KOMITI ITI AHUMONI I

TŪRARU|Audit and Risk Subcommittee

16

April 2021

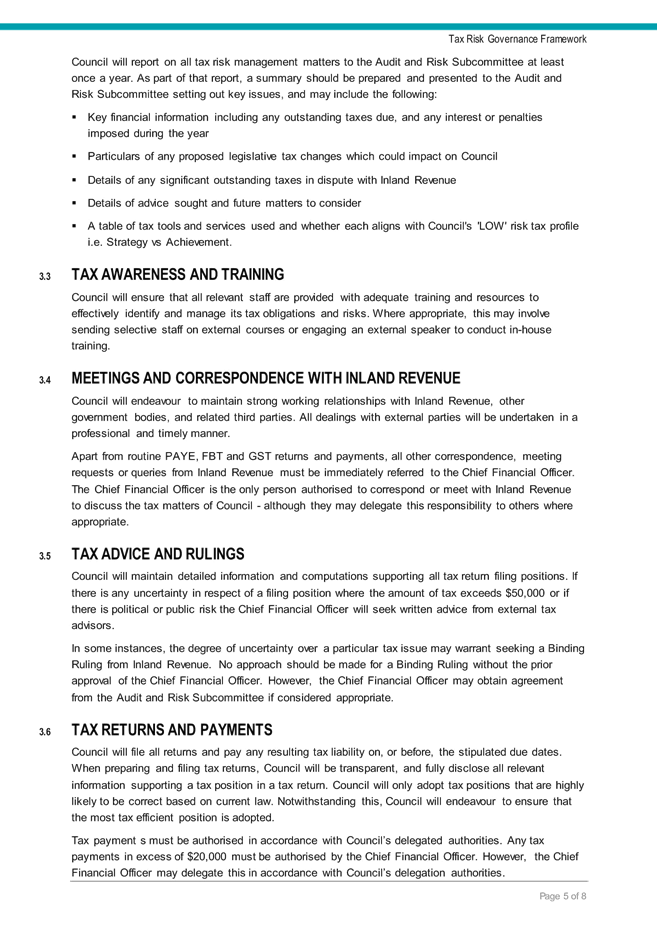

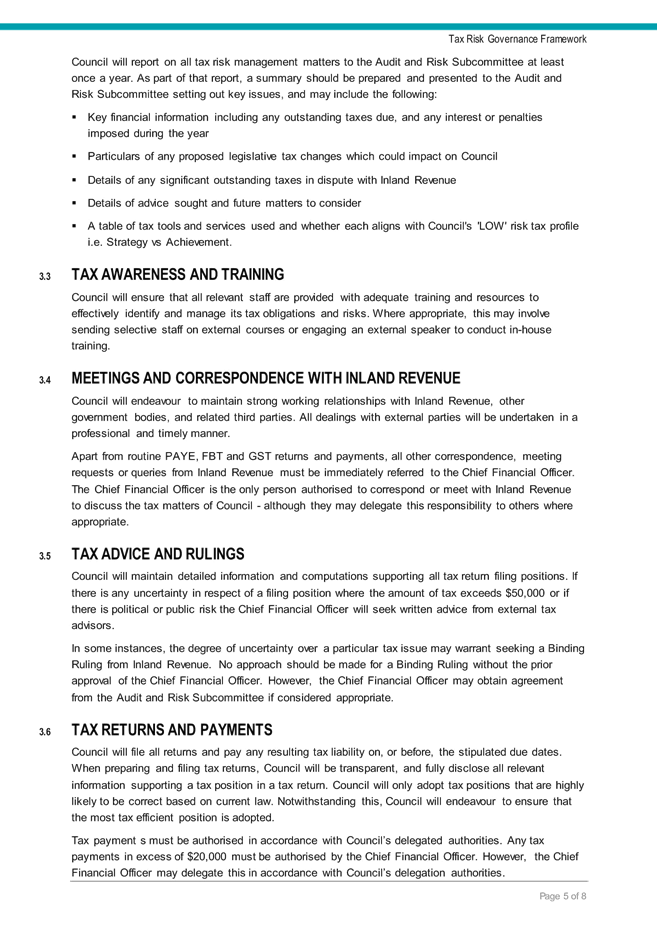

Order

Paper for the meeting to be held in the

Council

Chambers, 2nd Floor, 30 Laings Road, Lower Hutt,

on:

Friday 23

April 2021 commencing at 2.00pm

Membership

|

Ms

Suzanne Tindal (Independent Chair)

|

|

|

Mayor C Barry (Deputy

Chair)

