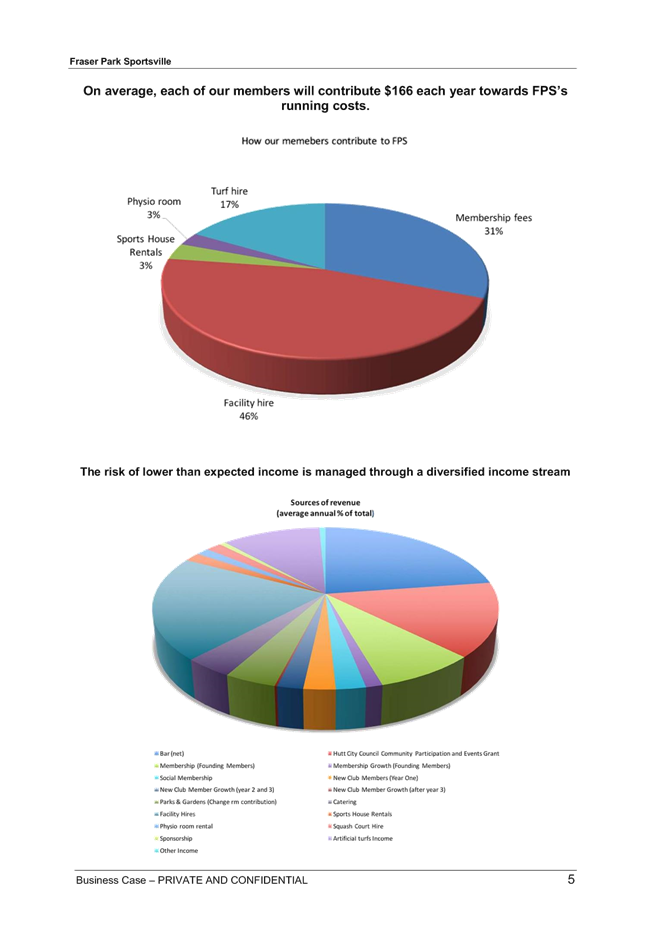

Ø Income includes a Council

Community Participation and Events Grant of $150,000 in year 1, $125,000 in

year 2 and $100,000 per annum thereafter. This is consistent with FPS

briefing to Council during 2016.

Ø There are multiple sources of

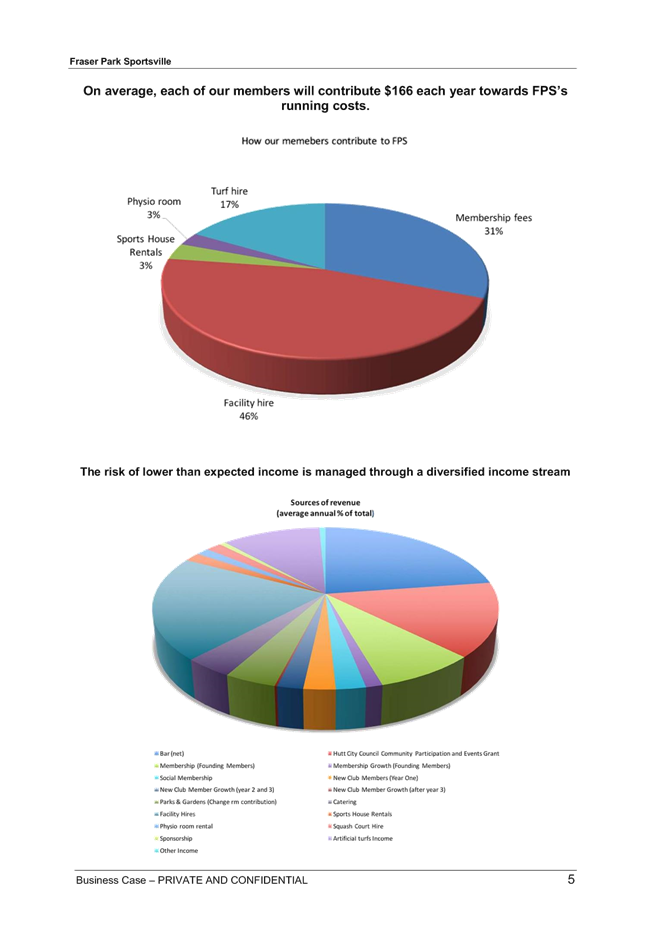

income forecast. The most significant are:

§ Bar Income $146k

- 21% of total year 3 income

§ Council $100k

- 15%

§ Facility Hires $140k

- 20%

§ Artificial Turfs Hires $80k

- 12%

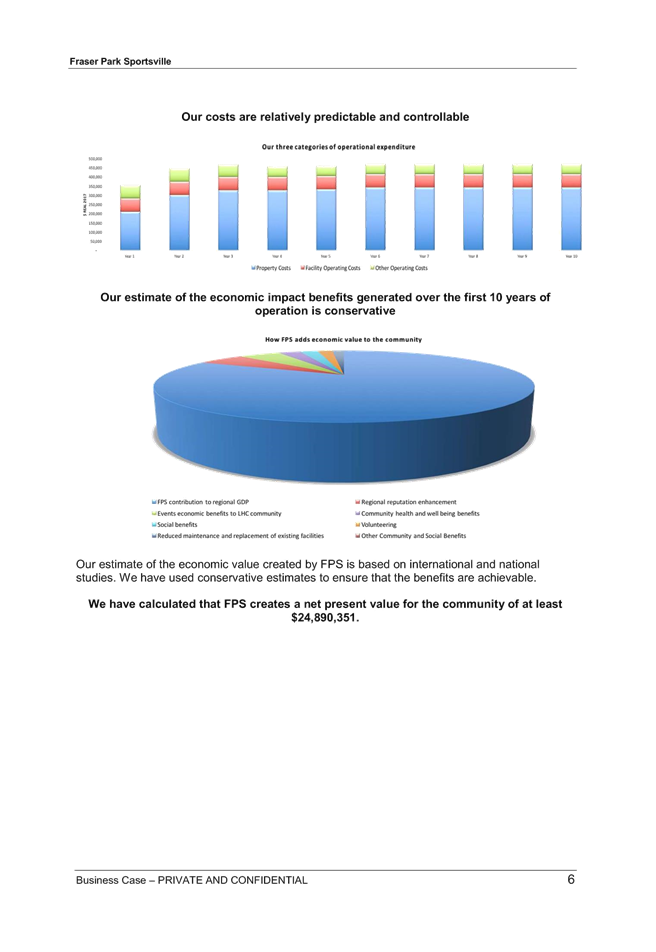

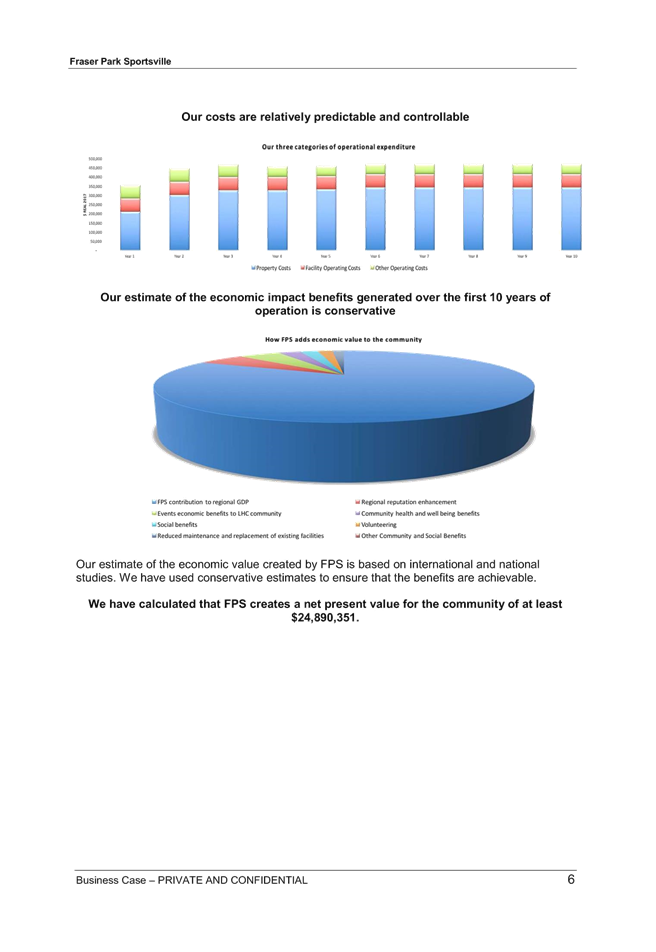

Ø Expenses are broken into the

following categories

§ Property Costs $327k

- 41% of total year 3 expenses

§ Facility Operating $73k

– 9%

§ Employment $299k

– 37%

§ Other $65k

– 8%

§ Depreciation $40k

– 5%

Note:

year 3 numbers used as when forecast to be more fully operational.

Ø Depreciation costs relate

only to assets that will be owned by FPS, ie the fit-out.

Ø Property costs per annum by

year 3 are made up of:

§ Insurance $50k

§ Rates $79k

§ CFT Future Maintenance $62k

§ Artificial Turf Costs $96k

§ Other $40k

Ø CFT Future Maintenance

– this relates to an annual payment to the CFT to ensure the asset is

maintained and that funds are kept in reserve (by the CFT) to fund future

medium term asset replacements – as per approach endorsed by Council.

28. There are

several key questions here for Council consideration. These include:

Ø Is the forecast achievable?

Ø Can users pay more?

Ø What are the risks to Council?

Is the forecast achievable?

29. For any new

business case there is an element of estimation and making assumptions. FPS

have presented very clear and detailed supporting data and analysis behind

almost every forecast budget line. This includes formal quotes,

benchmarking data from similar operations, existing financial and membership

data from current clubs, scenario analysis, professional research and other

information.

30. FPS has

deliberately and appropriately not forecast ‘best case’ scenarios

for both income and expenditure. For some areas of expenditure they have

included ‘worst case’ projections.

31. Overall the

FPS approach to forecasting has been conservative and responsible.

Expenditure

32. Overall

officers consider the expenditure forecasts to be reasonable.

33. Worthy of

the most commentary is the forecast property costs which make up approximately

40% of total expenses. These, mostly fixed costs, clearly cause the most

pressure to the FPS business case.

34. Council

rates have been quoted to FPS at $79k per annum. This is largely

attributable to the rateable value of the new asset, representing a real

challenge. $79k per annum is approximately 600% greater than the total rates

currently paid by all 9 member clubs. Benchmarking other similar sports hubs

and facilities, eg Papatoetoe Sports Hub, the tenants are not responsible for

paying rates. This is a complex issue and perhaps signals the need for

Council to review its rating policy.

35. FPS forecast

a $62k per annum expense to the CFT for a future maintenance/capital

replacement fund. In addition to this, included in the forecast

Artificial Turf Costs ($96K) is a further $20k per annum payment to a CFT

future turf replacement fund. This approach is consistent with that

endorsed by Council.

36. Basically

FPS is being challenged to make a significant annual payment to fund future

asset replacements. Very few sports and other community organisations

would operate this way, ie very few sports clubs/ community groups have cash

reserves to fund future asset replacements or medium/long term maintenance.

Officers acknowledge the challenge this represents to FPS, however conclude

that Council’s/CFT’s approach is entirely responsible and

fair.

37. The other

major expenditure forecast is for staff salaries. FPS will be managed by

professional staff, led by a General Manager. Adequate operational staff are

budgeted for, including a caretaker. All of the salary and hourly rate

assumptions are reasonable. Given the Hub will be open seven days per

week with extended hours, this is one area where the FPS Board have expressed

some concern, indicating that more staff would be ideal. Officers

conclude that staffing levels are adequate and ultimately all that can be

afforded. Officers also suggest that moving forward under the new model

efficiencies will be possible through even greater collaboration with paid

staff of the member

clubs.

Income

38. FPS is

forecasting revenue from multiple sources including: bar, memberships,

Council, catering, facility hires, rental, pay for use and other.

39. As listed in

the summary above the most significant of these are for bar, membership fees,

Council, facility hires and artificial turf usage.

40. Net income

from the bar is initially set at $120k in the first year of operating.

This is based on a gross bar income of $400k. $400k is slightly greater

than the existing combined total bar income for the existing member

clubs. On this basis and given the significant additional activity the new

facility will generate, this forecast appears reasonable.

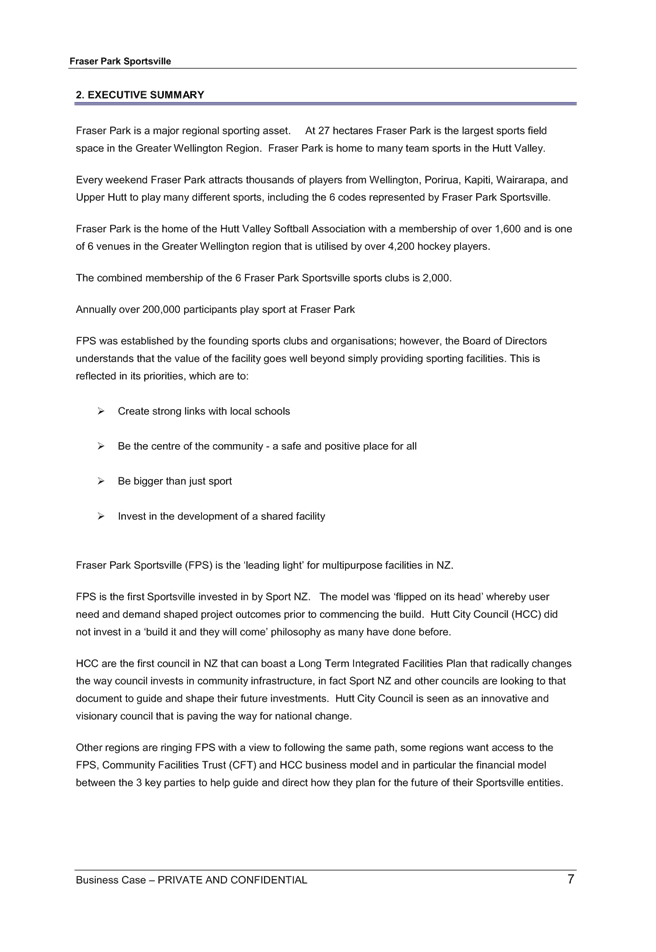

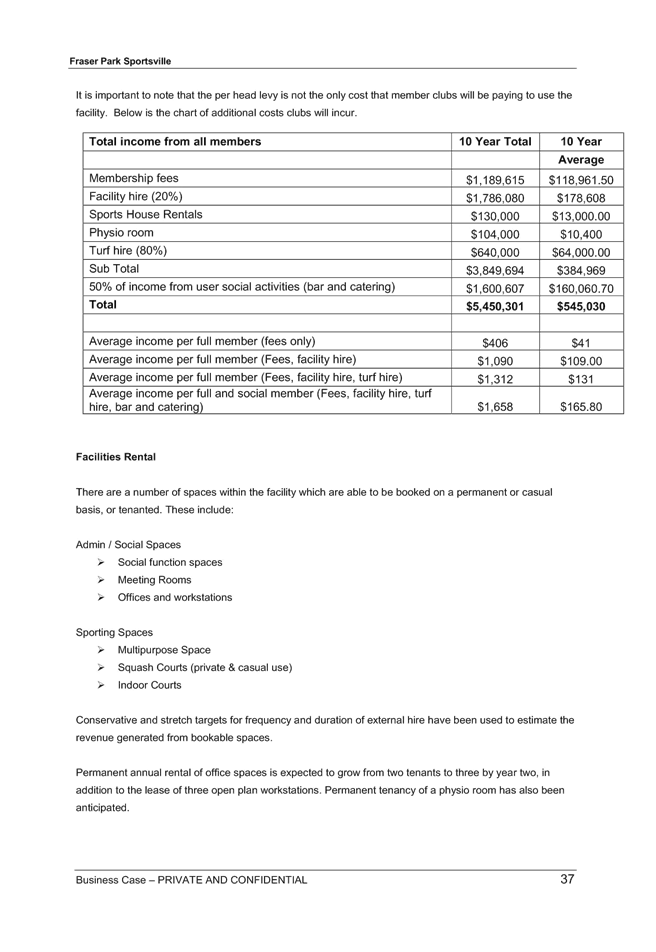

41. Membership

fees are presented in some detail – including projections for increased

membership to existing clubs as well as new clubs joining. The basic fee

structure is that each adult member will pay an annual affiliation fee of $50

to FPS as part of general club membership fees. The junior affiliation

fee is $25 per member.

