Policy, Finance and Strategy

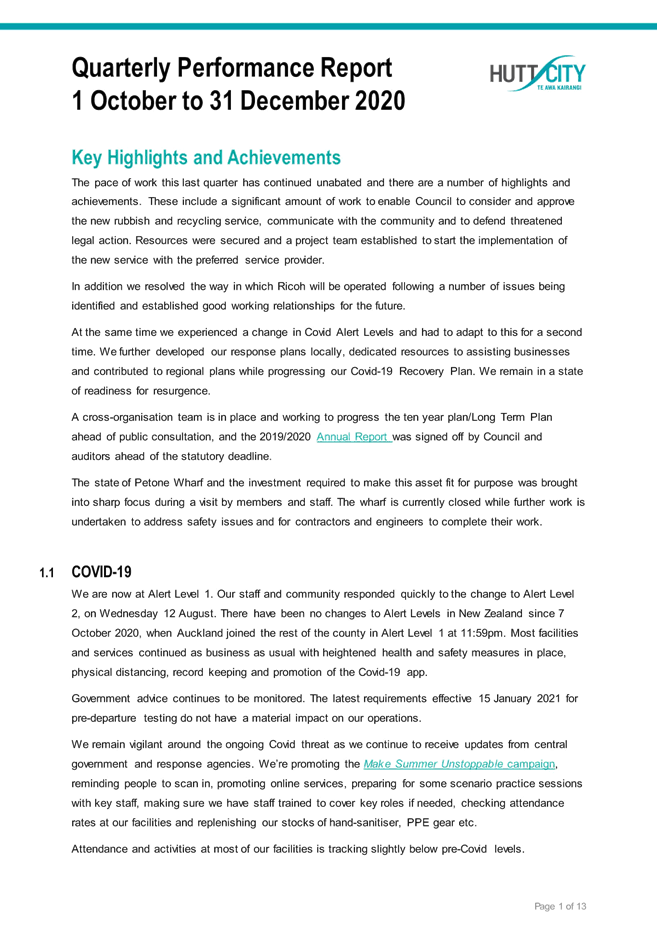

Committee|Komiti Ratonga Rangatōpū me te Rautaki

16

February 2021

Order

Paper for the meeting to be held in the

Council

Chambers, 2nd Floor, 30 Laings Road, Lower Hutt,

on:

Tuesday 23

February 2021 commencing at 2.00pm

Membership

|

Cr

S Edwards (Chair)

|

|

|

Mayor C Barry

|

Cr D Bassett

|

|

Cr J Briggs

|

Cr K Brown (Deputy

Chair)

|

|

Cr B Dyer

|

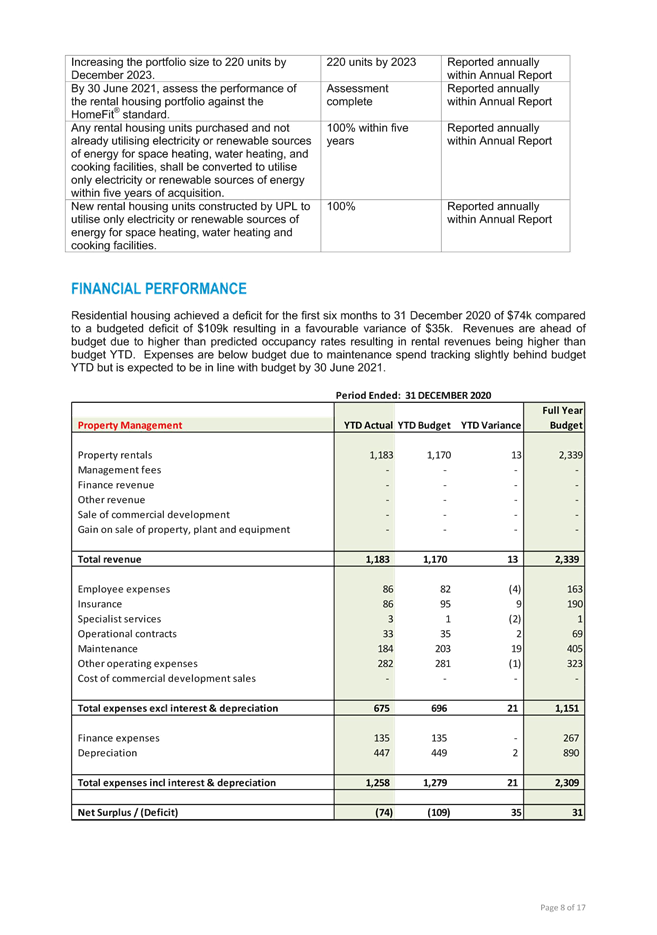

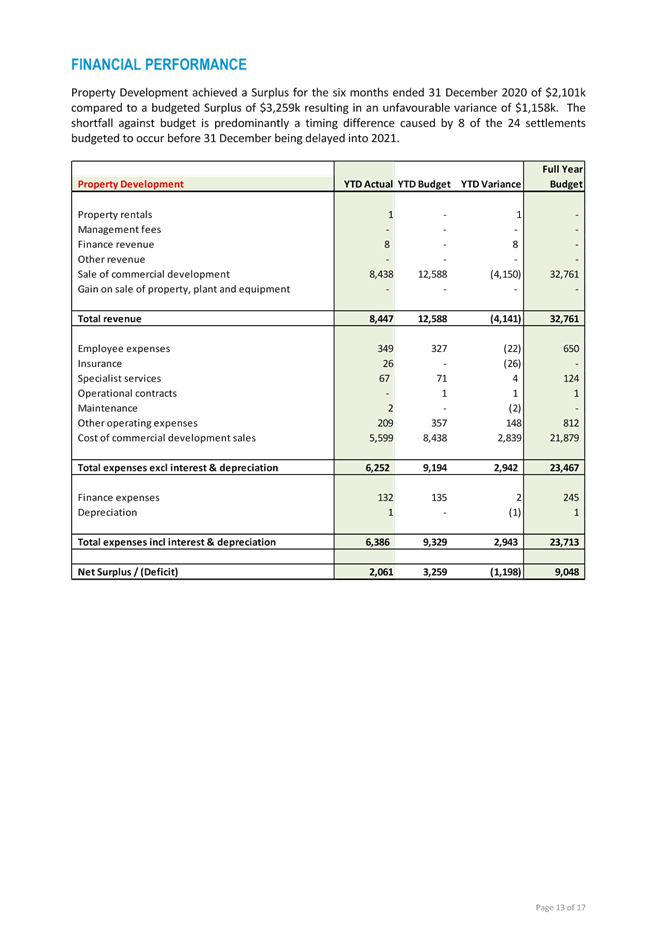

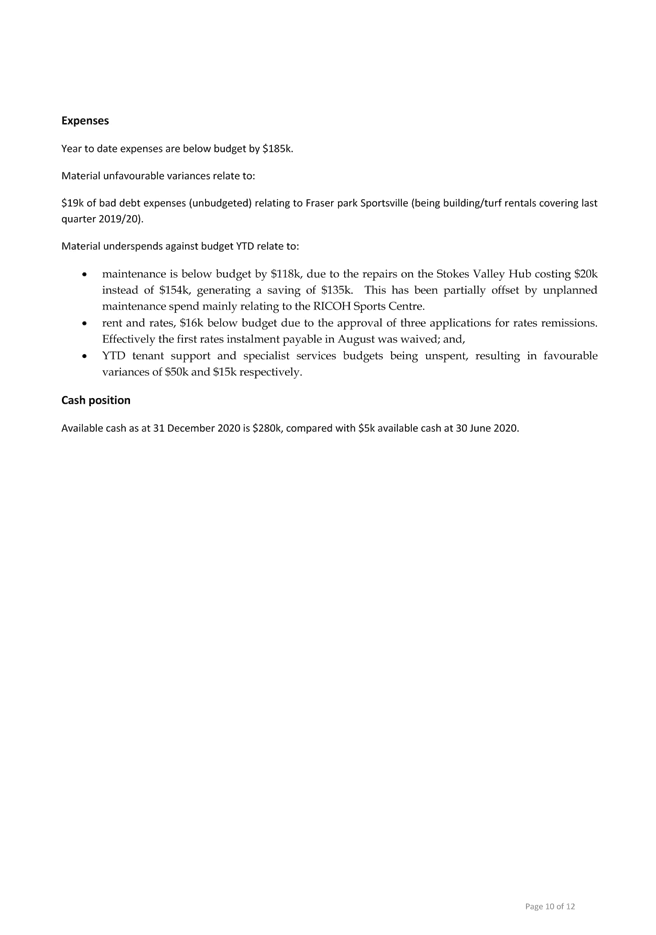

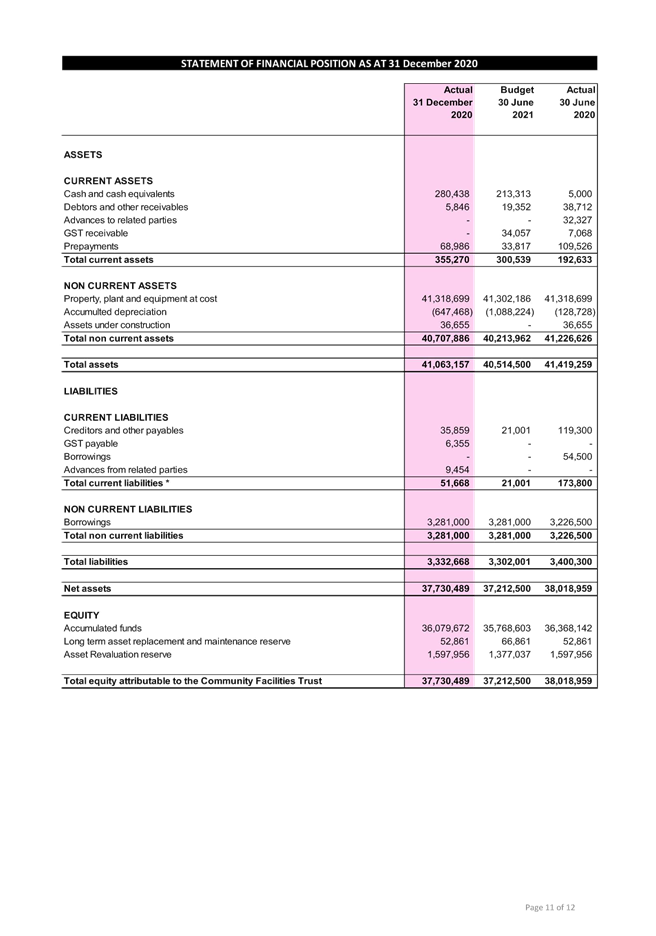

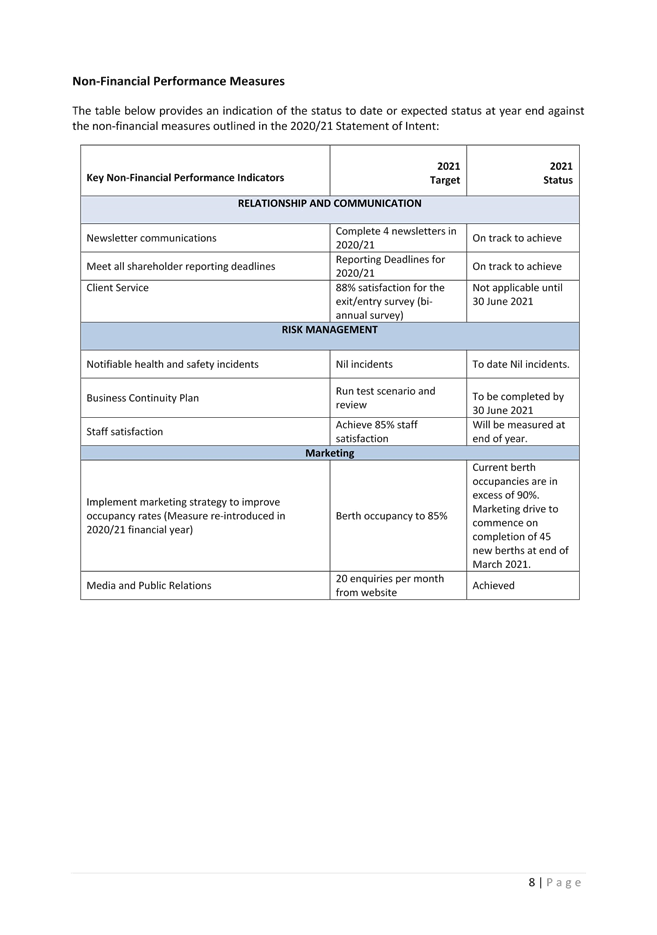

Cr D Hislop

|

|

Deputy Mayor T Lewis

|

Cr C Milne

|

|

Cr A Mitchell

|

Cr S Rasheed

|

|

Cr N Shaw

|

Cr L Sutton

|

For

the dates and times of Council Meetings please visit www.huttcity.govt.nz

Have your say

You can speak under public

comment to items on the agenda to the Mayor and Councillors at this meeting.

Please let us know by noon the working day before the meeting. You can do this

by emailing DemocraticServicesTeam@huttcity.govt.nz or

calling the Democratic Services Team on 04 570 6666 | 0800 HUTT CITY

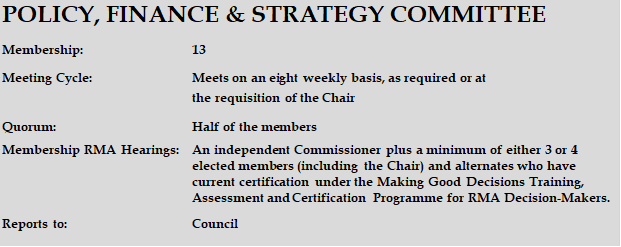

OVERVIEW:

This Committee assists Council in setting the broad direction

of the city, discharging statutory functions, and overseeing organisational

performance.

The Committee is aligned with the Transformation &

Resources, and Strategy & Engagement, Directorates.

Its areas of focus are:

§ Long term/high level

strategic focus

§ Long Term Plan/Annual Plan

oversight

§ District Plan oversight

§ Housing/homelessness

§ City growth/economic

development

§ Financial and

non-financial performance reporting

§ Oversight of Property

Working Group

§ Oversight of strategies

and policies

§ Bylaw development

§ Oversight of CCOs/approval

of SOIs

PURPOSE:

To assist the Council in setting the broad vision and direction of the

city in order to promote the social, economic, environmental and cultural

wellbeing of the city’s communities in the present and for the future.

This involves determining specific outcomes that need to be met to deliver on

the vision for the city, and overseeing the development of strategies,

policies, bylaws and work programmes to achieve those goals. This committee is

also responsible for monitoring the overall financial management and

performance of the Council Group.

DELEGATIONS FOR THE COMMITTEE’S AREAS OF FOCUS:

§ All powers necessary to perform the

Committee’s responsibilities including the activities outlined below.

§ Develop required strategies and

policies. Recommend draft and final versions to Council for adoption where they

have a city-wide or strategic focus.

§ Implement, monitor and review

strategies and policies.

§ Oversee the implementation of major

projects provided for in the LTP or Annual Plan.

§ Oversee budgetary decisions provided

for in the LTP or Annual Plan.

§ Recommend to Council the approval of

any financial decisions required outside of the annual budgeting process.

§ Maintain an overview of work

programmes carried out by the Council’s Transformation & Resources,

and Strategy & Engagement, Directorates.

§ Conduct any consultation processes

required on issues before the Committee.

§ Approval and forwarding of submissions.

§ Any other matters delegated to the

Committee by Council in accordance with approved policies and bylaws.

§ The committee has the powers to

perform the responsibilities of another committee where it is necessary to make

a decision prior to the next meeting of that other committee. When exercised, the

report/minutes of the meeting require a resolution noting that the committee

has performed the responsibilities of another committee and the reason/s.

§ If a policy or project relates

primarily to the responsibilities of the Policy, Finance & Strategy

Committee, but aspects require additional decisions by the Communities

Committee, Infrastructure & Regulatory Committee and/or Climate Change

& Sustainability Committee, then the Policy, Finance & Strategy

Committee has the powers to make associated decisions on behalf of those other

committees. For the avoidance of doubt, this means that matters do not need to

be taken to more than one of those committees for decisions.

District Plan Delegations:

§ Undertake a full review of the City

of Lower Hutt District Plan, including oversight of the District Plan Review

Subcommittee in establishing a District Plan work programme and monitoring its

implementation.

§ Consideration of matters related to

the preparation and ongoing monitoring of the City of Lower Hutt District Plan.

§ Preparation of required Changes and

Variations to the City of Lower Hutt District Plan for Council approval to call

for submissions.

§ Make recommendations to Council on

private District Plan Change requests for Council to accept, adopt or reject.

§ The Chair of the Policy, Finance

& Strategy Committee, in conjunction with the Chief Executive, is

authorised to appoint a District Plan Hearings Subcommittee of suitably

qualified persons to conduct hearings on behalf of the Committee.

Bylaw Delegations:

§ Develop and agree the Statement of

Proposal for new or amended bylaws for consultation.

§ Recommend to Council the approval of

draft bylaws prior to consultation.

§ The Chair of the Policy, Finance

& Strategy Committee, in conjunction with the Chief Executive, is

authorised to appoint a Subcommittee of suitably qualified persons to conduct

hearings on draft bylaws on behalf of the Committee.

§ Recommend to Council new or amended

bylaws for adoption.

Financial, Project and Performance Reporting Delegations:

§ Recommend to Council the budgetary

parameters for preparation of the Council’s Long Term Plans (LTP) and

Annual Plans.

§ Monitor progress towards achievement

of budgets and objectives for the Council Group as set out in the LTP and

Annual Plans, including associated

matters around the scope, funding, prioritising and timing of projects.

§ Monitoring and oversight of

significant city-wide or strategic projects including operational contracts,

agreements, grants and funding, except where these are the responsibility of

another standing committee.

§ Monitor progress towards achievement

of the Council’s outcomes as set out in its overarching strategies for

the city and their associated plans.

§ Oversee the activities of the Property

Working Group in its implementation of the Purchase and Sale of Property for

Advancing Strategic Projects Policy.

§ Oversee the acquisition and disposal

of property in accordance with the LTP.

§ Monitor the integrity of reported

performance information at the completion of Council’s Annual Report

process.

§ Review and recommend to Council the

adoption of the Annual Report.

§ Recommend to Council the approval of

annual Statements of Corporate Intent for Council Controlled Organisations and

Council Controlled Trading Organisations and granting shareholder approval of

major transactions.

§ Monitor progress against the CCO and

CCTO Statements of Intent and make recommendations to Council in the exercising

of Council powers, as the shareholder, in relation to Council Controlled Organisations/Council

Controlled Trading Organisations under sections 65 to 72 of the Local

Government Act.

§ Oversee compliance with

Council’s Treasury Risk Management Policy.

§ Consider and determine requests for

rates remissions.

§ Consider and determine requests for

loan guarantees from qualifying community organisations where the applications are within the approved guidelines and

policy limits.

NOTE:

The Ministry for

the Environment advocates that Councils offer specialist RMA training in areas

of law which are difficult to grasp or where mistakes are commonly made. This

is to complement the Good Decision Making RMA training that they run (which is

an overview and basic summary of decision making, rather than an in-depth

training in specific areas of the RMA). Therefore in order to facilitate this,

the RMA training run for councillors that wish to be hearings commissioners is

mandatory.

Reasons for the importance of

the training:

1.

Hearings commissioners are kept

abreast of developments in the legislation.

2. Legal and technical errors that have

been made previously are avoided (many of which have resulted in Environment

Court action which is costly, time consuming and often creates unrealistic

expectations for the community).

3. The

reputation of Council

as good and fair decision

makers or judges

(rather than legislators) is upheld.

Policy, Finance and Strategy

Committee | Komiti

Ratonga Rangatōpū me te Rautaki

Meeting

to be held in the Council Chambers, 2nd Floor, 30 Laings Road, Lower Hutt on

Tuesday

23 February 2021 commencing at 2.00pm.

ORDER

PAPER

Public Business

1. APOLOGIES

Cr

Chris Milne.

2. PUBLIC

COMMENT

Generally up to

30 minutes is set aside for public comment (three minutes per speaker on items appearing on the agenda). Speakers may be

asked questions on the matters they raise.

3. CONFLICT

OF INTEREST DECLARATIONS

Members

are reminded of the need to be vigilant to stand aside from decision making

when a conflict arises between their role as a member and any private or other

external interest they might have.

4. Recommendations to Council – 24 March 2021

a) Seaview Marina Limited

Draft Statement of Intent 2021/22 to 2023/24 (21/68)

Report

No. PFSC2021/1/18 by the Senior Management Accountant 9

Chair’s Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

b) Urban

Plus Group Draft Statement of Intent 2021/22 to 2023/24 (21/64)

Report No.

PFSC2021/1/20 by the Senior Accountant 36

Chair’s

Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

c) Hutt

City Community Facilities Trust Statement of Intent 2021/22 to 2023/24 (21/69)

Report No.

PFSC2021/1/24 by the Senior Management Accountant 63

Chair’s

Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

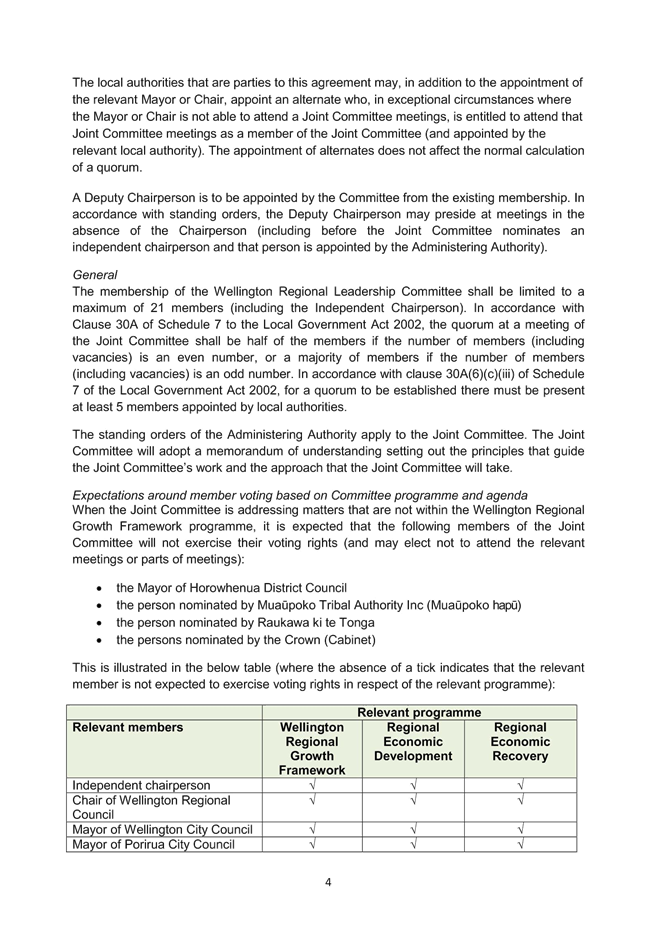

d) Wellington

Regional Leadership Committee - a new Joint Committee (21/42)