|

Cr D Bassett

|

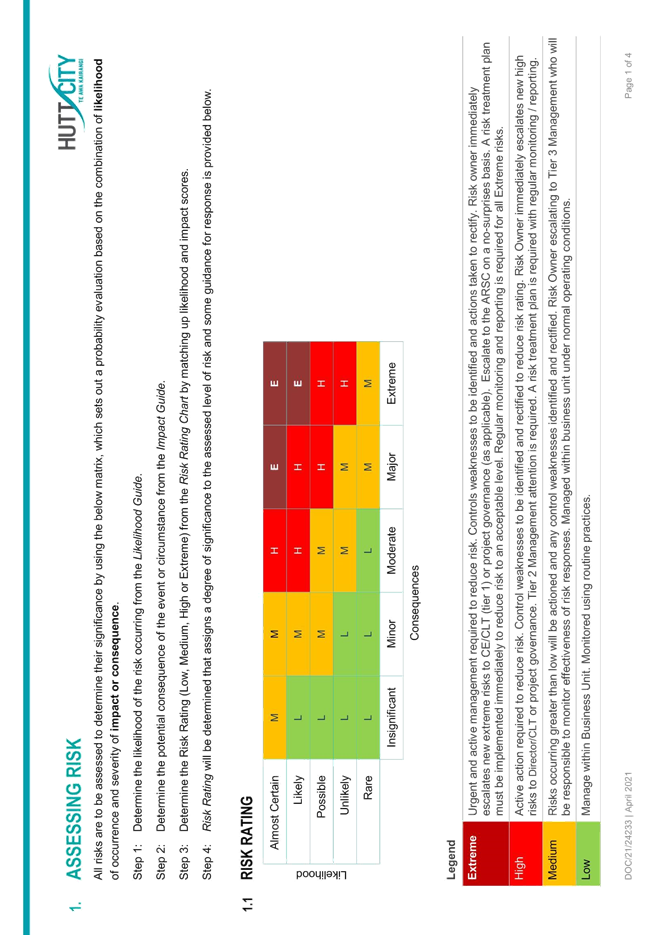

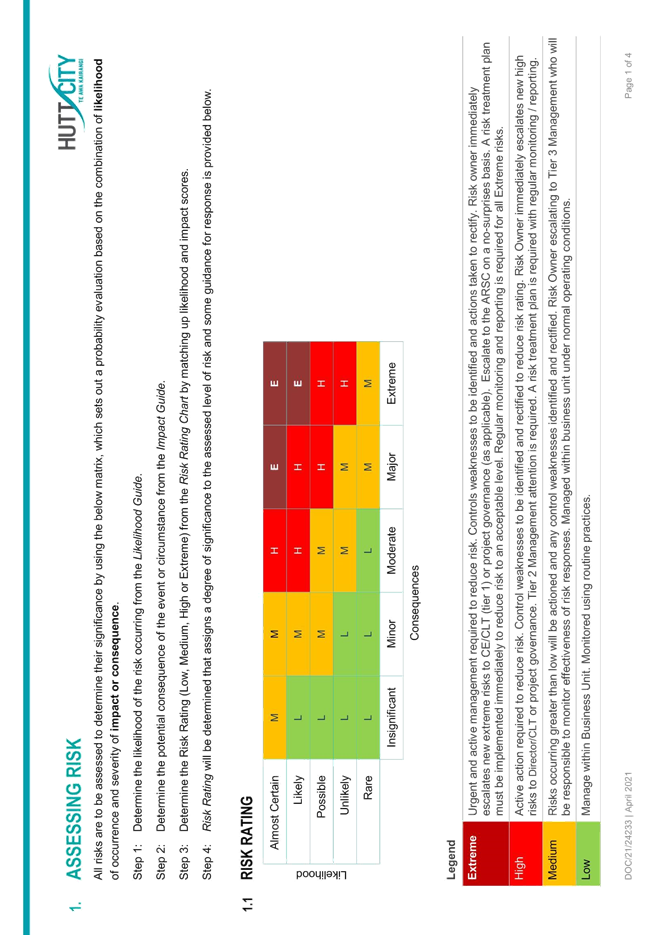

|

Cr J Briggs

|

Cr S Edwards

|

|

Cr A Mitchell

|

Cr S Rasheed

|

|

Cr N Shaw

|

|

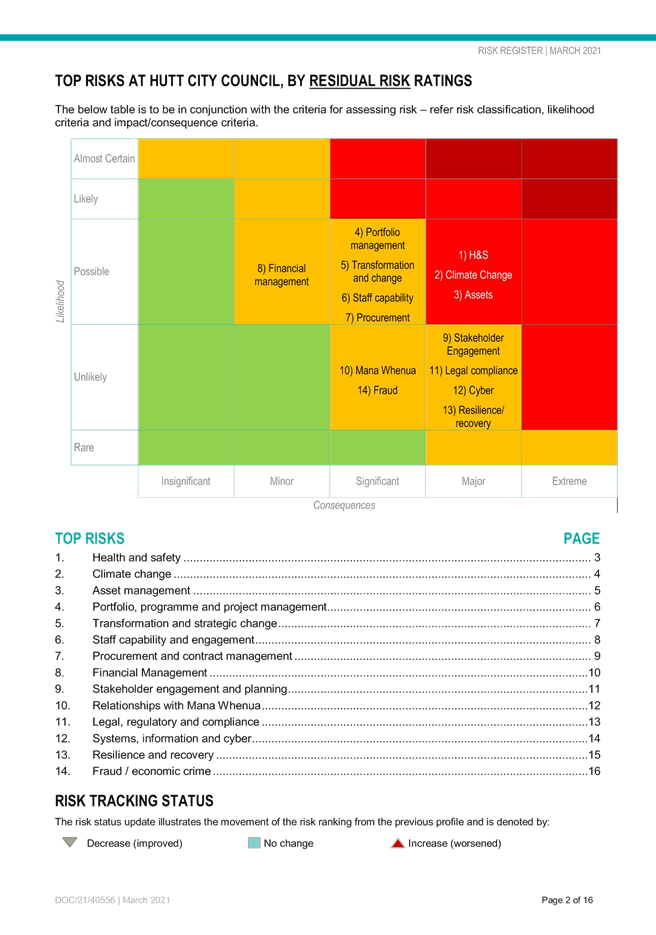

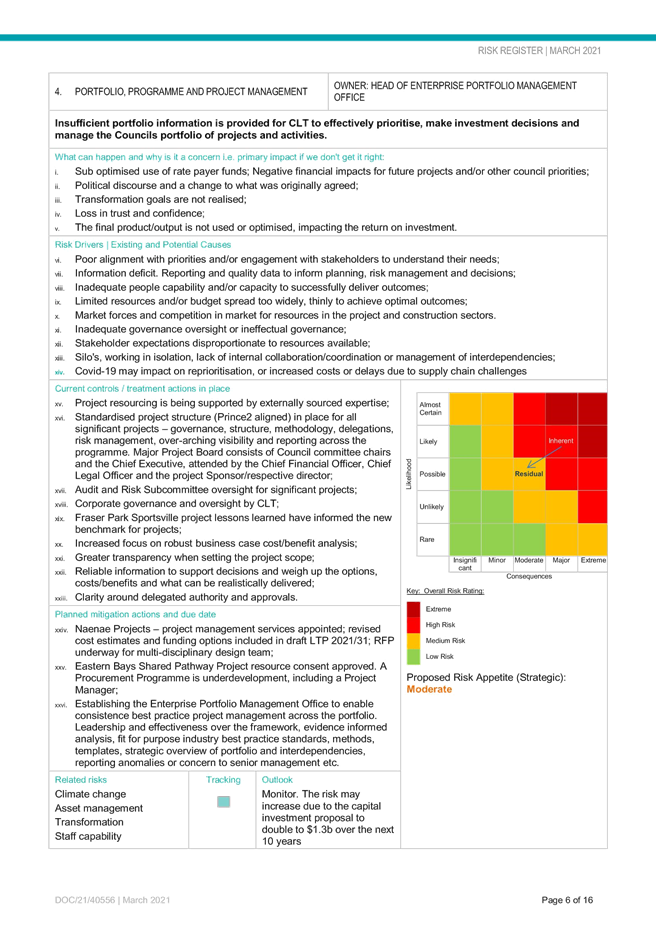

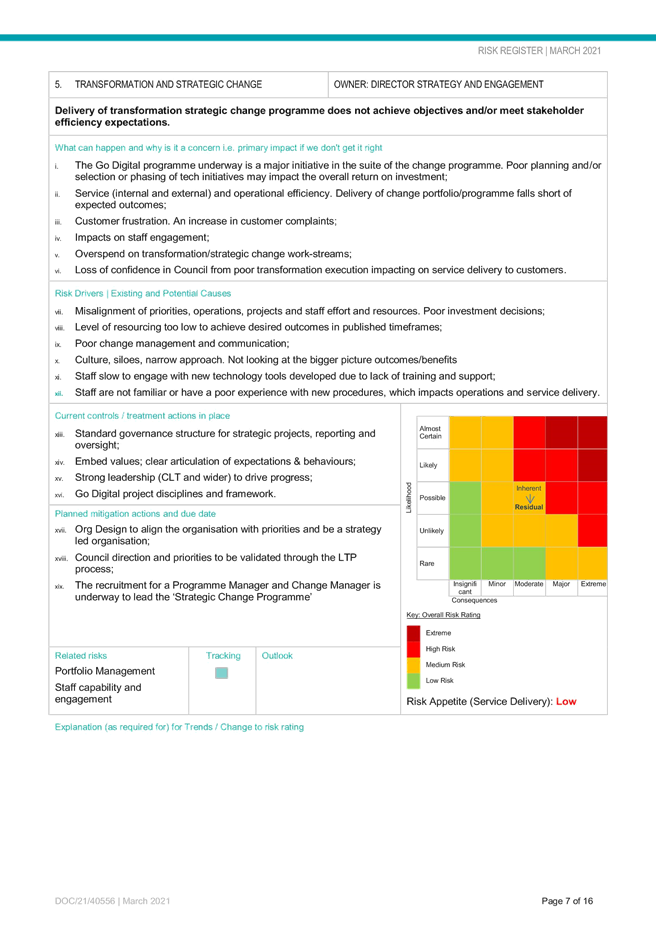

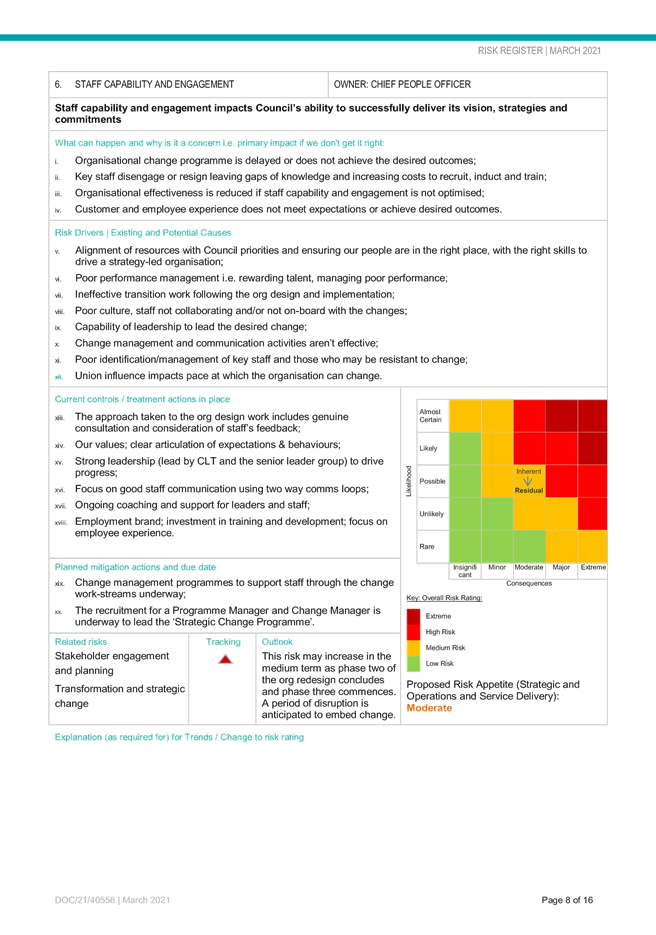

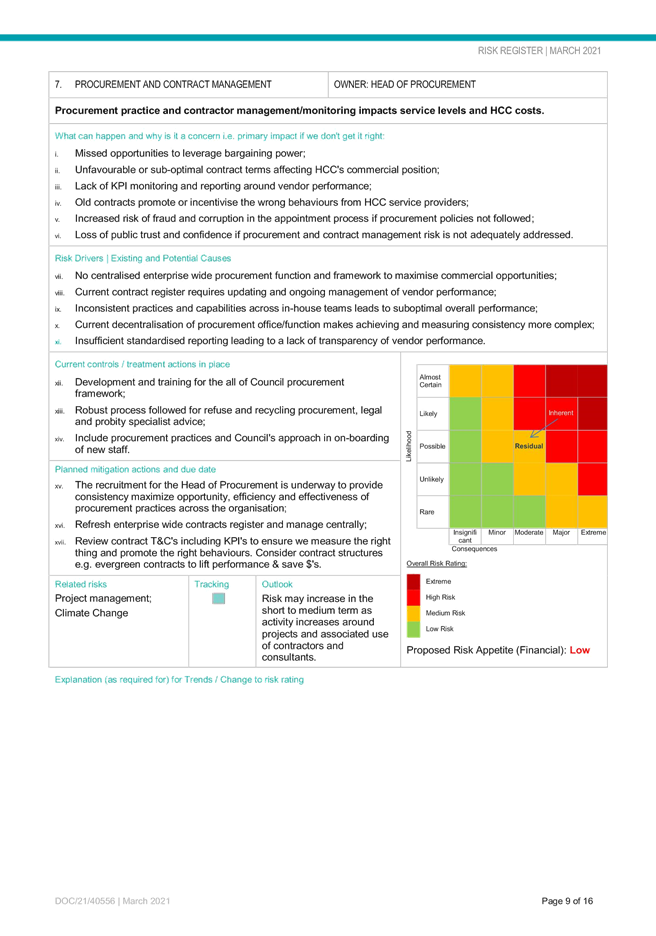

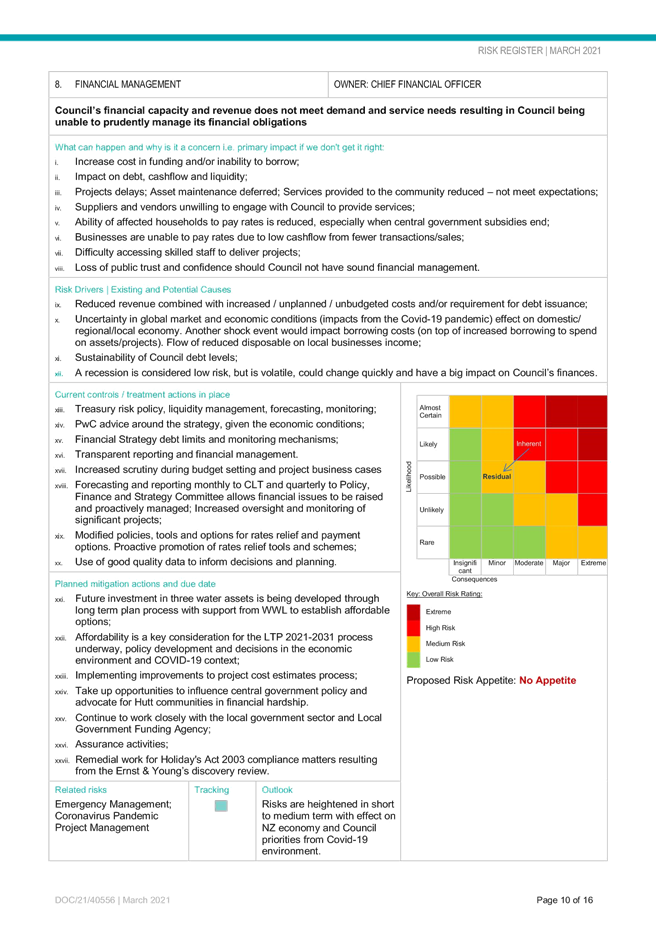

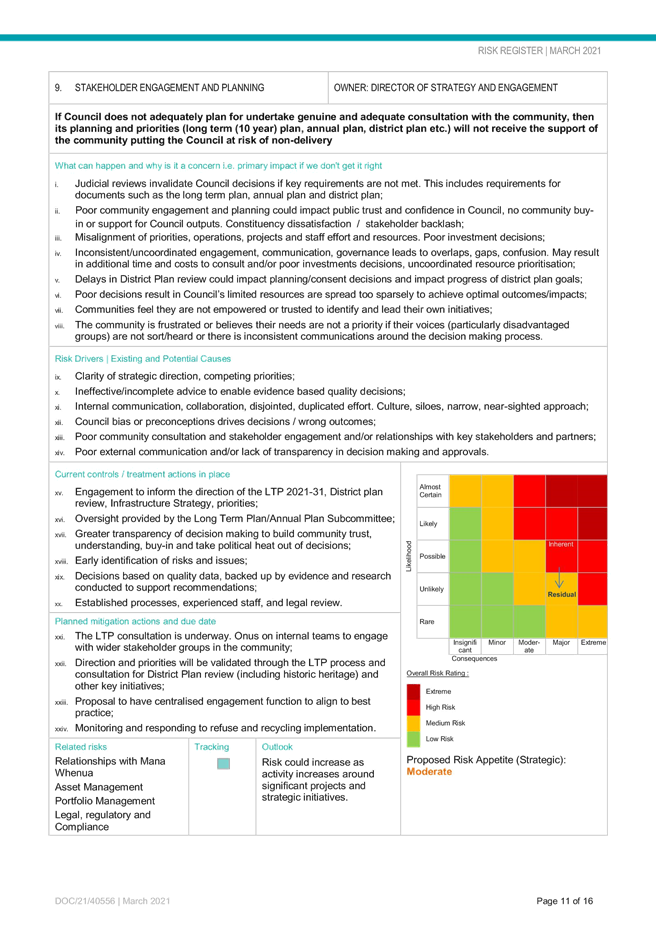