42. Note: in

addition to affiliation fees to FPS, each club member will also pay a regular

membership fee to their respective club – this is to cover regional and

national sport affiliation fees, programmes, uniforms, equipment, entry fees,

travel, and other club specific related costs.

43. Affiliation

fees have been carefully structured according to the total cost per club member

as well as the overall financial viability of clubs. Given the ongoing

pressure on club membership numbers, FPS is motivated to ensure fees are

affordable and don’t significantly exceed what is currently paid.

This is especially relevant given the local community demographics.

44. Total income

to FPS from affiliation fees from Founding Members based on existing player

numbers (2,404 members) is $59k per annum. Based on the attraction of a

new facility, programmes and services FPS have assumed 3% growth per annum in

members. This equates to an additional $1,700 per annum. In light

of current club trends, 3% growth appear ambitious, although given the quality

of the new offer, Officer’s believe 3% to be possible, if not a minimum

expectations. Note: a significant variation to the 3% target does not

have a material impact on the overall business case.

45. FPS also

forecast membership growth in the first 3 years from new clubs of 1000 members.

i.e. new clubs will seek to join the new facility. By year 3 this equates to an

additional $35k per annum in income. Officer’s agree that new clubs

will be motivated and attracted to join the new facility, however find it

difficult to assess the likelihood without directly talking to

clubs.

46. Artificial

Turf income is forecast at $80k per annum. FPS now has two years of

actual income analysis to support this. Based on current usage this

income projection is very reasonable.

47. Facility

Hires include rental of social spaces, meeting rooms, indoor activity spaces

and mutli-purpose rooms. In year 1 this is forecast to be $64k rising to

$170k by year 5. The charge rates have been benchmarked on other like

facilities in the region and are reasonable.

48. Year 1

Facility Hires is based on 50% of the desired occupancy of target. The

target is 3500 hours across the facility. Some hire spaces, especially activity

spaces are expected to be close to capacity and other spaces (non activity eg

meeting rooms) are more conservative.

49. Facility

Hire income projections are reasonable although represent some challenge,

especially in the participation/activity spaces. FPS has a proven track

record and managing participation spaces as demonstrated by the results being

achieved from the artificial

turfs.

50. It is worth

noting that reducing the overall business case risk is that FPS income is

forecast to come from a number of different sources, ie they are not simply

relying on one source of income. A reduction in one income stream

doesn’t have a material impact on the overall business case.

51. Is the

forecast achievable? Yes. Officers acknowledge some areas of risk

and challenge, however overall agree that the business case is

achievable.

Can users pay more?

52. A fair

question and expectation is that given the quality of the new facility,

shouldn’t its members and or users pay more?

53. FPS has

carefully structured fees and charges to ensure they are transparent, fair and

affordable. An obvious pressure of simply increasing fees is the likely

impact that then has on membership numbers and therefore consequently

participation.

54. Given the

pressure and general national trend of declining membership to sports clubs,

FPS has structured its fees to generally ensure club membership fees will not

significantly exceed current membership fees.

55. When

considering the total capital investment in the new facility, another fair

question also concerns some sports getting greater benefit over others so

should they pay more, eg squash.

56. Given the

large number of other income streams, a significant increase in member fees

does not have a large impact on the overall business

case.

57. Can users

pay more? FPS would argue strongly ‘no’. Officers think

there is potential for greater user charges although note that it would not

have a material impact on the overall business case. Given the motivation

behind FPS is to drive participation, officers generally support the proposed

fee structure and accept the forecast user charges are

reasonable.

What are the risks to Council?

58. Ultimately

FPS will be the tenant of a Council owned facility – albeit through the

CFT. If FPS is unsuccessful this may place pressure on their ability to

fund rent and other related costs to the CFT. Or worst case place

pressure on their ability to even operate the facility – keeping the

lights on.

59. Should FPS

be unsuccessful Council would be unlikely to let such a significant facility

fail. It could choose to operate the facility itself or seek interest from

other external organisations experienced at running such

facilities.

60. In assessing

this risk perhaps the most significant consideration needs to be given to

quality of leadership and governance. FPS to date has operated with

incredibly strong governance with a very skilled and experienced Board.

They have established sound governance systems and policies including

demonstrating clear plans to ensure continuity. FPS operations to date

have been professionally managed by very capable talent.

Council Operational Funding

61. FPS has

requested as part of their business case operational funding from Council.

There is a precedent within other Councils to provide operational grants to

external organisations to manage Council owned facilities across a range of

industries. In Hutt City this has not occurred previously within the sport and

recreation sector outside of Walter Nash Stadium and our aquatic

facilities.

62. Comparing

the evidence presented in this business case and previous documentation

supplied to Council from FPS to best practice planning processes, FPS have

demonstrated an ability to conduct robust planning in line with industry

requirements.

63. Good

practices are observed in capital work planning and project management via

establishment of a tripartite PCG group comprised of Council, FPS and CFT.

64. Fraser Park has requested an ongoing operational grant ($150,000,

$125,000 respectively for years 1-2, then $100,000 each year after) to achieve the following outcomes for Hutt City Council and local

residents:

· Proactively

address the issue of deteriorating facility standards at Fraser Park

· Increase

non-organised physical activity at Fraser Park

· Enable

this facility to host national sports events, and increase the number of local

events

· Strengthen

member clubs processes, policies, and financial sustainability

· Increase

formal membership levels

· Deliver

new services and activities to the local community

· Be a

destination sports ground for the region

· Assist

the community to build positive relationships between players, coaches and

other local leaders

· Development

of networks of peers and colleagues

· Building

personal skills in emotional control, confidence, discipline

· Improving

children’s academic achievement

· Improving

mental health and wellbeing of the community

· Improving

life satisfaction

65. The request

for operational funding can be compared to the management costs Hutt City

Council has for the new Walter Nash Centre, aquatic facilities or libraries. In

these instances Council manages the facilities internally, however all have

associated operating budgets.

66. Officers

support the request made by FPS for operational funding on the basis that:

· Council

would be ensuring return on investment for a significant capital contribution;

· Fraser

Park is noted as a regional/national facility which offers a variety of

community benefits through high quality management;

· A robust

business case has been supplied to Council detailing why an operational

contribution is required and;

· There

are precedents nationally and locally where community services and activities

relating to physical activity and/or provision are funded by Councils.

67. If FPS is

successful in achieving Council’s desired outcomes and the benefits

highlighted above, arguably an annual investment of $100k per annum can be

considered high quality value for money.

68. Theoretically the annual cost of depreciation and finance costs

(associated with Council’s $12m investment) should also be considered.

Estimated at $150,000 per annum this makes the notional contribution per annum

to $250k. Again in consideration of the likely benefits and outcomes to the

City this can be considered value for

money.

Options

69. The

alternative option is for Council to not agree to ongoing operational funding

requiring FPS to be self-sufficient. This would represent a significant problem

for FPS and they would be likely to not agree lease terms with the CFT

accordingly.

Other Considerations

70. In making

this recommendation, officers have given careful consideration to the purpose

of local government in section 10 of the Local Government Act 2002.

Officers believe that this recommendation falls within the purpose of the local

government act.

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Fraser Park Sportsville Business Case

- March 2017

|

45

|

Author: Matt

Reid

General Manager Community Services

Reviewed By: Brent Kibblewhite

Chief Financial Officer

Approved By: Tony Stallinger

Chief Executive

|

Attachment 1

|

Fraser Park Sportsville Business Case - March 2017

|

Finance

and Performance Committee

Finance

and Performance Committee

05 April 2017

File: (17/602)