Report No. PFSC2021/1/19

by the Head of City Growth 83

Chair’s

Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

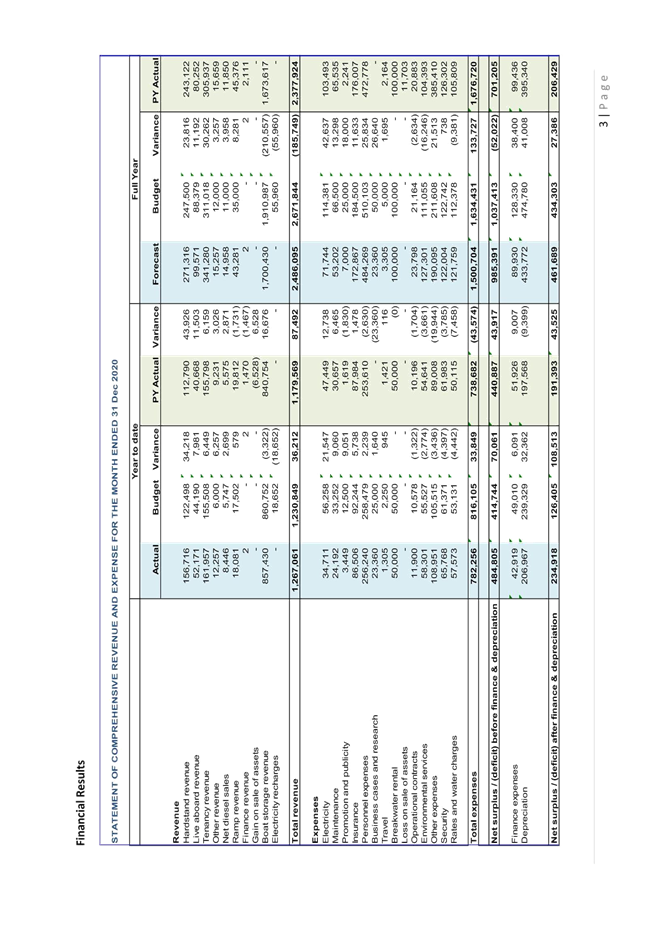

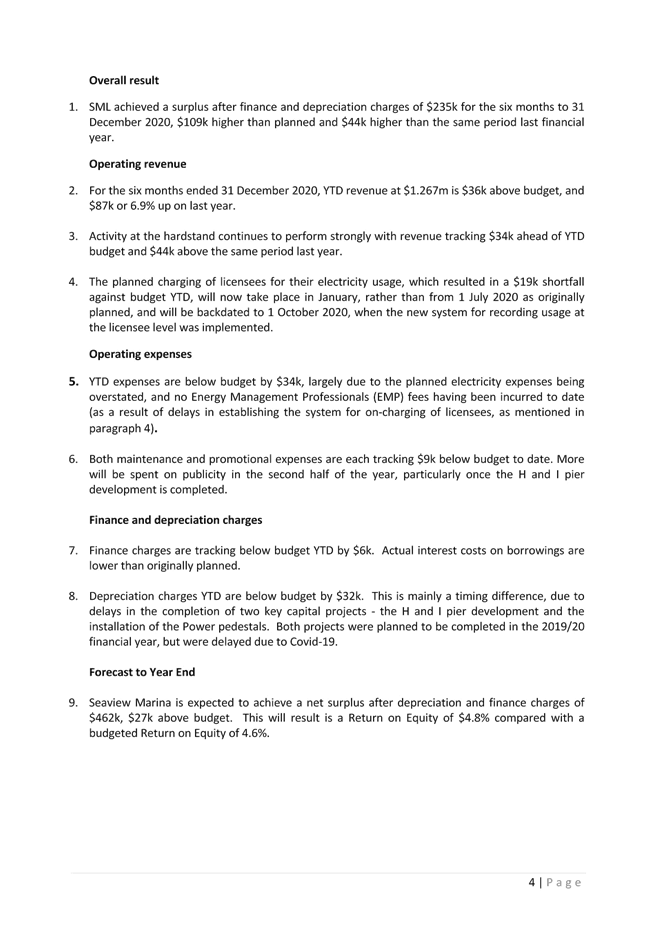

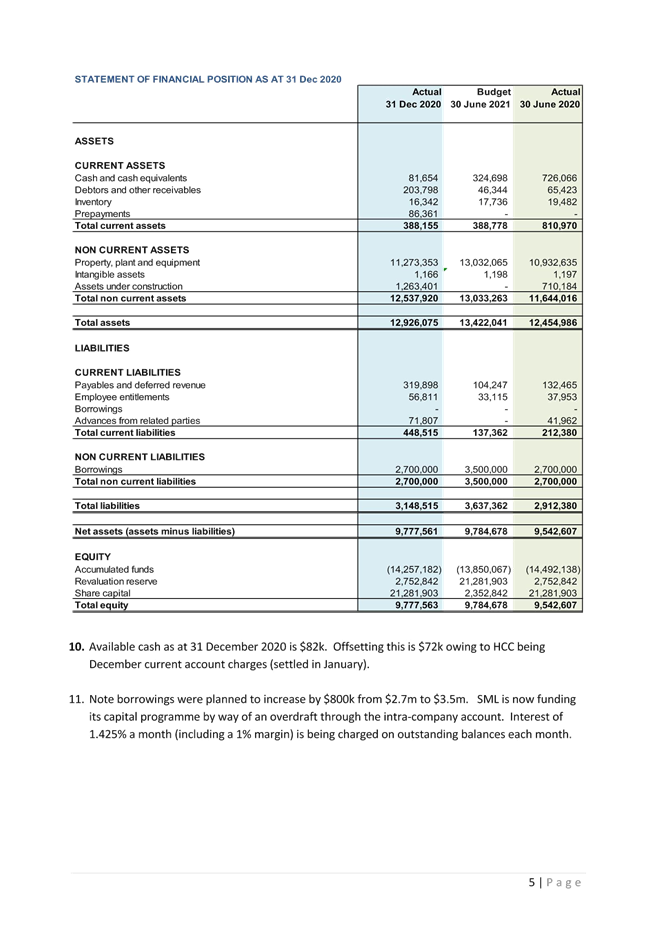

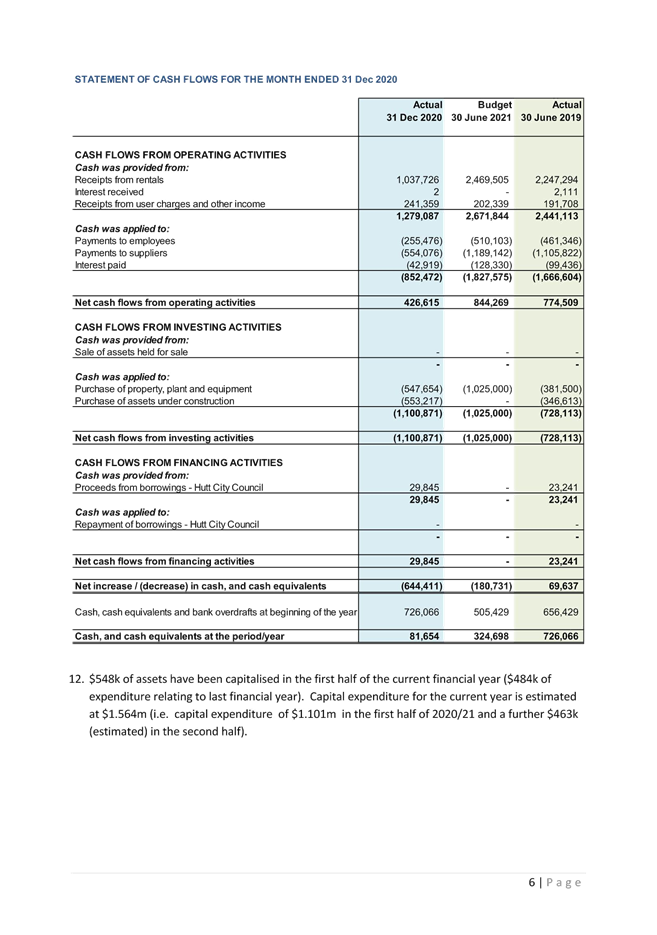

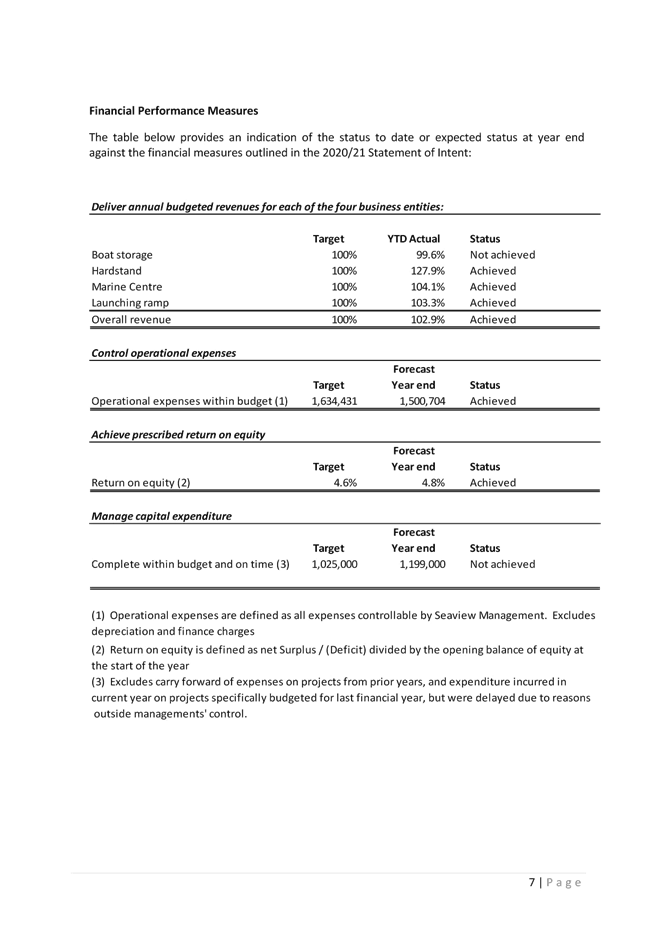

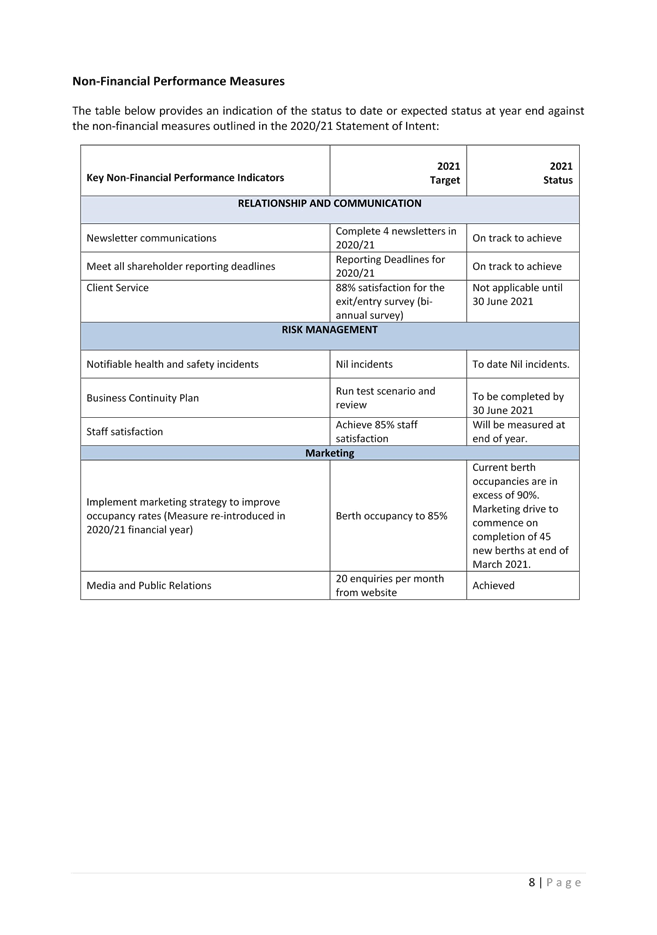

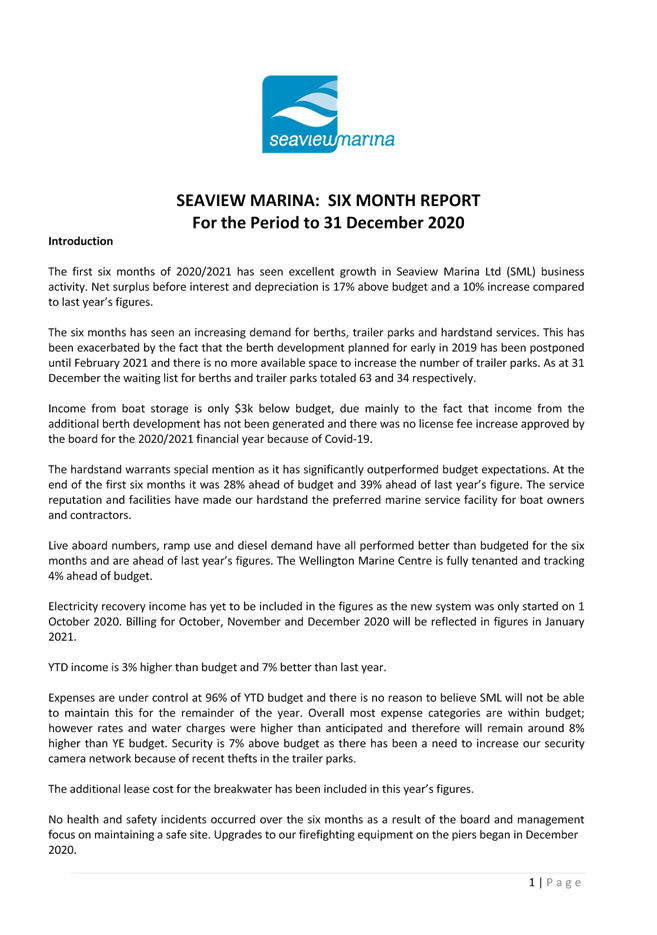

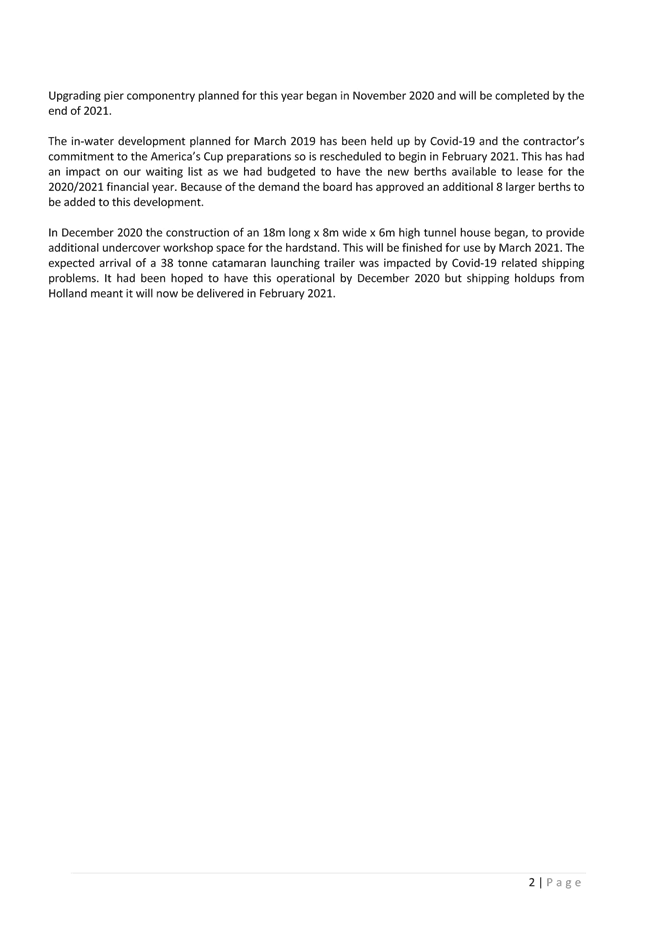

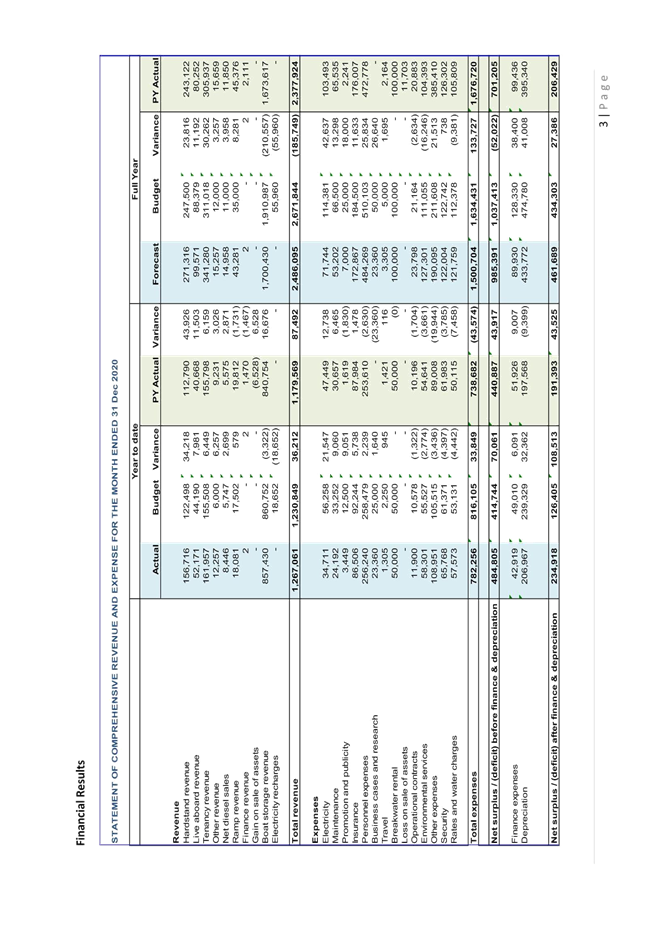

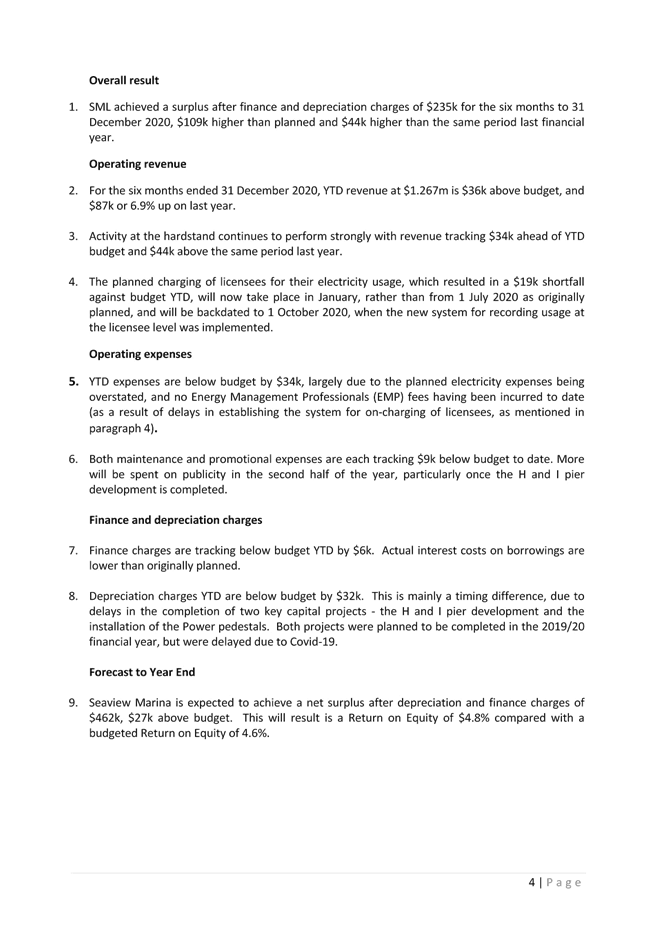

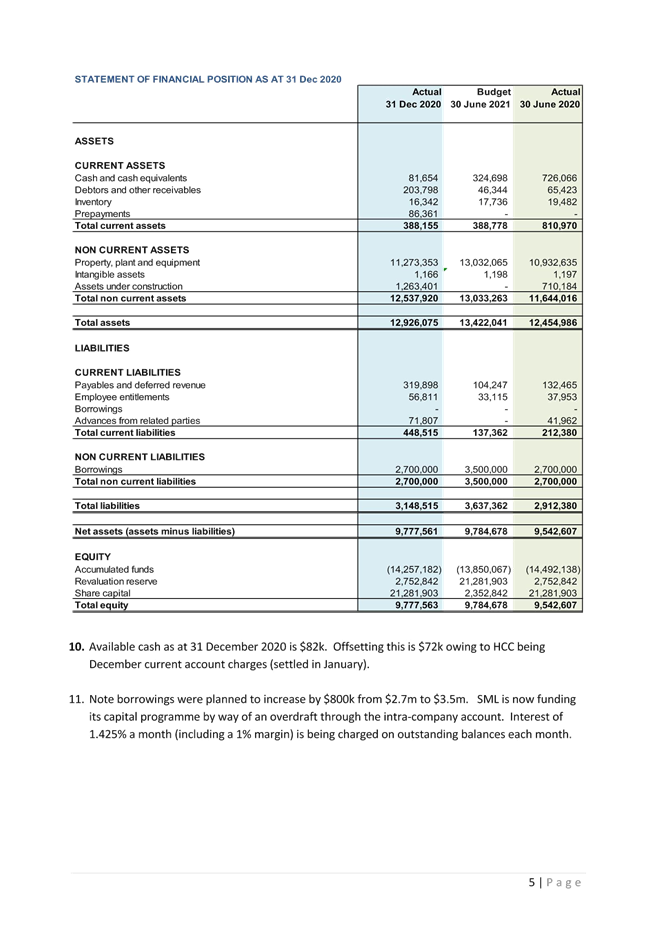

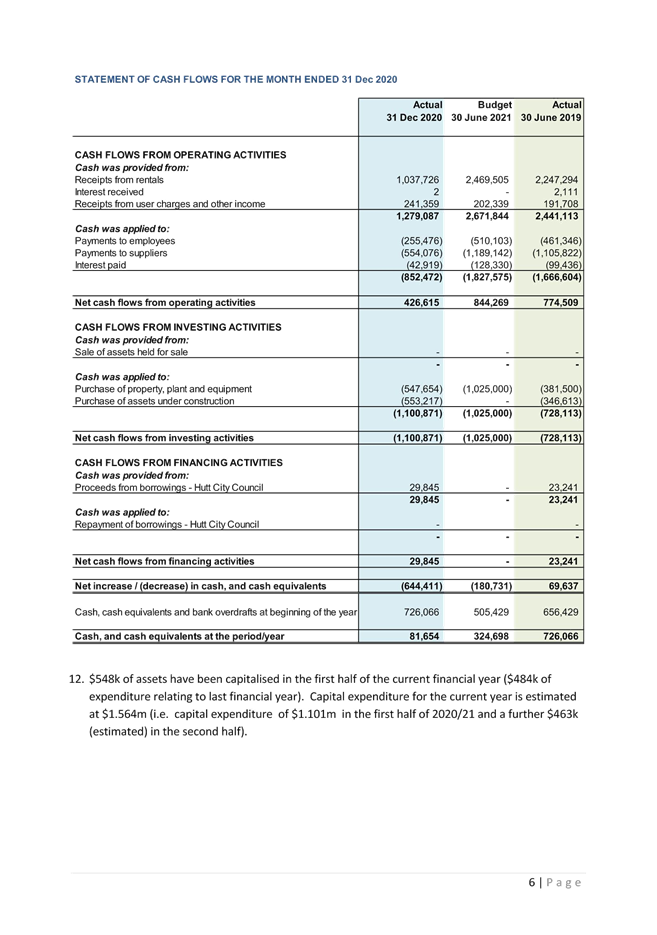

5. Seaview Marina Limited Six Month Report to 31

December 2020 (21/70)

Report

No. PFSC2021/1/21 by the Senior Management Accountant 118

Chair’s

Recommendation:

|

“That the recommendation contained in the report be

endorsed.”

|

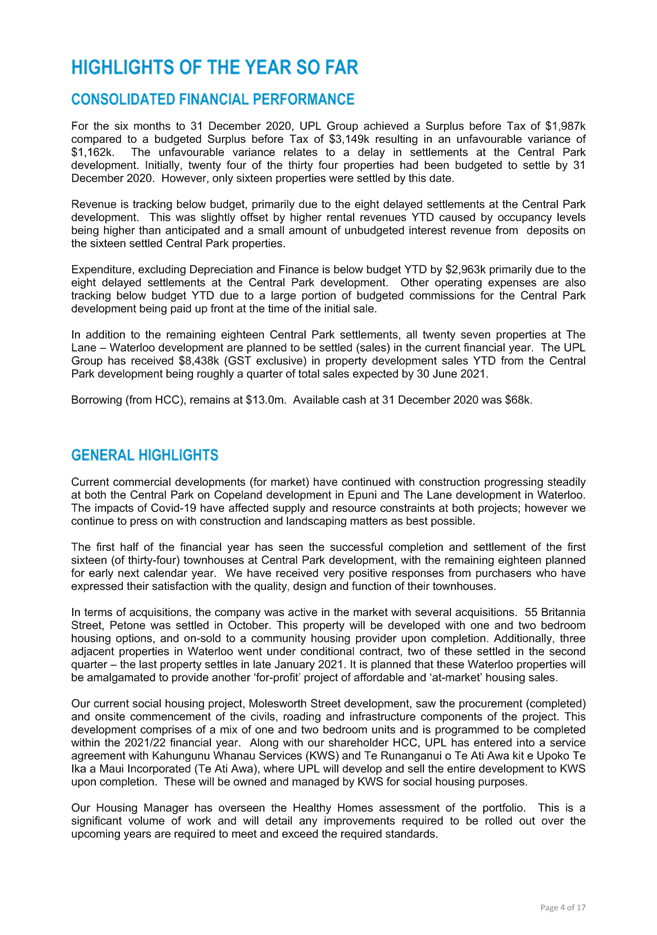

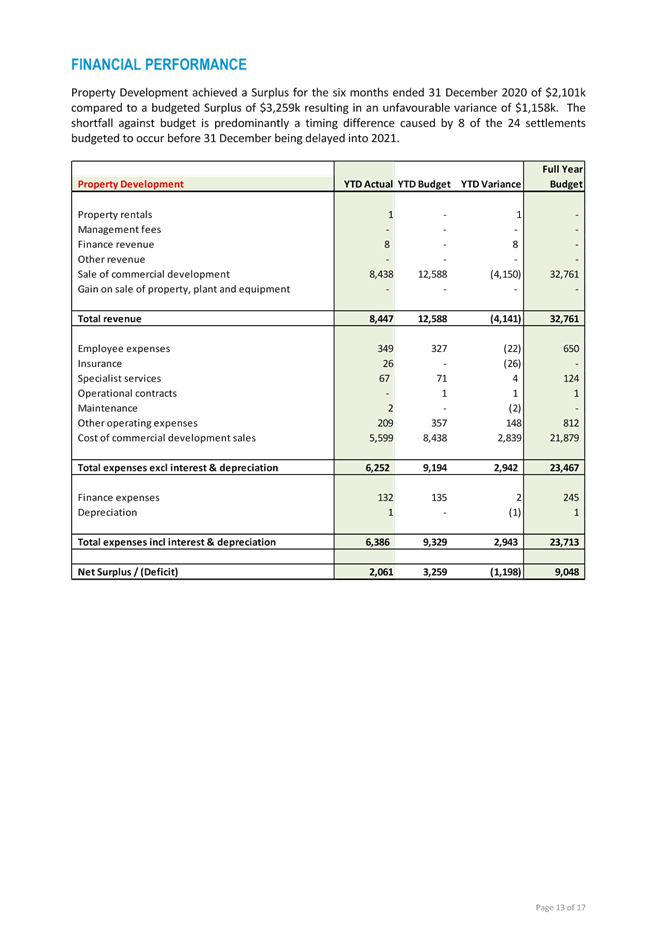

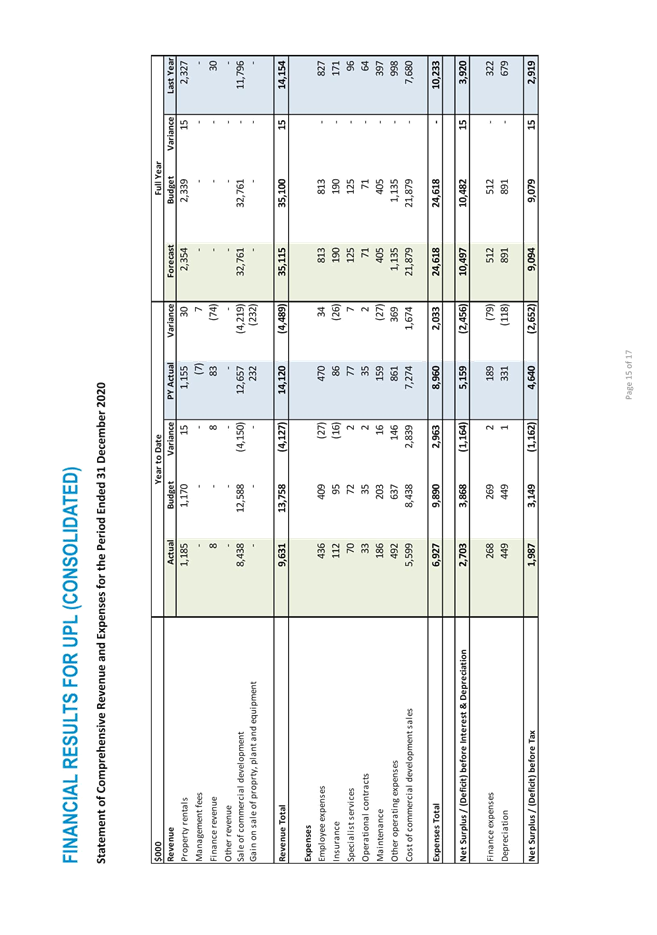

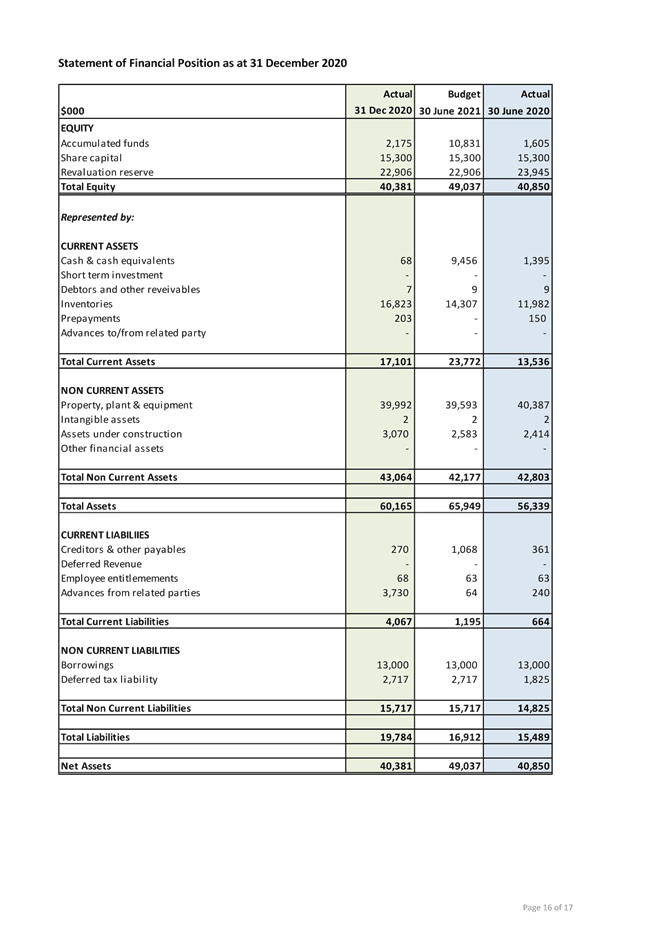

6. Urban Plus Group Six Month Report to 31

December 2020 (21/63)