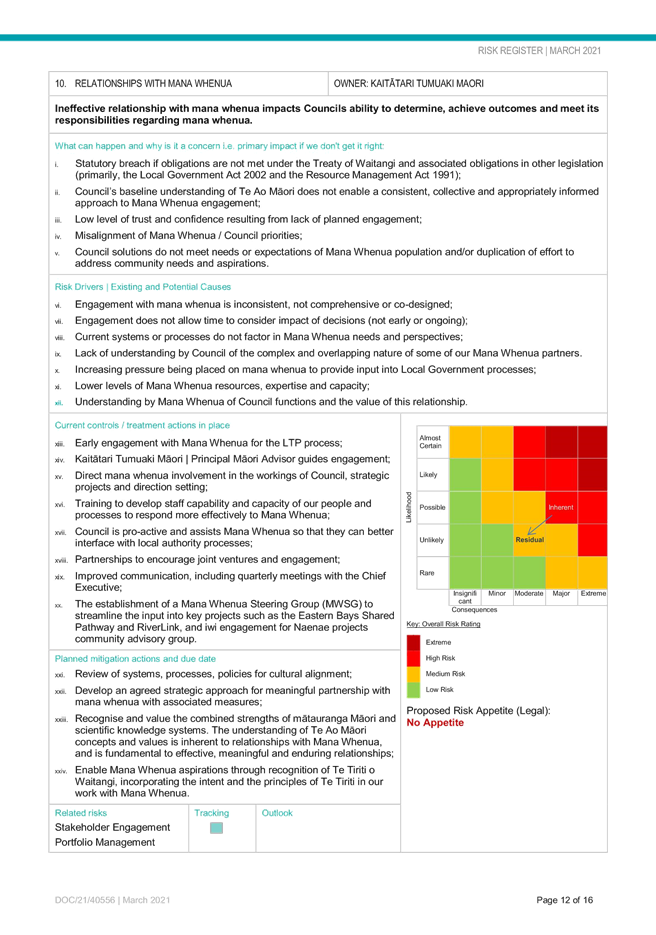

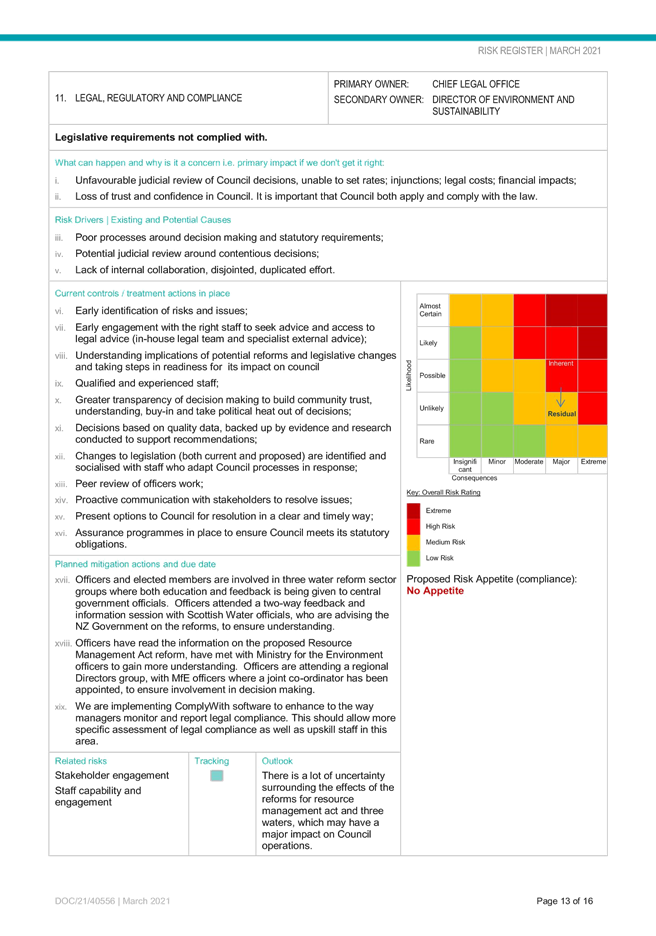

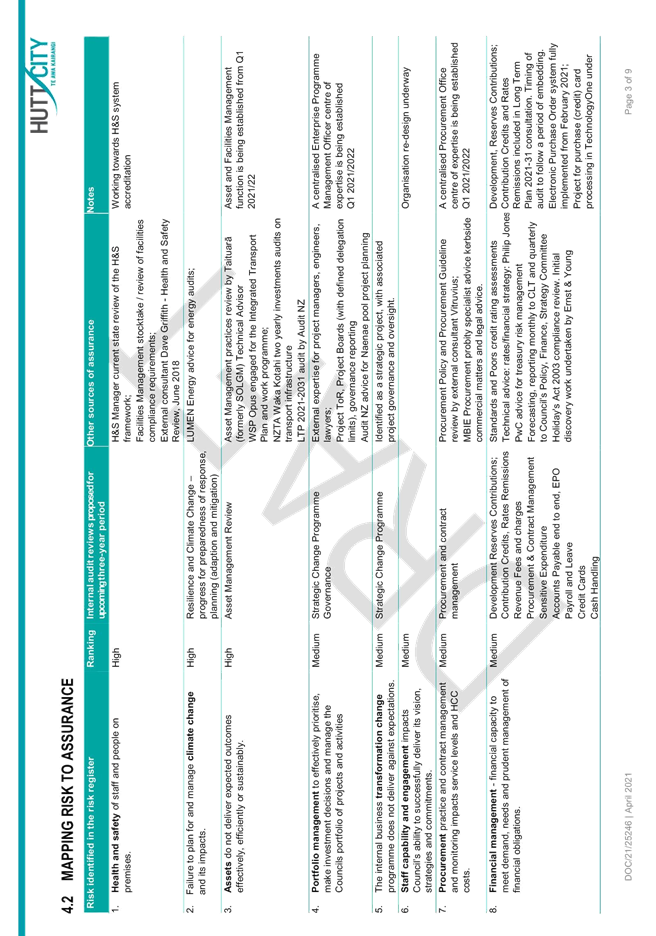

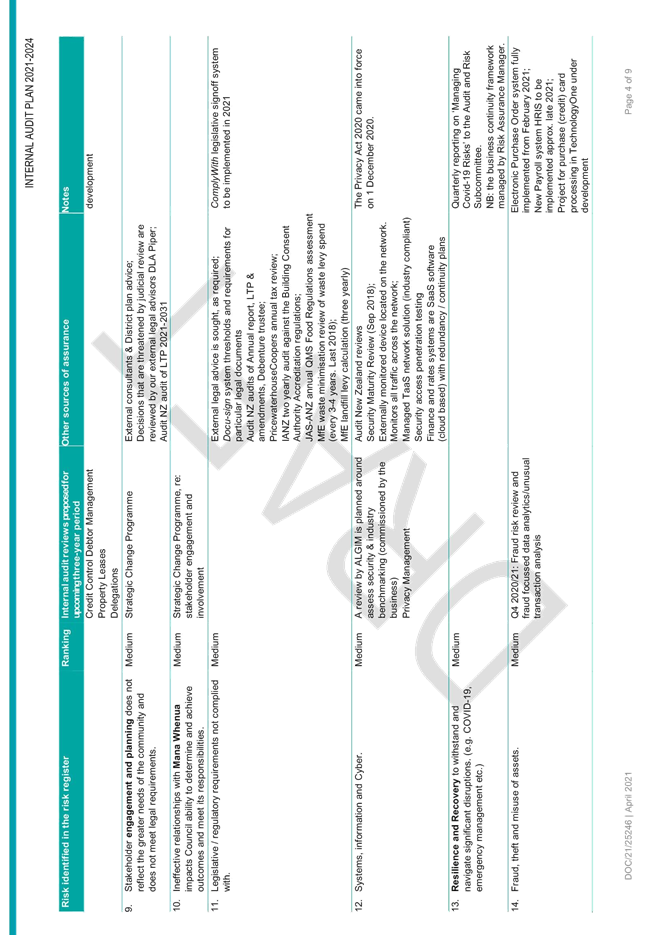

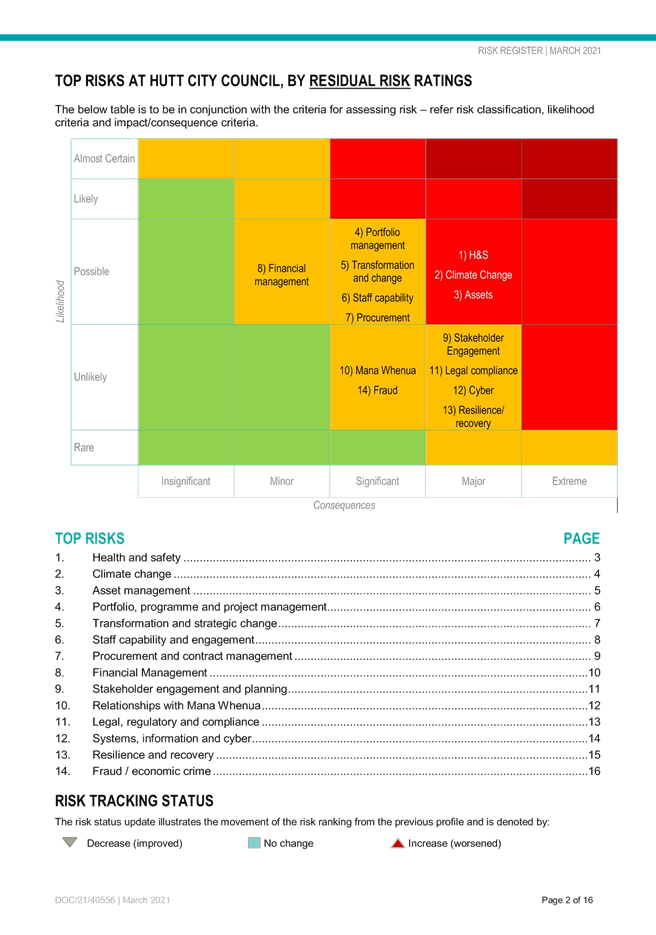

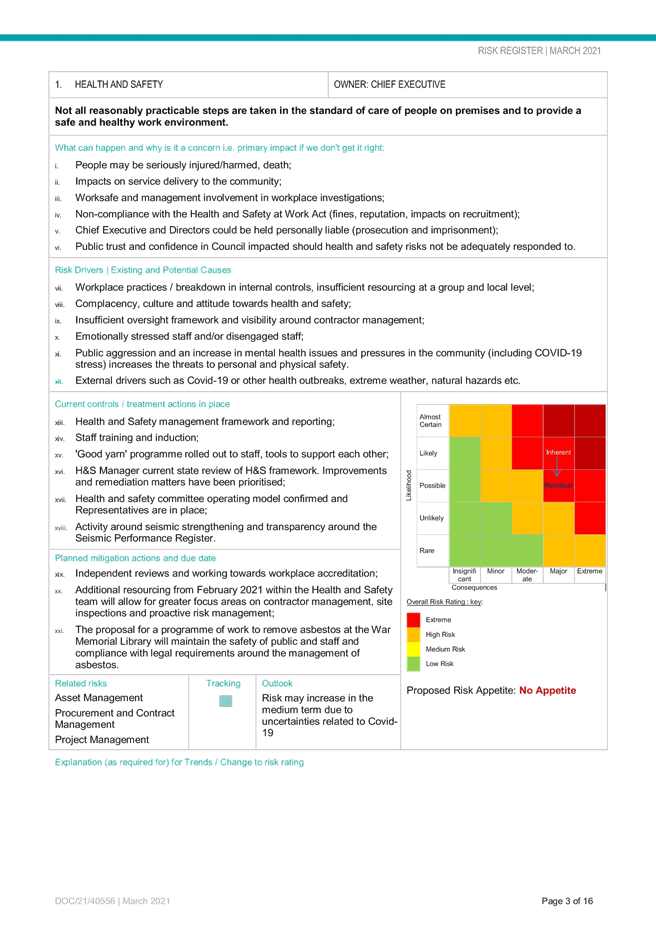

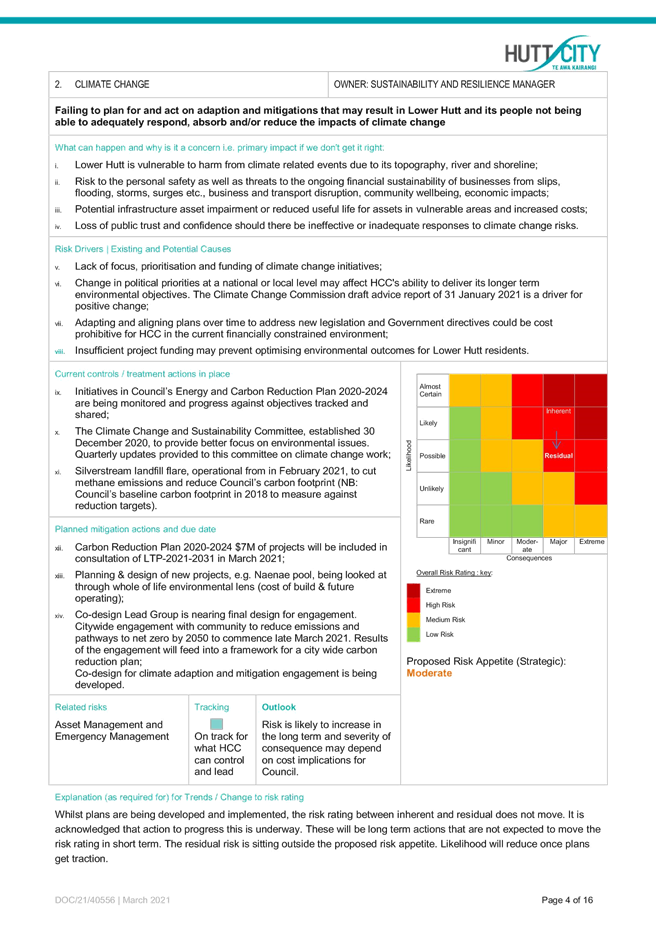

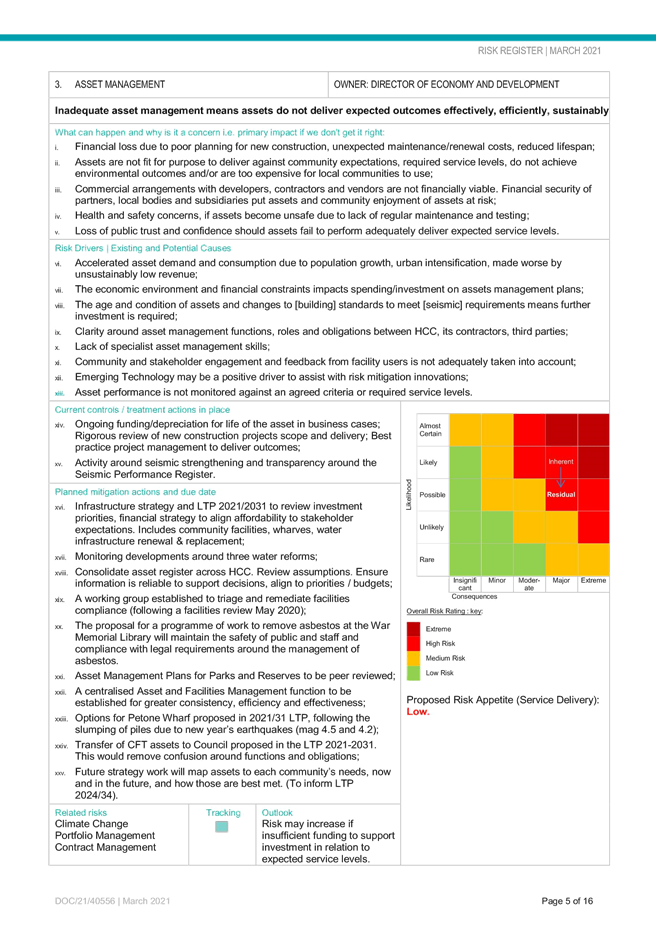

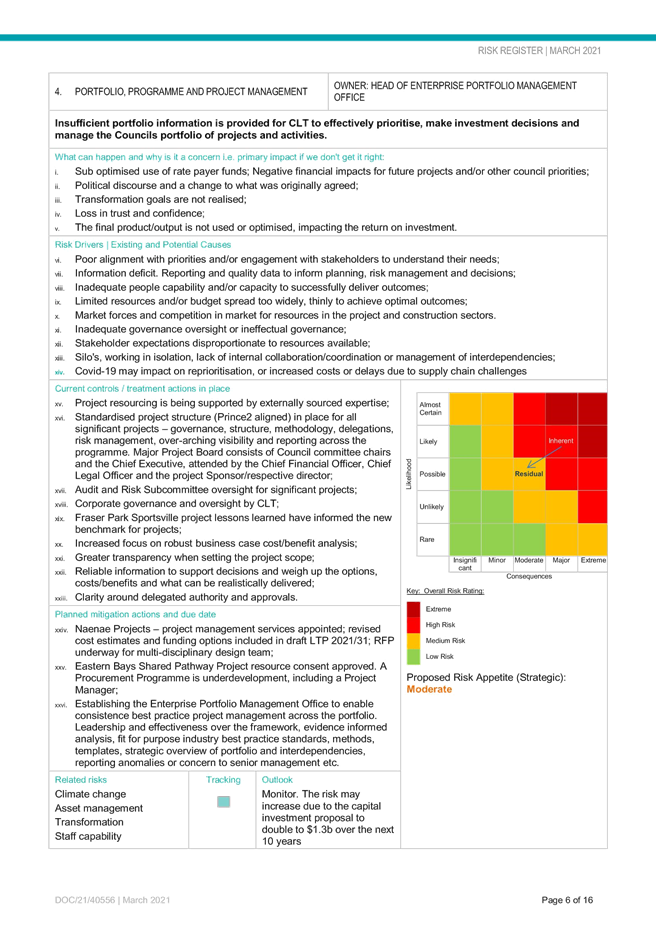

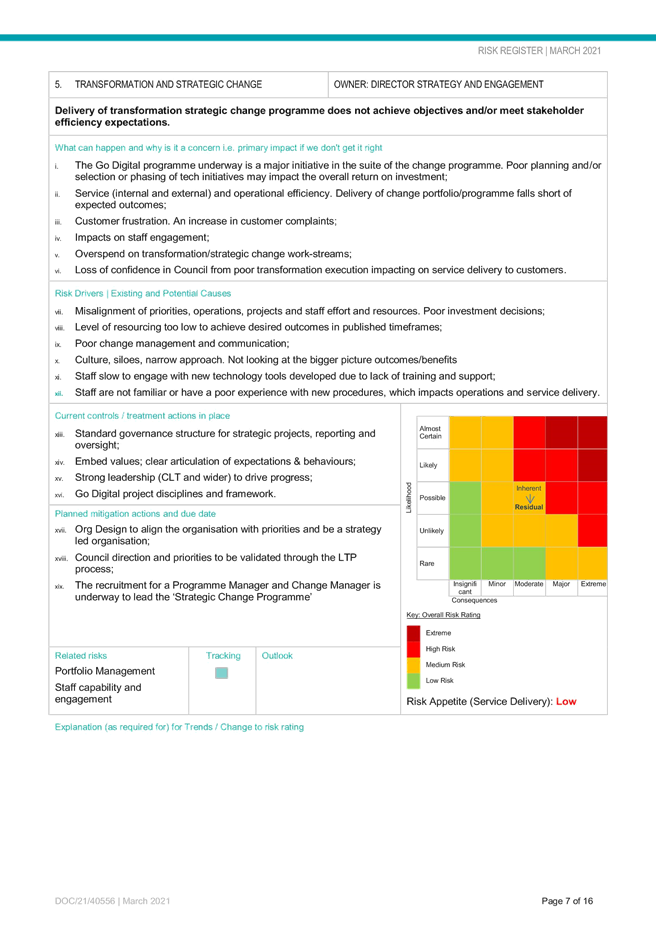

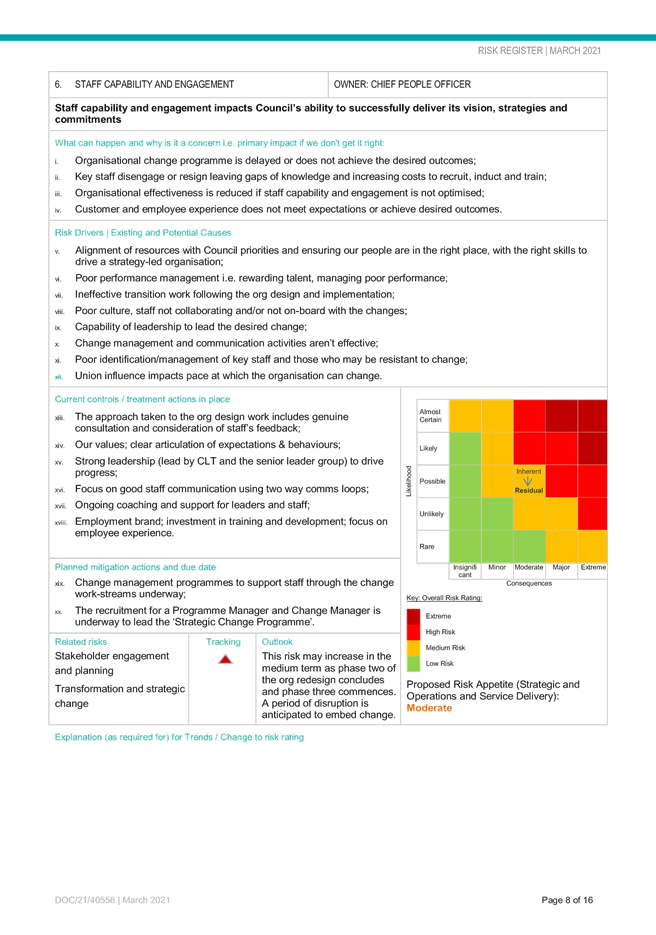

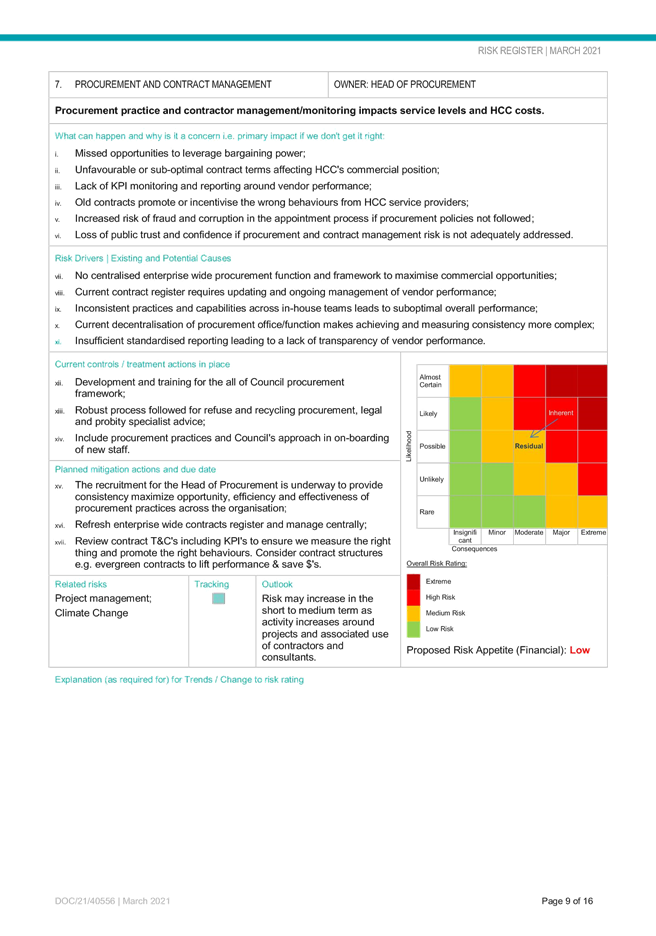