Report

no: FPC2017/2/104

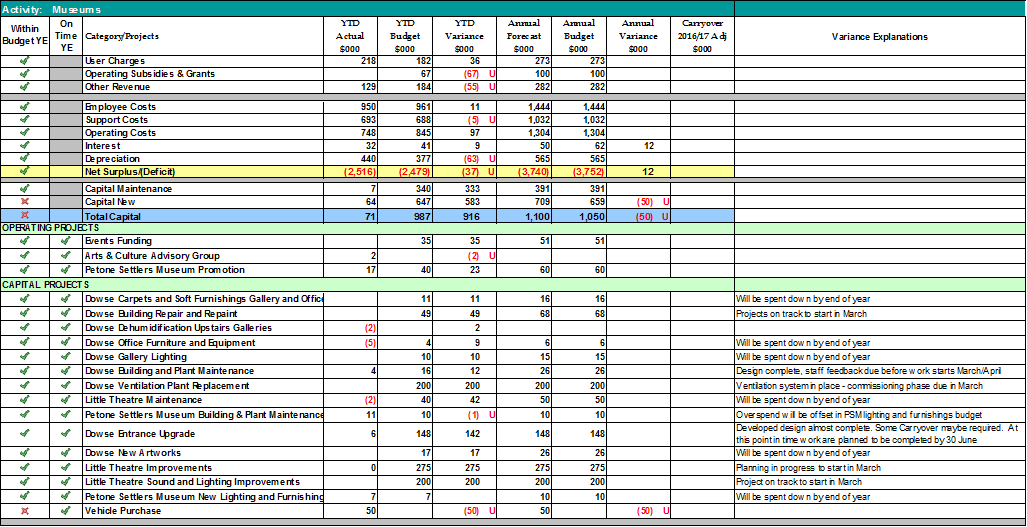

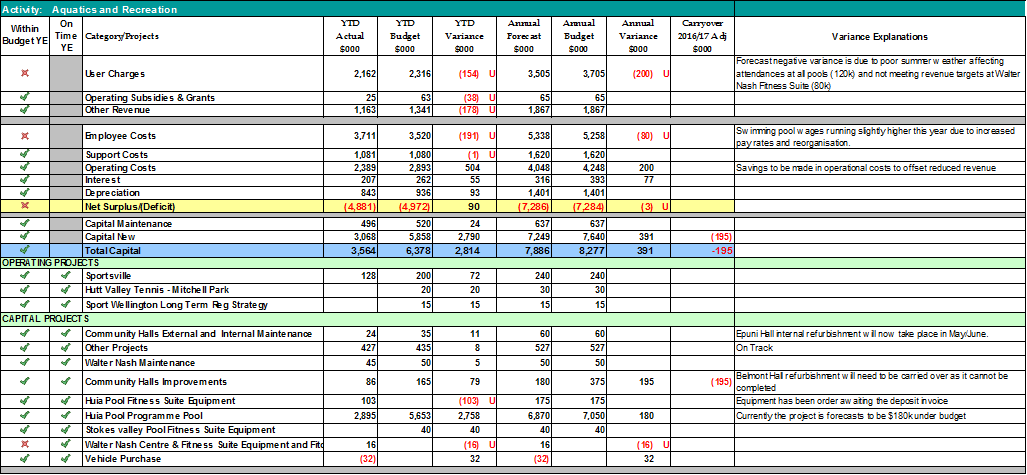

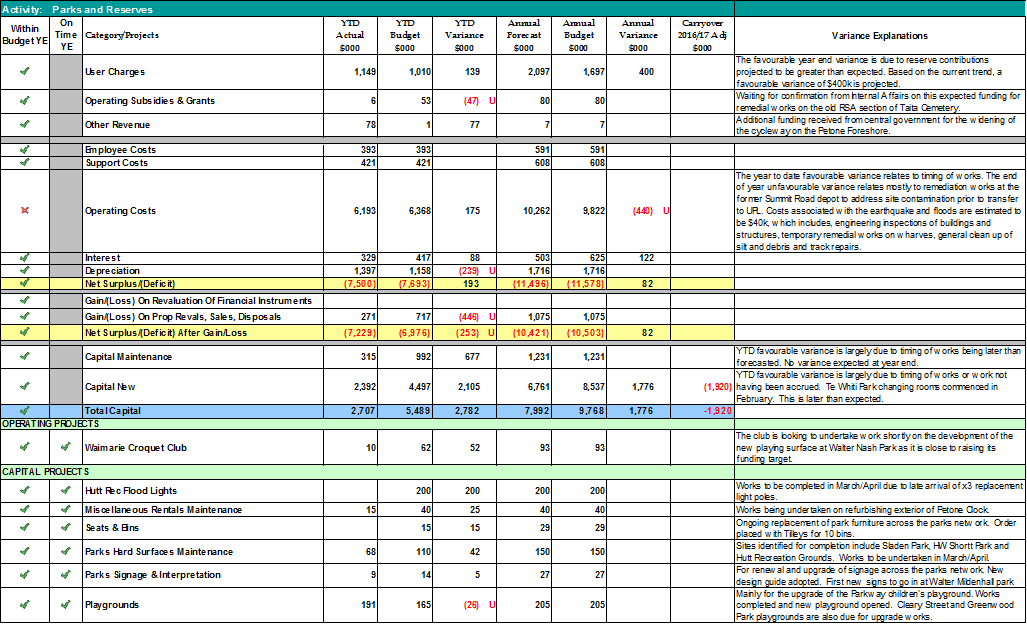

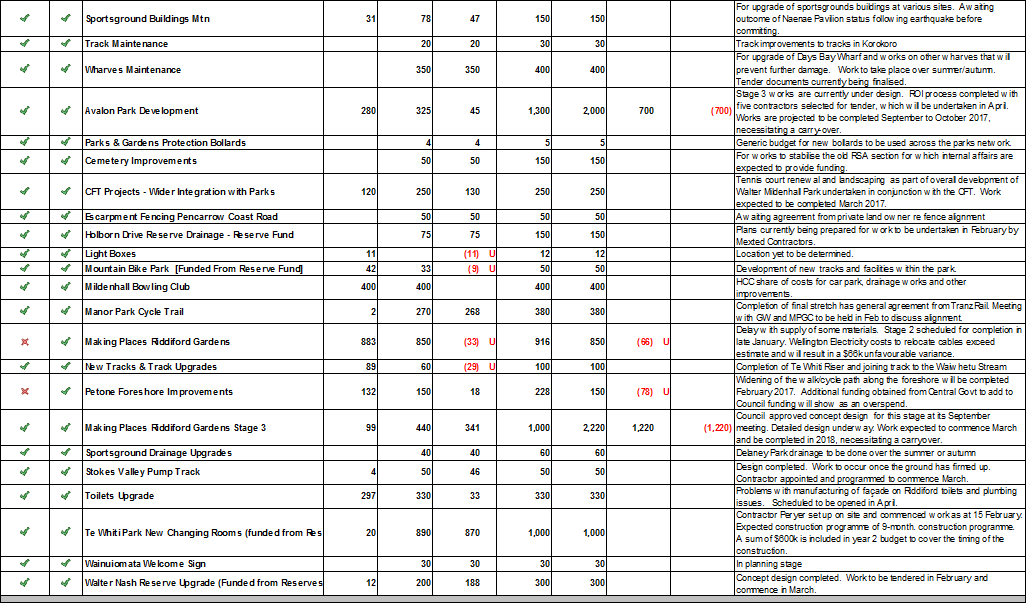

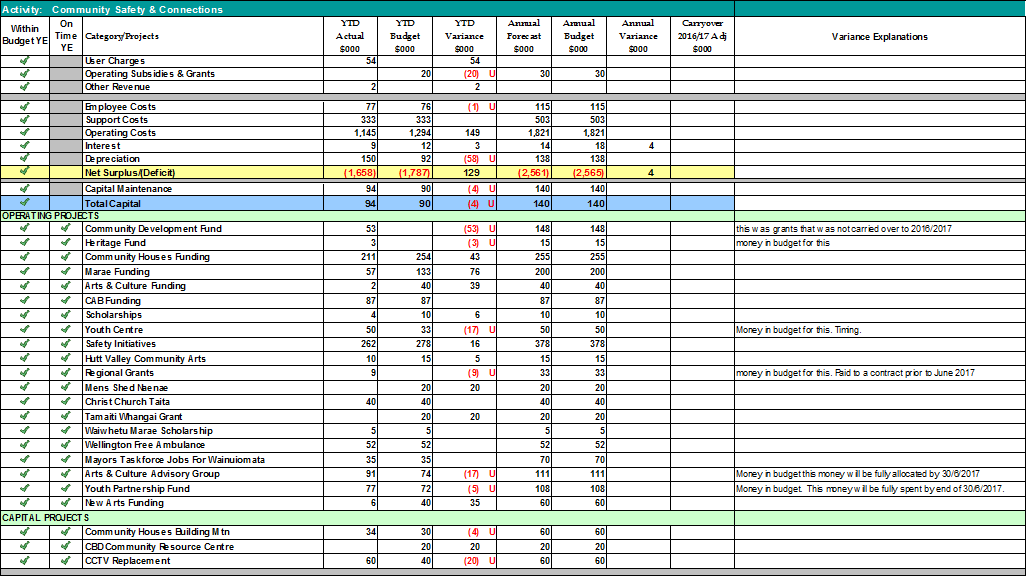

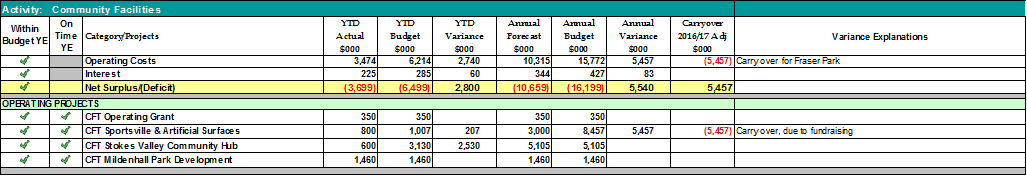

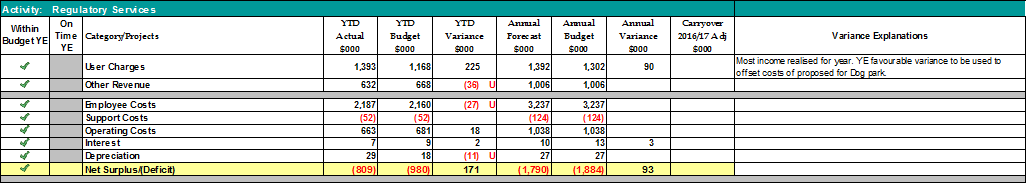

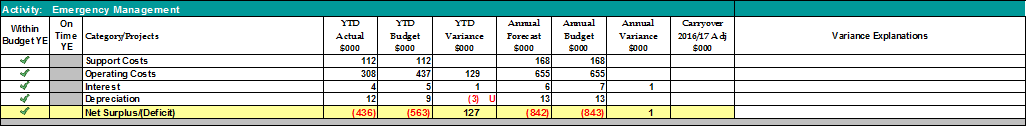

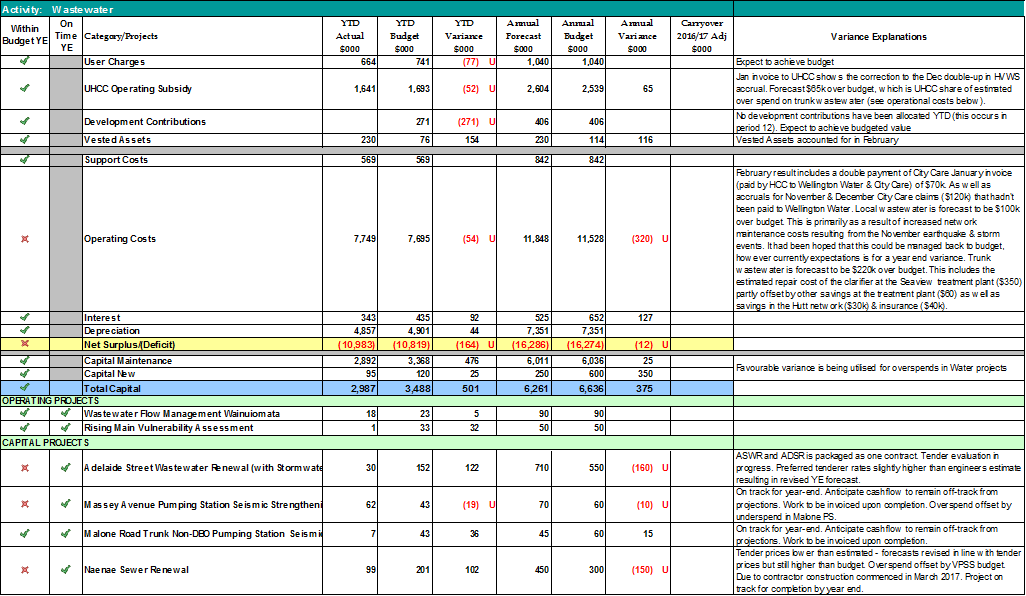

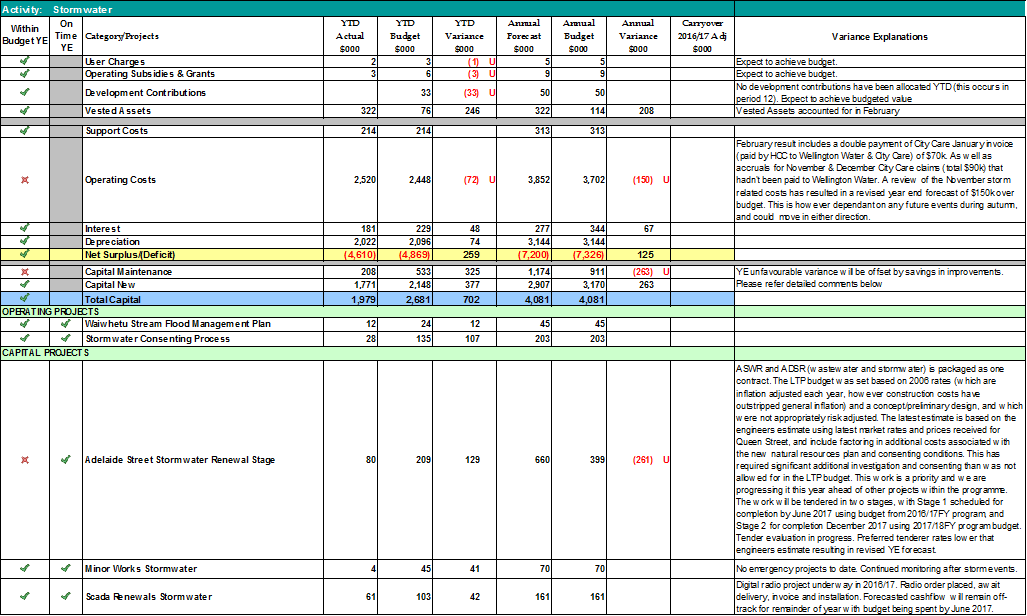

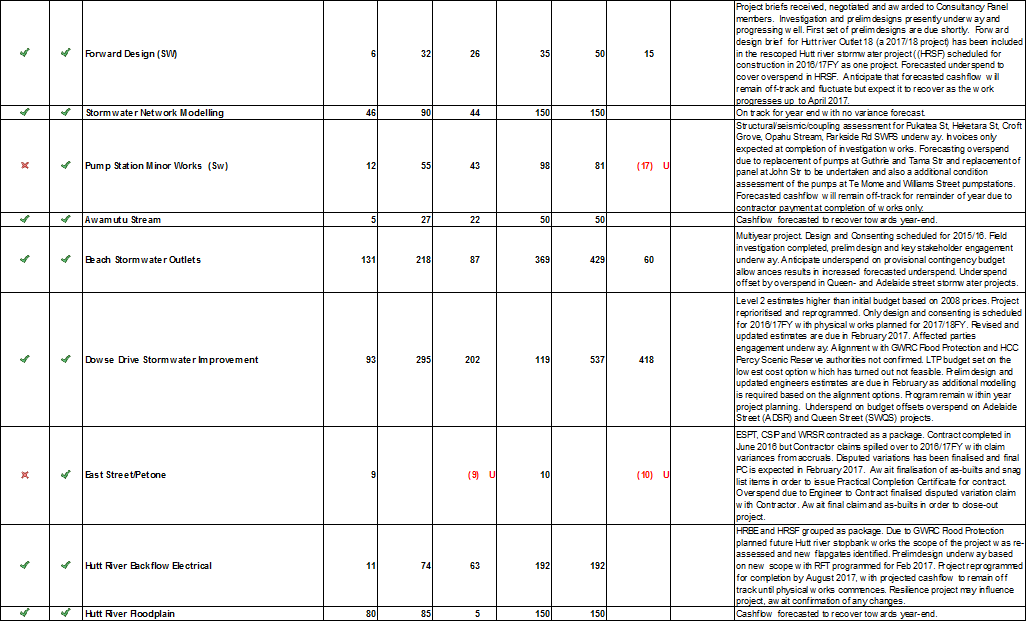

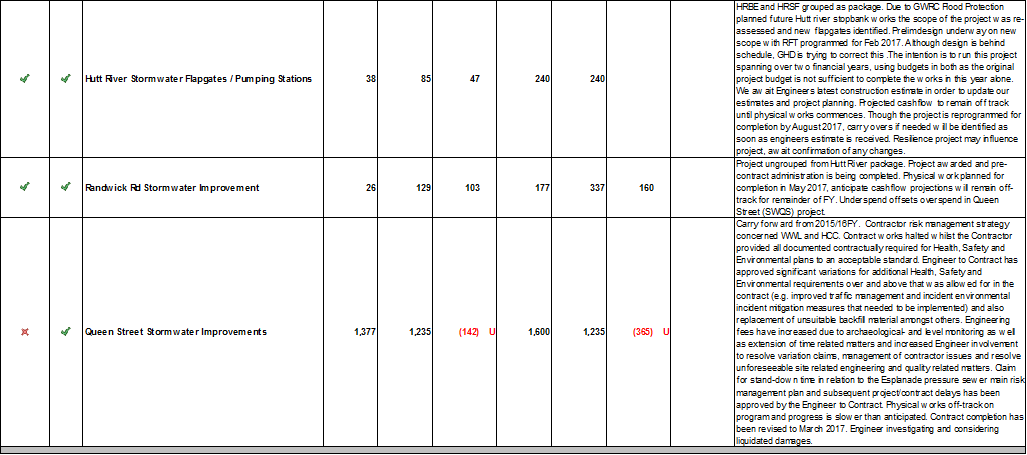

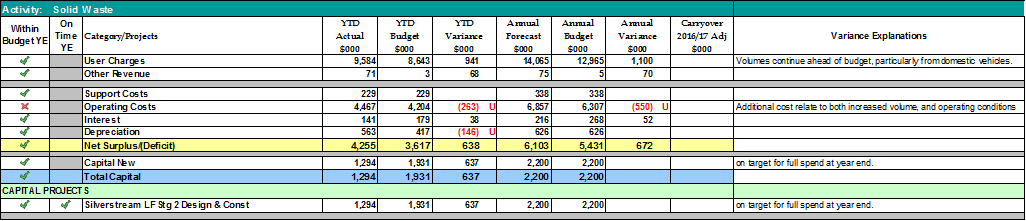

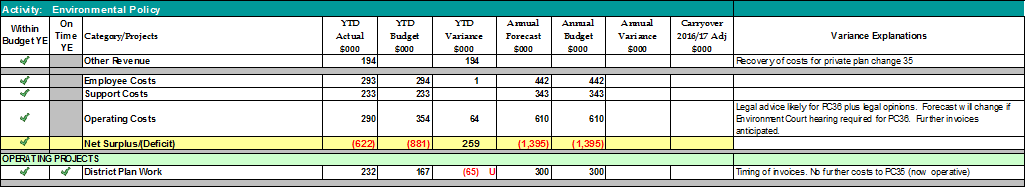

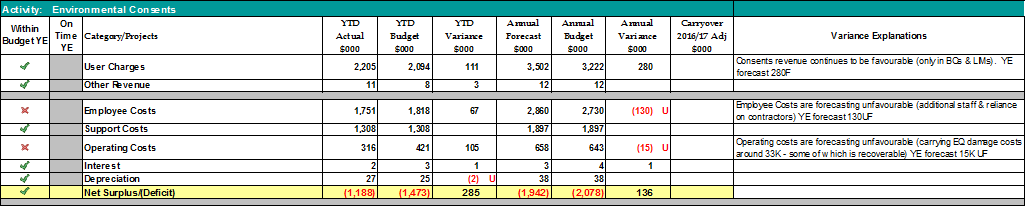

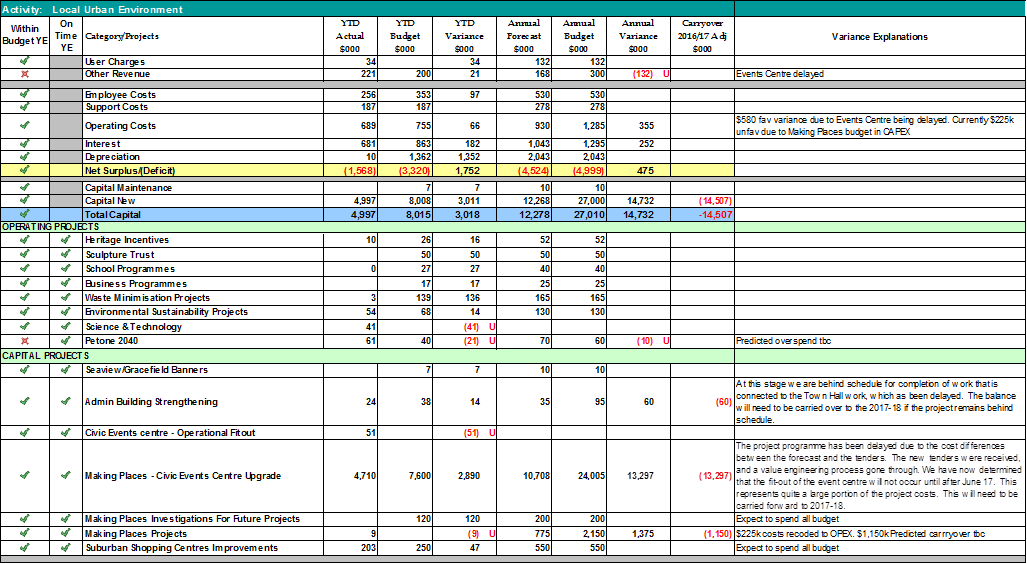

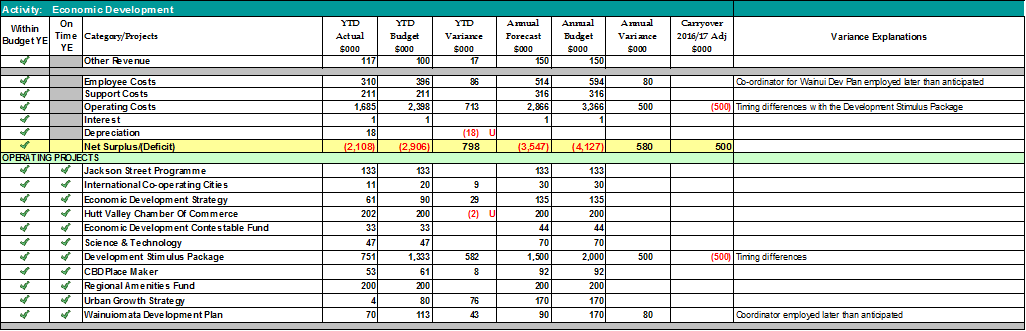

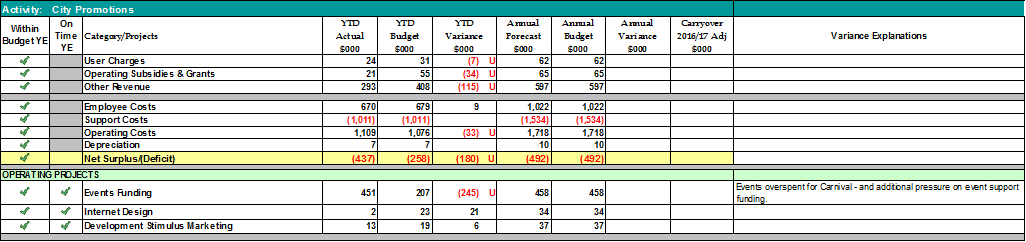

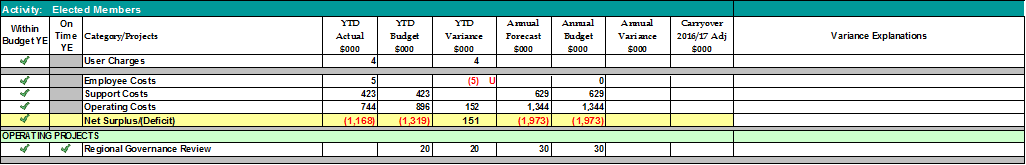

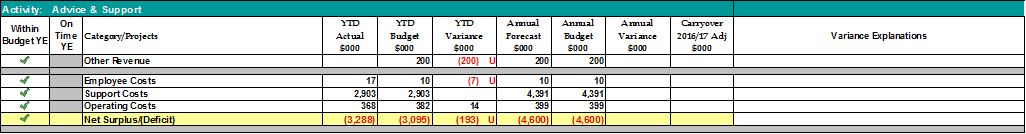

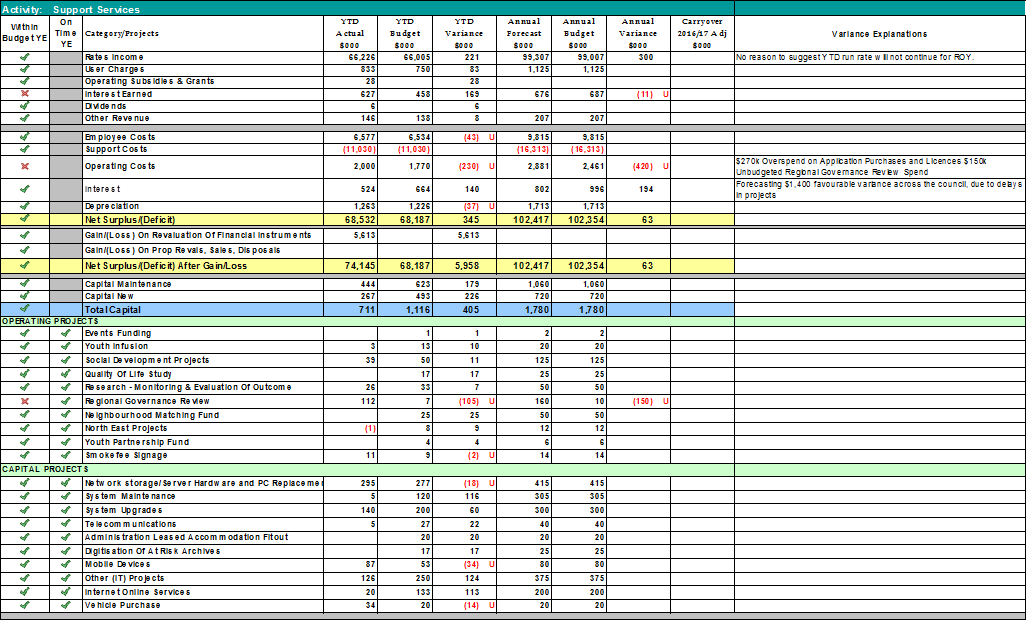

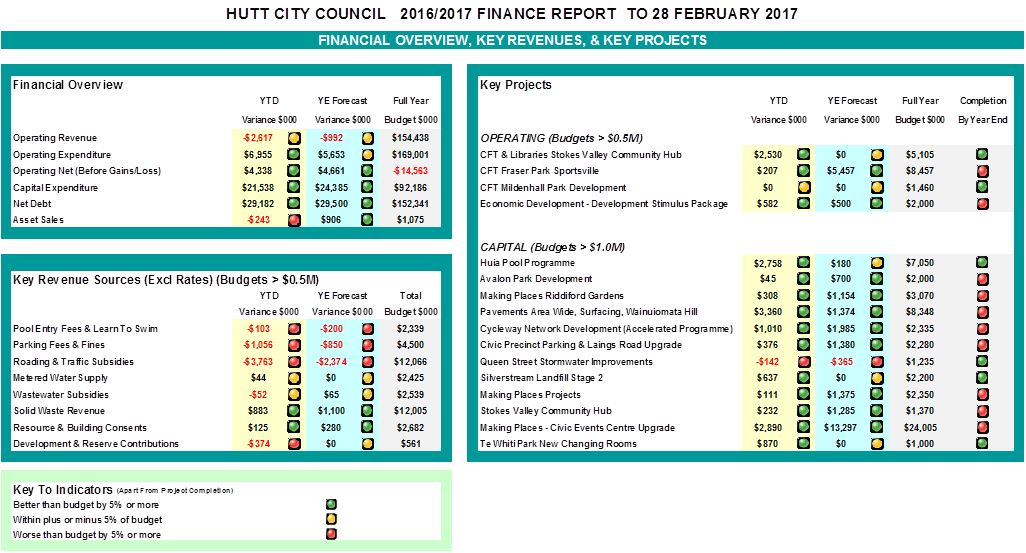

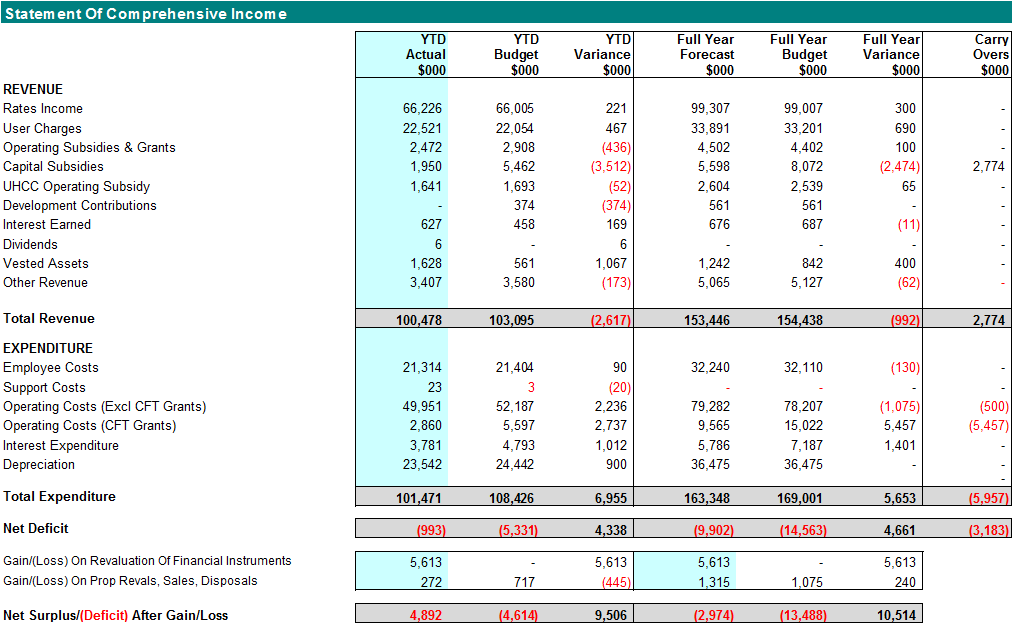

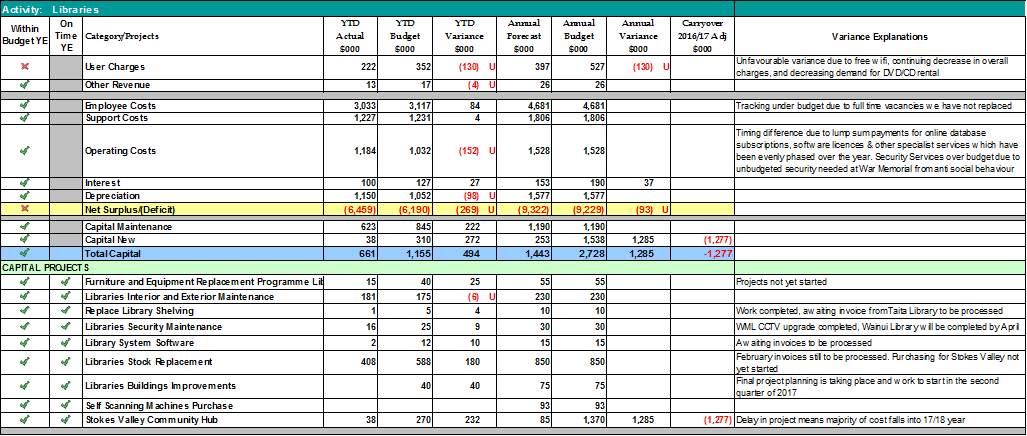

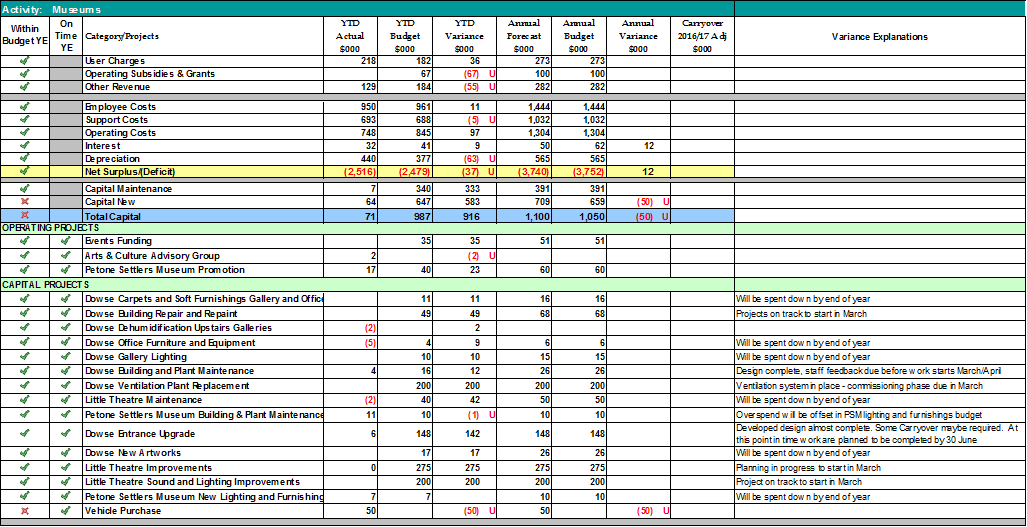

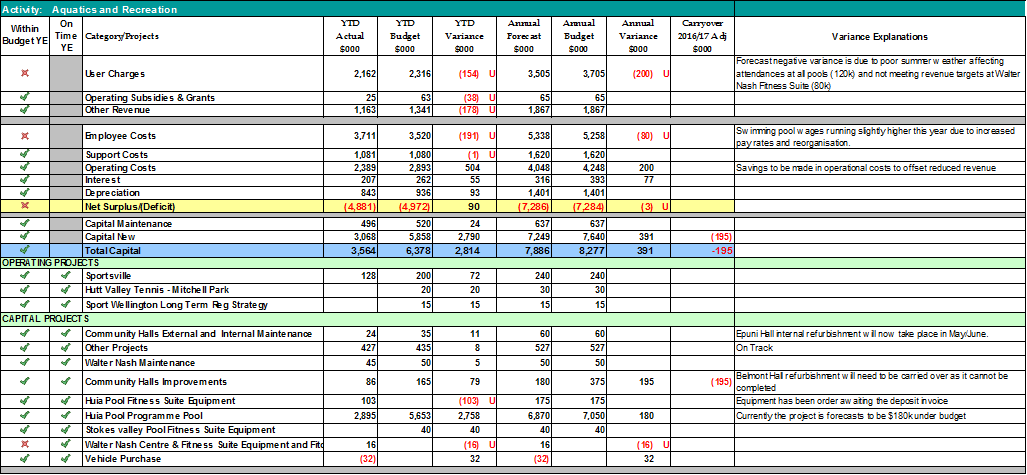

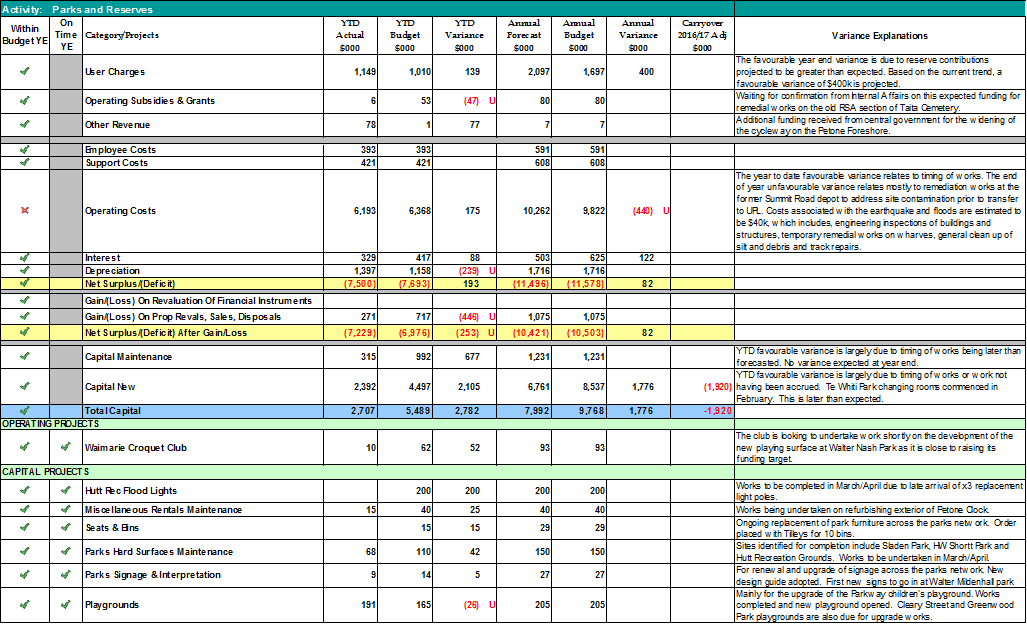