Report

No. PFSC2021/1/22 by the Senior Accountant 128

Chair’s

Recommendation:

|

“That the recommendation contained in the report be

endorsed.”

|

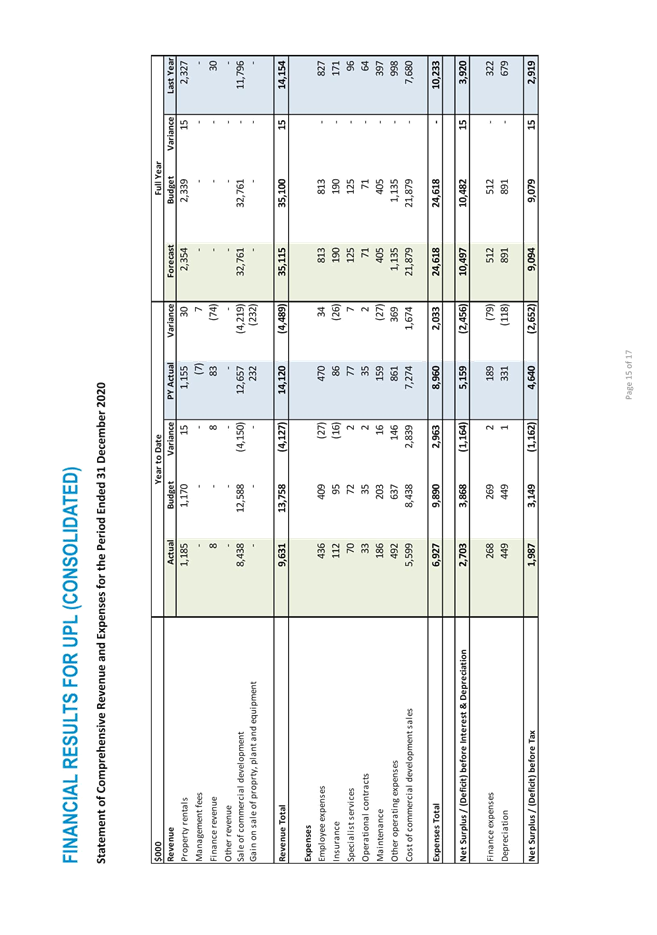

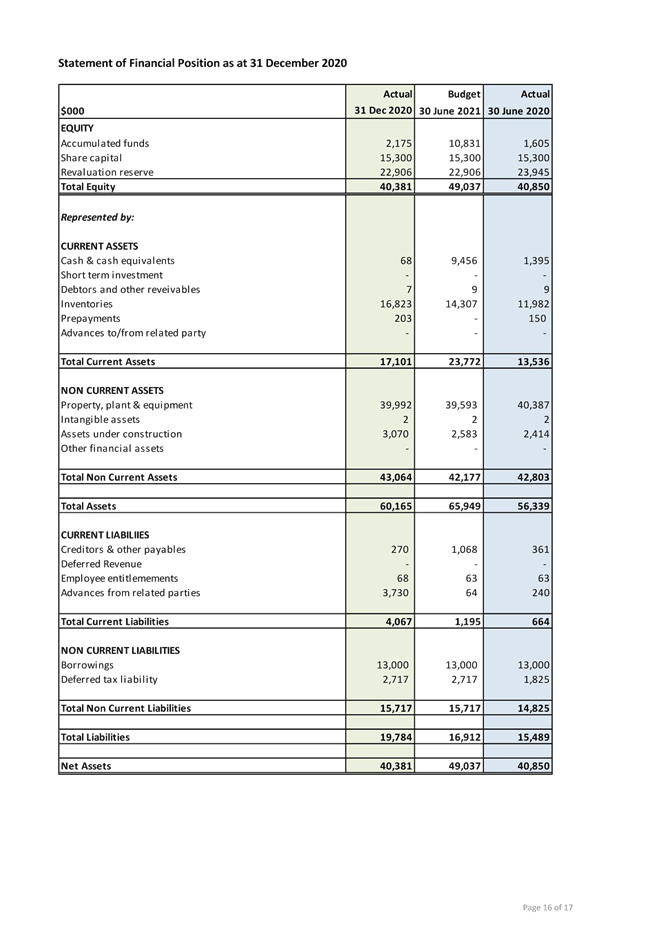

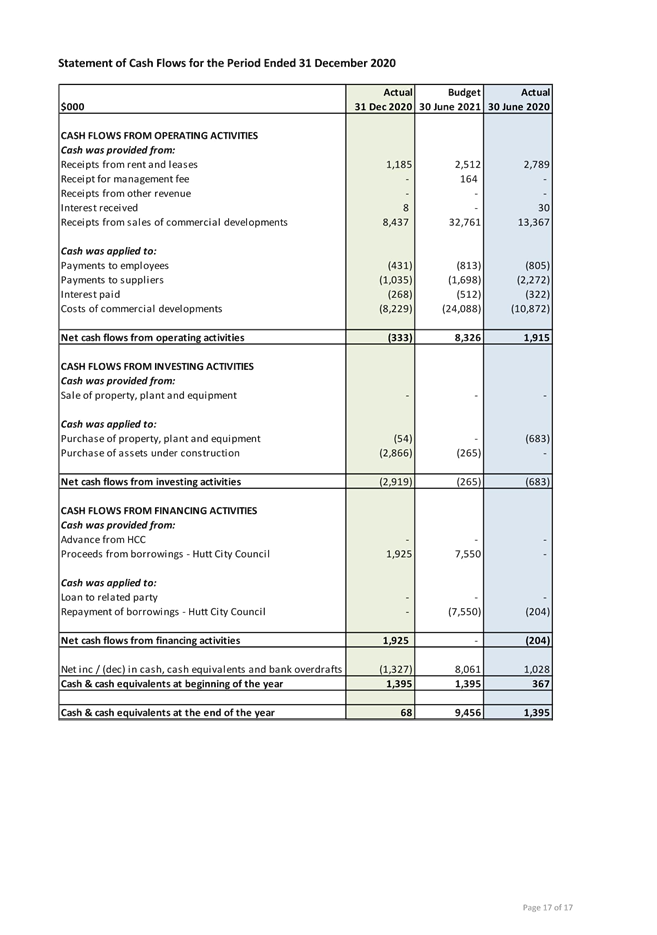

7. Hutt City Community Facilities Trust Six Month

Report to 31 December 2020 (21/71)

Report

No. PFSC2021/1/25 by the Senior Management Accountant 148

Chair’s

Recommendation:

|

“That the recommendation contained in the report be

endorsed.”