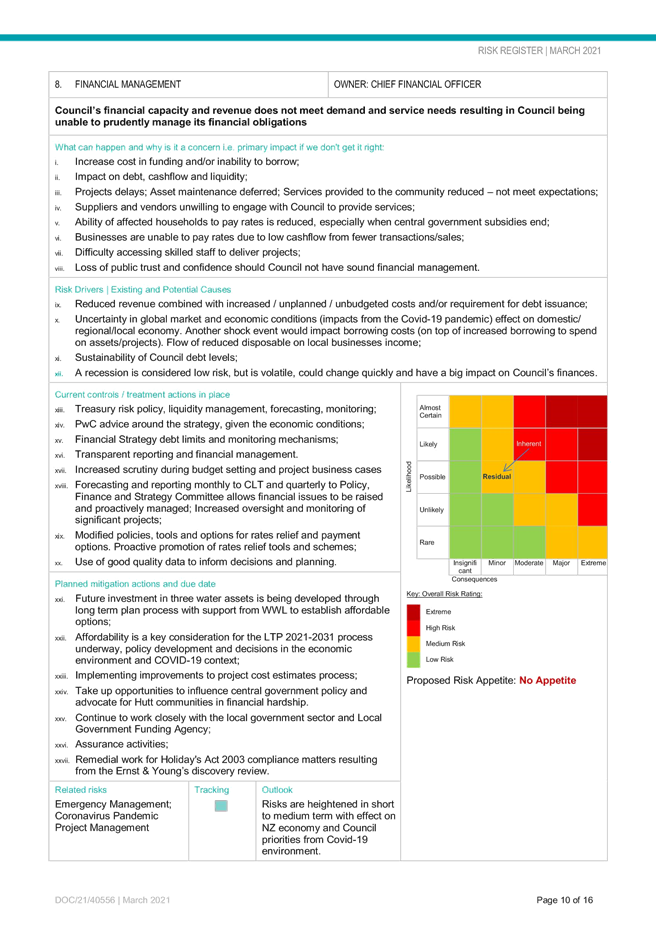

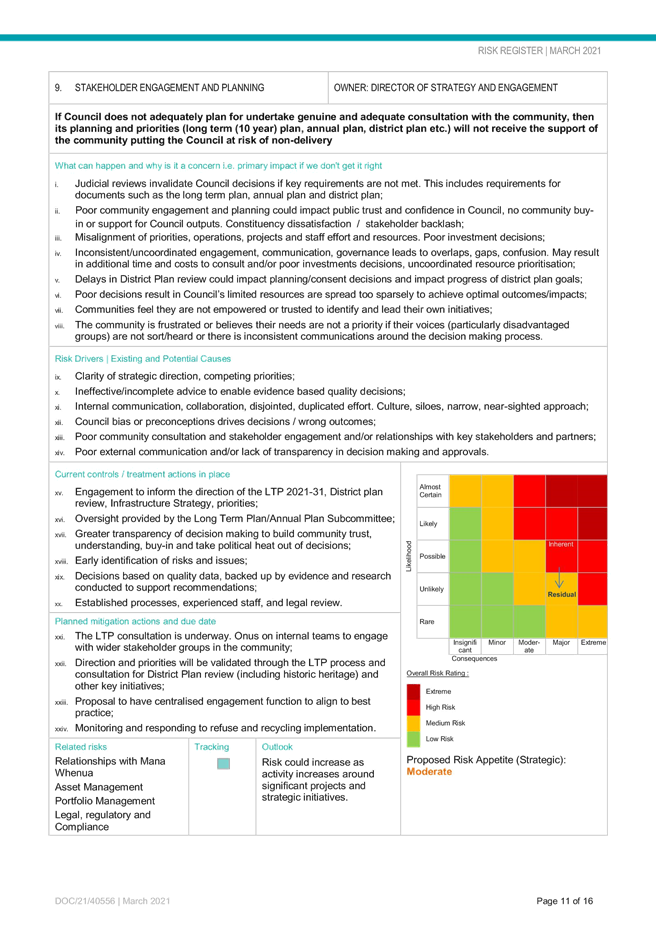

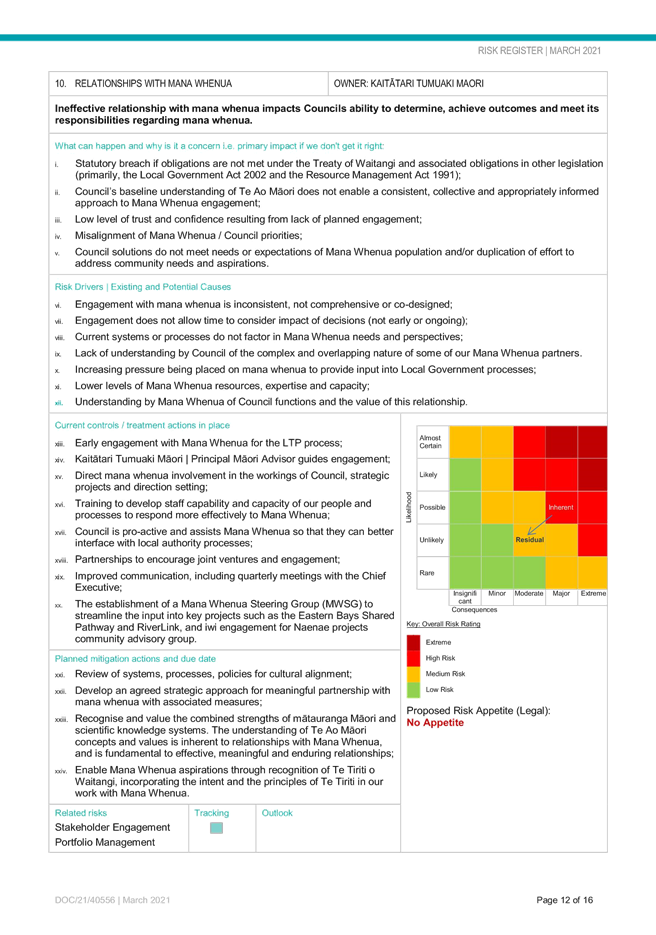

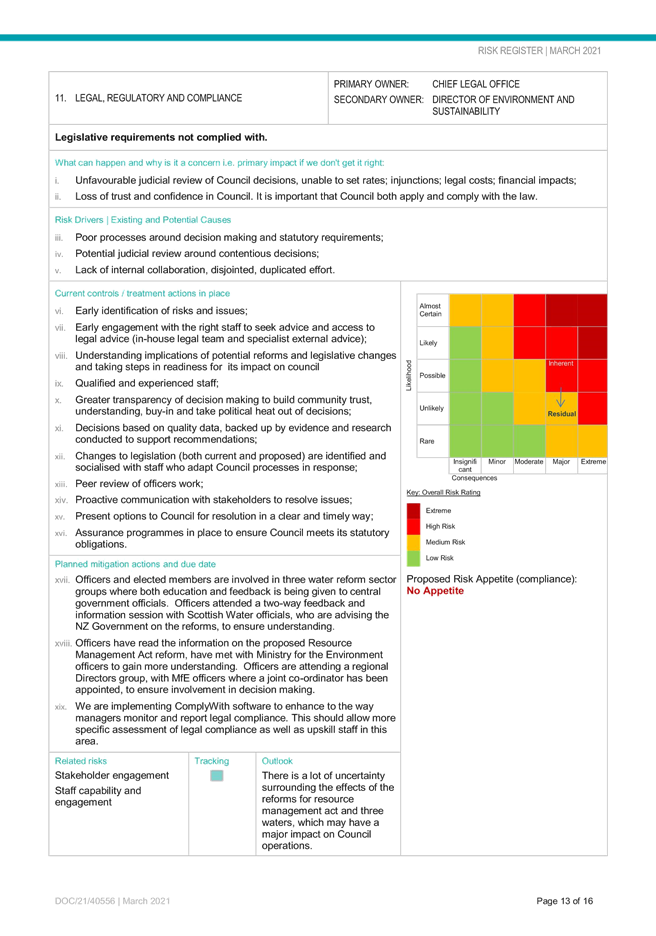

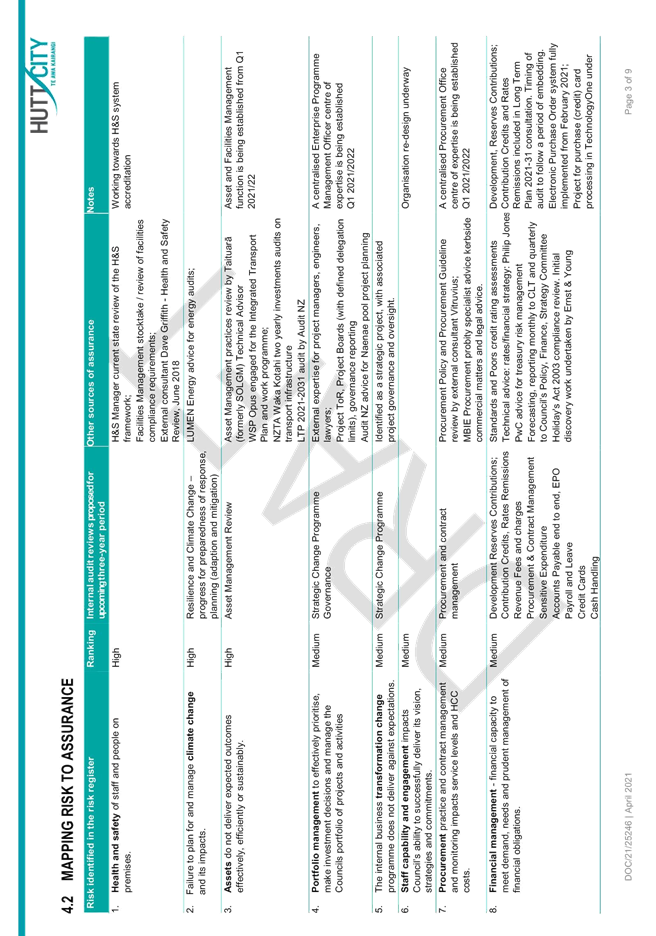

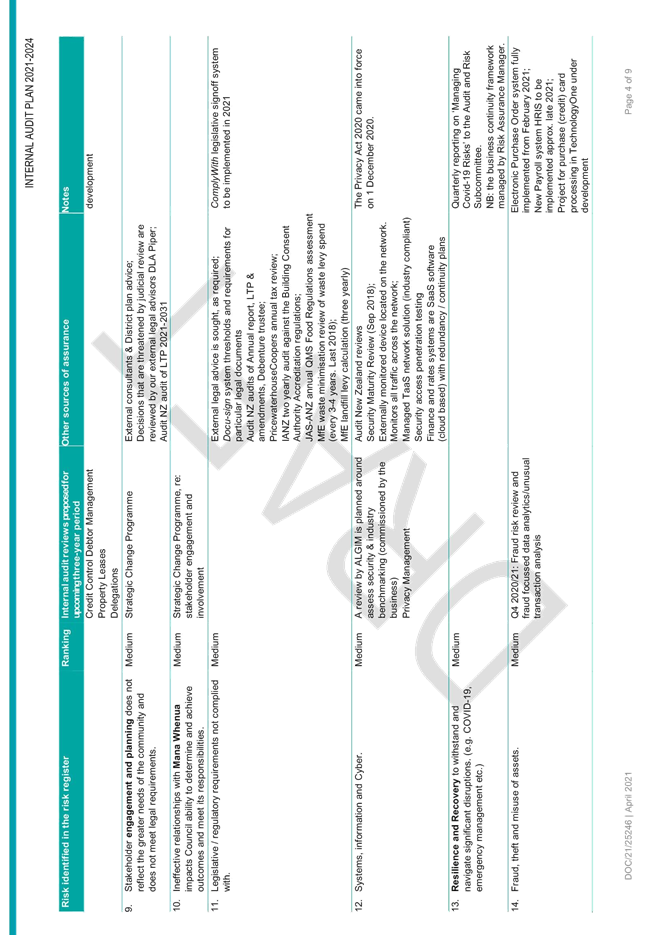

For

the dates and times of Council Meetings please visit www.huttcity.govt.nz

Have your say

You can speak under public

comment to items on the agenda to the Mayor and Councillors at this meeting.

Please let us know by noon the working day before the meeting. You can do this

by emailing DemocraticServicesTeam@huttcity.govt.nz or

calling the Democratic Services Team on 04 570 6666 | 0800 HUTT CITY

OVERVIEW:

This Subcommittee has a monitoring and advisory role in

reviewing the effectiveness of the manner in which Council discharges its

responsibilities in respect to governance, risk management and internal

control.

The Committee is primarily aligned with the Office of the

Chief Executive.