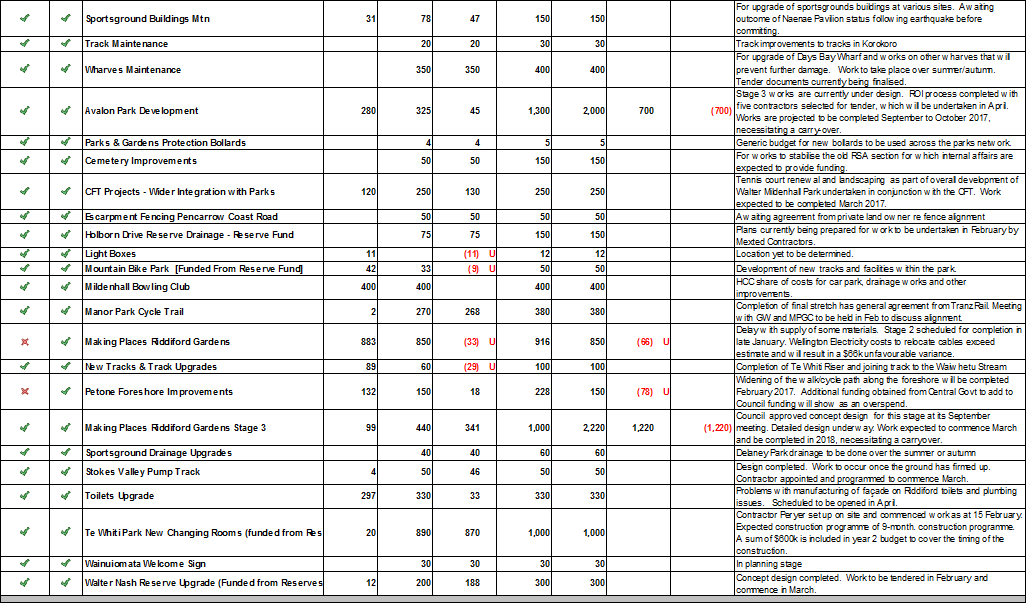

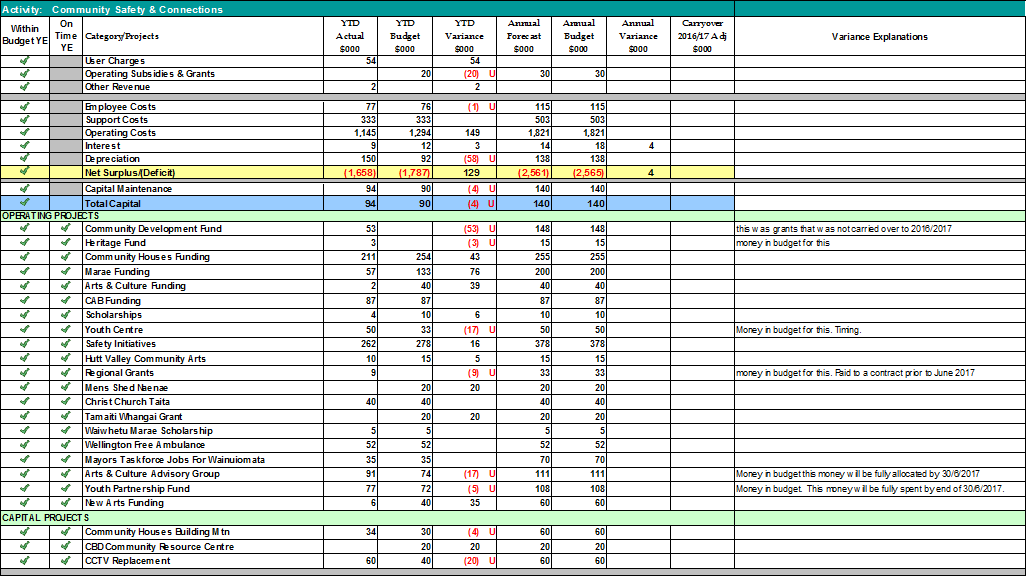

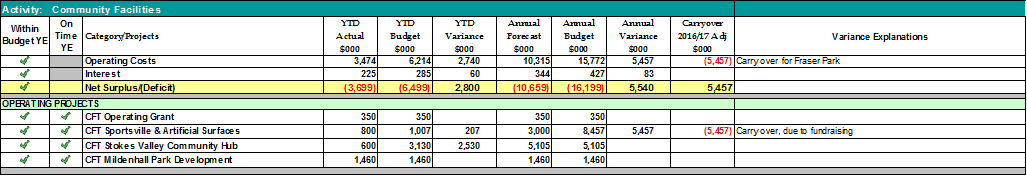

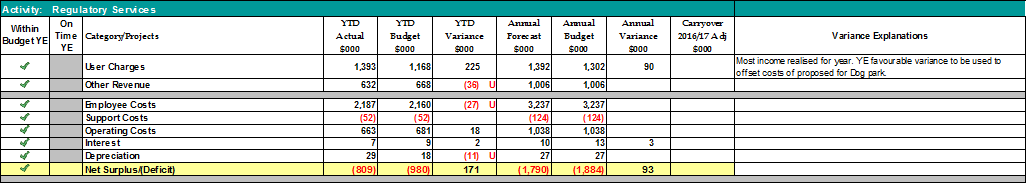

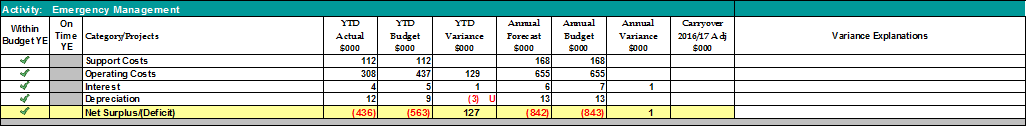

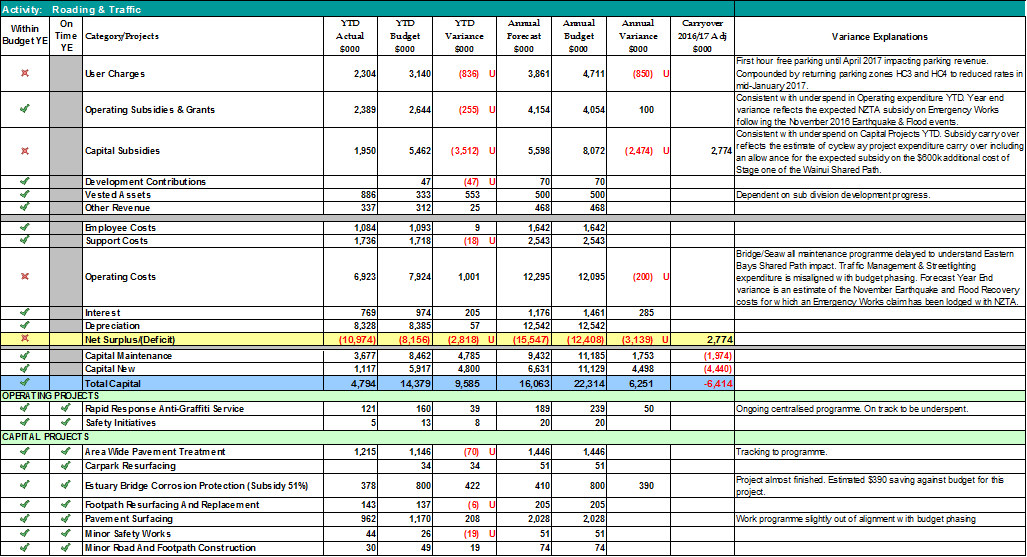

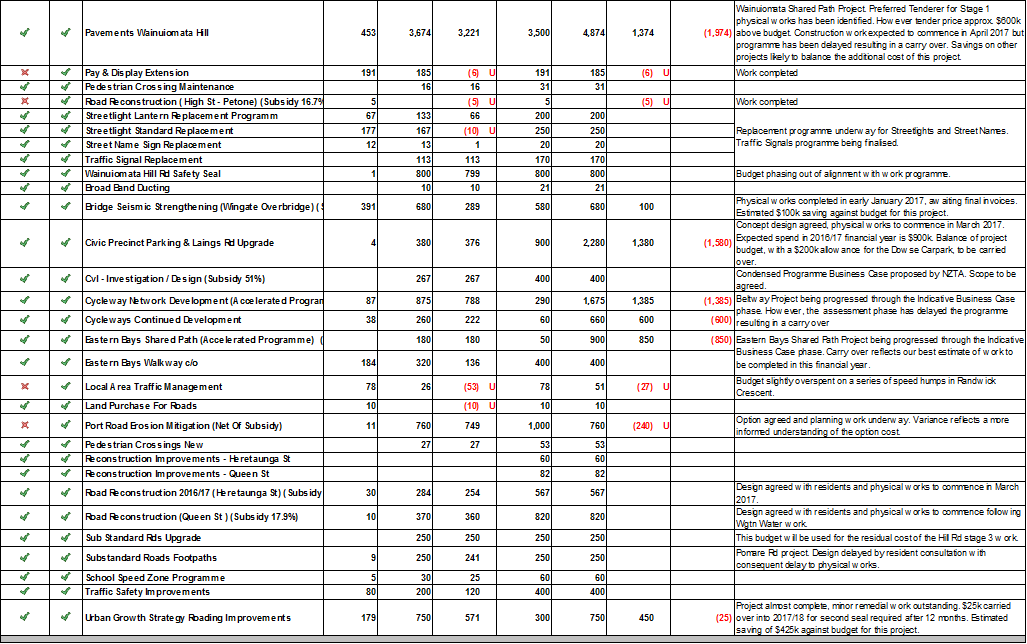

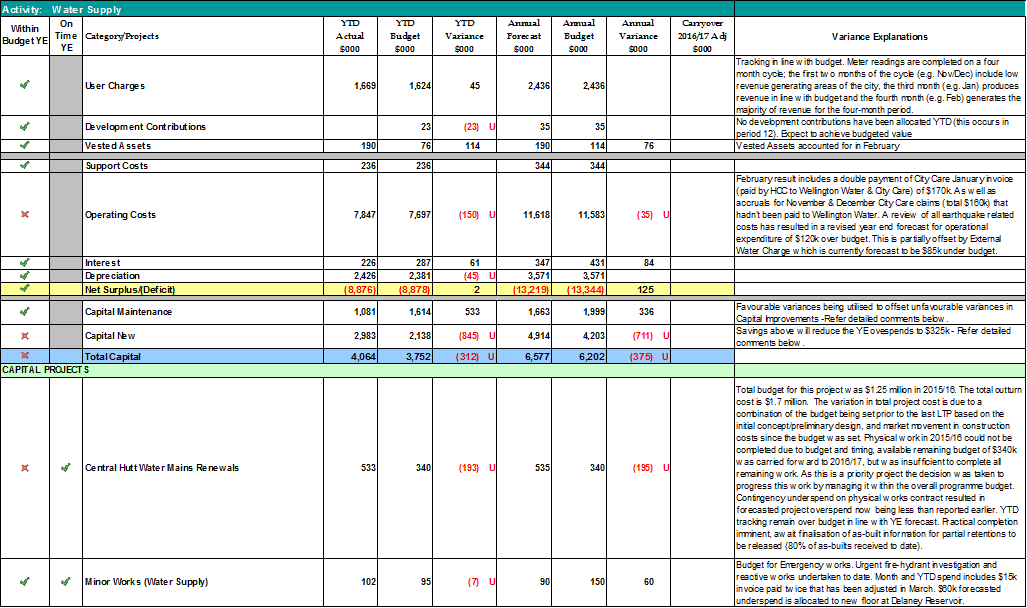

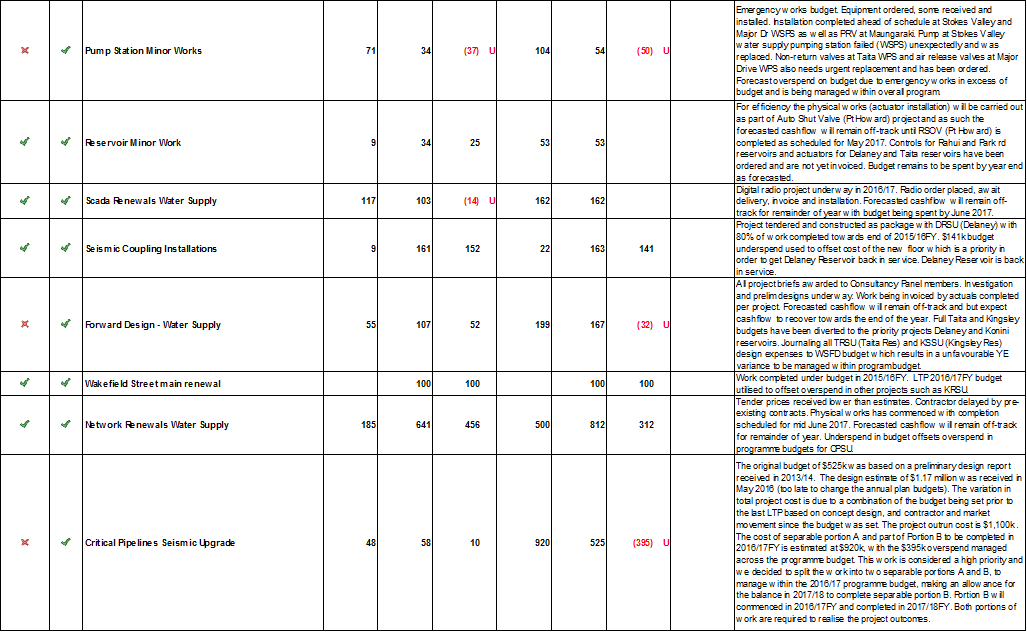

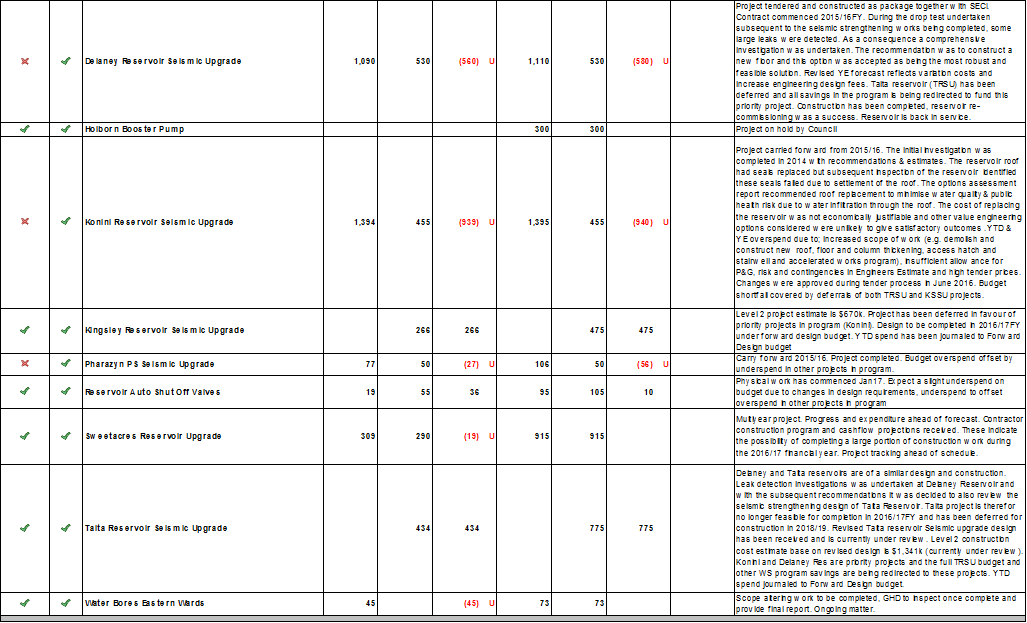

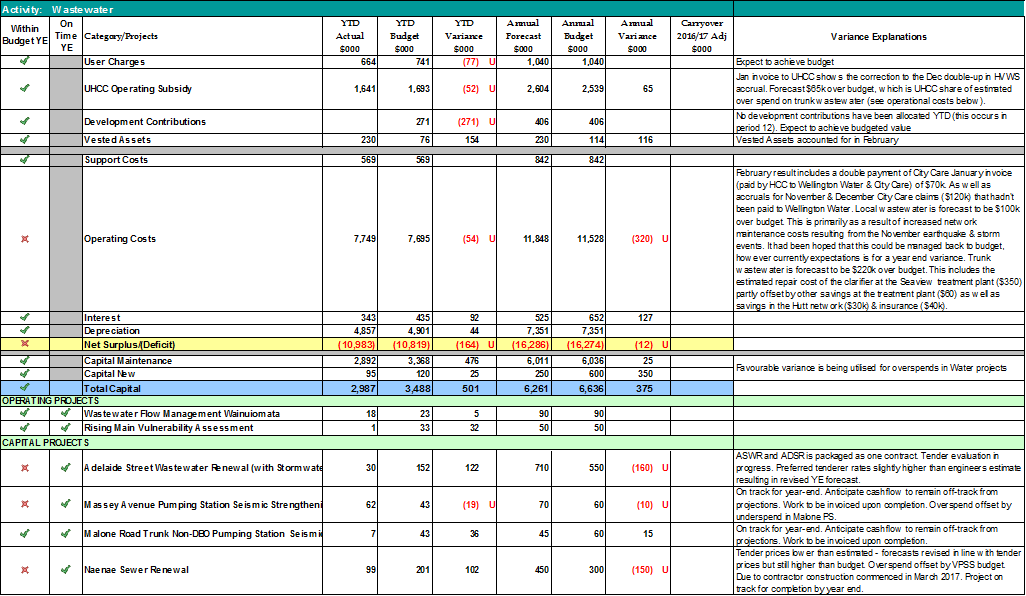

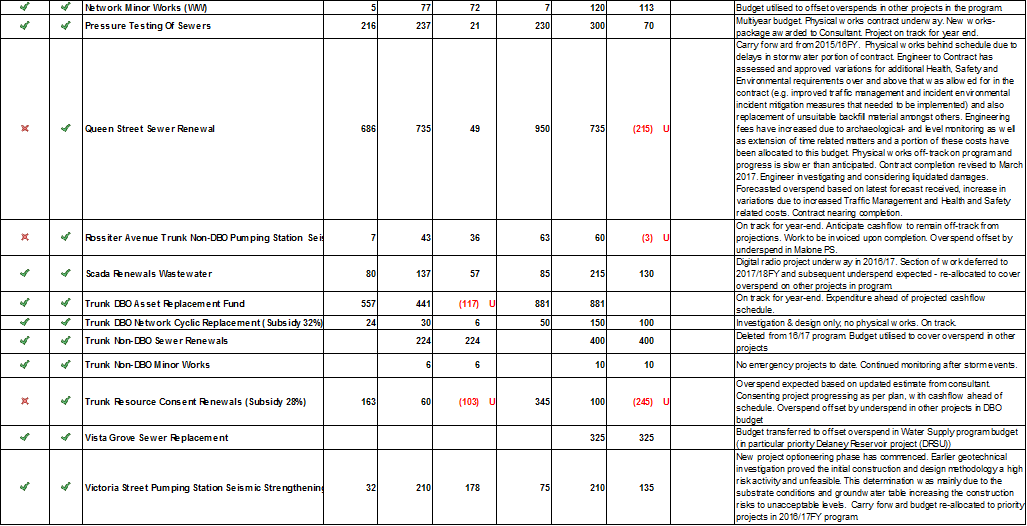

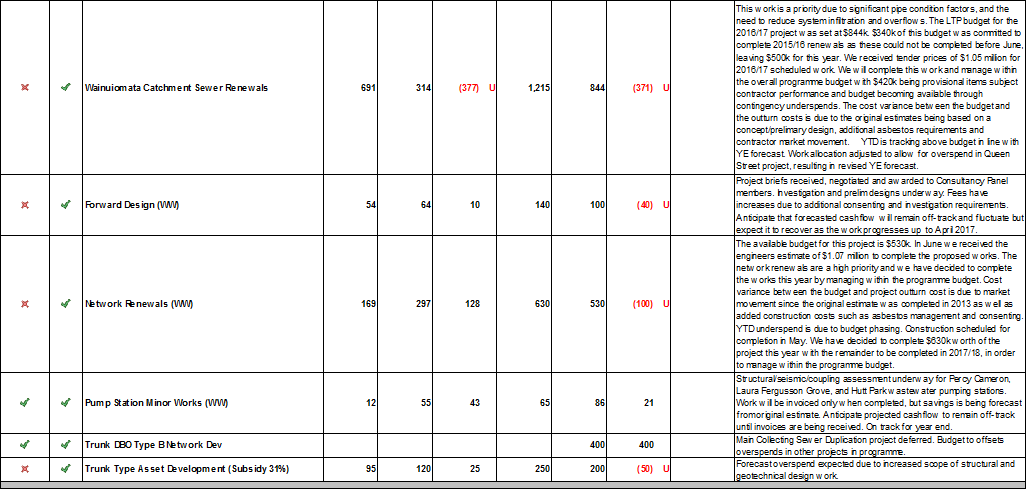

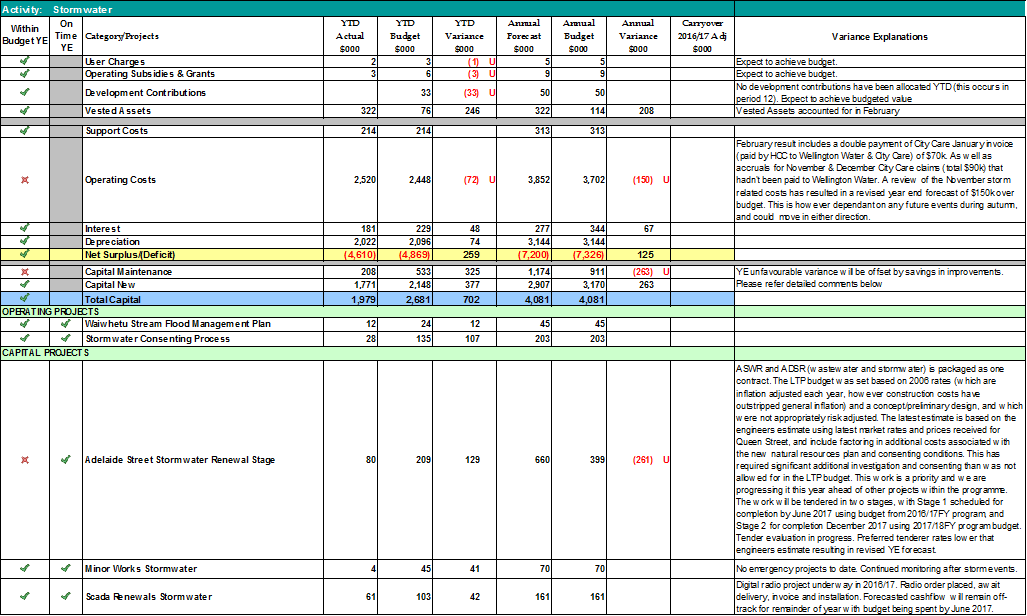

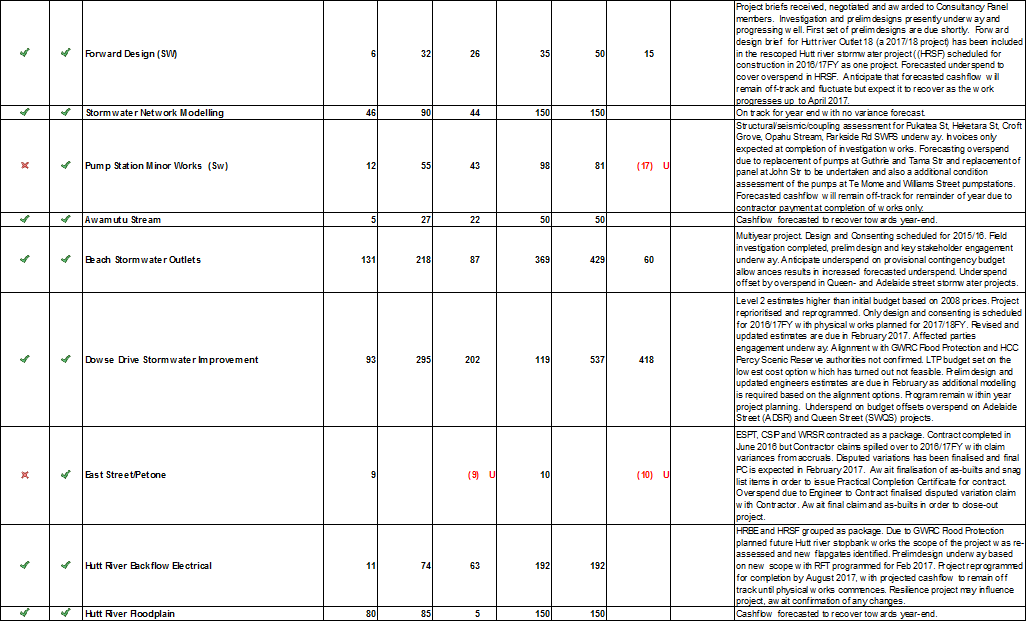

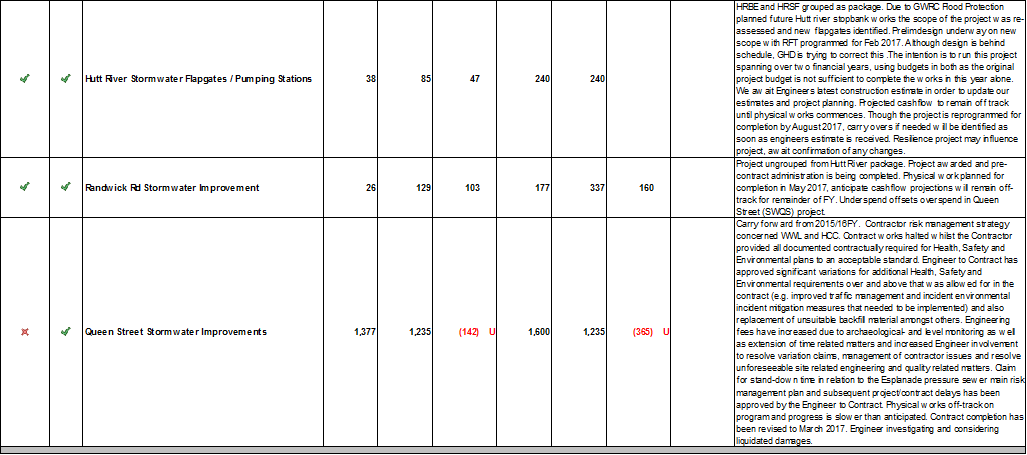

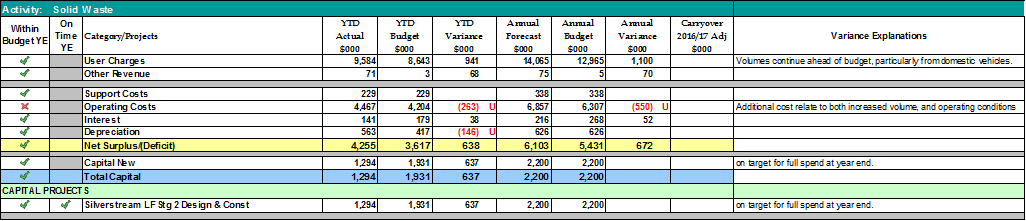

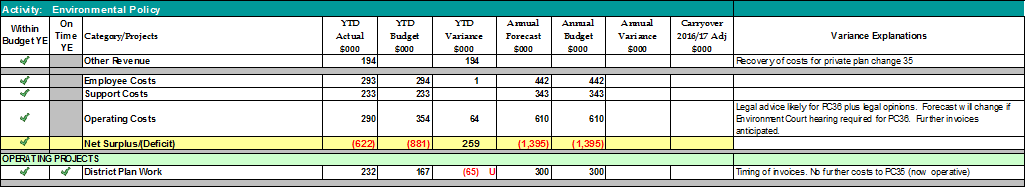

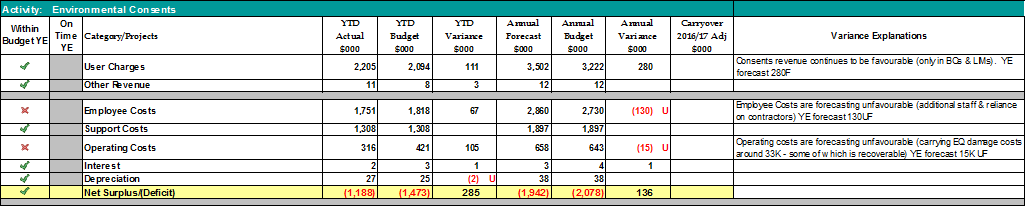

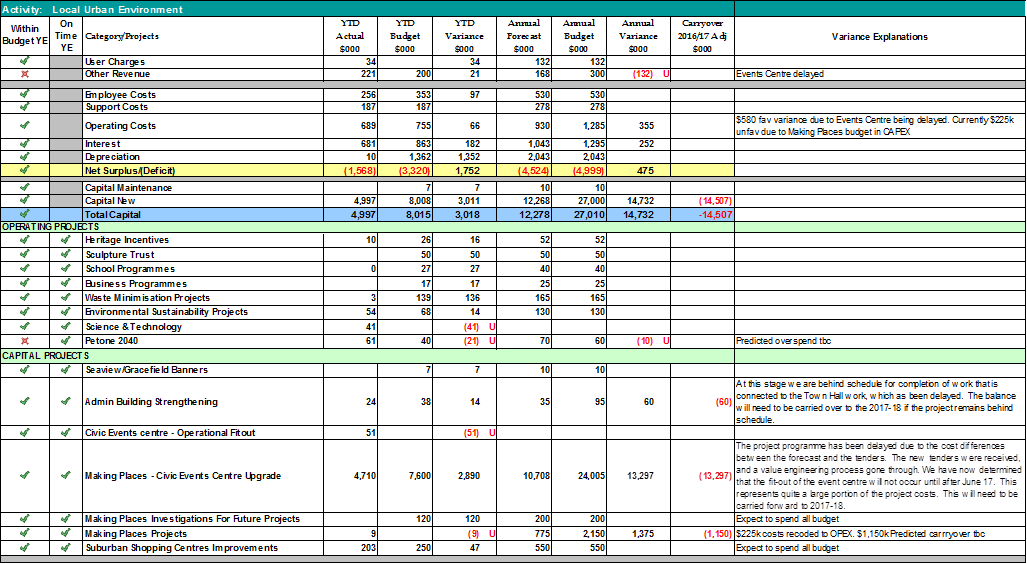

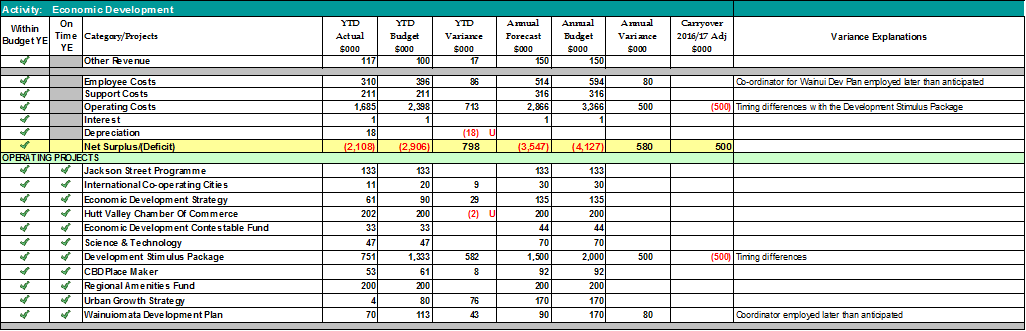

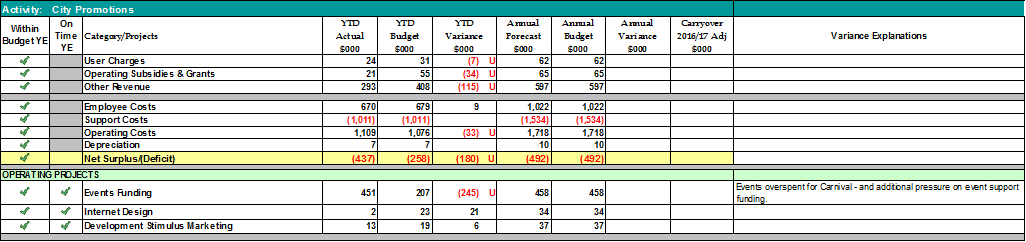

Finance Update

Purpose

of Report

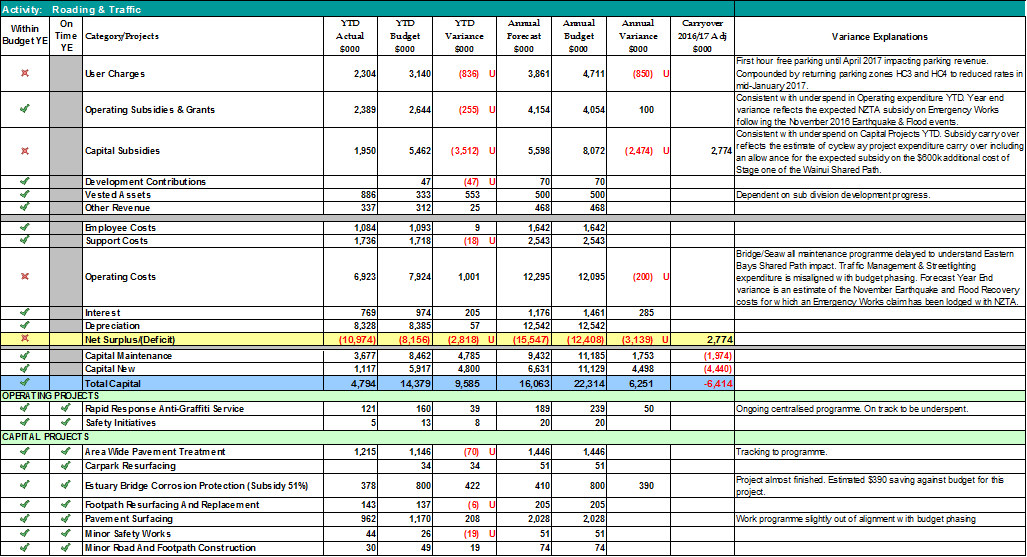

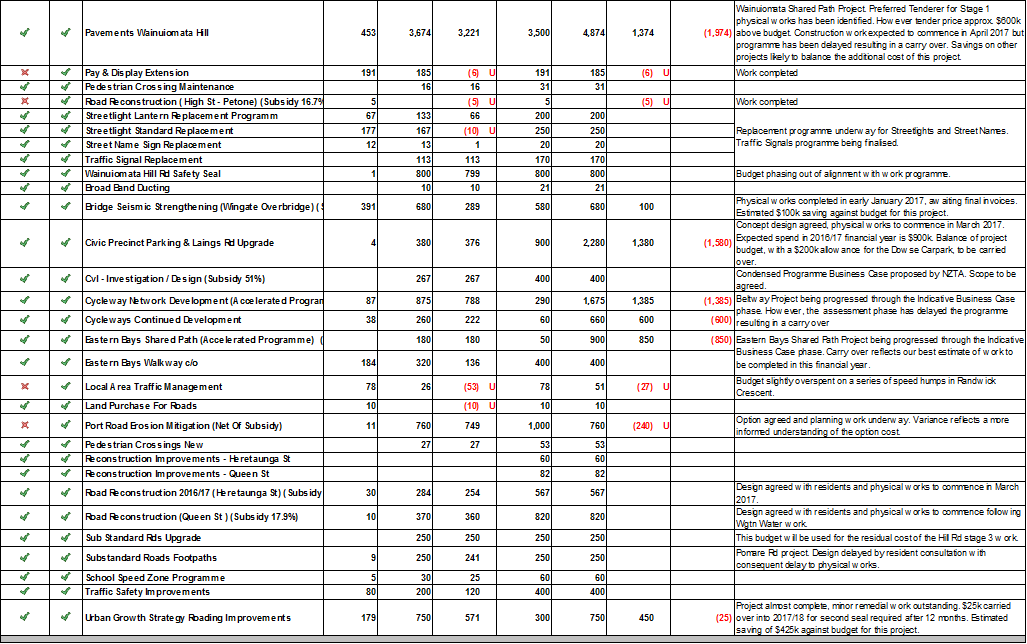

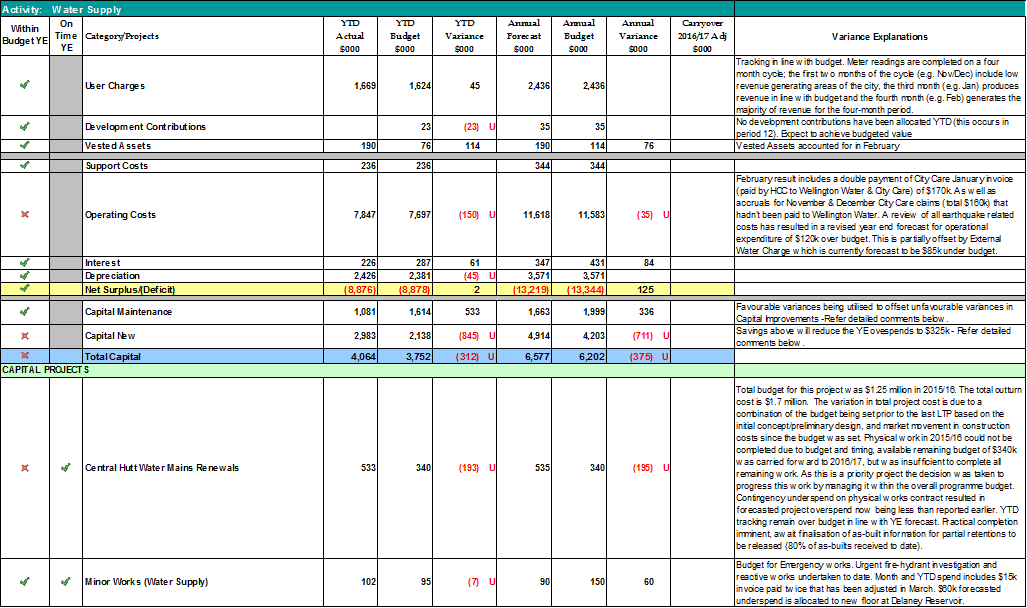

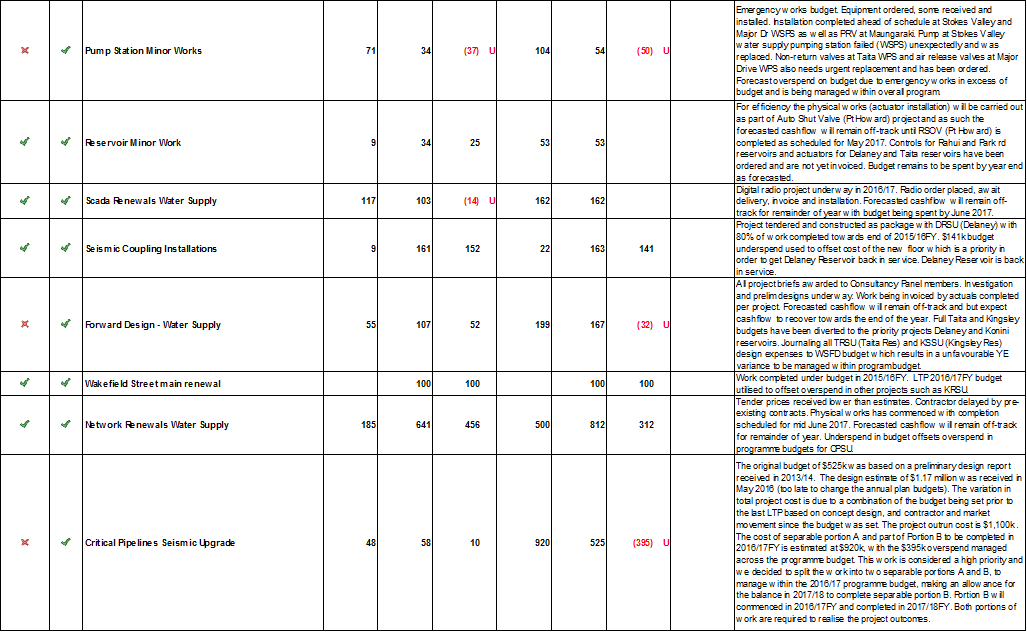

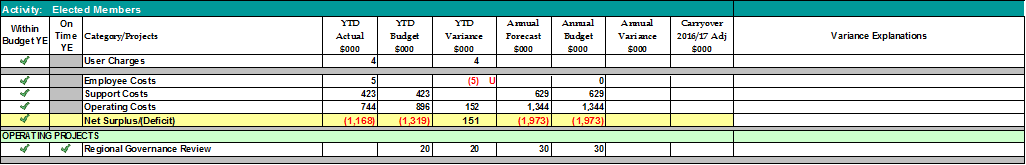