|

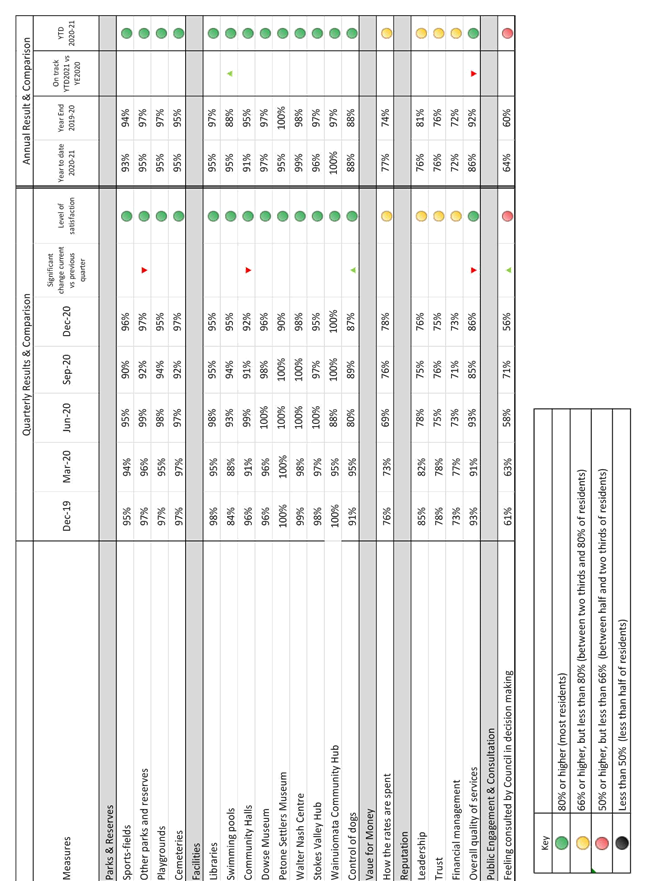

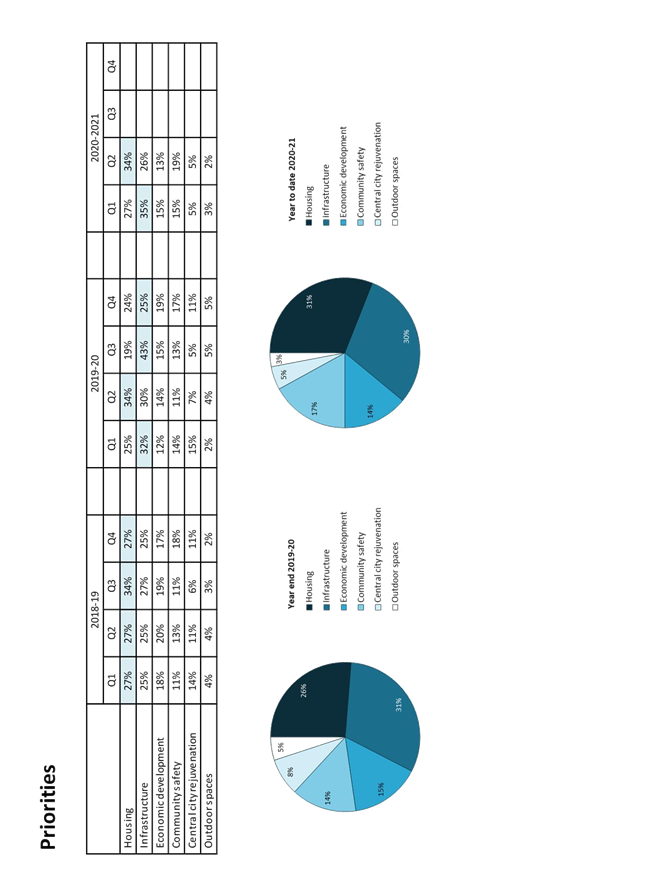

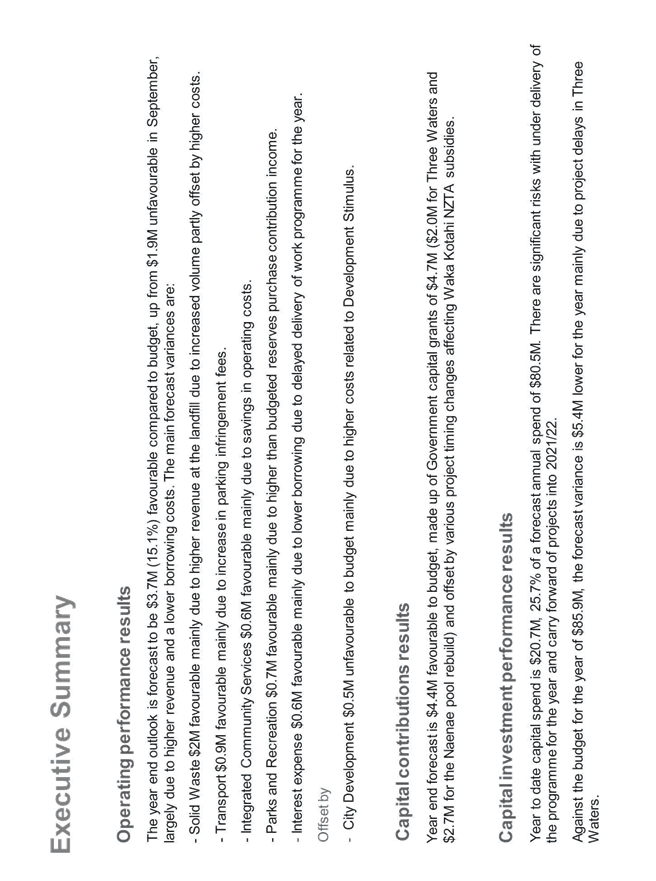

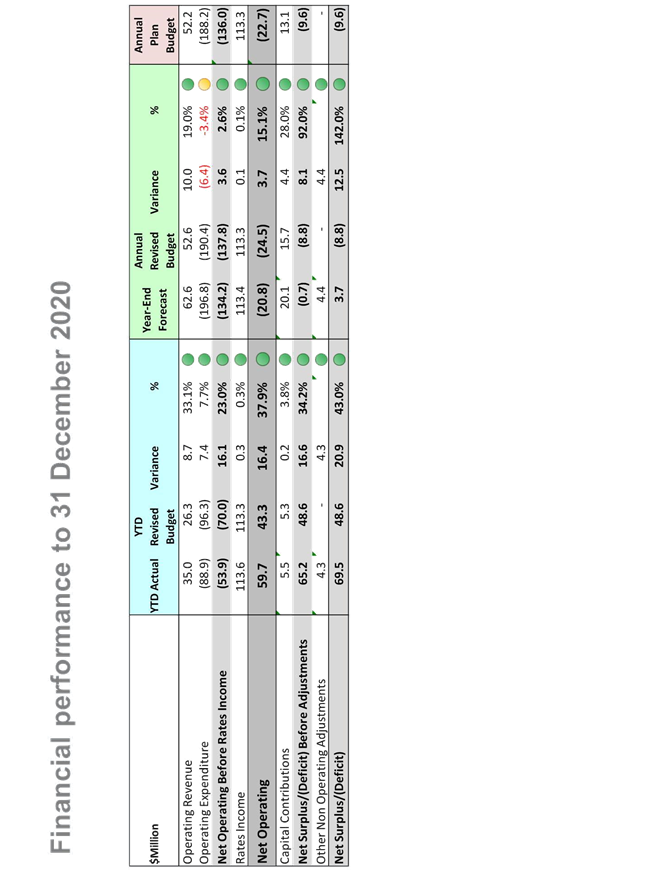

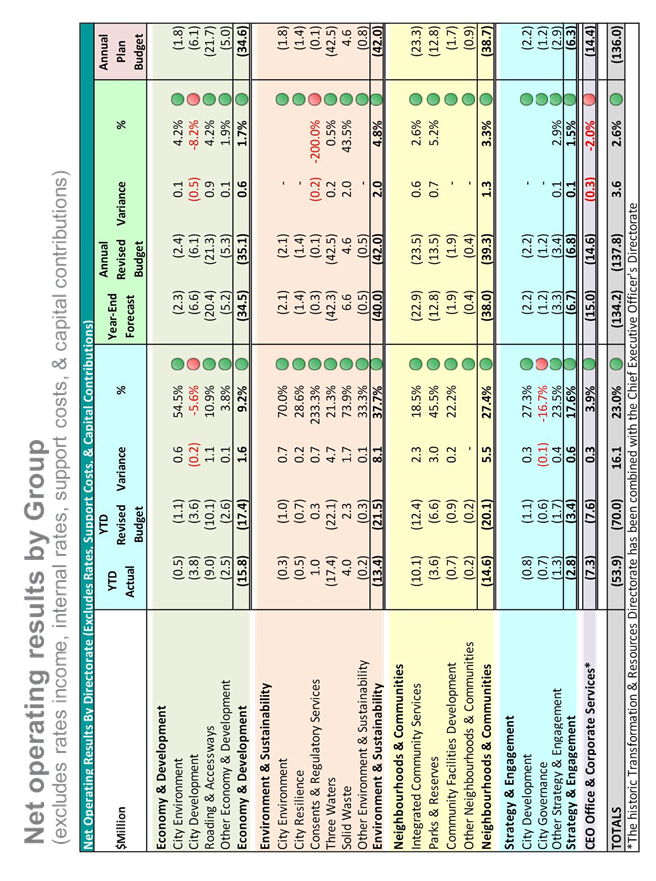

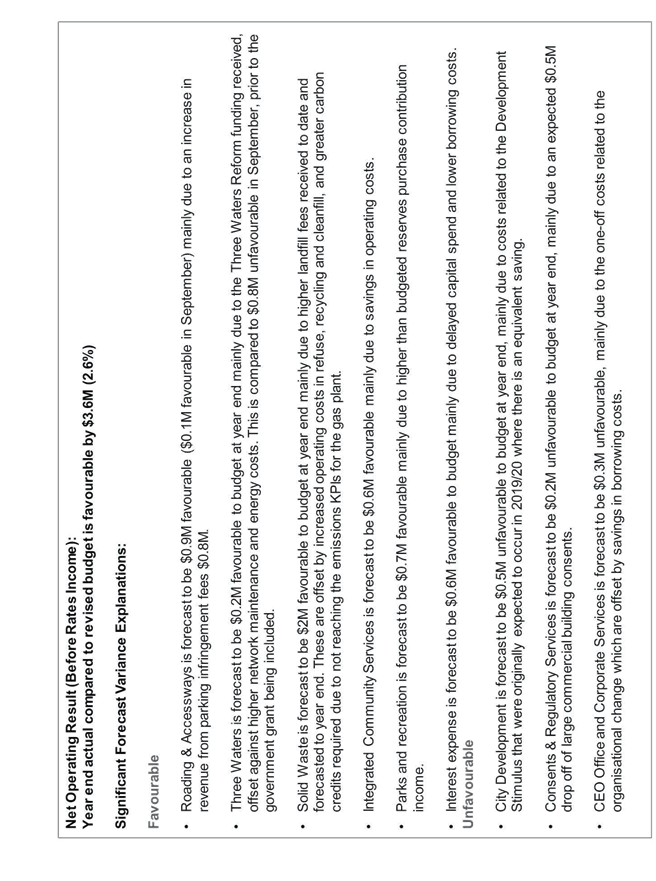

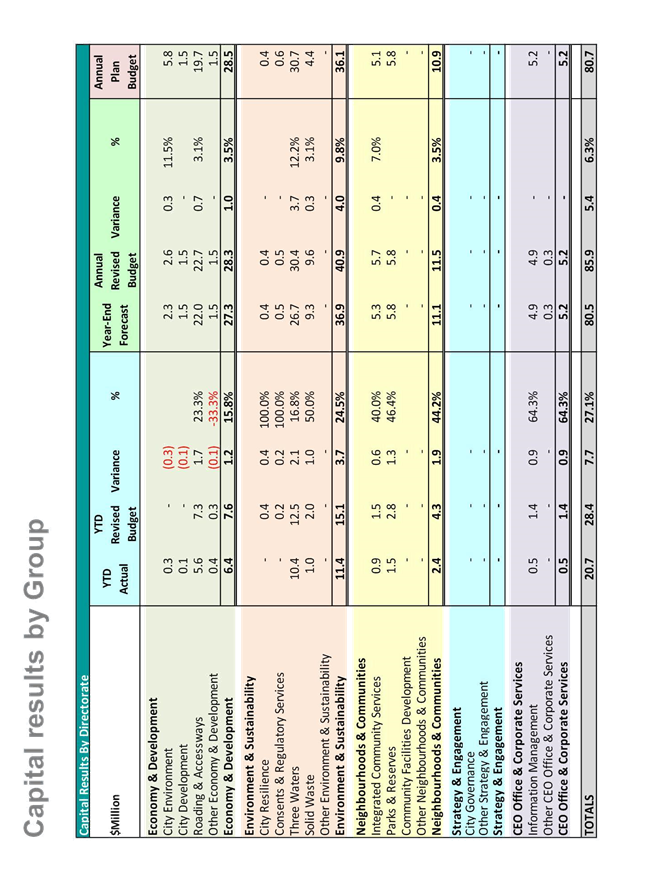

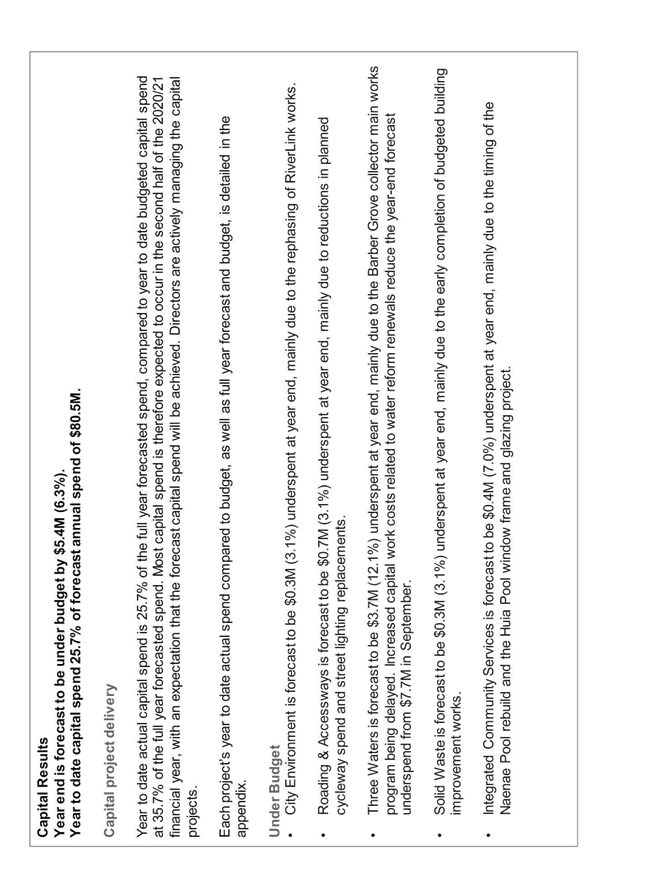

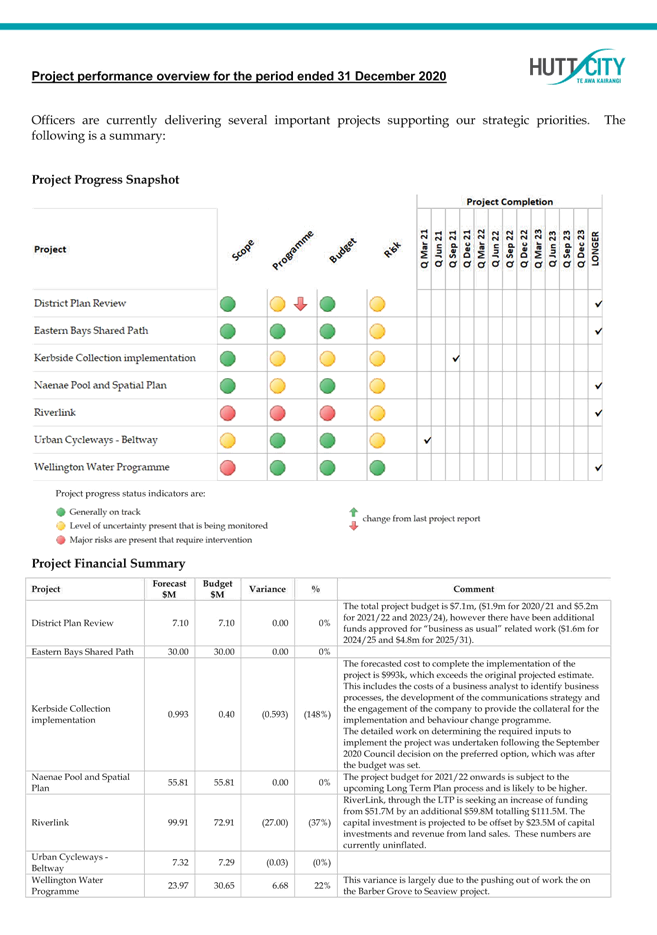

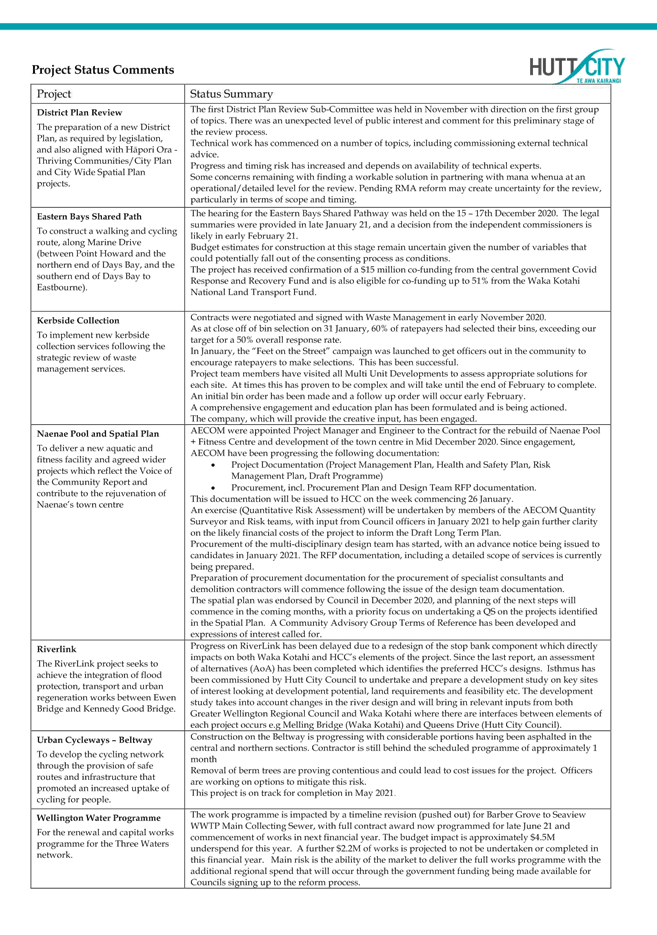

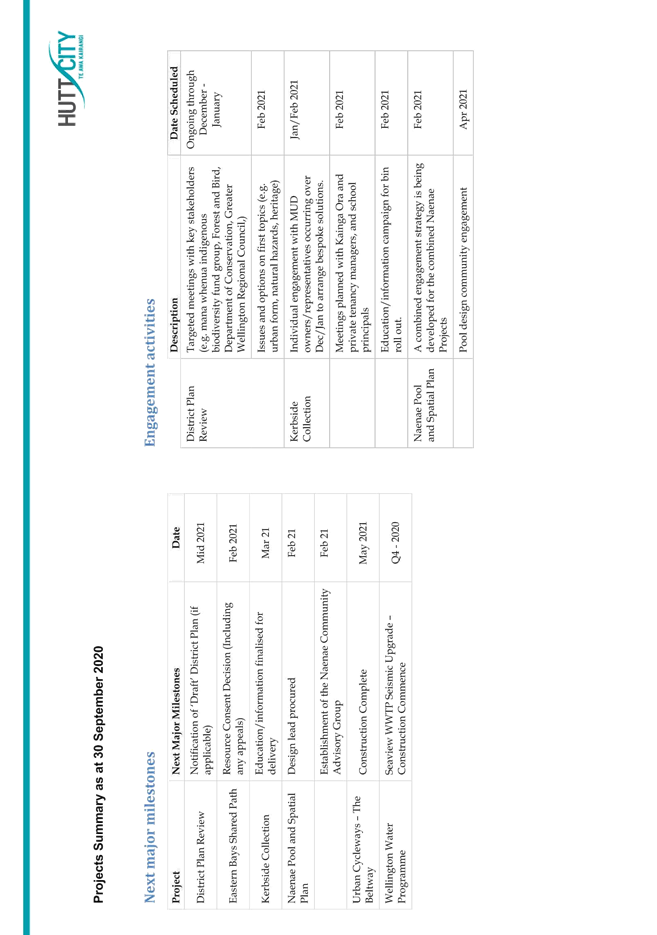

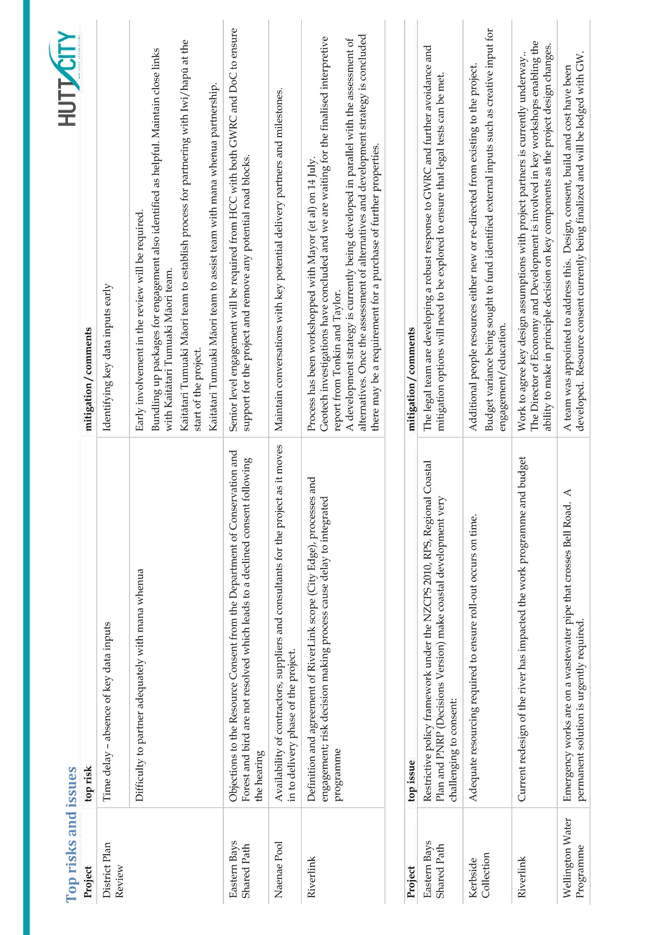

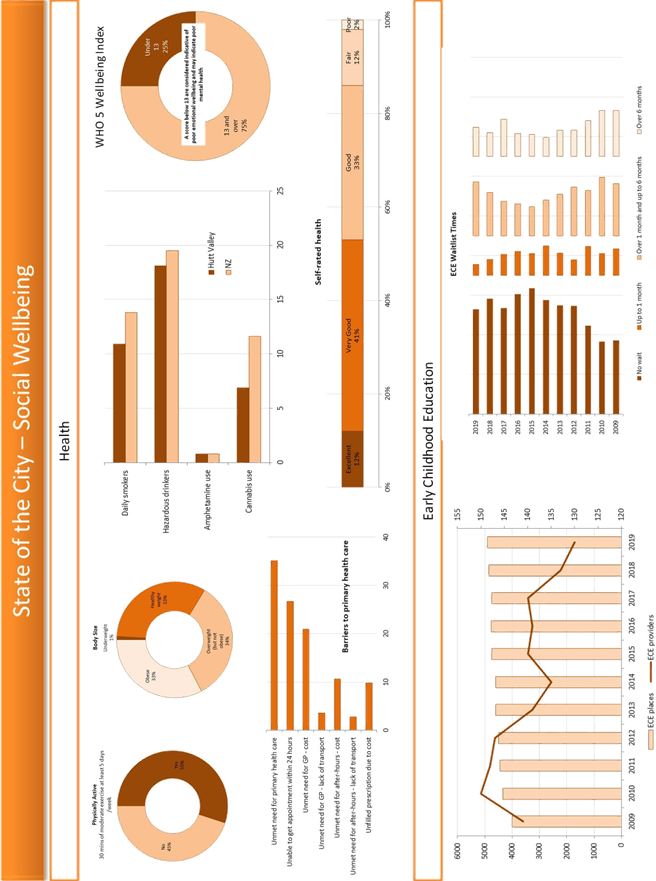

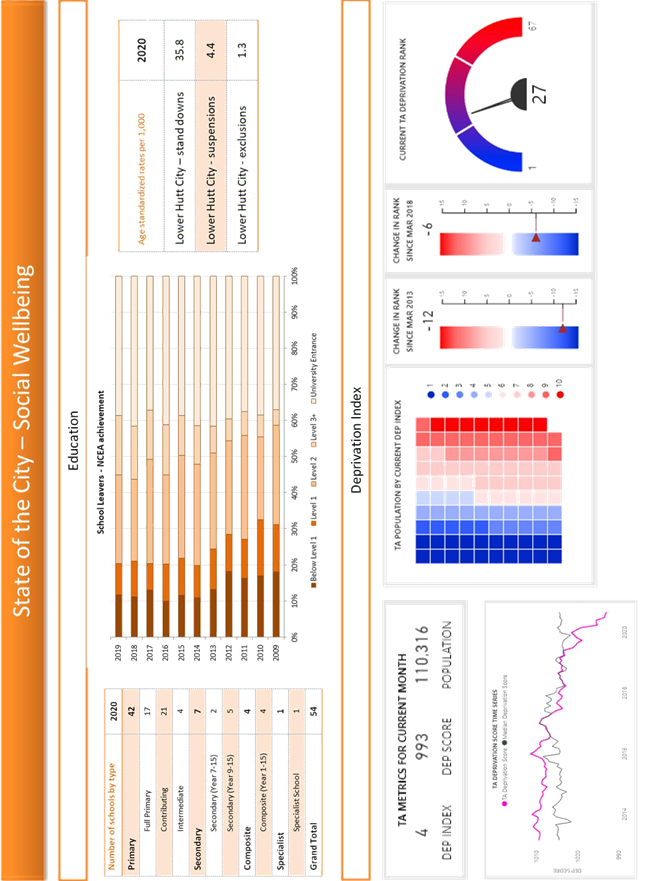

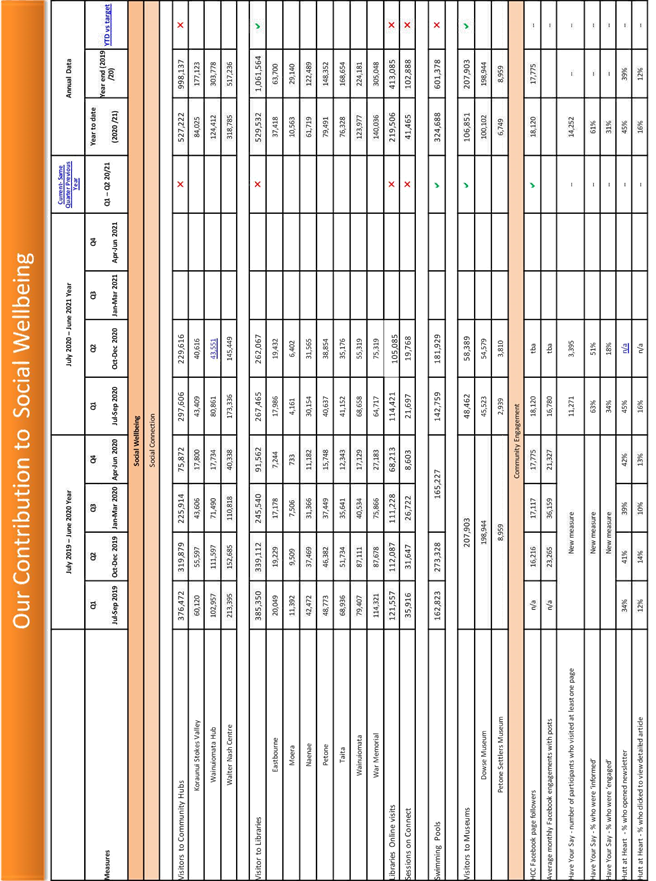

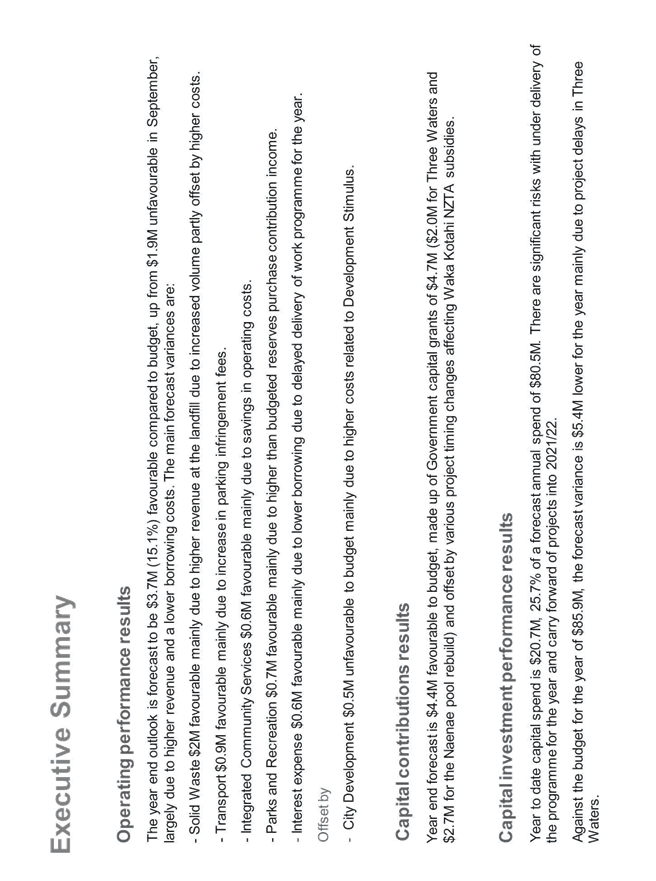

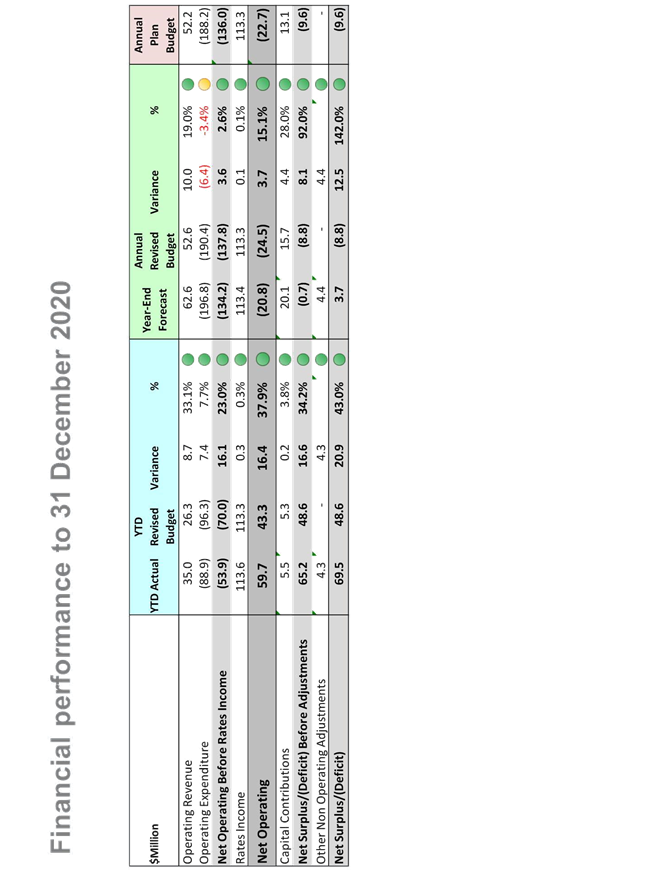

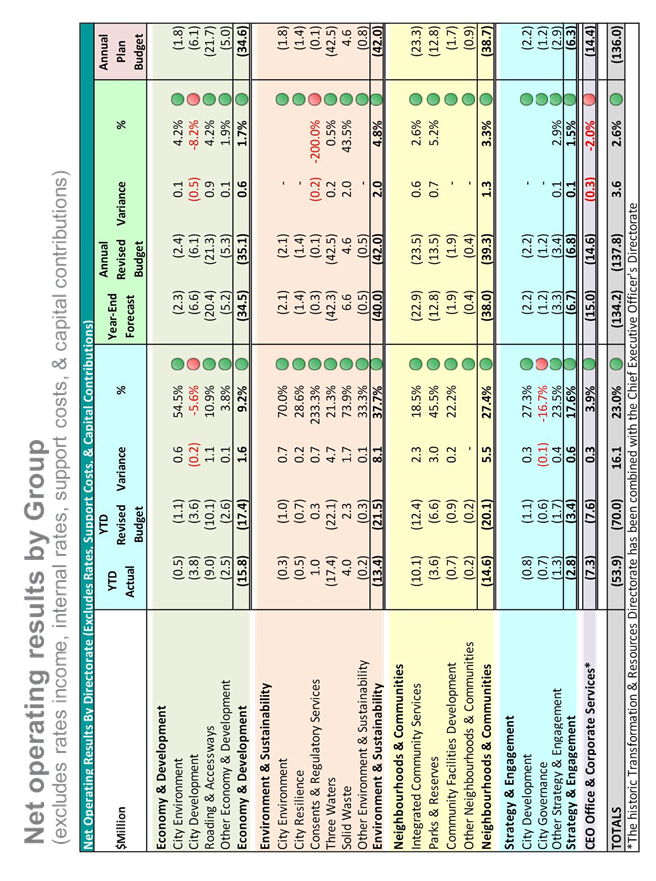

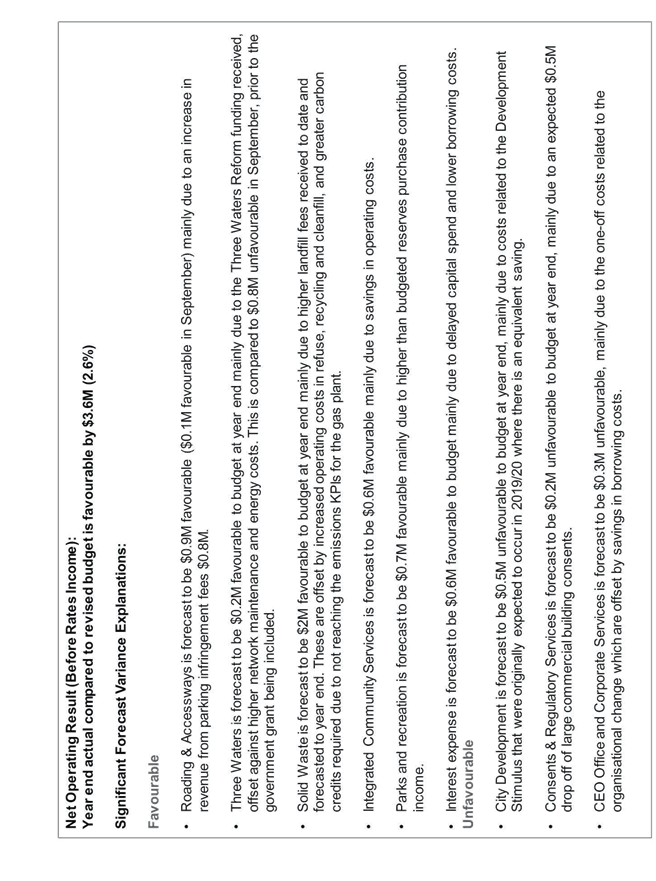

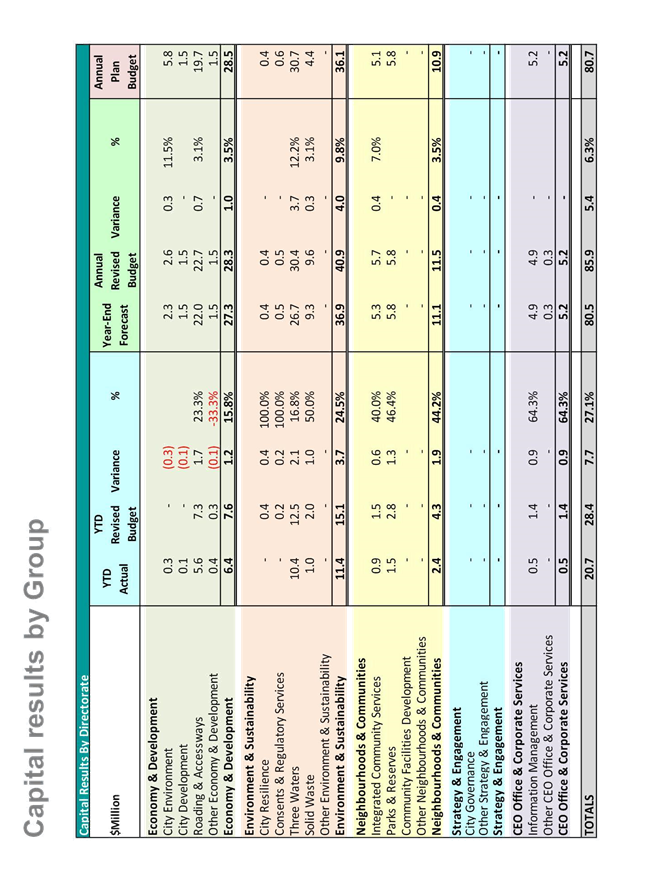

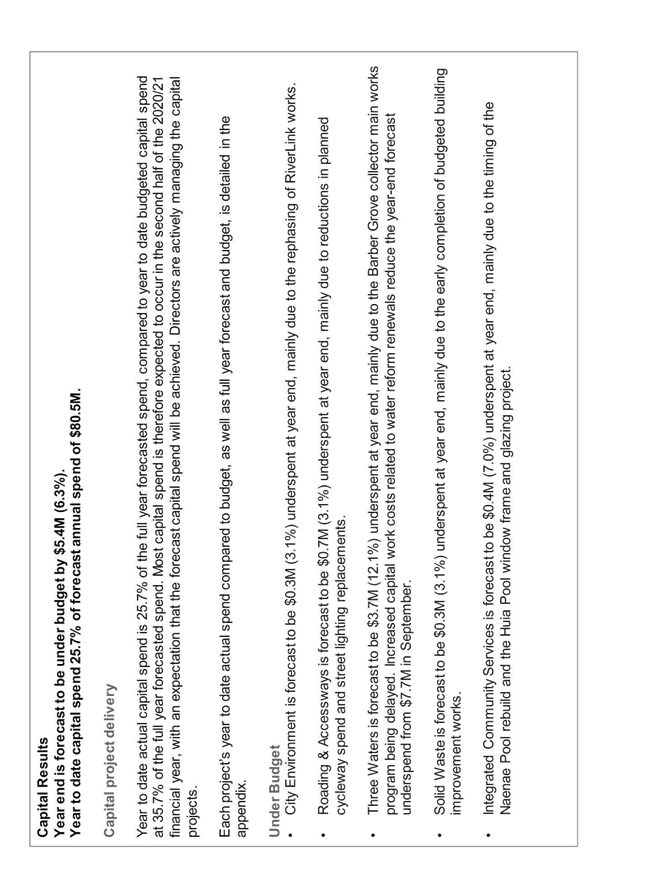

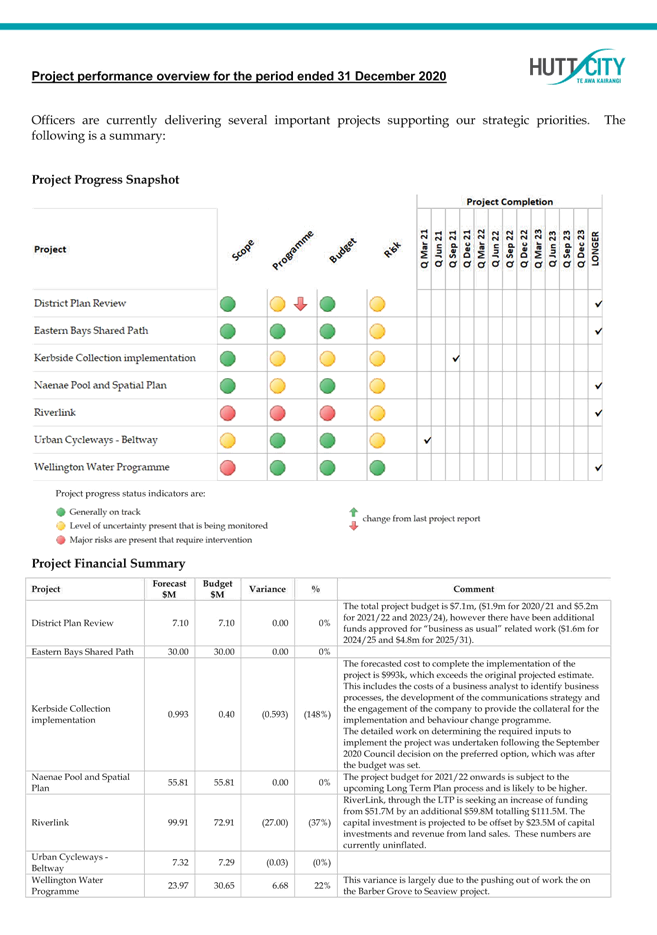

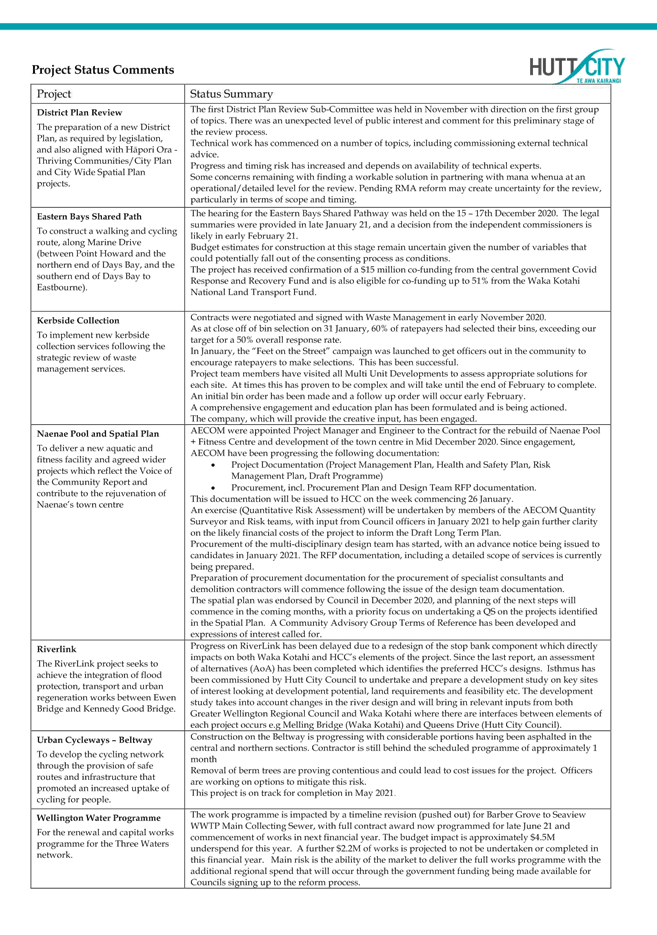

8. Council performance overview for the half year

ended 31 December 2020 (21/80)

Report

No. PFSC2021/1/23 by the Senior Management Accountant 162

Chair’s

Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

9. Heritage Policy – taonga tuku iho

Report

to be separately circulated.