Its areas of focus are:

§ Oversight of risk

management and assurance across the Council Group with respect to risk that is

significant

§ Internal and external

audit and assurance

§ Health, safety and

wellbeing

§ Business continuity and resilience

§ Integrity and

investigations

§ Monitoring of compliance

with laws and regulations

§ Significant projects,

programmes of work and procurement, focussing on the appropriate management of

risk

§ The LTP, Annual Report and

other external financial reports required by statute.

PURPOSE:

To carry out a

monitoring and advisory role and provide objective advice and recommendations

around the effectiveness of the manner in which Council discharges its

responsibilities in respect to governance frameworks, risk management, internal

control systems and the Council Group’s financial management practices.

DELEGATIONS FOR THE SUBCOMMITTEE’S AREAS OF FOCUS:

§ The

Subcommittee has no decision-making powers other than those in these Terms of

Reference.

§ The

Subcommittee may request expert advice through the Chief Executive where

necessary.

§ The

Subcommittee may make recommendations to the Council and/or Chief Executive.

Risk Management:

§

Review, approve and monitor the

implementation of the risk management framework and strategy, including

significant risks to the Council Group.

§

Review the effectiveness of risk

management and internal control systems including all material financial,

operational, compliance and other material controls. This includes legislative

compliance (including health and safety), significant projects and programmes

of work, and significant procurement.

§

Review risk management reports

identifying new and/or emerging risks.

Assurance:

§

Review and approve, and monitor

the implementation of, the assurance strategy and detailed internal audit

coverage and annual work plans.

§

Review the coordination between

the risk and assurance functions, including the integration of the

Council’s risk profile with the internal audit programme. This includes

assurance over all material financial, operational, compliance and other

material controls. This includes legislative compliance (including health and

safety), significant projects and programmes of work, and significant

procurement.

§

Review the reports of the

assurance functions dealing with findings, conclusions and recommendations

(including assurance over risks pertaining to Council Controlled Organisations

and Council Controlled Trading Organisations that are significant to the

Council Group).

§

Review and monitor management’s

responsiveness to the findings and recommendations, inquiring into the reasons

that any recommendation is not acted upon.

Fraud and Integrity:

§

Review, approve and monitor the

implementation of the assurance strategy, including the fraud and integrity

aspects.

§

Review the arrangements in place

by which staff may, in confidence, raise concerns about possible improprieties

in matters of financial reporting, financial control or any other matters, and

ensure that there is proportionate and independent investigation of such

matters and appropriate follow-up action.

§

Review the procedures in

relation to the prevention, detection, reporting and investigation of bribery

and fraud.

§

Review and monitor policy and

process to manage conflicts of interest amongst elected and appointed members,

management, staff, consultants and contractors.

§

Review internal and external

reports related to possible improprieties, ethics, bribery and fraud related

incidents.

Statutory Reporting:

§

Review and monitor the integrity

of the Long Term Plan and Annual Report including statutory financial

statements and any other formal announcements relating to the Council’s

financial performance, focussing particularly on the areas listed below.

§

Compliance with, and the

appropriate application of, relevant accounting policies, practises and

accounting standards.

§

Compliance with applicable legal

requirements relevant to statutory reporting.

§

The consistency of application

of accounting pollicies, across reporting periods, and the Council Group.

§

Changes to accounting policies

and practices that may affect the way that accounts are presented.

§

Any decisions involving

significant judgement, estimation or uncertainty.

§

The extent to which financial

statements are affected by any unusual transactions and the way they are

disclosed.

§

The disclosures of contingent

liabilities and contingent assets.

§

The clarity of disclosures

generally.

§

The basis for the adoption of

the going concern assumption.

§

Significant adjustments

resulting from the audit.

External Audit:

§

Discuss with the external

auditor, before the audit commences, the nature, scope and fees of the external

audit, areas of audit focus, and error and materiality levels.

§

Review, with the external

auditors, representations required by elected members and senior management,

including representations as to the fraud and integrity control environment.

§

Review the external

auditor’s management letter and management responses, and inquire into

reasons for any recommendations not acted upon.

§

Where required, the Chair may

ask a senior representative of the Office of the Auditor General to attend

meetings of the Subcommittee to discuss the office’s plans, findings and

other matters of mutual interest.

Interaction with Council Controlled Organisations and Council Controlled

Trading Organisations:

§

Other committees dealing with

CCO and CCTO matters may refer matters to the Audit & Risk Subcommittee for

review and advice.

§

This Subcommittee will inquire

to ensure adequate processes at a governance level exist to identify and manage

risks within a CCO. Where an identified risk may impact on Council or the

Council Group, the Subcommittee will also ensure that all affected entities are

aware of and are appropriately managing the risk.

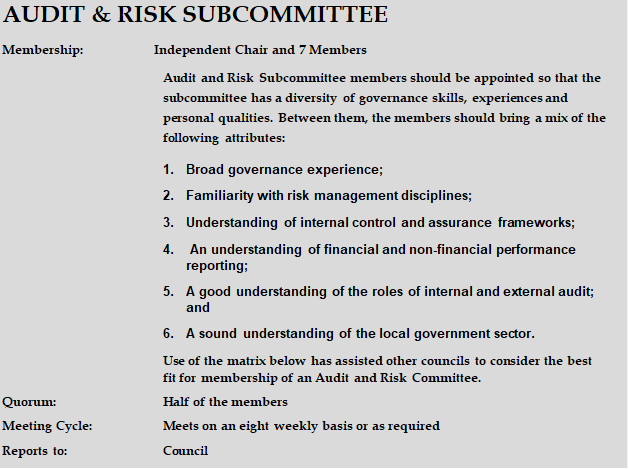

Matrix of

Experience, Skills and Personal Qualities

|

Experience,

Skills and Personal Qualities

|

Member A

|

Member B

|

Member C

|

Member

D

|

Independent

Chairperson

|

|

The

recommended combination of experience is:

|

|

·

financial

reporting

|

|

|

|

|

|

|

·

broad

governance experience

|

|

|

|

|

|

|

·

familiarity

with risk management disciplines

|

|

|

|

|

|

|

·

understanding

of internal control and assurance frameworks

|

|

|

|

|

|

|

·

good

understanding of the roles of internal and external audit

|

|

|

|

|

|

|

·

local

government expertise

|

|

|

|

|

|

|

For

an “advisory-oriented” audit committee, particular emphasis

should be placed on:

|

|

·

Strategy

|

|

|

|

|

|

|

·

Performance

management

|

|

|

|

|

|

|

·

Risk

management disciplines

|

|

|

|

|

|

|

In

determining the composition of the audit committee, the combined experience,

skills, and personal qualities of audit committee members is critical.

Members should bring:

|

|

·

the

ability to act independently and objectively

|

|

|

|

|

|

|

·

the

ability to ask relevant and pertinent questions, and evaluate the answers

|

|

|

|

|

|

|

·

the

ability to work constructively with management to achieve improvements

|

|

|

|

|

|

|

·

an

appreciation of the public entity’s culture and values, and a

determination to uphold these

|

|

|

|

|

|

|

·

a

proactive approach to advising the governing body and chief executive of

matters that require further attention

|

|

|

|

|

|

|

·

business

acumen

|

|

|

|

|

|

|

·

appropriate

diligence, time, effort, and commitment

|

|

|

|

|

|

|

·

the

ability to explain technical matters in their field to other members of the

audit committee

|

|

|

|

|

|

Komiti Iti Ahumoni I

Tūraru|Audit and Risk Subcommittee

Meeting

to be held in the Council Chambers, 2nd Floor, 30 Laings Road, Lower Hutt on

Friday

23 April 2021 commencing at 2.00pm.

ORDER

PAPER

Public Business

1. APOLOGIES

2. PUBLIC

COMMENT

Generally up to

30 minutes is set aside for public comment (three minutes per speaker on items appearing on the agenda). Speakers may be

asked questions on the matters they raise.

3. CONFLICT

OF INTEREST DECLARATIONS

Members

are reminded of the need to be vigilant to stand aside from decision making

when a conflict arises between their role as a member and any private or other

external interest they might have.

4. Recommendation to Council – 1 JUNE 2021

Risk management update, including the setting of risk

appetite (21/371)

Report

No. ARSC2021/2/79 by the Risk and Assurance Manager 10

Chair’s Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

5. Kerbside Rubbish and Recycling Implementation

Project

(21/574)

Report

No. ARSC2021/2/80 by the Strategic Advisor 45

Chair’s Recommendation:

|

“That the recommendation contained in the report be endorsed.”

|

6. Petone Wharf Refurbishment Project (21/564)

Report

No. ARSC2021/2/81 by the Reserves Asset Manager 50

Chair’s Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

7. RiverLink Project Update (21/587)

Report

No. ARSC2021/2/82 by the Project Manager Riverlink 56

Chair’s Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

8. Naenae Projects Update April 2021 (21/565)

Memorandum

dated 6 April 2021 by the Strategic Projects Manager 64

Chair’s Recommendation:

|

“That the recommendation contained in the report be

endorsed.”