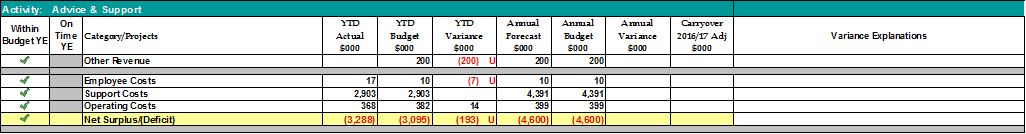

1. The

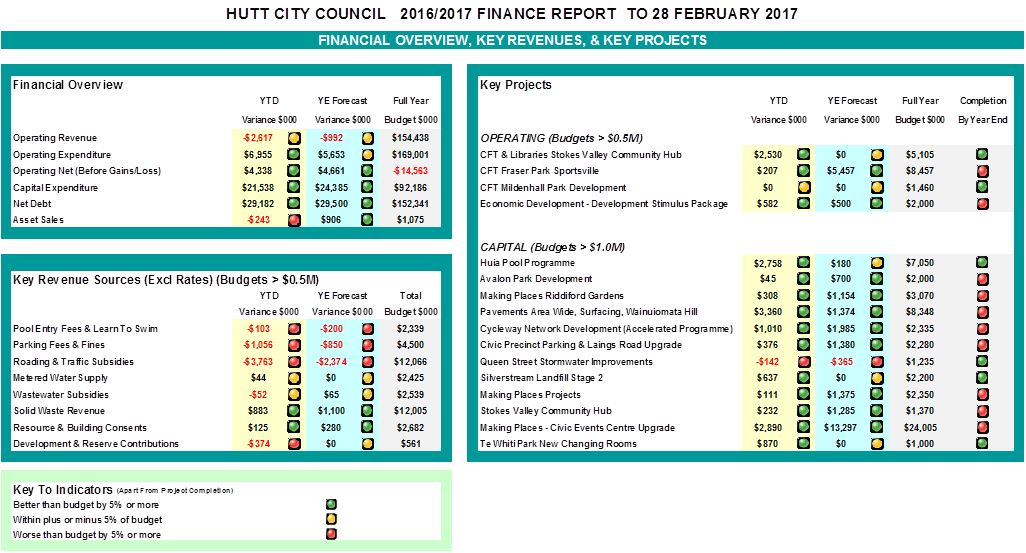

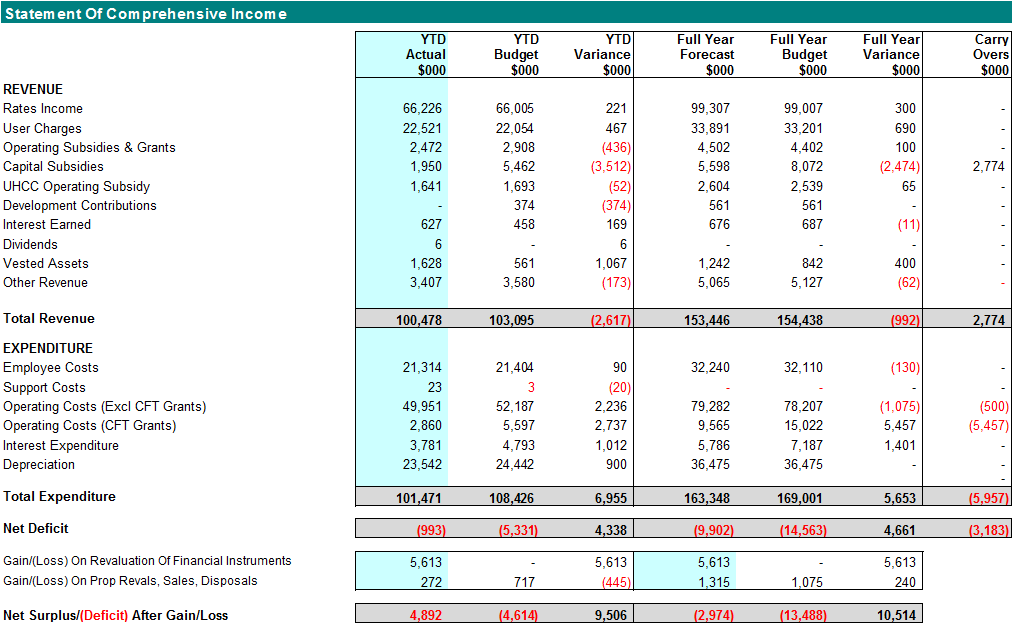

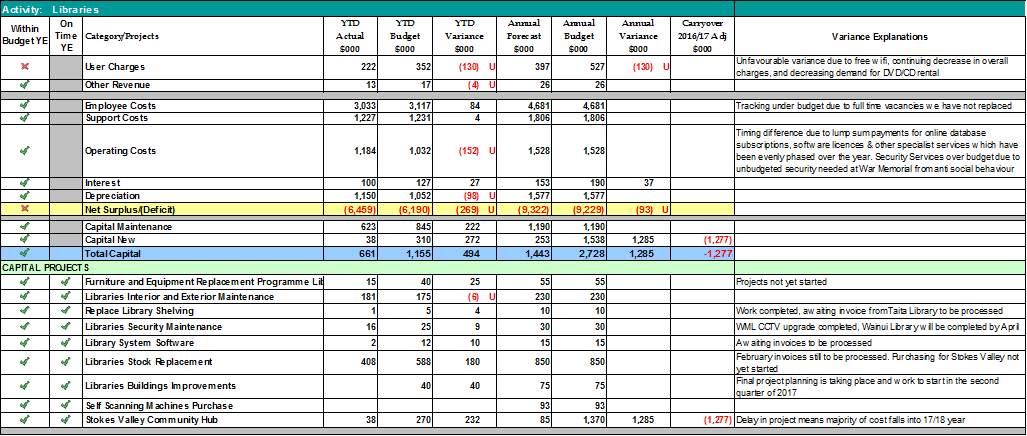

purpose of the report is to present the Committee with Council’s

financial performance to 28 February 2017 and the 2016/17 forecast year-end

financial position.

|

Recommendation

That the Committee notes the year to date financial performance and the forecast

year-end position.

|

Background

2. The

report provides information comparing year to date actual and year-end

forecasts against budgets set by Council in its 2016/17 Annual Plan.

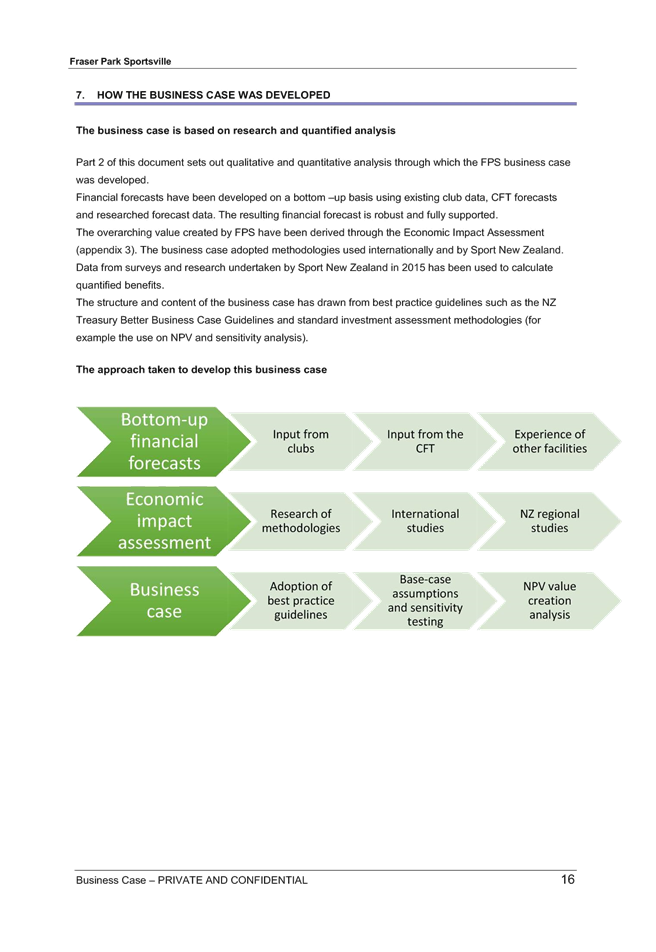

Summary

3. Year

to date revenue and operating costs (excluding gains/losses) are under budget

giving a favourable operating variance of $4.3M. At year end a $4.7M

favourable variance is being forecast.

4. A

significant portion of this variance relates to under spending on CFT projects

and the Development Stimulus Package which are slightly offset by reduced

subsidies due to delays in roading projects.

5. Capital

expenditure is under budget to date by $21.5M with only $27.9M spent to date of