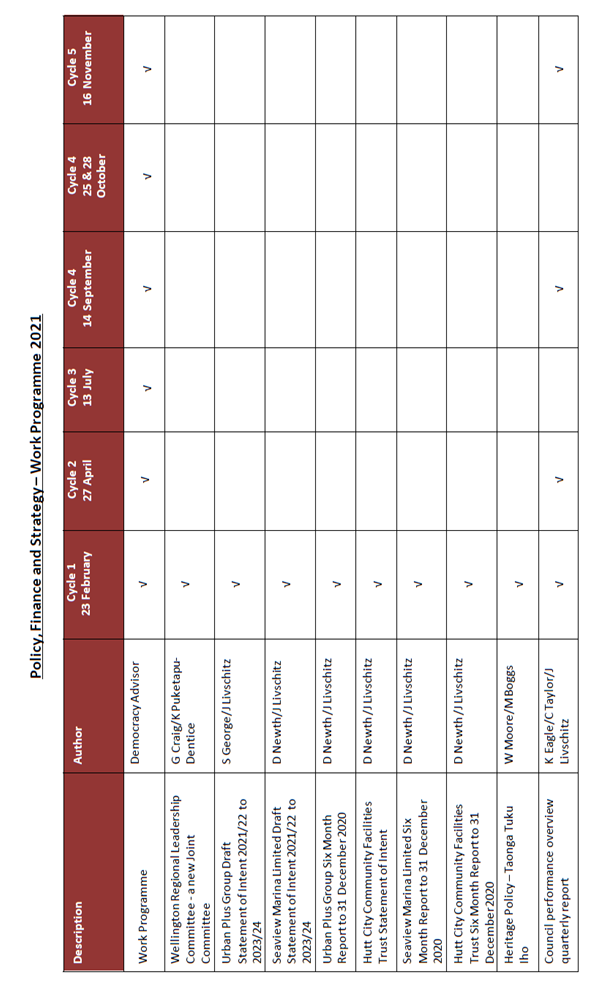

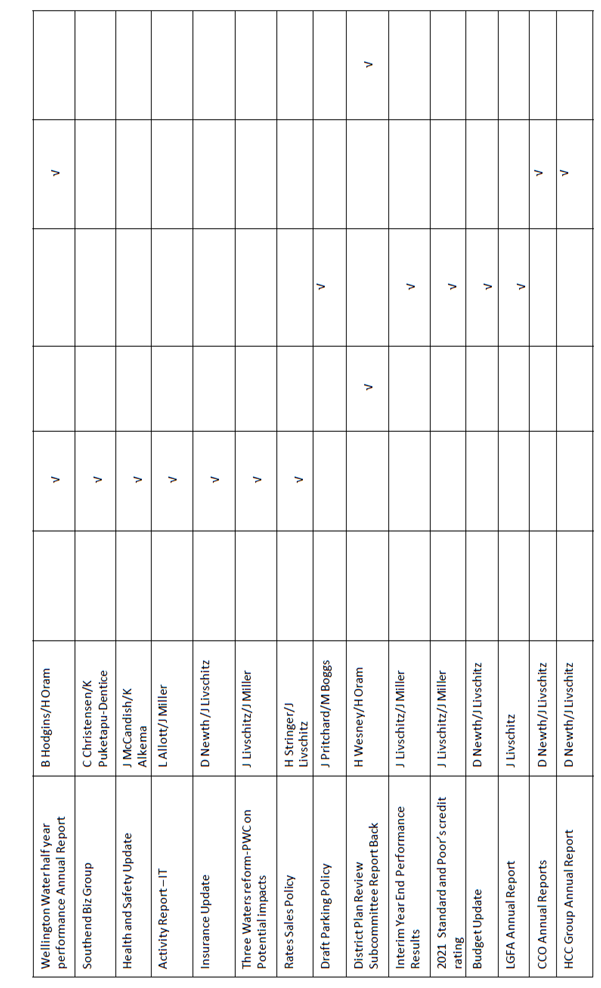

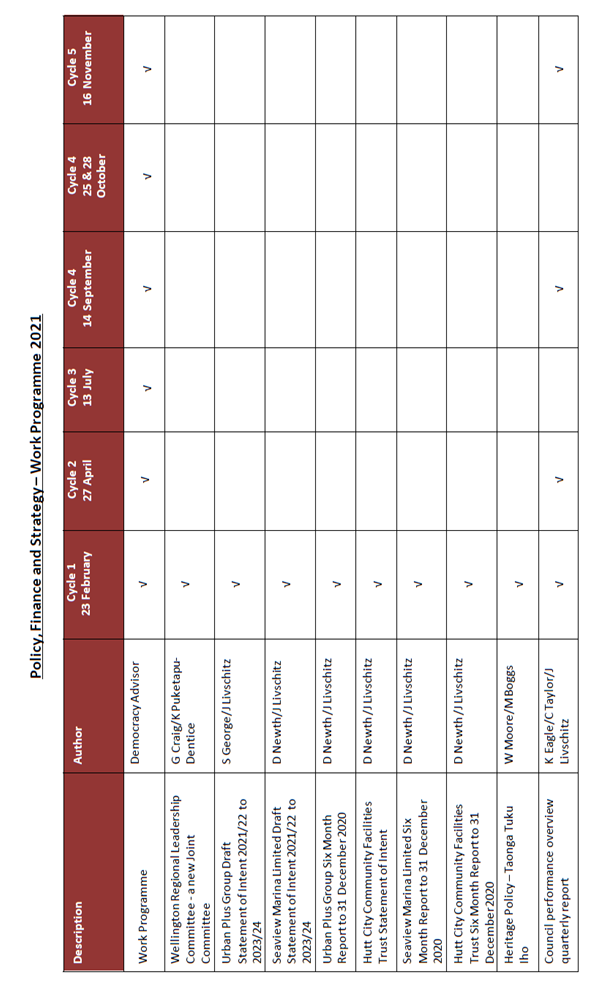

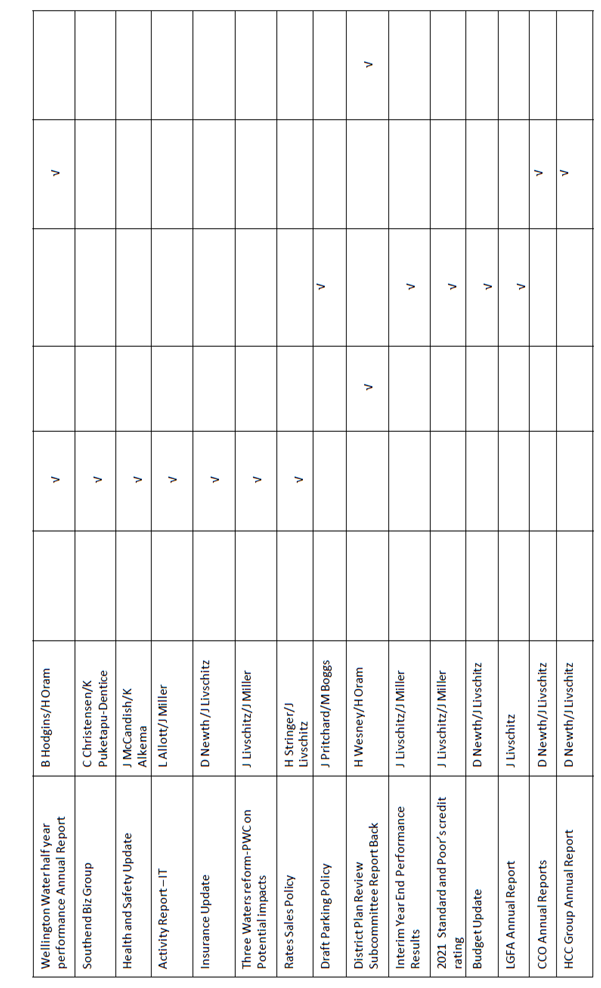

10. Policy,

Finance and Strategy Committee Work Programme 2021 (21/34)

Report

No. PFSC2021/1/8 by the Democracy Advisor 216

Chair’s

Recommendation:

|

“That the recommendation contained in the work

progamme be endorsed.”

|

11. QUESTIONS

With reference to section 32 of

Standing Orders, before putting a question a member shall endeavour to obtain

the information. Questions shall be concise and in writing and handed to the

Chair prior to the commencement of the meeting.

Toi Lealofi

DEMOCRACY ADVISOR

Policy, Finance and

Strategy Committee

Policy, Finance and

Strategy Committee

22 January 2021

File:

(21/68)

Report no:

PFSC2021/1/18

Seaview Marina

Limited Draft Statement of Intent 2021/22 to 2023/24

Purpose

of Report

1. The purpose of

this report is to provide the draft 2021-2024 Statement of Intent for Seaview

Marina Limited for Council to review.

|

Recommendations

That the Committee

recommends that Council:

(1)

notes the

Seaview Marina Ltd (SML) board has submitted a draft Statement of Intent

(SOI) for the three years 2021/22 to 2023/24, attached as Appendix 1 to this

report, in accordance with the Local Government Act 2002;

(2)

notes that

officers have reviewed the draft Seaview Marina Ltd SOI for compliance with

the Local Government Act 2002 and provided their analysis;

(3)

receives the

draft Seaview Marina Ltd SOI;

(4)

reviews the

draft Seaview Marina Ltd SOI and considers if any modifications should be

made; and

(5)

provides

comment for the Seaview Marina Ltd Board to consider in finalising its SOI

(including any modifications suggested by the Committee arising under

recommendation (4) above).

|

Background

2. The Local

Government Act 2002 (LGA) requires the board of a Council Controlled Organisation

(CCO) to deliver to its shareholders a draft SOI on or before 1 March of each

year.

Discussion

3. The board of SML

has submitted a draft SOI to Council. This is attached as Appendix 1 of

this report.

4. The board of a CCO

must provide information prescribed by the LGA for the SOI, to the extent is

appropriate given the organisation form of the CCO. They must do this for

the ‘the group’ – which comprises the CCO and its

subsidiaries. The information is required to be provided for the 2021/22

financial year and the two years following that (section 9, Schedule 8 of the

LGA).

5. The compliance of

the company with the legislative requirements for the SOI and a summary of the

amendments proposed by the Board for their 2021-2024 SOI are detailed below:

|

Required Content

|

SML Draft SOI Content

|

|

(a)

the objectives of the company

|

The

objectives of the SML are stated.

|

|

(b)

a statement of the board’s approach to governance of the group

|

A

statement is included.

|

|

(c)

the nature and scope of the activities undertaken by the group

|

The

nature and scope of activities are outlined – no significant changes.

|

|

(d)

the ratio of consolidated shareholders’ funds to total assets, and the

definition of those terms

|

Ratio

provided.

|

|

(e)

the accounting policies of the group

|

Accounting

policies are outlined.

|

|

(f)

the performance targets and other measures by which performance of the group

may be judged in relation to its objectives

|

Performance

targets are included.

|

|

(g)

an estimate of the amount or proportion of accumulated profits and capital

reserves that is intended to be distributed to the shareholders

|

Information

provided.

|

|

(h)

the kind of information to be provided to the shareholders by the group

during the course of those financial years, including the information to be

included in each half yearly report (and, in particular, what prospective financial

information is required and how it is to be presented)

|

The

kind of information to be provided is outlined.

|

|

(i)

the procedures to be followed before any member or the group subscribes for,

purchases, or otherwise acquires shares in any company or other organisation

|

Information

on procedures is not provided but it is noted that there is no intention to

subscribe or invest in any other organisation.

|

|

(j)

any activities for which the board seeks compensation from any local

authority (whether or not the local authority has agreed to provide the

compensation)

|

No

compensation requested.

|

|

(k)

the boards estimate of the commercial value of the shareholders’

investment in the group and the manner in which and the times at which that

value is to be reassessed

|

A

statement as to the net value of shareholder’s investment is provided.

|

|

(l)

any other matters that are agreed by the shareholders and the board

|

Some

additional information is provided.

|

6. The draft SOI has

been prepared to address the priorities included in the Letter of Expectation

it received from Council on 15 October 2020.

7. There are no

significant differences to the previous SOI with the exception of the dividend

payment being delayed by a year and expected to start in 2023-24.

Legal

Considerations

8. Council may

suggest changes which the Board must consider in finalising its SOI. The

Board must consider within two months of 1 March any comments on the draft SOI

that are made by the shareholders. The Board must deliver a completed SOI

to Council on or before 30 June 2021.

9. Outside of this

current process, the Council may, by resolution, require the Board to modify

the SOI and the Board must comply (section 5, Schedule 8 LGA), provided that

Council first consults the Board.

Financial

Considerations

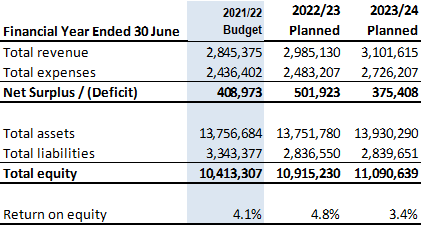

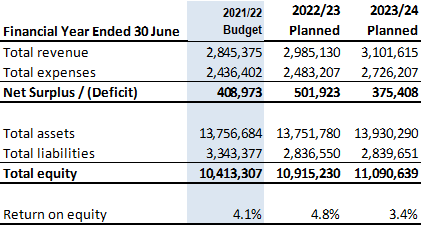

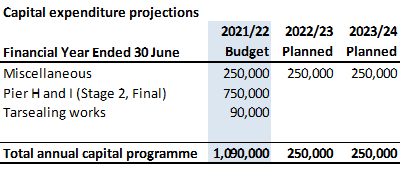

10. The draft SOI contains the

financial forecasts for SML for the three year period commencing 1 July

2021. Council will also need to decide whether the prescribed ROE for the

next year should be revised.

11. In the past SML has been required

to achieve a prescribed rate of return on equity (ROE) of at least 5%, which

was achievable. However, with the charging of a breakwater lease payment

by Council of $100k a year, the planned ROE for the next 3 years (including the

Breakwater lease) will fall below the 5% target as below:

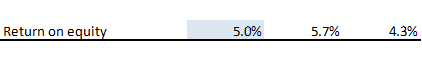

|

Return on

Equity

|

2021/22

Budget

|

2022/23

Planned

|

2023/24

Planned (*)

|

|

ROE

including Breakwater Lease Payment

|

4.1%

|

4.8%

|

3.4%

|

(*)

Expenses are higher in 2023/24 due to a one-off payment for maintenance

dredging

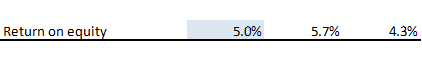

12. Excluding the breakwater

lease payments, a ROE of 5% is achievable over the next two years, but not in

2023/24 due to the need to undertake maintenance dredging.

13. We recommend the ROE be

lowered to 4.1% for 2021/22 only and reviewed annually in subsequent years.

14. The Total Equity of SML is

estimated to be $10.1M at 30 June 2021.

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Appendix 1: Seaview Marina Limited Draft

Statement of Intent - 2021/22 to 2023/24

|

14

|

Author: Sharon Page

Senior Management Accountant

Author: Alan McLellan

Manager, Seaview Marina

Reviewed By: Darrin Newth

Financial Accounting Manager

Reviewed By: Jenny Livschitz

Chief Financial Officer

Approved By: Jo Miller

Chief Executive

|

Attachment 1

|

Appendix 1: Seaview Marina Limited Draft

Statement of Intent - 2021/22 to 2023/24

|

SEAVIEW MARINA

LIMITED

DRAFT

STATEMENT OF INTENT

2021/22 to 2023/24

Contents

1. Mission. 3

2. Nature and Scope of

Activities. 3

3. Corporate Governance

Statement. 3

4. Corporate Goals. 3

5. Specific Objectives

for the Year Ending 30 June 2022. 4

6. Performance

Measures. 6

7. Financial

Projections. 8

8. Accumulated Profits

and Capital Reserves. 14

9. Share Acquisition. 14

10. Information to be

Provided to Shareholders. 14

11. Pricing Policy. 14

12. Transactions with

Related Parties. 15

13. Directory. 16

14. Accounting Policies. 17

1. Mission

Seaview Marina Limited’s mission

is to be the centre for recreational marine activities and services in the Wellington

Region.

2. Nature and Scope of

Activities

Seaview Marina Limited (the Company)

is responsible for the operation of the boating facilities and services, the

maintenance of infrastructural assets and the development of additional

facilities and services as demand dictates.

3. Corporate

Governance Statement

The Company is 100% owned by Hutt City

Council and accordingly is a Council Controlled Trading Organisation (CCTO) as

defined by the Local Government Act 2002 (LGA). The Directors’ role is defined

in Section 58 of the LGA which requires that all decisions relating to the

operation of a CCTO shall be made pursuant to the authority of the directorate

of the CCTO and its Statement of Intent (SOI). In addition to the obligations

of the LGA, the Company is also covered by the Companies Act 1993 which places

other obligations on the Directors.

The Directors are responsible for the

preparation of the SOI which, along with the three-year financial plan, is

provided to the Company’s Shareholder, Hutt City Council. Six

monthly and annual reports of financial and operational performance are

provided to the Shareholder. Financial and operational /management

reports are prepared monthly for the Directors.

The Directors of the Company are

responsible for the overall control of the Company but no cost-effective

internal control system will permanently preclude all errors or

irregularities. The control systems operating within the Company reflect

the specific risks associated with the business of the company.

4. Corporate Goals

The principle goal of the Company is

to operate as a successful business, achieving the objectives of its

shareholder as specified in this Statement of Intent. The specific corporate

goals of the Company are as follows:

General

4.1 To

ensure that the Statement of Intent and operating policies for the Company are

consistent with the operating policies of Hutt City Council.

4.2 To

ensure that the Statement of Intent and operating strategies are adhered to.

4.3 To

keep the Shareholder informed of matters of substance affecting the Company.

4.4 To

perform continual reviews of the operating strategies, financial performance

and service delivery of the Company.

4.5 To

develop the Company into one of New Zealand’s premier marina businesses.

4.6 To

further expand and diversify the Company’s marina facilities.

Economic

4.7 To

maximise the financial returns achieved and the value added by the Company.

4.8 To

return a minimum % return on equity (ROE) per annum as specified by the

Shareholder.

4.9 To

maintain the Company’s financial strength through sound and innovative

financial management.

Social and Environmental

4.10 To

support recreational boating activities in the Wellington Region.

4.11 To

promote safe work practices.

4.12 To

act as a socially responsible and environmentally aware corporate citizen and

to contribute to, or assist where possible, with Hutt City Council’s

community outcomes (as listed in the HCC Annual or Long Term Plan).

4.13 Move

towards meeting the Hutt City Council Carbon Policy.

5. Specific Objectives

for the Year Ending 30 June 2022

In pursuit of its corporate goals, the

Company has the following objectives for the next 12 months:

General

5.1 To

review the Statements of Intent and Strategic Plans for consistency with the

objectives of Hutt City Council.

5.2 To

review the operating activities of the Company for compliance with the goals

and objectives stated in the Statement of Intent and Strategic Plan.

5.3 To

report all matters of substance to the Shareholder.

Economic

5.4 To

achieve all financial projections.

5.5 To

achieve or exceed a Return on Equity (ROE) as defined by the Shareholder (See

section 7 item 3).

5.6 To

ensure that the reporting requirements of the Company and the Shareholder are

met.

Social and Environmental

5.7 To

maintain good employer status by:

(a)

complying with all employment legislation;

(b)

operating open and non-discriminatory employment practices.

5.8 To

ensure no transgression of environmental and resource laws.

5.9 To

review the activities undertaken by the Company for the purposes of being a

good socially and environmentally responsible corporate citizen.

6. Shareholder

Expectations

The Shareholder has provided the

Company with its expectations for the business over the next three years. These

expectations are laid out under the following four categories: development,

return to shareholder, social and environmental and lastly health and safety.

The details are outlined below:

Continue

with development plans

Focus on completing the remaining

in-water development as the market demands and operating cash flows permit. Any

substantial variations will require engagement with the Shareholder.

Returns

to Shareholder

In the medium term the Shareholder

expects financial returns by way of dividends and breakwater lease payments.

Breakwater lease payments commenced in 2019/20. The timing of dividend payments

is dependent on completion of the in-water development programme, which is

currently planned for 2023/24. The Board will develop a Dividend Policy

for consideration and approval of the shareholder.

Social

and environmental

Support of charitable non-profit

ventures connected with the Company’s business will continue to be a

focus.

The Company will take steps to respond

to the potential impacts of climate change and align itself with the

Council’s ‘carbon zero’ initiatives.

Health

and safety

Health and safety

will continue to be a top priority and embedded within all activities of the

marina.

7. Performance

Measures

|

|

Key

Performance Indicator

|

2021/22

|

2022/23

|

2023/24

|

Reporting

Frequency

|

|

|

Financial

|

|

|

|

1

|

Deliver

annual budgeted incomes for each of the four business entities

· Boat storage

· Hardstand

· Marine Centre

· Launching ramp

|

Achieve

100% of budgeted incomes

|

Achieve

100% of budgeted incomes

|

Achieve

100% of budgeted incomes

|

Six

monthly

|

|

2

|

Control

operational expenses (1)

|

Operational

expenses within budget

|

Operational

expenses within budget

|

Operational

expenses within budget

|

Six

monthly

|

|

3

|

Achieve

prescribed rate of return on equity (2)

|

4.1%

|

4.8%

|

3.4%

|

Annually

|

|

4

|

Manage

Capital Expenditure (3)

|

Complete

within capital budget and on time

|

Complete

within capital budget and on time

|

Complete

within capital budget and on time

|

Annually

|

|

|

Relationship

&

Communication

|

|

|

|

5

|

Client

Service

|

88%

satisfaction in the bi-annual survey

|

88%

satisfaction

for

the exit/entry survey

|

88%

satisfaction

in

the bi-annual survey

|

Annually

|

|

6

|

Newsletter

communications

|

Complete

four newsletters per annum

|

Complete

four newsletters per annum

|

Complete

four newsletters per annum

|

Quarterly

|

|

7

|

Meet

all shareholder reporting deadlines

|

See

Section 9

|

See

Section 9

|

See

Section 9

|

Schedule

in Section 9

|

|

|

Risk

Management and Human Resources

|

|

|

|

8

|

Notifiable

health and safety incidents

|

None

|

None

|

None

|

Monthly

to board

|

|

9

|

Business

Continuity Plan

|

Run

one test scenario and review

|

Run

one test scenario and review

|

Run

one test scenario and review

|

Annually

|

|

10

|

Staff

Satisfaction

|

Achieve

85% staff satisfaction

|

Achieve

85% staff satisfaction

|

Achieve

85% staff satisfaction

|

Six

Monthly

|

|

|

Marketing

|

|

|

|

11

|

Implement

marketing strategy to improve occupancy rates (additional berth development

initially impacts negatively on berth occupancy rates)

|

Berth

occupancy equal or greater than 95%

|

Berth

occupancy equal or greater than 95%

|

Berth

occupancy equal or greater than 95%

|

Monthly

|

|

12

|

Media

and Public Relations

|

Six

media releases or PR exercises per year

|

25

enquiries per month from website

|

30

enquiries per month from website

|

Annually

|

|

Non- Financial

|

|

13

|

To

provide financial or non- financial support to at least three charitable

(non-profit) ventures with a marine focus during any given financial year.

|

Support

to at least three organisations

|

Support

to at least three organisations

|

Support

to at least three organisations

|

Annually

|

Notes

to Financial Measures

(1) Operational

expenses are defined as all expenses controllable by Seaview Management.