|

9. External Audit Update - Hutt City Council (21/560)

Report

No. ARSC2021/2/83 by the Financial Accounting Manager 69

Chair’s Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

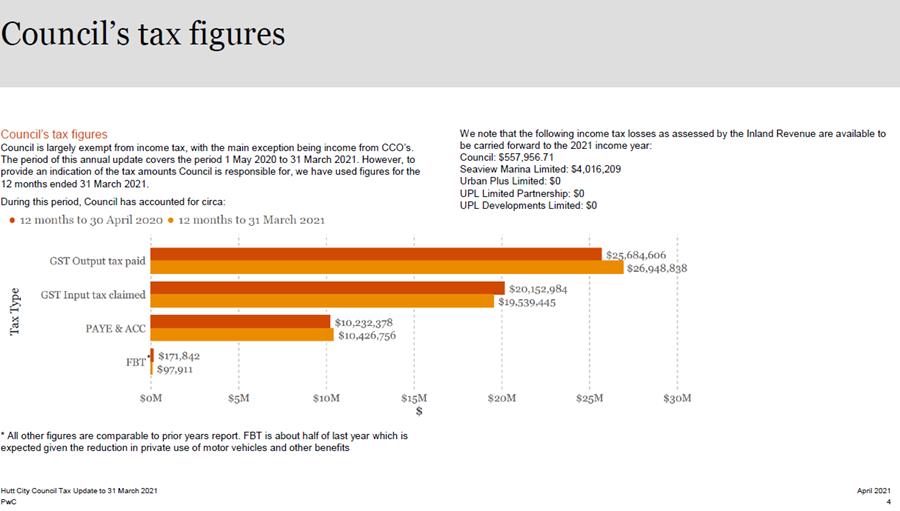

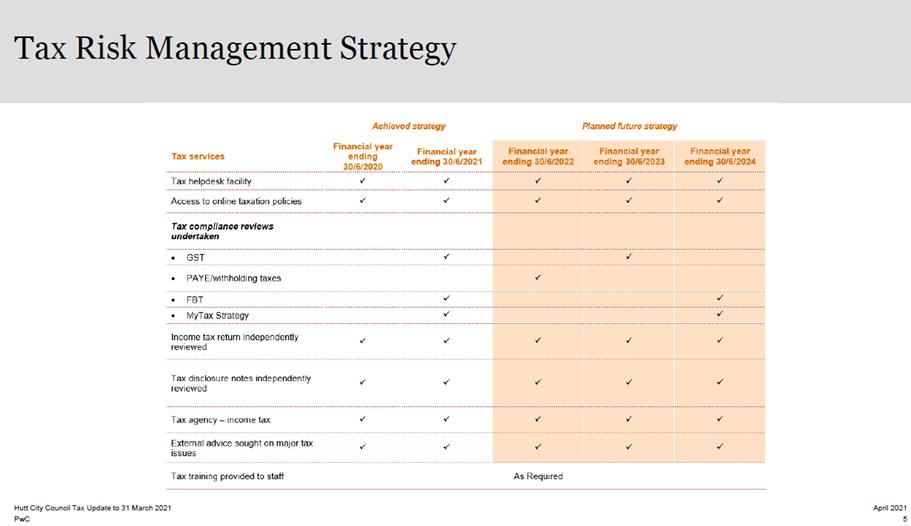

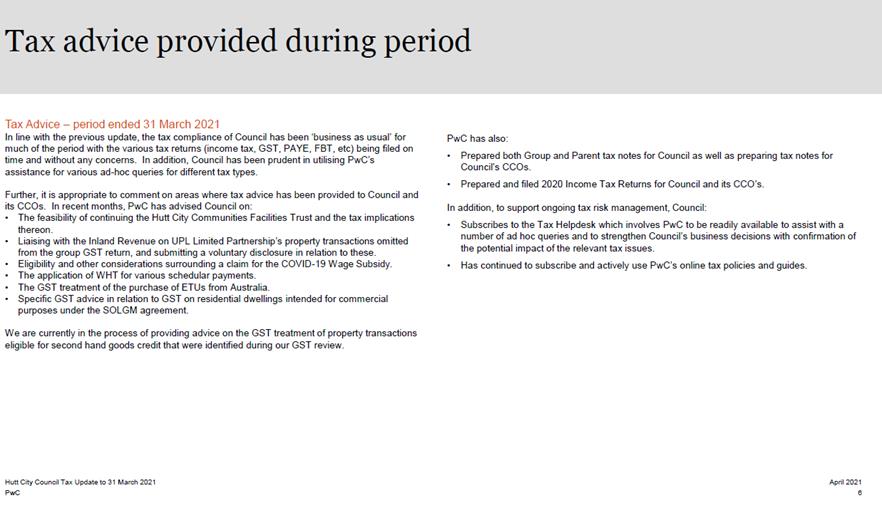

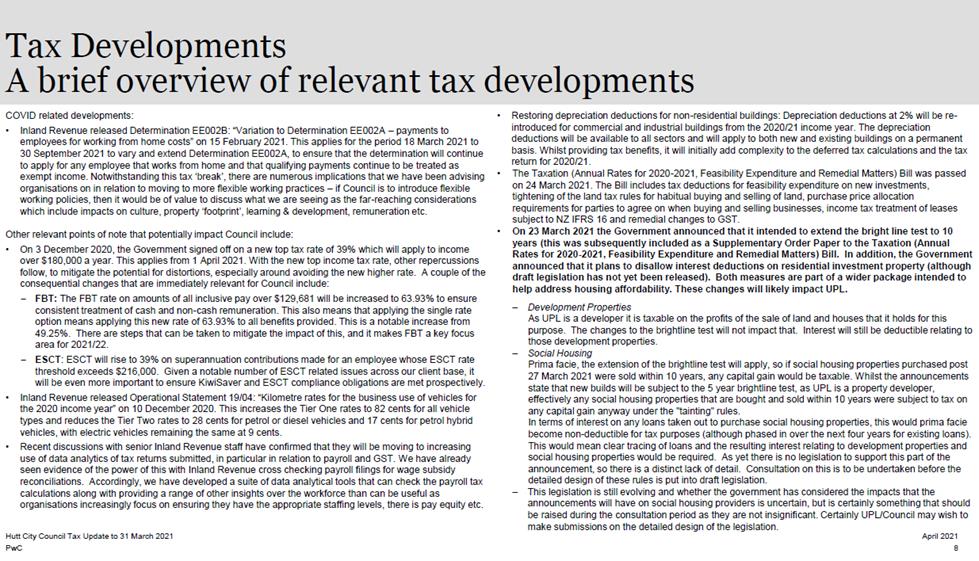

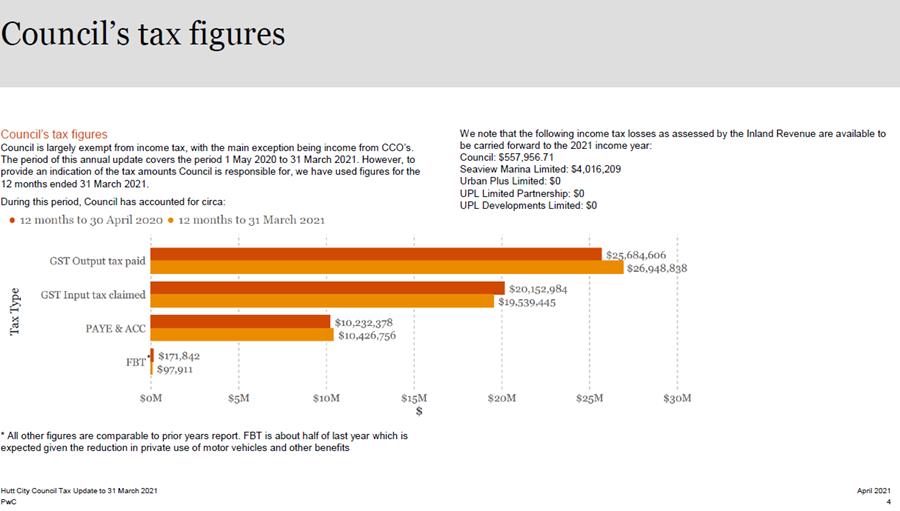

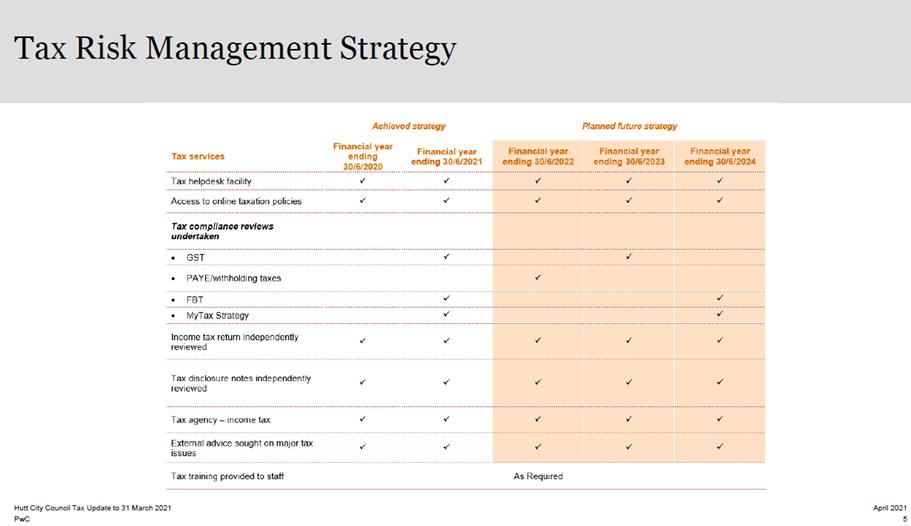

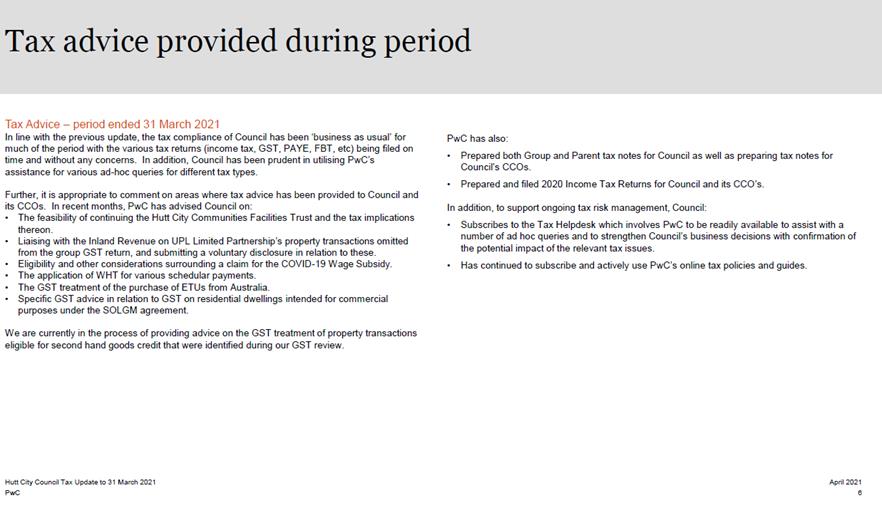

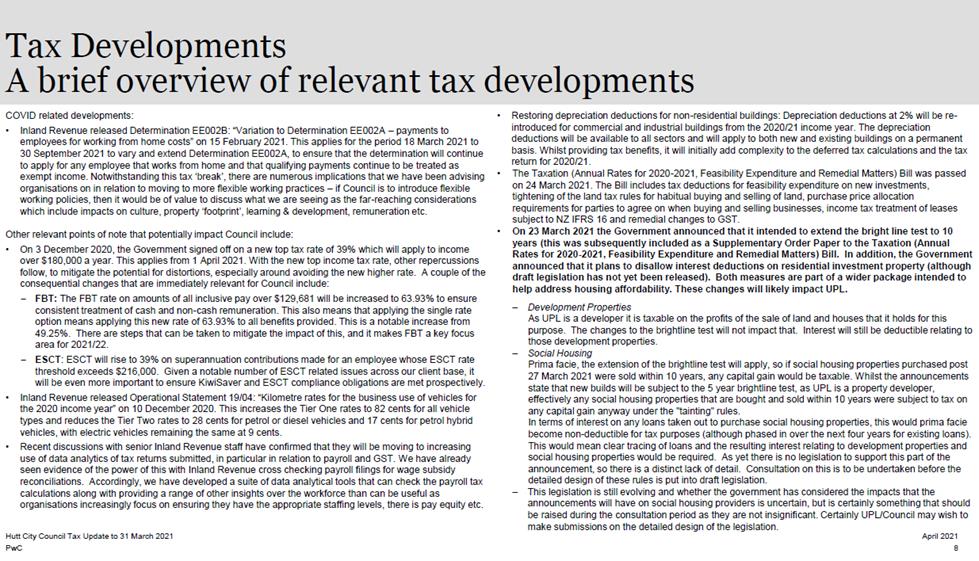

10. Annual Tax Compliance Update (21/575)

Report

No. ARSC2021/2/57 by the Financial Accounting Manager 129

Chair’s Recommendation:

|

“That the recommendation contained in the report be

endorsed.”