an annual budget of $92.1M. A favourable year end variance of $24.4M is

forecast.

6. Debt

at year end is expected to be under budget by $29.5M.

Operating Position: (excluding

Gains/Losses)

Year to Date

7. There

is a Year to Date operating deficit of -$1.0M compared to a budgeted deficit of

$5.3M giving a favourable variance of $4.3M.

8. Revenue

is -$2.6M under budget due to capital subsidies (-$3.5M), and to a lesser

extent operating subsidies (-$0.4M), principally due to the cycleway projects

being behind their budgeted schedule.

9. Operating

costs are under budget by $6.9M mainly due to delays with the Stokes Valley

Community Hub project ($2.5M), roading maintenance ($1.0M), the Development

Stimulus Package payments ($0.6M), plus reduced interest ($1.0M), and

depreciation expense ($0.9M). These are partially offset by costs arising

from the November earthquake and flood events which to date amount to $0.5M.

Year End

Forecast

10. At year end

there is expected to be a forecast deficit of -$9.9M compared to the budgeted

deficit of -$14.6M, giving a favourable variance of $4.7M.

11. Revenue is

forecast to be under budget by -$1.0M due to reduced capital subsidies of

-$2.5M because of the deferral of some roading projects including the cycleway

projects.

12. Operating

costs are forecast to be under budget by $5.7M mainly due to an underspend in

the operating grant payments to CFT for Fraser Park Sportsville of $5.4M, and

savings in Interest costs of $1.4M due to underspend on capital projects plus

lower than budgeted interest rates. The Development Stimulus Package

payments are expected to be $0.5M underspent.

13. Council’s

Parks and Reserves Division are forecasting a $0.4M overspend due to unbudgeted

costs for remediation work to address soil contamination at the former Summit

Road Depot, some of which has been recovered via associated landfill

fees.

14. Unbudgeted

costs arising from the November 2016 earthquake and flood events are expected

to be about $1.0M (originally estimated to be $1.2M). Some of these costs

have been offset by other operating savings.

15. Operating

carryovers will be required for Capital subsidies of $2.8M, CFT grants of $5.5M, and $0.5M for Development Stimulus Package.