Excludes depreciation and finance charges and losses arising from the revaluation

of similar assets within an asset class.

(2) Return

on equity is defined as net Surplus / (Deficit) excluding losses or gains

arising from the revaluation of similar assets within an asset class divided by

the opening balance of equity at the start of the year.

(3) Excludes

carry forward of expenses on projects from prior years, unless specifically

budgeted for (e.g. where project spans two or more fiscal periods)

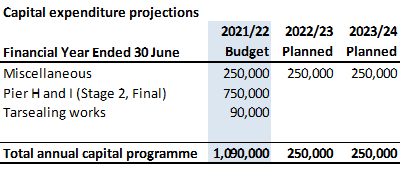

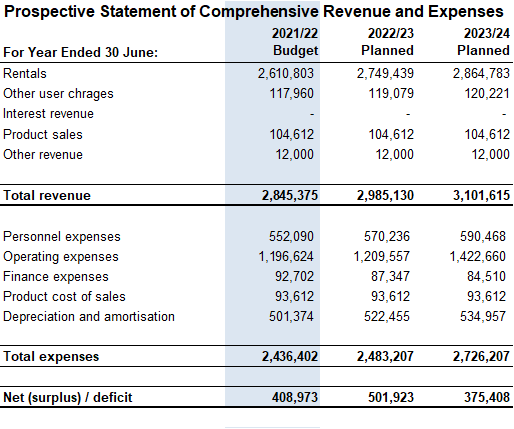

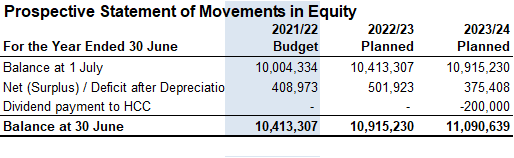

8. Financial

Projections

The projections

have been prepared using a number of assumptions about the future as well as

business trends over the previous five years. In determining these

projections the Board and Management have applied their judgement to the future

commercial environment in which the Company operates.

The Return on equity without the breakwater

lease is:

Note 1:

Ownership of infrastructural assets is retained by the Shareholder (or other

clients).

Note 2: Seaview Marina has to date

returned all financial benefits to its Shareholder through increasing the

capital value of the marina with trading profits being retained and invested in

the strategic development programme. Dividends are expected to be returned

to the Shareholder after completion of the marina in-water capital development

programme (i.e. 2023/24).

Equity

Value of the Shareholders’ Investment

The

estimated net value of the shareholders’ investment in the company at 30

June 2021 will be $10.1m and $10.4m on 30 June 22.

9. Accumulated

Profits and Capital Reserves

The intention is to pay a dividend to

the Shareholder commencing in 2023/24. The Company will develop a

Dividend Policy upon completion of the planned in-water developments (H and I

Piers).

10. Share

Acquisition

There is no intention to subscribe for

shares in any other company or invest in any other organisation during the

period covered by this Statement of Intent. Not with standing this, the

purchase of any shares requires shareholder approval.

11. Information

to be provided to Shareholders

In each year the Company shall comply

with the reporting requirements under the Local Government Act 2002, the

Companies Act 1993, and other relevant regulations. In particular the

Company will provide:

11.1 Statement

of Intent

A draft Statement of Intent by 1 March

of the year preceding the financial year to which it relates detailing all

matters required under the Local Government Act 2002, including financial information

for the next three years.

A final Statement of Intent before the

commencement of the financial year to which it relates.

11.2 Half-Yearly

Report

Within two months after the end of the

first half of each financial year, the Company shall provide a report on the

operation of SML to enable an informed assessment of its performance, including

financial statements, and progress on activities and projects (in accordance

with section 66 of the LGA 2002).

11.3 Annual

Report

Within three months after the end of

each financial year, the Company will provide an annual report which provides a

comparison of its performance with the Statement of Intent, with an explanation

of any material variances, audited consolidated Financial Statements for that

financial year, and an Auditor’s Report (in accordance with section 67,

68 and 69 of the LGA 2002).

12. Pricing

Policy

The Company operates in a competitive

market competing with four other marinas within the Wellington Region and to a

lesser extent with the Marlborough marinas. All marina charges, apart from the

Wellington Marine Centre Leases, are reviewed on an annual basis. The review is

based on a number of criteria which are listed below:

12.1 Market

Trends

The Company positions it charges at

the lower end of the Wellington marina market but will adjust charges according

to movements in other marinas of a similar standard.

12.2 Operating

Costs

Increases in operating costs related

to the marina activities compared with the previous year (not CPI).

12.3 Achievement

of ROE

Hutt City Council sets a minimum ROE

which the Company is required to achieve each year and to achieve this rental

charges are set accordingly.

13. Transactions

with Related Parties

Transactions

between the Company, Lower Hutt City Council and other Hutt City Council

controlled enterprises will be conducted on a wholly commercial basis. Charges

from Hutt City Council and its other companies will be made for services

provided as part of the normal trading activities of the Company.

|

Related Party

|

Transaction

|

|

Hutt City Council Finance Department

|

Provision of accounting services and the

consolidation of the Company’s financial accounts into the Hutt City

Council’s accounts.

|

|

Hutt City Council IT Department

|

Provision of technical support for the Company’s

computer hardware and systems.

|

14. Directory

Directors

Brian

Walshe (Chairman)

D Hislop

Peter Steel

Chief Executive

Alan McLellan

Registered Office

100 Port Road

Seaview

Lower Hutt

New Zealand

Postal Address

Private Bag 33 230

Petone 5012

Telephone

+64 (4) 568 3736

Website

www.seaviewmairna.co.nz

Auditor

Audit New Zealand on behalf of the Auditor General

Bankers

Westpac Banking Corporation of

New Zealand Limited

Lower Hutt

New Zealand

Solicitors

Thomas Dewar Sziranyi Letts

Level 2, Corner Queens Drive

& Margaret Street

Lower Hutt

New Zealand

15. Accounting Policies

REPORTING ENTITY

Seaview

Marina Limited (SML) is a Council Controlled Trading Organisation (CCTO), 100

per cent owned by Hutt City Council. The primary objective of SML is the

operation of a marina which benefits the community of Hutt City. SML is

designated a public benefit entity for financial reporting purposes.

BASIS OF PREPARATION

The

financial statements have been prepared on the going concern basis, and the

accounting policies have been applied consistently throughout the period.

Statement

of compliance

These

financial statements have been prepared in accordance with the requirements of

the Local Government Act 2002, which includes the requirement to comply with

generally accepted accounting practice in New Zealand (NZ GAAP). They

comply with IPSAS and other applicable Financial Reporting Standards, as

appropriate for public benefit entities (PBE) that apply Tier 2 PBE accounting

standards. As SML’s total expenses are under $30,000,000, it has

elected to apply Tier 2 PBE accounting standards.

Measurement

base

The

accounting policies set out below have been applied consistently to all periods

presented in these financial statements.

The

financial statements have been prepared on a historical cost basis.

Functional

and presentation currency

The financial statements are

presented in New Zealand dollars and all values have been rounded to the

nearest dollar. The functional currency of SML is New Zealand

dollars.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICES

Revenue

SML

derives revenue from its licensees and casual clients. The income is

generated from a range of rentals for boat storage and building tenancies as

well as services available through the facilities provided by SML.

Revenue

is measured at the fair value of consideration received. THE FINANCIAL STATEMENTS

Revenue from the

rendering of services is recognised by reference to the stage of completion of

the transaction at balance date, based on the actual service provided as a

percentage of the total services to be provided.

Sales of goods are

recognised when a product is sold to the customer. The recorded revenue

is the gross amount of the sale, including credit card fees payable for the

transaction. Such fees are included in other expenses.

Interest revenue is

recognised using the effective interest method.

Expenses

Expenses

are recognised when the goods or services have been received on an accrual

basis.

Cash

and cash equivalents

Cash

and cash equivalents includes cash on hand, deposits held at call with banks,

other short term highly liquid investments with original maturities of three

months or less, and bank overdrafts.

Trade

debtors and other receivables

Trade debtors and other receivables are

initially measured at fair value and subsequently measured at amortised cost

using the effective interest method, less any provision for impairment.

Inventory

Inventory

is recorded at cost on a first in – first out basis.

Property,

plant and equipment

Land

is measured at fair value, and buildings are measured at fair value less

accumulated depreciation. All other asset classes are measured at cost

less accumulated depreciation and impairment losses.

Additions

Expenditure of a capital nature

of $500 or more is capitalised. Expenditure of less than $500 is charged

to operating expenditure. The cost of an item of property, plant and

equipment is recognised as an asset if, and only if, it is probable that future

economic benefits or service potential associated with the item will flow to

SML and the cost of the item can be measured reliably.

Labour costs relating to self-constructed

assets are capitalised if, and only if, it is probable that future economic

benefits or service potential associated with the item will flow to SML and the

cost of the item can be measured reliably.

Work in progress is recognised at cost less

impairment and is not depreciated.

Disposals

Gains and losses on

disposals are determined by comparing the proceeds with the carrying amount of

the asset. Gains and losses on disposals are recognised in the Statement of Comprehensive

revenue and expense.

Subsequent costs

Costs incurred

subsequent to initial acquisition are capitalised only when it is probable that

future economic benefits or service potential associated with the item will

flow to SML and the cost of the item can be measured

reliably.

Revaluation

Land

and buildings are reviewed each year to ensure that their carrying amount does

not differ materially from fair value, and are revalued when there has been a

material change. All other asset classes are carried at depreciated

historical cost. Revaluation movements are accounted for on a class of

asset basis.

The net revaluation results are

credited or debited to other comprehensive revenue and expenses and are

accumulated to an asset revaluation reserve in equity for that class of

asset. Where this would result in a debit balance in the asset

revaluation reserve, this balance is not recognised in other comprehensive

revenue and expenses but is recognised in the surplus or deficit. Any subsequent

increase on revaluation that reverses a previous decrease in value recognised

in the surplus or deficit will be recognised first in the surplus or deficit up

to the amount previously expensed, and then recognised in other comprehensive

revenue and expenses.

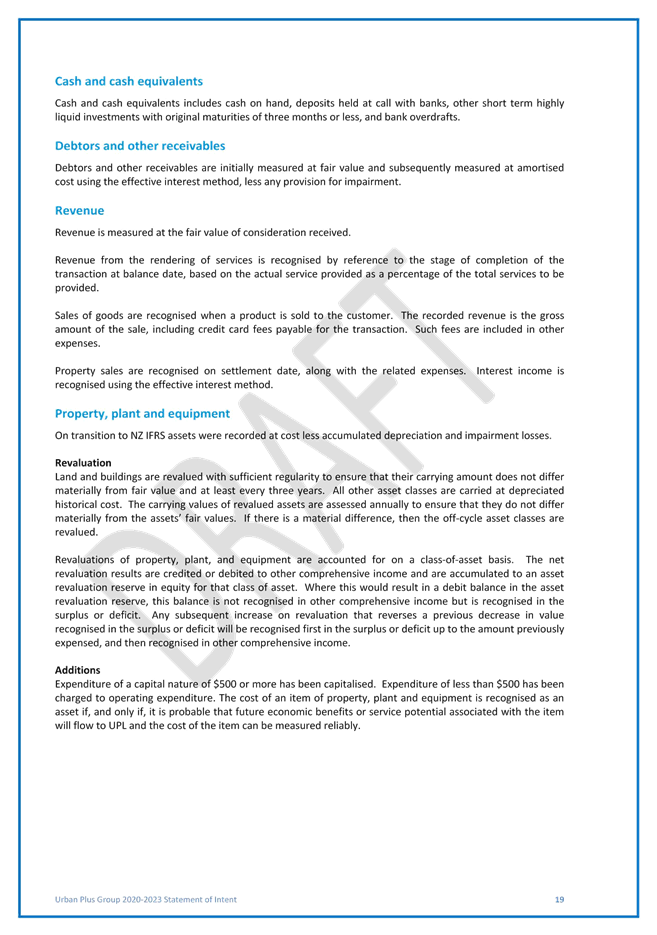

Depreciation

Depreciation is

provided on a straight-line basis on all property, plant and equipment at rates

that will write off the cost of the assets to their estimated residual values

over their useful lives. The straight-line depreciation rates are as

follows:

Property,

plant and equipment consist of the following asset classes: land, buildings,

leasehold improvements, furniture and office equipment and motor vehicles.

|

Estimated economic lives

|

Years

|

Rate

|

|

Buildings

Service Centre, hardstand, travel lift

|

5 - 33

2 - 77

|

3% - 20%

1.3% - 50%

|

|

Site improvements

|

3 - 60

|

1.7% - 33.3%

|

|

Piers and marina berths

|

4 - 30

|

3.3% - 25%

|

|

Plant and equipment

|

1.5 - 66

|

1.5% - 67%

|

|

Vehicles

|

5

|

20%

|

The residual value and useful life of an asset is reviewed and

adjusted if applicable at each financial year end.

Intangible

assets

Software acquisition and

development

Acquired computer software

licenses are capitalised on the basis of the costs incurred to acquire and

bring to use the specific software. Costs associated with maintaining

computer software are recognised as an expense when incurred. Costs that

are directly associated with the development of software for internal use by

SML, are recognised as an intangible asset.

Amortisation

The carrying value of an intangible asset with a finite life is

amortised on a straight-line basis over its useful life. Amortisation

begins when the asset is available for use and ceases at the date that the

asset is derecognised. The amortisation charge for each period is

recognised in the Statement of Comprehensive revenue and

expense.

The useful lives and associated amortisation rates of major

classes of intangible assets have been estimated as follows:

|

Estimated economic lives

|

Years

|

Rate

|

|

Computer

software

|

2.5 -

33

|

3% -

40%

|

Impairment of

non-financial assets

Assets with a finite useful

life are reviewed for impairment whenever events or changes in circumstances

indicate that the carrying amount may not be recoverable. If an asset’s carrying

amount exceeds its recoverable amount, the asset is impaired and the carrying

amount is written down to the recoverable amount. The recoverable

amount is the higher of the asset’s fair value less costs to sell and

value in use. The total impairment loss is recognised in the Statement of

Comprehensive revenue and expense.

Goods

and services Tax

All items in the financial

statements are stated exclusive of GST, except for receivables and payables,

which are presented on a GST inclusive basis. Where GST is not

recoverable as input tax then it is recognised as part of the related asset or

expense.

Employee

entitlements

Short-term entitlements

Employee benefits that SML

expects to be settled within 12 months of balance date are measured at nominal

values based on accrued entitlements at current rates of pay. These

include salaries and wages accrued up to balance date, annual leave earned to,

but not yet taken at balance date, retiring and long service leave entitlements

expected to be settled within 12 months, and sick leave.

SML recognises a liability for sick leave to the extent that

absences in the coming year are expected to be greater than the sick leave

entitlements earned in the coming year. The amount is calculated based on

the unused sick leave entitlement that can be carried forward at balance date,

to the extent that SML anticipates it will be used by staff to cover those

future absences.

SML recognises a liability and an expense for bonuses where

contractually obliged or where there is a past practice that has created a

constructive obligation.

Payables

Short

term creditors and other payables are recorded at their face value.

Provisions

SML recognises a provision for

future expenditure of uncertain amount or timing when there is a present

obligation (either legal or constructive) as a result of a past event, it is

probable that expenditures will be required to settle the obligation and a

reliable estimate can be made of the amount of the obligation.

Provisions are not recognised for future operating losses.

Provisions are measured at the present value of the expenditures

expected to be required to settle the obligation using a pre-tax discount rate

that reflects current market assessments of the time value of money and the

risks specific to the obligation. The increase in the provision due to the

passage of time is recognised as an interest expense.

Borrowings

Borrowings

are initially recognised at their fair value plus transaction costs. After

initial recognition, all borrowings are measured at amortised cost using the

effective interest method. Borrowings are classified as current

liabilities unless SML has an unconditional right to defer settlement of the

liability for at least 12 months after balance date.

Borrowing

costs

Borrowing

costs are recognised as an expense in the period in which they are incurred.

Income

tax

Income

tax expense includes components relating to both current tax and deferred tax.

Current

tax is the amount of income tax payable based on the taxable profit for the

current year, and any adjustments to income tax payable in respect of prior

years. Current tax is calculated using tax rates (and tax laws) that have

been enacted or substantively enacted at balance date

Deferred

tax is the amount of income tax payable or recoverable in future periods in

respect of temporary differences and unused tax losses. Temporary

differences are differences between the carrying amount of assets and

liabilities in the financial statements and the corresponding tax bases used in

the computation of taxable profit.

Deferred

tax is measured at tax rates that are expected to apply when the asset is

realised or the liability is settled, based on tax rates that have been enacted

or substantively enacted at balance date. The measurement of deferred tax

reflects the tax consequences that would follow from the manner in which the

entity expects to recover or settle the carrying amount of its assets and

liabilities.

Deferred

tax liabilities are generally recognised for all taxable temporary

differences. Deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which the deductible

temporary differences or tax losses can be utilised.

Deferred

tax is not recognised if the temporary difference arises from the initial

recognition of goodwill or from the initial recognition of an asset or

liability in a transaction that is not a business combination, and at the time

of the transaction, affects neither accounting profit nor taxable profit.

Current

and deferred tax is recognised against the surplus or deficit for the period,

except to the extent that it relates to a business combination, or to

transactions recognised in other comprehensive revenue and expense or directly

in equity.

Leases

Operating

leases

An

operating lease is a lease that does not transfer substantially all the risks

and rewards incidental to ownership of an asset. Lease payments under an

operating lease are recognised as an expense on a straight-line basis over the

lease term.

Finance

leases

SML

has not entered into any material finance leases.

Financial

instruments

The

Company is party to financial instrument arrangements as part of its normal

operation. Revenue and expenses in relation to all financial instruments

are recognised in the Statement of Comprehensive Revenue and Expenses.

All

financial instruments are recognised in the Statement of Financial Position on

the basis of the Company’s accounting policies. All financial

instruments disclosed on the Statement of Financial Position are recorded at

fair value.

Budget

figures

The

budget figures are those approved by the Board at the beginning of the

year. The budget figures have been prepared in accordance with generally

accepted accounting practice (GAAP), using accounting policies that are

consistent with those adopted by the Board for the preparation of the financial

statements.

Critical

accounting estimates and assumptions

In

preparing these financial statements SML has made estimates and assumptions

concerning the future. These estimates and assumptions may differ from

the subsequent actual results. Estimates and assumptions are continually

evaluated and are based on historical experience and other factors, including

expectations of future events that are believed to be reasonable under the

circumstances.

The

estimates and underlying assumptions are reviewed on an on-going basis.

Revisions to accounting estimates are recognised in the reporting period in

which the revision is made and in any future periods that will be affected by

those provisions.

Assumptions

have been made for the useful lives of property, plant and equipment and

intangible assets as noted above.

Policy, Finance and Strategy Committee

Policy, Finance and Strategy Committee

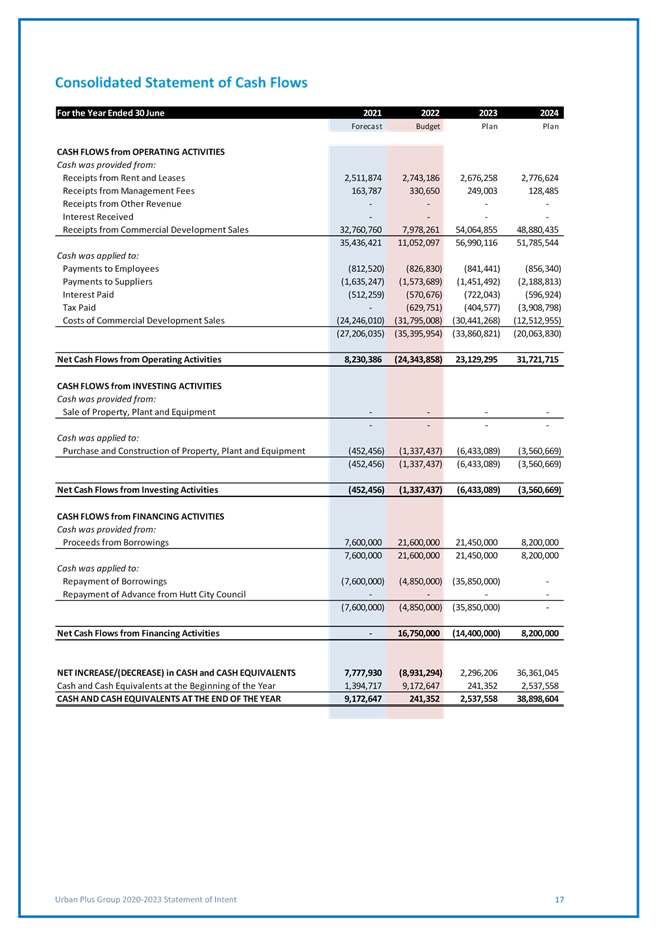

20 January 2021

File:

(21/64)

Report no:

PFSC2021/1/20

Urban Plus Group

Draft Statement of Intent 2021/22 to 2023/24

Purpose

of Report

1. The

purpose of the report is to provide a review of the draft 2021-2024 Statement

of Intent for Urban Plus Group (UPL) as delivered to

Council for Council’s consideration.

|

Recommendations

That the Committee recommends that Council:

(1) notes that the Urban Plus Group (UPL) Board has

submitted a draft Statement of Intent (SOI) 2021/22 - 2023/24, attached as

Appendix 1 to the report, in accordance with the Local Government Act 2002;

(2) notes that officers have reviewed the draft Urban

Plus Group SOI for compliance with the Local Government Act 2002 and provided

their analysis;

(3) receives the draft Urban Plus Group SOI;

(4) reviews the draft Urban Plus Group SOI and

considers if any modifications should be made; and

(5) provides

comment for the Urban

Plus Group Board to consider in finalising its SOI

(including any modifications suggested by the Committee arising under

recommendation (4) above).

|

Background

2. The Local

Government Act 2002 (LGA) requires the board of a Council Controlled

Organisation (CCO) to deliver to its shareholders a draft SOI on or before 1

March of each year.

Discussion

3. The Board of UPL

has submitted a draft SOI to Council. This is attached as Appendix 1 to

the report.

4. The board of a CCO

must provide information prescribed by the LGA for the SOI, to the extent is

appropriate given the organisation form of the CCO. They must do this for

the ‘the group’ – which comprises the CCO and its

subsidiaries. The information is required to be provided for the 2021/22

financial year and the two years following that (section 9, Schedule 8 of the

LGA).

5. The compliance of

the company with the legislative requirements for the SOI and a summary of the

amendments proposed by the Board for their 2021-2024 SOI are detailed below:

|

Required Content

|

UPL Draft SOI Content

|

|

(a)

the objectives of the company

|

The

objectives of the UPL are stated.

|

|

(b)

a statement of the board’s approach to governance of the group

|

A

statement is included.

|

|

(c)

the nature and scope of the activities undertaken by the group

|

The

nature and scope of activities are outlined.

|

|

(d)

the ratio of consolidated shareholders’ funds to total assets, and the

definition of those terms

|

Ratio

provided.

|

|

(e)

the accounting policies of the group

|

Accounting

policies are outlined.

|

|

(f)

the performance targets and other measures by which performance of the group

may be judged in relation to its objectives

|

Performance

targets are included.

|

|

(g)

an estimate of the amount or proportion of accumulated profits and capital

reserves that is intended to be distributed to the shareholders

|

Information

provided.

|

|

(h)

the kind of information to be provided to the shareholders by the group

during the course of those financial years, including the information to be

included in each half yearly report (and, in particular, what prospective financial

information is required and how it is to be presented)

|

The

kind of information to be provided is outlined.

|

|

(i)

the procedures to be followed before any member or the group subscribes for,

purchases, or otherwise acquires shares in any company or other organisation

|

Information

on procedures is not provided but it is noted that there is no intention to

subscribe or invest in any other organisation. A further note states

UPL has established a subsidiary. Established procedures are in place

which require approval from the CEO of Council, who can grant authority to

UPL on certain conditions.

|

|

(j)

any activities for which the board seeks compensation from any local

authority (whether or not the local authority has agreed to provide the

compensation)

|

No

compensation requested.

|

|

(k)

the boards estimate of the commercial value of the shareholders’

investment in the group and the manner in which and the times at which that

value is to be reassessed

|

A

statement as to the net value of shareholder’s investment is provided.

|

|

(l)

any other matters that are agreed by the shareholders and the board

|

Some

additional information is provided.

|

6. The draft SOI has

been prepared to address the priorities included in the Letter of Expectation

it received from Council on 15 October 2020, i.e. it is consistent with the

amended 2020-2023 SOI.

7. In accordance with

the resolution at the Long Term Plan/Annual Plan Subcommittee Meeting on 21

December 2020, this SOI is dependent upon the outcome of the LTP consultation

process and the additional funding arrangements.

8. Officers advised

last year that the long held target date for UPL to achieve 220 rental units

would not be achieved. The original target date was 30 June 2020, but the

target date was reset in the amended 2020-2023 SOI to 31 December 2023.

This target remains unchanged in the draft 2022-2024 SOI and is based on

UPL’s current four year development programme.

9. Until a decision

has been made by the UPL board on its Jackson Street site to either develop

apartments to sell to the market or to a Community Housing Provider (CHP), or

to build further units to be added to UPL’s rental portfolio, or to sell

the site as is where is, this development opportunity has been excluded from

UPL’s financial forecasts (other than the land and current site

improvements remaining part of UPL’s asset base).

Climate

Change Impact and Considerations

10. The matters addressed in this

report have been considered in accordance with the process set out in

Council’s Climate Change Considerations Guide.

Legal

Considerations

11. Council may suggest changes

which the Board must consider in finalising its SOI. The Board must

consider within two months of 1 March any comments on the draft SOI that are

made by the shareholders. The Board must deliver a completed SOI to

Council on or before 30 June 2021.

12. Outside of this current

process, the Council may, by resolution, require the Board to modify the SOI

and the Board must comply (section 5, Schedule 8 LGA), provided that Council

first consults the Board.

Financial

Considerations

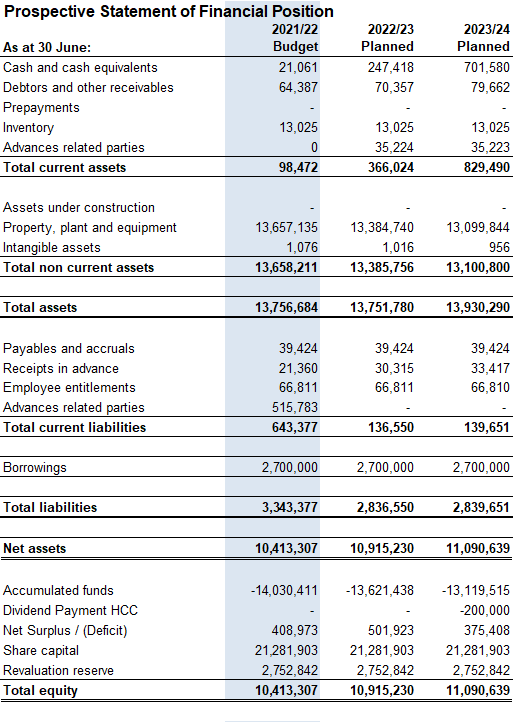

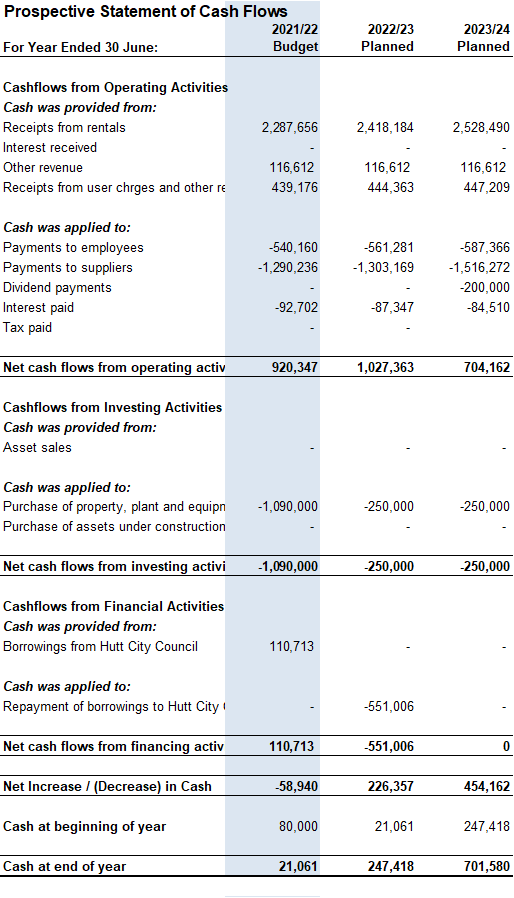

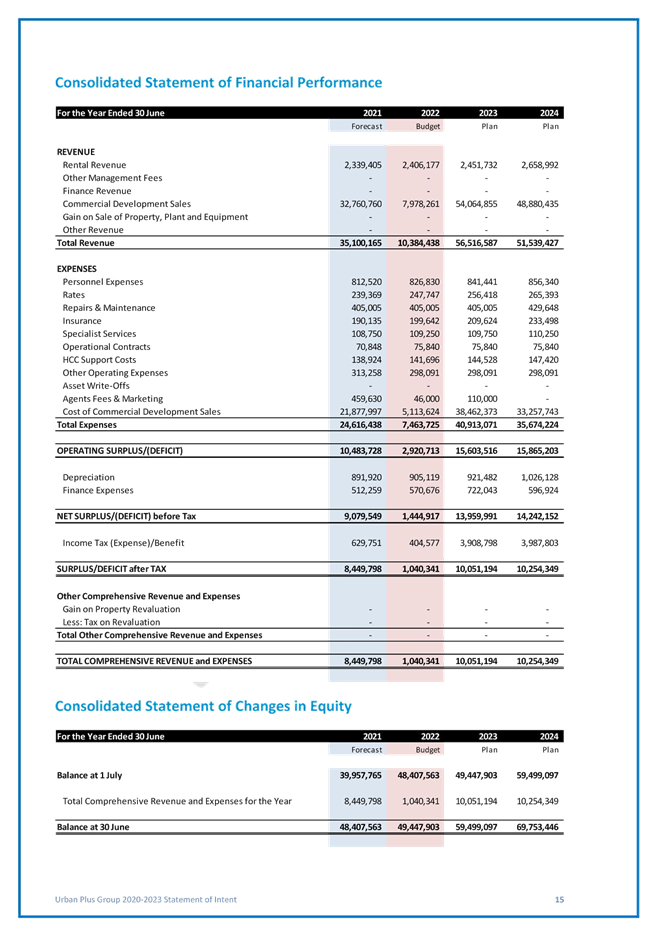

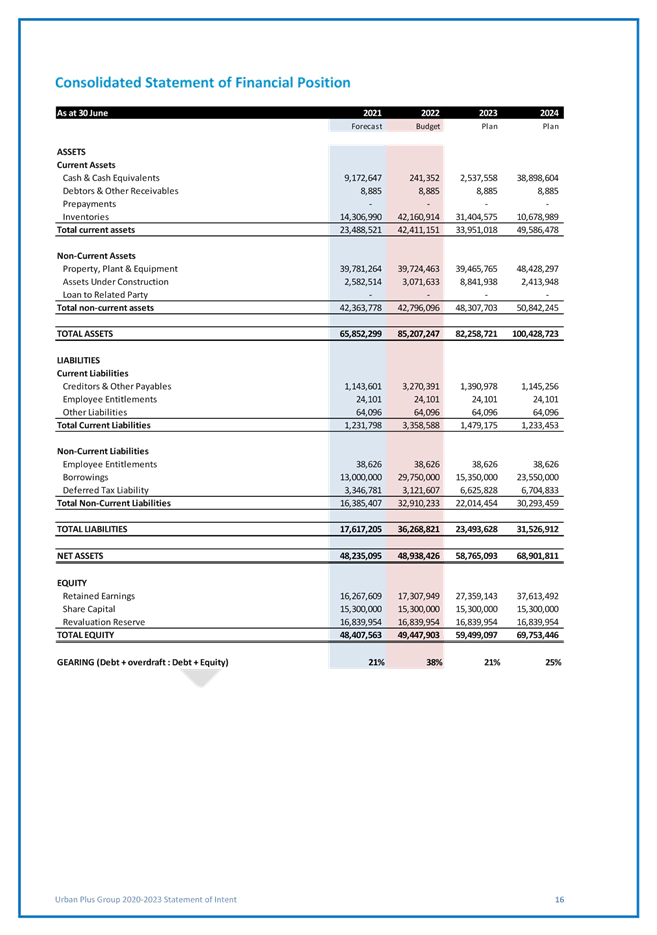

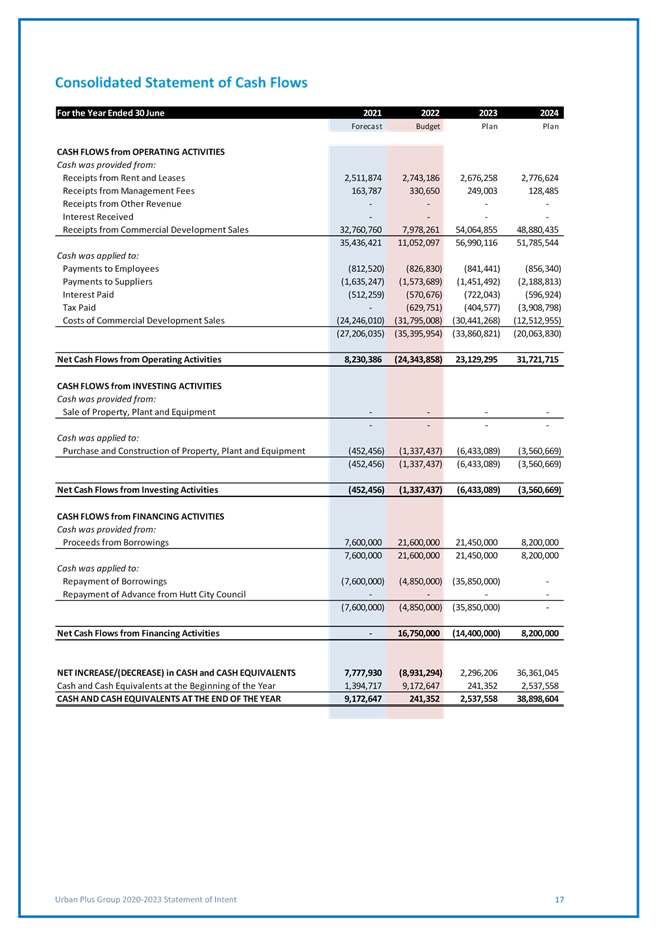

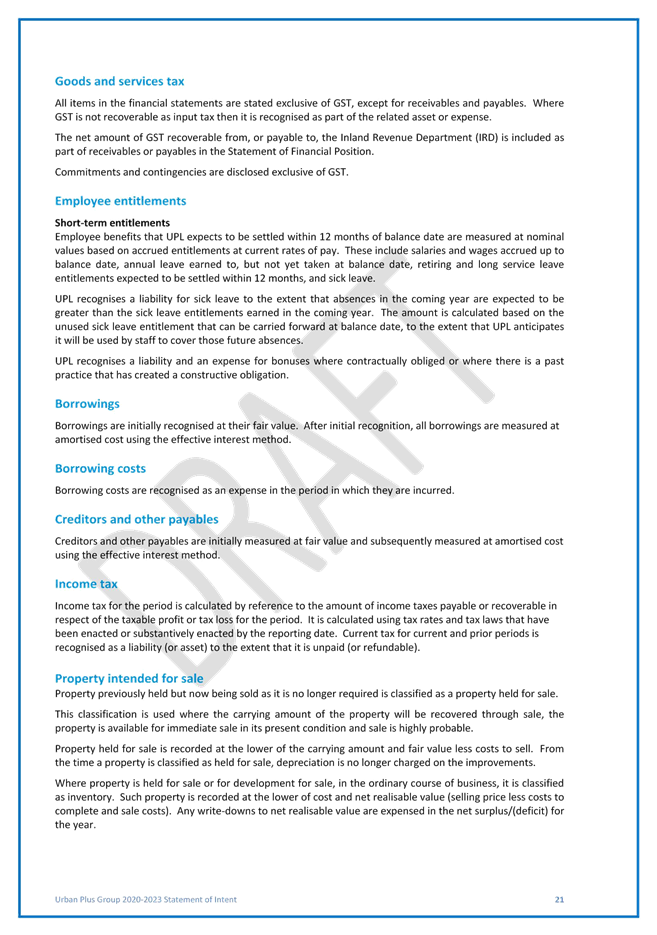

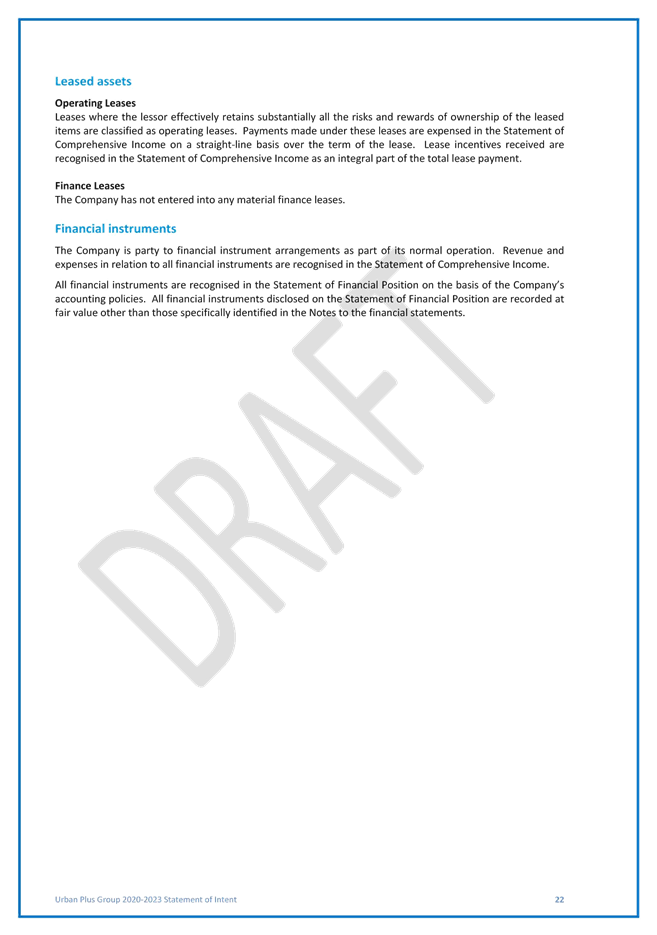

13. The draft SOI contains the

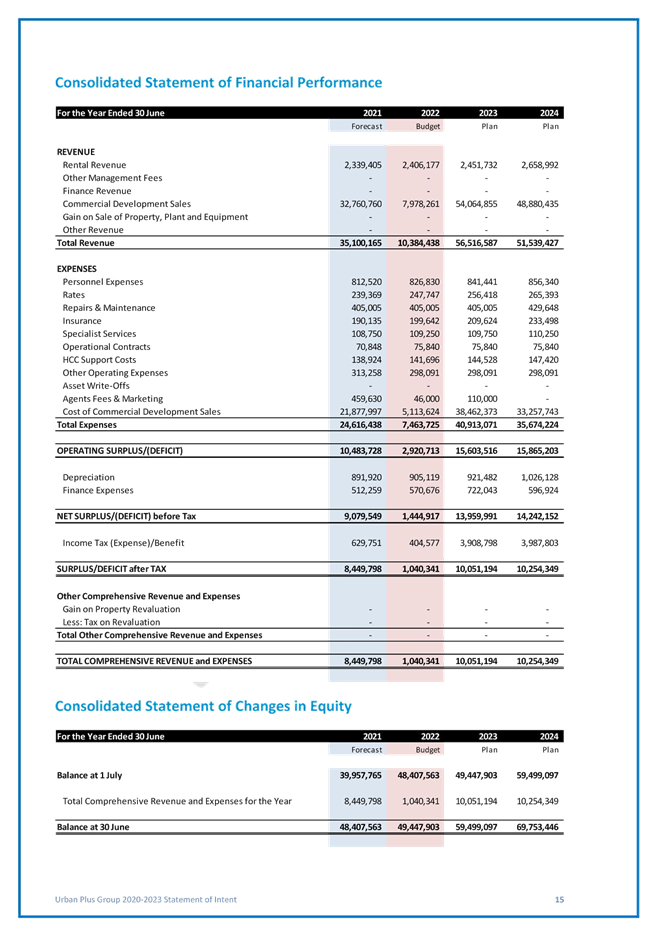

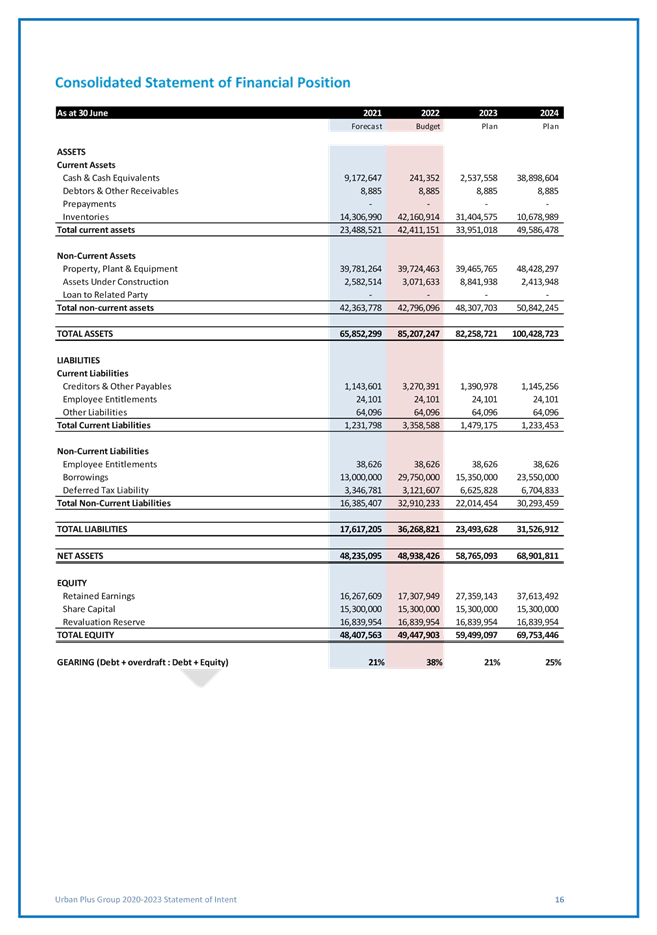

financial forecasts for UPL for the three year period commencing 1 July 2021.

14. The Total Equity of UPL is

estimated to be $49.4M at 30 June 2021.

15. In accordance with the

resolution at the Long Term Plan/Annual Plan Subcommittee Meeting on 21

December 2020, the Long Term Plan consultation process will be used to seek

feedback on increasing investment in Urban Plus. This

SOI is based on the assumption that Council will increase funding to UPL.

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Appendix 1: UPL GROUP DRAFT Statement of Intent

2021-2024

|

41

|

Author: Simon

George

Senior Accountant

Author: Daniel Moriarty

Chief Executive, Urban Plus

Reviewed By: Darrin Newth

Financial Accounting Manager

Reviewed By: Jenny Livschitz

Chief Financial Officer

Reviewed By: Kara Puketapu-Dentice

Director Economy and Development

Approved By: Jo Miller

Chief Executive

|

Attachment 1

|

Appendix 1: UPL GROUP DRAFT Statement of Intent

2021-2024

|

Policy, Finance and Strategy Committee

Policy, Finance and Strategy Committee

22 January 2021

File:

(21/69)

Report no:

PFSC2021/1/24

Hutt City Community

Facilities Trust Statement of Intent 2021/22 to 2023/24

Purpose

of Report

1. The purpose of

this report is to provide the draft 2021-2024 Statement of Intent for Hutt City

Community Facilities Trust (CFT) for Council’s review.

|

Recommendations

That the Committee recommends

that Council:

(1)

notes the Hutt

City Community Facilities Trust (CFT) board has submitted a draft Statement

of Intent (SOI) for the three years 2021/22 to 2023/24, attached as Appendix

1 to this report, in accordance with the Local Government Act 2002;

(2)

notes that

officers have reviewed the draft Hutt City Community Facilities Trust SOI for

compliance with the Local Government Act 2002 and provided their analysis;

(3)

receives the

draft Hutt City Community Facilities Trust SOI;

(4)

reviews the

draft Hutt City Community Facilities Trust SOI and considers if any

modifications should be made;

(5)

notes the Long

Term Plan process currently underway contained in paragraph 6 of the report;

and

(6)

provides

comment for the Hutt City Community Facilities Trust Board to consider in

finalising its SOI (including any modifications suggested by the Committee

arising under recommendation (4) above).

|

Background

2. The Local

Government Act 2002 (LGA) requires the board of a Council Controlled

Organisation (CCO) to deliver to its shareholders a draft SOI on or before 1

March of each year.

Discussion

3. The board of CFT

has submitted a draft SOI to Council. This is attached as Appendix 1 of

this report.

4. The board of a CCO

must provide information prescribed by the LGA for the SOI, to the extent it is

appropriate given the organisation form of the CCO. The information is

required to be provided for the 2021/22 financial year and the two years

following that (section 9, Schedule 8 of the LGA).

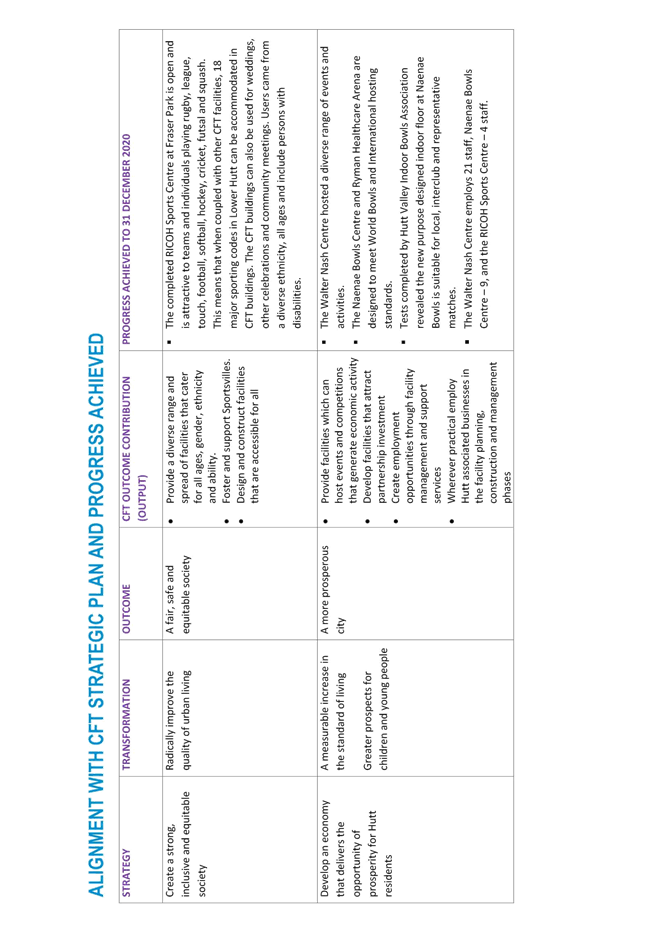

5. The compliance of

the company with the legislative requirements for the SOI and a summary of the

amendments proposed by the Board for their 2021-2024 SOI are detailed below:

|

Required Content

|

CFT Draft SOI Content

|

|

(a)

the objectives of the company

|

The

objectives of the CFT are stated.

|

|

(b)

a statement of the board’s approach to governance of the group

|

A

statement is included.

|

|

(c)

the nature and scope of the activities undertaken by the group

|

The

nature and scope of activities are outlined – no significant changes.

|

|

(d)

the accounting policies of the group

|

Accounting

policies are outlined.

|

|

(e)

the performance targets and other measures by which performance of the group may

be judged in relation to its objectives

|

Performance

targets are included.

|

|

(f)

an estimate of the amount or proportion of accumulated profits and capital

reserves that is intended to be distributed to the shareholders

|

Not

applicable.

|

|

(g)

the kind of information to be provided to the shareholders by the group

during the course of those financial years, including the information to be

included in each half yearly report (and, in particular, what prospective financial

information is required and how it is to be presented)

|

The

kind of information to be provided is outlined.

|

|

(h)

the procedures to be followed before any member or the group subscribes for,

purchases, or otherwise acquires shares in any company or other organisation

|

Information

on procedures is not provided but it is noted that there is no intention to

subscribe or invest in any other organisation.

|

|

(i)

any activities for which the board seeks compensation from any local

authority (whether or not the local authority has agreed to provide the

compensation)

|

No

compensation requested.

|

|

(j)

the boards estimate of the commercial value of the shareholders’

investment in the group and the manner in which and the times at which that

value is to be reassessed

|

A

statement as to the net value of shareholder’s investment is provided.

|

|

(kl)

any other matters that are agreed by the shareholders and the board

|

Some

additional information is provided.

|

6. The Board has not received from Council the usual letter of

expectation to guide it in the completion of this SOI. This is due to the

pending decision by Council for CFT to be retained as a

“non-active” trust with the transfer of its assets to Council by 30

June 2021. This matter will be included in the public consultation of

Council’s Long Term Plan, with the outcome known by 30 June 2021. Should this preferred option be ratified, CFT will transfer

assets to Council by 30 June 2021 and then become non-active.

7. However, the SOI reflects the continued management of existing facilities

should the preferred option not be ratified by 30 June 2021.

Legal Considerations

8. Council may

suggest changes which the Board must consider in finalising its SOI. The

Board must consider within two months of 1 March any comments on the draft SOI that

are made by the shareholders. The Board must deliver a completed SOI to

Council on or before 30 June 2021.