Revaluation of Financial Instruments:

16. Year to

Date, the revaluation of interest rate swaps has resulted in an

unrealised gain of $5.6M due to higher market floating interest rates relative

to interest rates fixed by Council.

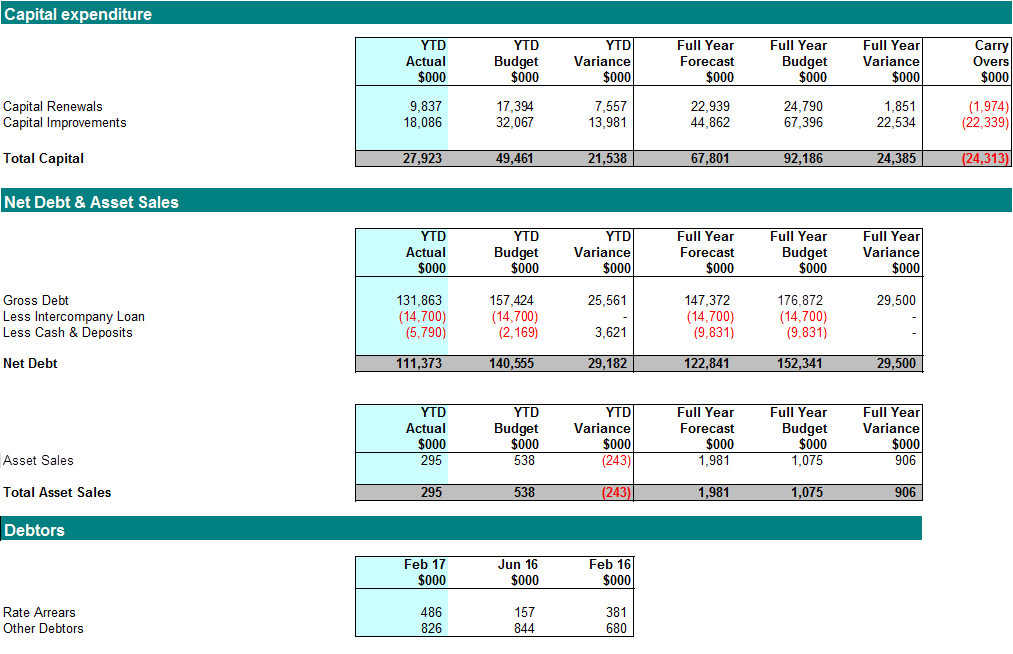

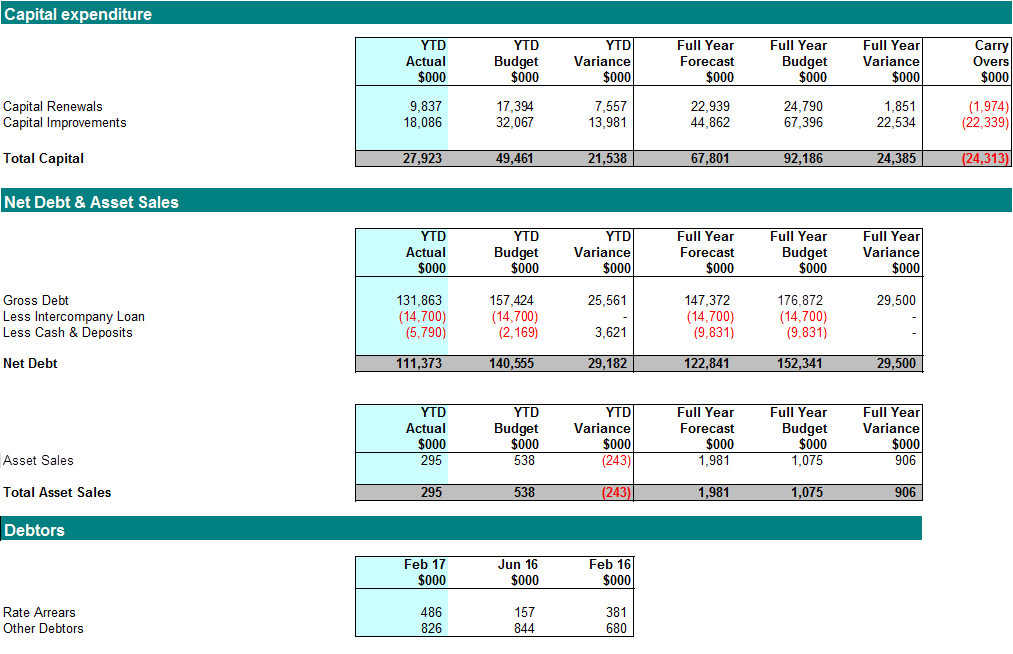

Capital Expenditure:

Year to Date

17. There is a

favourable variance of $21.5M against a budget of $49.5M.

18. This is

mainly due to delays in the following projects; $2.8M for Huia Pool; $2.9M for

the Civic Events Centre project; and $9.6M for Roading and Traffic (including

cycleways) projects.

Year End

Forecast

19. At year end

there is a forecast favourable variance of $24.4M against a budget of $92.1M.

20. This is

mainly due to delays in some major projects including; $6.2M for Roading

projects including cycleway / shared path projects and Civic Precinct parking;

$1.3M for Stokes Valley Community Hub; $0.7M for Avalon Park; $1.2M for

Riddiford Gardens; and $13.3M for the Civic Events Centre project. All of

these projects will require carryovers.

21. At this

stage a total of $24.3M will need to be carried over to 2017/18.

22. Most other

projects at this stage are expected to be completed on time and within budget

by year end.

Asset Sales

23. Asset Sales

at this stage are forecast to be $2.0M for the year which is $1.0M above budget

due to; a Council approved plan change for an area north of Avalon Park which

will enable a sale this financial year; and the inclusion of two sales not

completed in 2015/16.

Net Debt

24. Net Debt as

at 28 February 2017 is $29.2M below budget which reflects the Year to

Date favourable variances in operating and capital expenditure offset by an

unfavourable variance in asset sales.

25. Forecast

year end Net Debt is expected to be under budget by $29.5M mainly as a result

of the forecast underspend in capital and the favourable variances in operating

costs and asset sales.

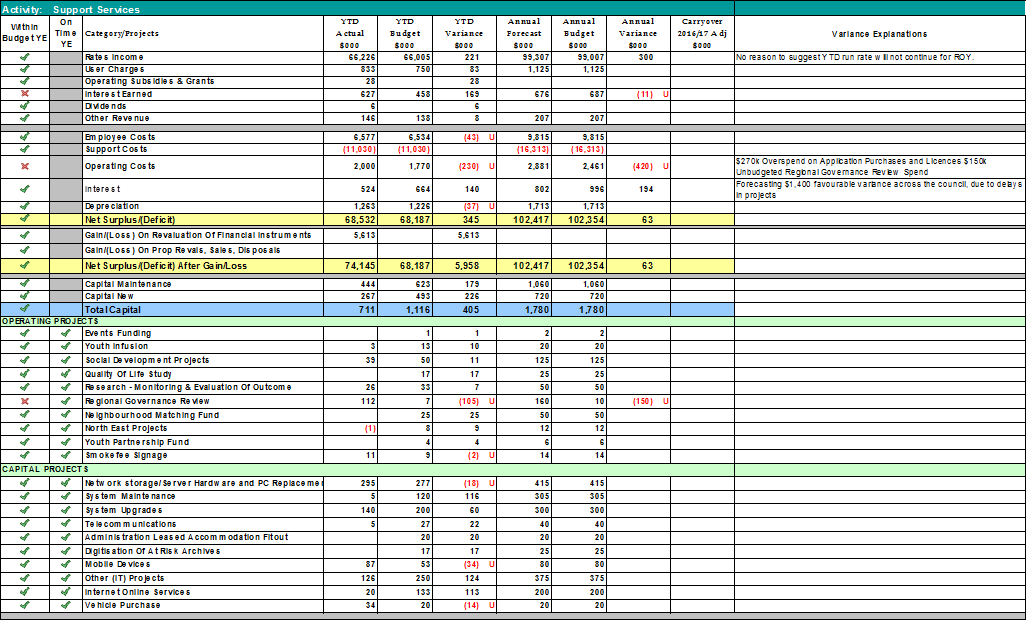

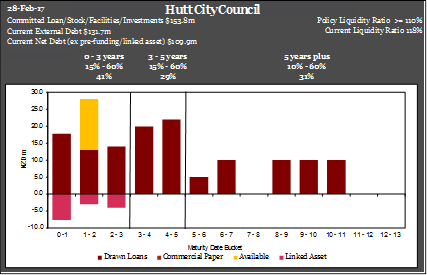

Treasury Compliance

26. All limits

within the Treasury Risk Management Policy have been fully complied with.

27. The Treasury

Compliance Report as at 28 February 2017 is attached as Appendix 2 to the

report.

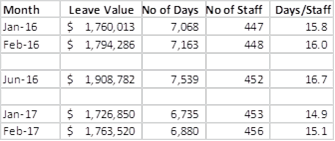

Annual Leave Liability

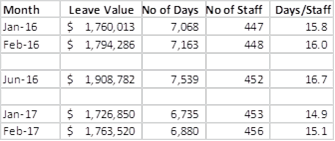

28. There has

been a slight increase in the annual leave liability during February which is

expected following a large amount of leave taken over the Christmas / New Year

holiday period.

29. Leave

liability for both January and February were lower than for the same months

last year.

Consultation

30. There is no

requirement to consult.

Legal Considerations

31. There are no

legal considerations.

Financial Considerations

32. The

financial considerations are covered in the report.

Other Considerations

33. In making this recommendation, officers have given careful

consideration to the purpose of local government in section 10 of the Local

Government Act 2002. Officers believe that this recommendation falls within the

purpose of the local government in that it provides it provides

Councillors with the necessary information to effectively undertake their

governance role.

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Financial Report February 2017 FINAL

|

114

|

|

2⇩

|

Treasury Compliance Report February

2017

|

142

|

Author: Brent

Kibblewhite

Chief Financial Officer

Approved By: Tony Stallinger

Chief Executive

|

Attachment 1

|

Financial Report February 2017 FINAL

|

|

Attachment 2

|

Treasury Compliance Report February 2017

|

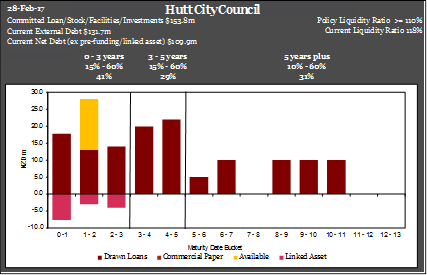

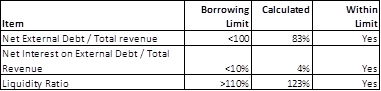

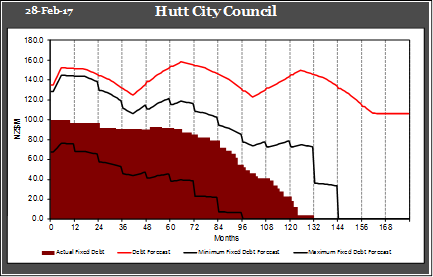

Treasury Compliance Report

As at 28 February

2017

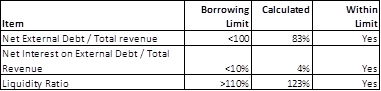

Policy Limits – Snap Shot:

Borrowing Limits:

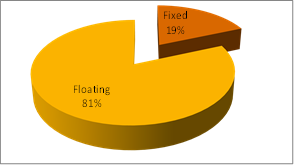

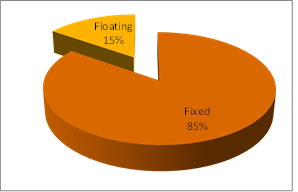

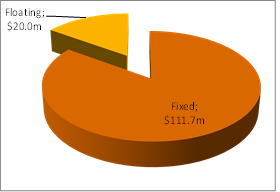

Fixed Interest Compliance:

Fixed Interest Compliance:

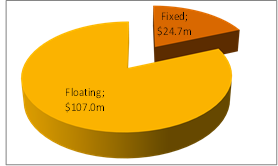

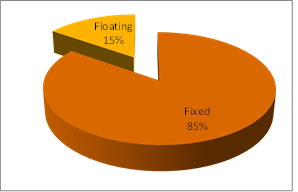

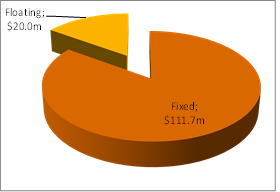

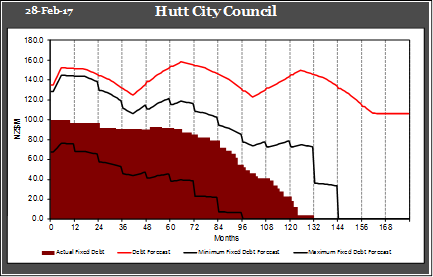

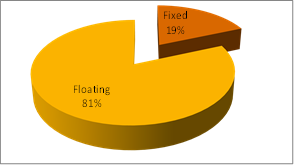

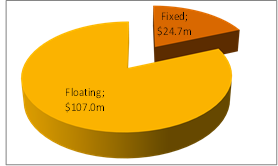

At month end, Council has $131.7M of

fixed/floating borrowings (including borrowings on behalf of CCO’s);

However, with interest rate swaps in place,

effectively the split between fixed/floating is;

Swap Performance:

The Council has a number of interest rate

swap agreements in place to comply with policy and to provide some certainty

with future interest costs. Due to fluctuations in the interest rate

market, the overall value of these agreements is constantly changing.

YTD there has been a $5.6M favourable gain

in the revaluation of interest rate swaps.

Finance

and Performance Committee

Finance

and Performance Committee

06 April 2017

File: (17/625)

Report

no: FPC2017/2/69

Finance and

Performance Work Programme 2017

|

Recommendation

That the report be noted and received.

|

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Finance and Performance Work

Programme for 2017

|

146

|

Author: Annie

Doornebosch

Committee Advisor

Reviewed By: Kate Glanville

Senior Committee Advisor

Approved By: Kathryn Stannard

Divisional Manager, Secretariat Services

|

Attachment 1

|

Finance and Performance Work Programme for 2017

|

Finance & Performance

Committee Work Programme 2017

|

Description

|

Author

|

For

Council

|

|

Cycle 3 – 2 August 2017

|

|

|

|

Finance

Update

|

B

Kibblewhite

|

|

|

Rates

Postponement Scheme for Residential Ratepayers Aged 65 and over

|

B

Kibblewhite

|

|

|

Insurance

Update

|

B

Kibblewhite

|

|

|

Risk

and Assurance Update and Operational Risk Register

|

E

Davids

|

|

|

Audit

NZ Interim Management Report

|

D

Newth

|

|

|

Activity

Report – Information Technology

|

L

Allott

|

|

|

Appointment

of Directors CFT

|

B

Cato

|

·

|

|

Finance

& Performance Work Programme

|

A

Doornebosch

|

|

|

Cycle 4 - 27 September 2017

|

|

|

|

Finance

Update – 2016/2017 Provisional Year End Position

|

B

Kibblewhite

|

|

|

Annual

Reports for CCOs – UPL, SML, CFT

|

B

Kibblewhite

|

·

|

|

Finance

& Performance Work Programme

|

A

Doornebosch

|

|

|

18 October 2017

|

|

|

|

Hutt

City Council’s Annual Report

|

J

Stevens

|

·

|

|

Annual

Report for LGFA

|

B

Kibblewhite

|

|

|

Cycle 5 - 29 November 2017

|

|

|

|

Finance

Update

|

B

Kibblewhite

|

|

|

Risk

and Assurance Update and Strategic Risk Register

|

E

Davids

|

|

|

Audit

NZ Final Management Report

|

D

Newth

|

|

|

Insurance

Update

|

B

Kibblewhite

|

|

|

Finance

& Performance Work Programme

|

A

Doornebosch

|

|

Other

Appointment of Directors SML and UPL

– 31 March 2018

Council Asset Revaluations – Cycle 1

or 2, 2018

CCO Lending – due for review 30 June

2018

Review of Agreement with GWRC to collect

rates – on or before 30 June 2018

Appointment of Directors to CFT – 10

July 2018

Libraries Clubhouse Teen Summit Travel 2018

Activity Report – Organisation

– Cycle 5, 2018