9. Outside of this

current process, the Council may, by resolution, require the Board to modify

the SOI and the Board must comply (section 5, Schedule 8 LGA), provided that

Council first consults the Board

Financial

Considerations

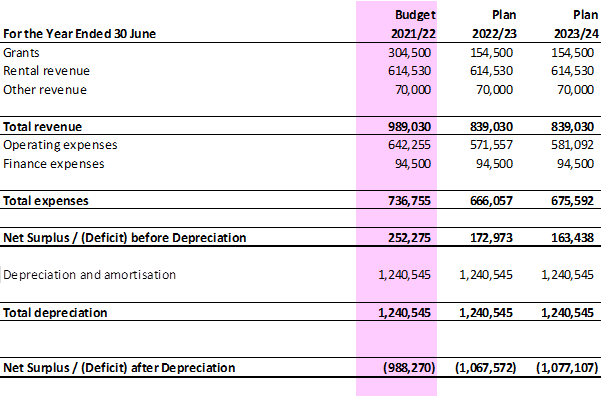

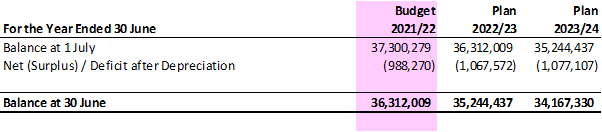

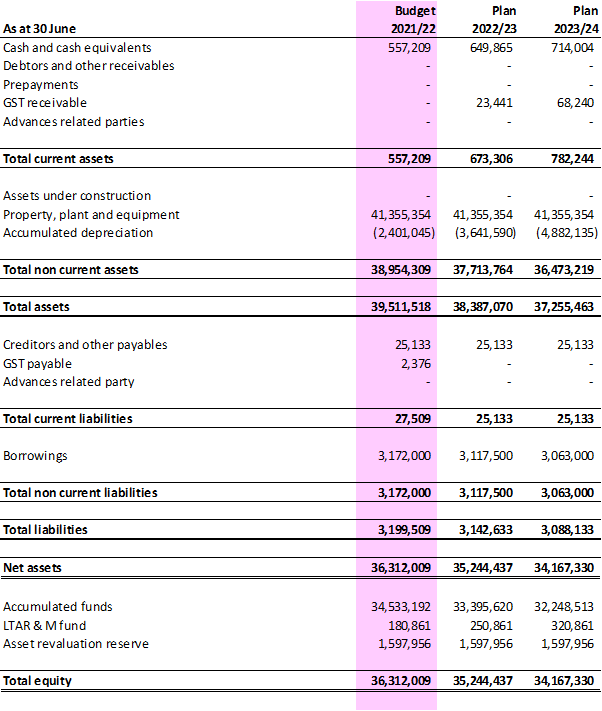

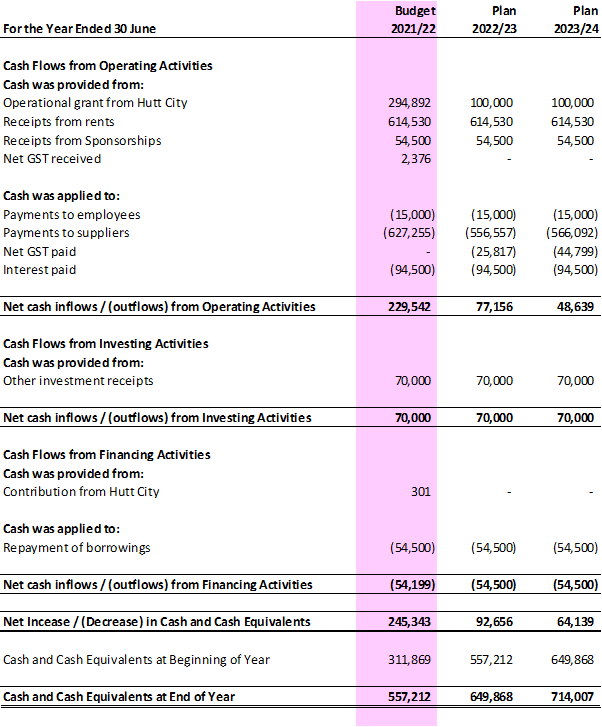

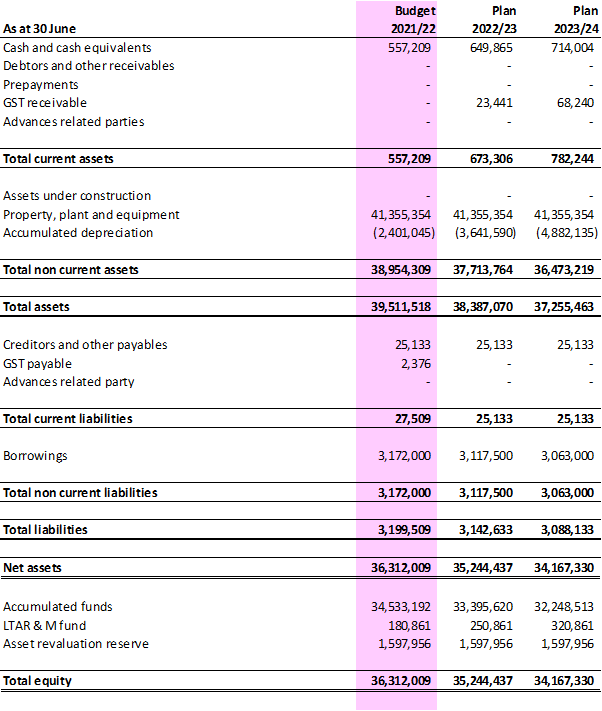

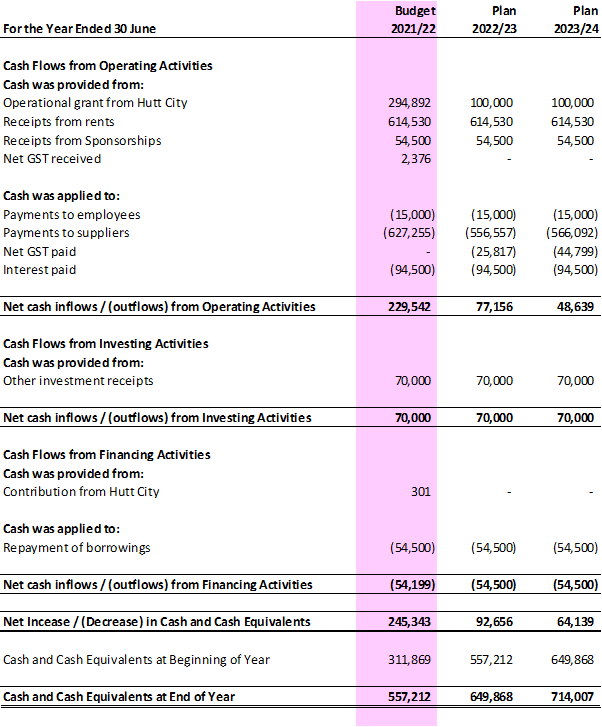

10. The draft SOI contains the

financial forecasts for CFT for the three year period commencing 1 July 2021.

11. The Total Equity of CFT is

estimated to be $37M at 30 June 2021.

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Hutt City Community Facilities Trust Draft Statement

of Intent 2021/22 to 2023/24

|

67

|

Author: Sharon Page

Senior Management Accountant

Reviewed By: Darrin Newth

Financial Accounting Manager

Reviewed By: Jenny Livschitz

Chief Financial Officer

Approved By: Jo Miller

Chief Executive

|

Attachment 1

|

Hutt City Community Facilities Trust Draft Statement

of Intent 2021/22 to 2023/24

|

Statement of Intent

Hutt City Community Facilities Trust

2021/22 – 2023/24

Contents

Introduction. 3

Objectives. 4

Activities. 5

Governance. 5

Ratio of

Consolidated Shareholders’ Funds to Total Assets. 6

Accounting Policies

of the CFT. 6

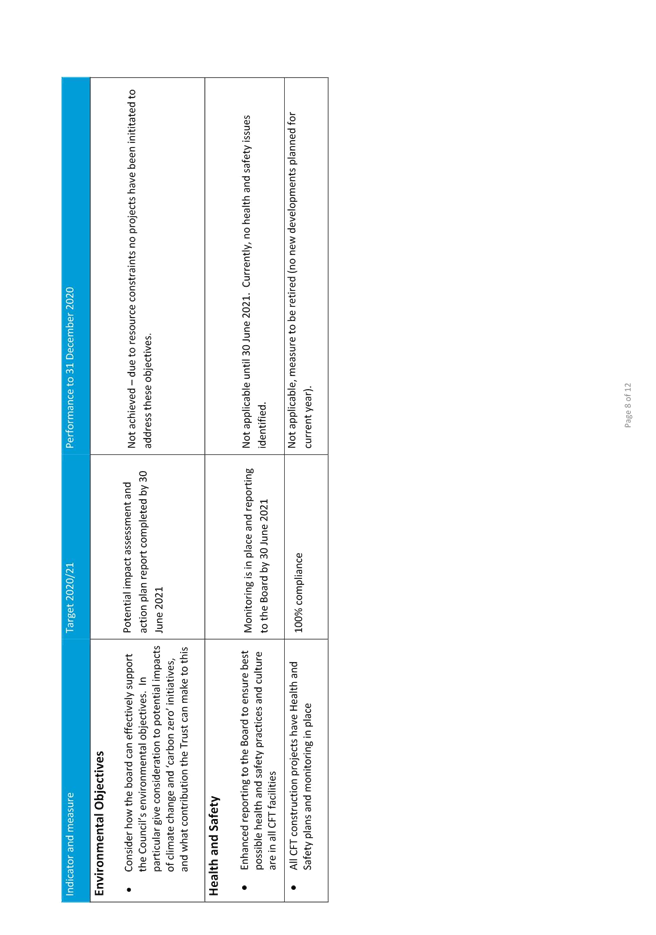

Performance Targets. 8

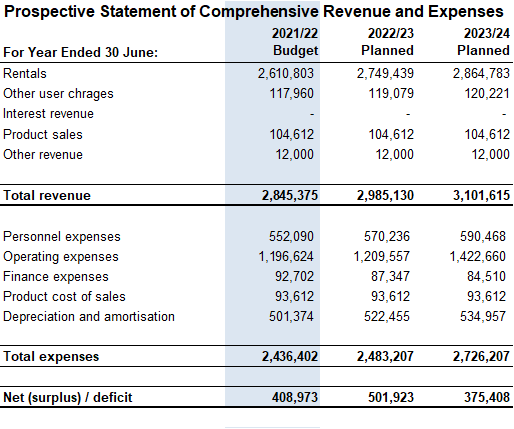

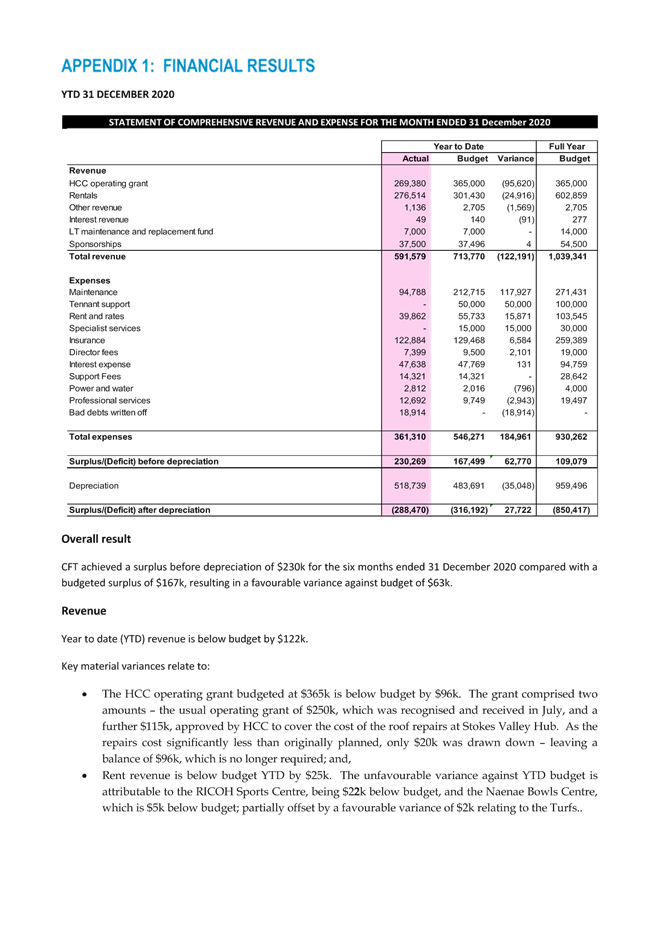

Prospective

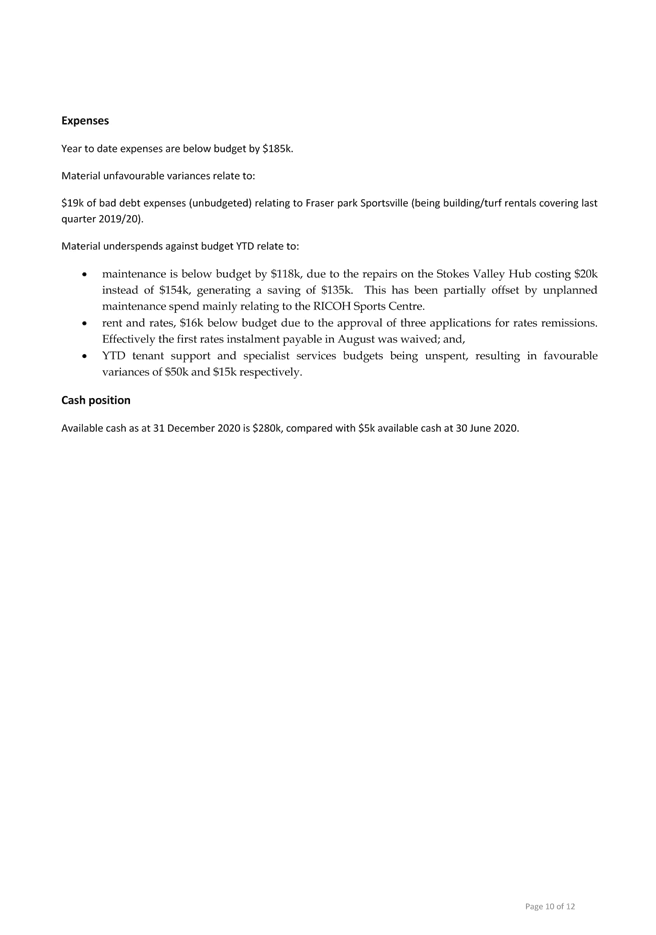

Statement of Financial Performance. 9

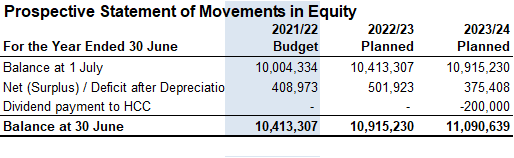

Prospective

Statement of Movements in Equity. 10

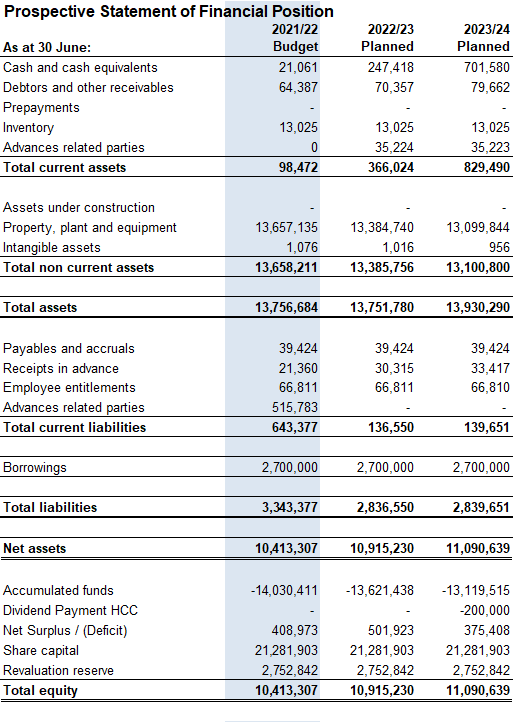

Prospective

Statement of Financial Position. 11

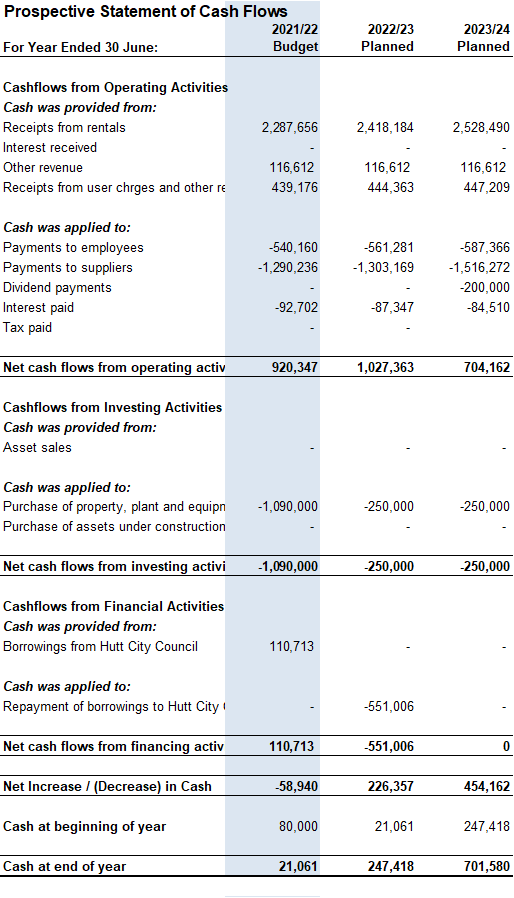

Prospective

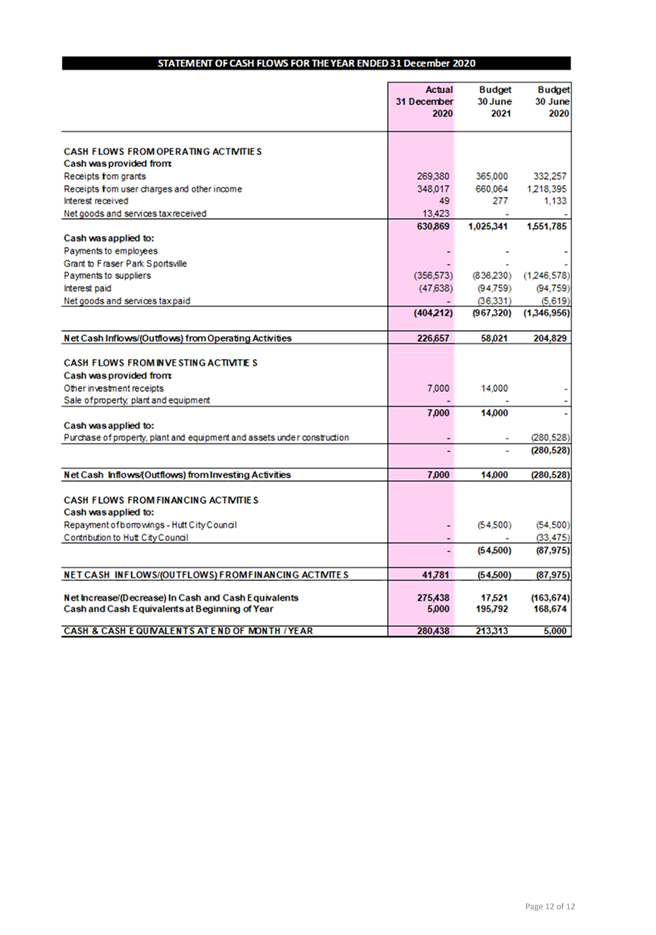

Statement of Cash Flows. 12

The CFT Depreciation

Policy. 13

Information to be

provided to Shareholders. 13

Procedures to be

followed before members acquire shares in other groups etc. 14

Activities for

which the Board seeks compensation from a local authority. 14

Board estimate of

the commercial value of the shareholder’s investment in the group. 14

Other Management

Issues. 15

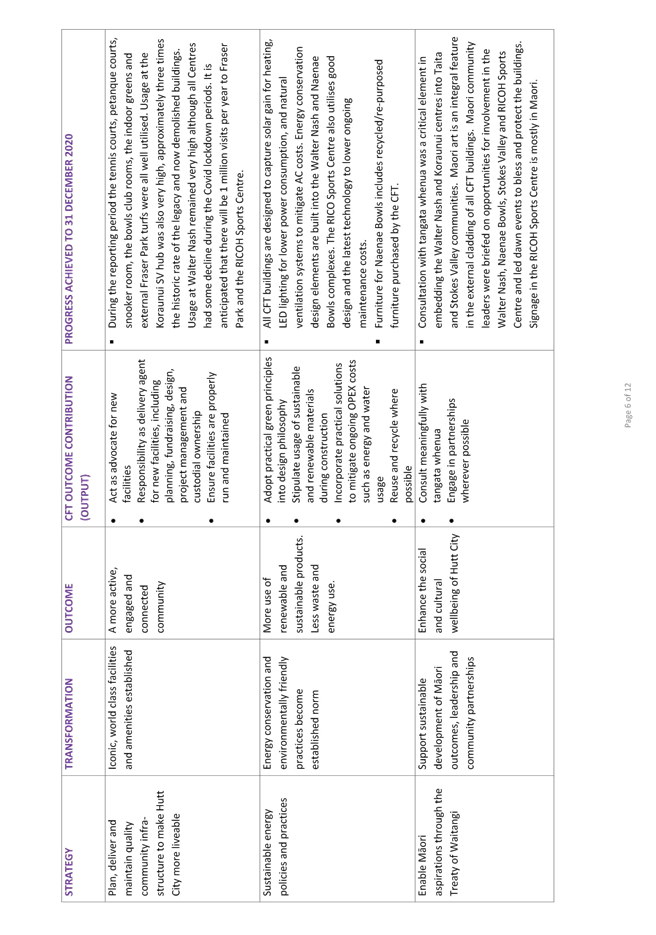

The Future of Hutt City

Community Facilities Trust (CFT)

No development

projects have been identified for CFT delivery over the next 10 years.

Given CFT’s role has been to develop and then maintain leisure,

recreation and community facilities for Lower Hutt residents and visitors,

advice was sought relating to the future of CFT.

A paper was

presented to Councillors in December 2020, which identified merits/demerits

relating to three options.

The three options

presented to Council were:

1. Retention

of the current CFT structure and operating model;

2. Dissolution/disestablishment

of CFT and the distribution, gifting and/or transfer of its assets/liabilities

to Council; or,

3. Retention

of CFT as a “non-active” trust with the distribution, gifting

and/or transfer of its assets/liabilities to Council by or on 30 June 2021.

Council agreed

option 3 as the “preferred option”. Accordingly, this has

been included in the Council’s Draft Long Term Plan 2021-2031 for public

consultation. The outcome of the consultation will be known by 30 June 2021.

Should the

preferred option not proceed by 30 June 2021, this Statement of Intent for the

next three years (2021/22 to 2023/24), has been based on continued maintenance

of all existing facilities, with no new developments (option 1 above), and

prepared in line with requirements under the Local Government Act 2002

(refer schedule 8, Part 1, clauses (2) and (3)).

Introduction

This Statement of

Intent has been prepared by the Hutt City Community Facilities Trust (CFT), as

required under Section 64(1) of the Local Government Act 2002 for a Council

Controlled Organisation (CCO). It gives an overview of the CFT, the

objectives we will work to achieve, the activities we will undertake, and how

we will measure our performance. It covers the three year period to 30

June 2023.

The CFT was

established by the Hutt City Council (Council) in August 2012 as a CCO to

promote, develop, own, operate, and maintain recreational, leisure, and

community facilities in Lower Hutt. Over the next 30 years a number of

facilities in Lower Hutt will have to be upgraded or replaced. Changing

preferences in the community for the way recreation, leisure, and community

services are delivered led HCC to adopt an integrated facilities approach to

new developments, which will allow for a range of services to be accessed in

one place. The Walter Nash Centre completed by the CFT in late 2015 is a

good example of an integrated community facility. The Walter Mildenhall Park

Redevelopment completed in 2017 at Naenae, the Koraunui Stokes Valley Community

Hub also completed in 2017 and the Ricoh Sports Centre at Fraser Park,

completed in 2019, are examples of projects that also follow the integrated

facilities model.

The main role of

the CFT has been to develop and then maintain a range of fit-for-purpose,

leisure, recreation and community facilities that are attractive to the

residents and visitors of Lower Hutt.

In 2019 the

trustees conducted a strategic review of the CFT’s future direction and

concluded that while it will remain a landlord of its existing facilities, most

day to day work to provide ongoing management for these is best conducted by

Council staff as is future project management of new builds. The board

concluded that CFT’s main focus will be to provide leadership in the

identification, promotion and fundraising for new projects which support

Council’s overall strategic objectives.

Where appropriate,

the CFT will assist with fundraising work to attract donations for these

developments from philanthropic organisations, the corporate sector and the community.

The Trust will do this by acting as a voice for community facilities in Lower

Hutt, using the skills and expertise its trustees bring from valuable

experience in business, asset management, and community affiliation.

The CFT will strive

to have a positive and productive working relationship with Council. The Trust

will contribute to Council’s community outcomes of a city that is

actively engaged in community activities, and a city that promotes strong and

inclusive communities. Accordingly, the CFT Board looks forward to

working with Council to optimise the overall social, cultural, health and

economic wellbeing of Lower Hutt.

Objectives

The objectives of the CFT will follow

section 59 of the Local Government Act 2002, which outlines the principal

objectives for a Council Controlled Organisation as follows:

(a) Achieve the objectives of its

shareholders, both commercial and non-commercial, as specified in the Statement

of Intent;

(b)

Be a good employer; and

(c) Exhibit

a sense of social and environmental responsibility by having regard to the

interests of the community in which it operates and by endeavouring to

accommodate or encourage these when able to do so.

In addition to the

statutory objectives, the CFT Deed of Trust has a range of charitable

objectives designed to promote the health and wellbeing of Lower Hutt’s

communities. These objectives are to:

· Promote, operate,

develop, and maintain community facilities in Lower Hutt through the management

of the interests and rights relating to these facilities.

· Assist with

attracting fundraising from the community and philanthropic organisations for

the development of high quality community facilities.

· Provide strategic

planning, in partnership with HCC, in relation to the ongoing development and

administration of community facilities in Lower Hutt.

· Provide high

quality amenities which attract and engage, promoting the health and well-being

of residents of and visitors to Lower Hutt.

· Practise prudent

commercial administration of high quality community, recreation, and leisure

facilities, with a view that they will be financially sustainable.

Environmental

objectives

The Board will be considering during the

year what we can do effectively to support the Council’s environmental