|

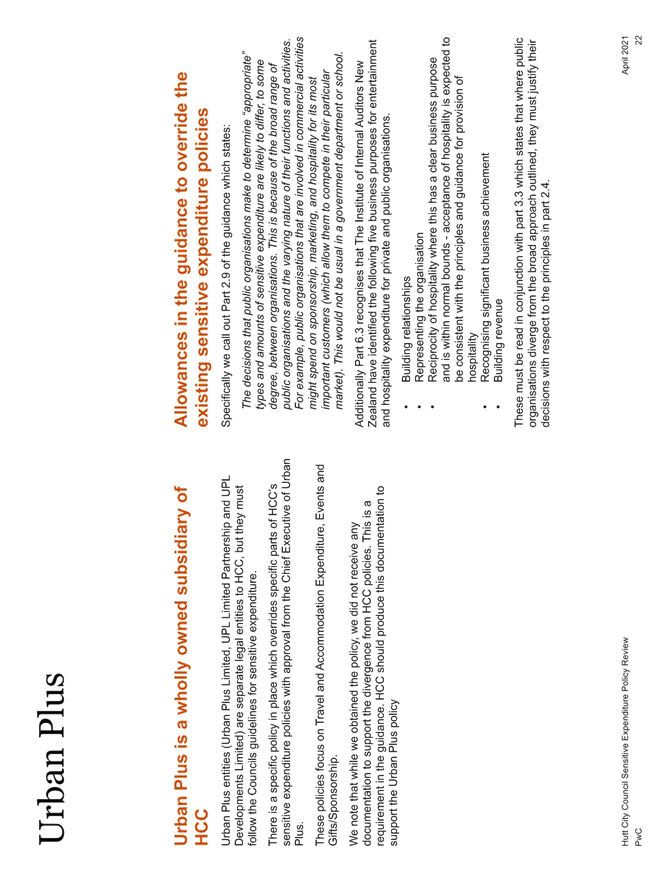

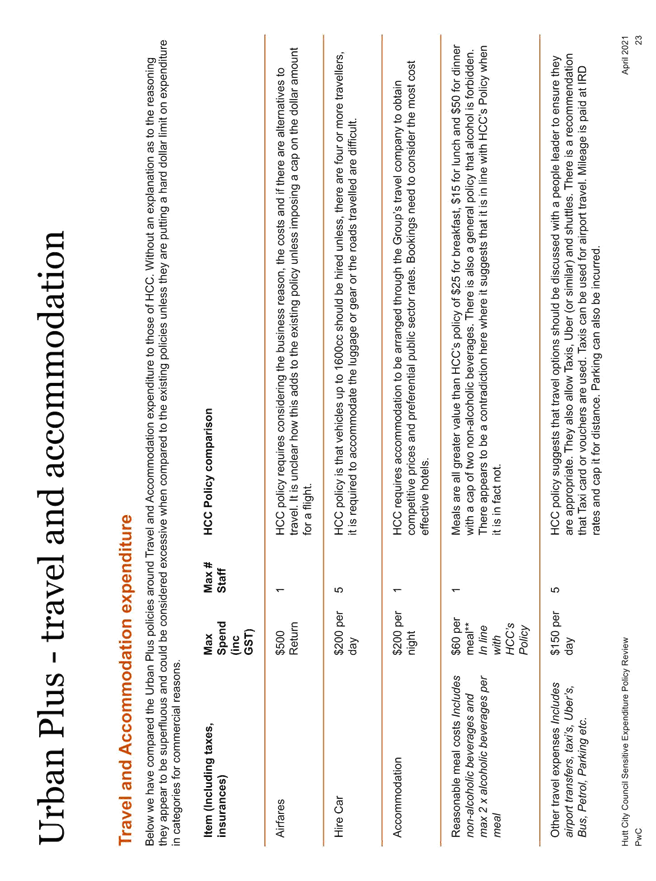

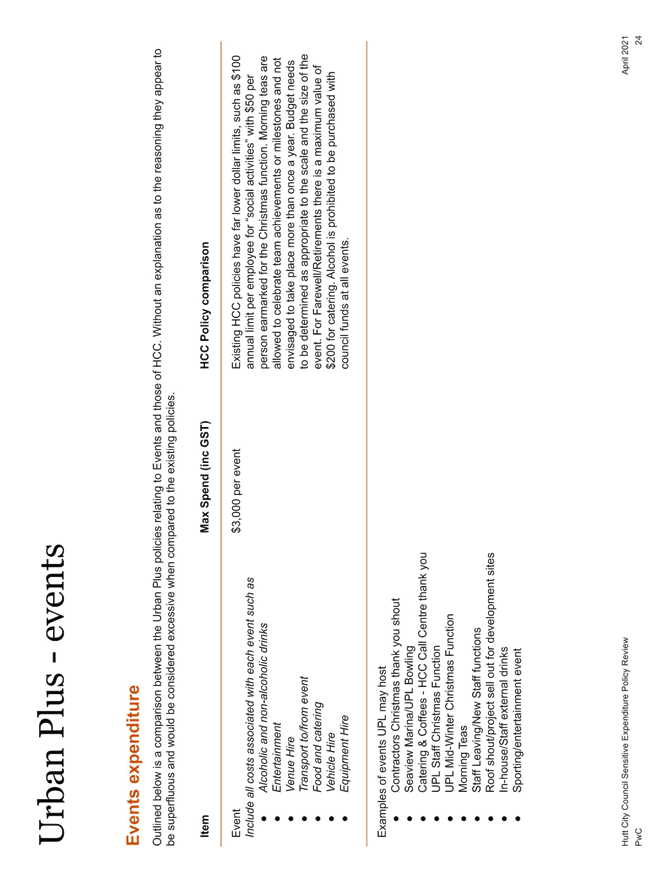

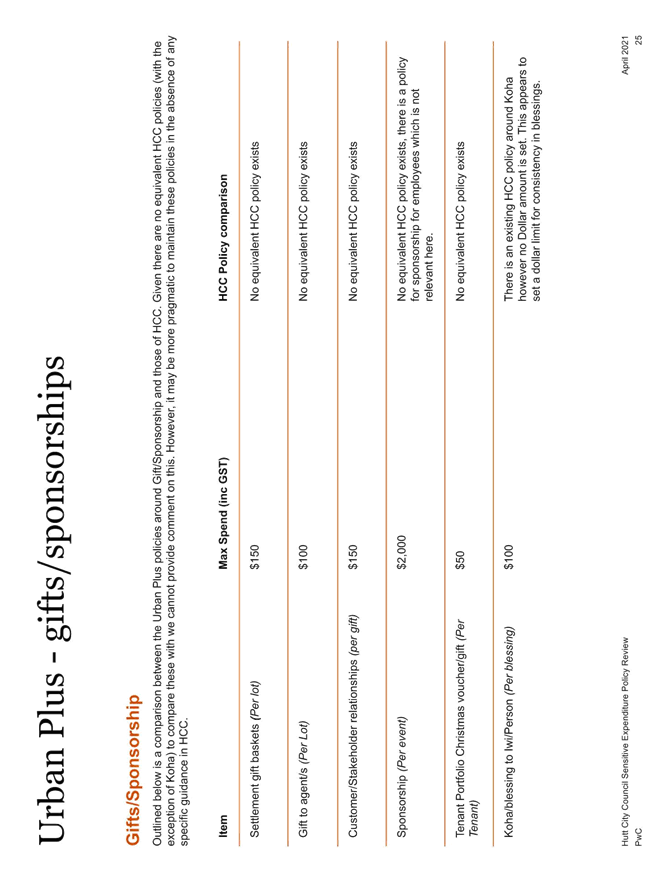

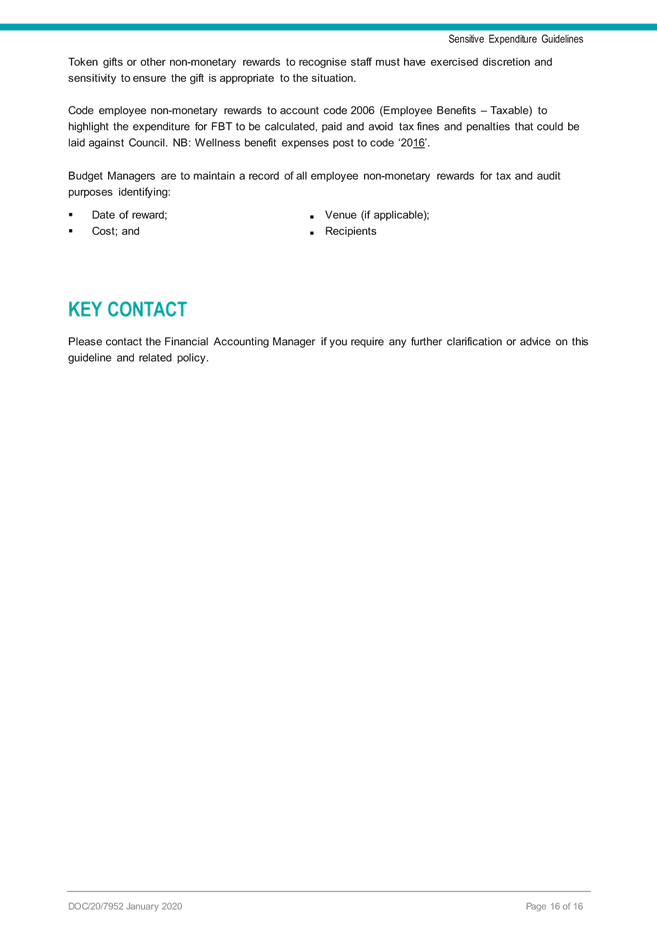

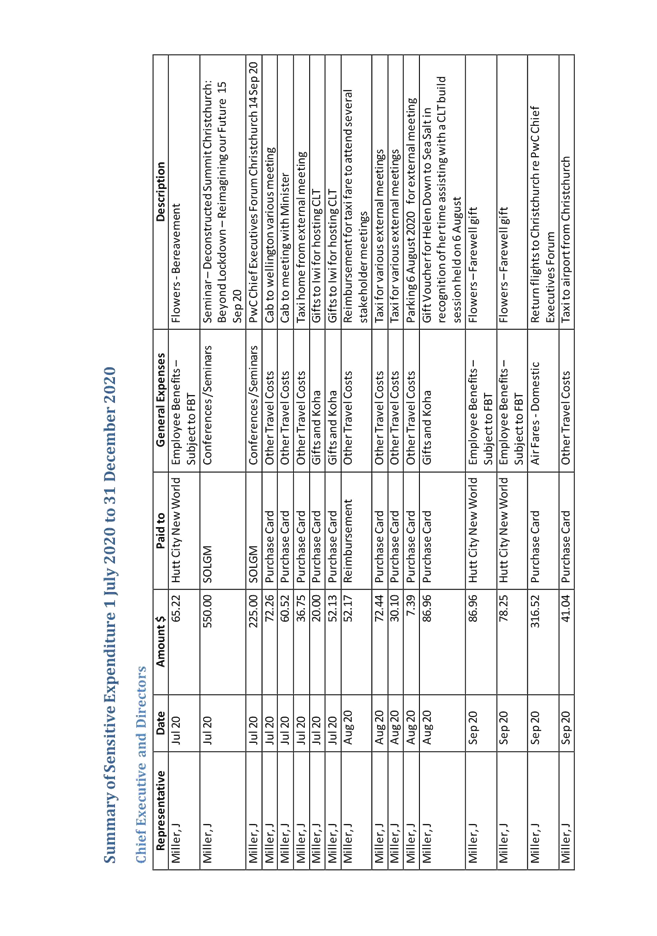

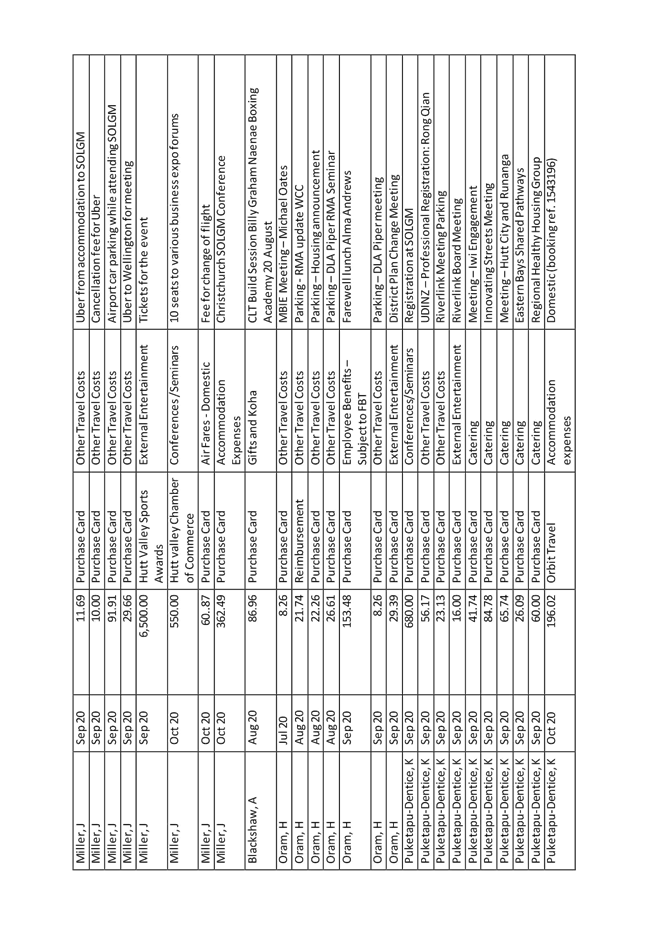

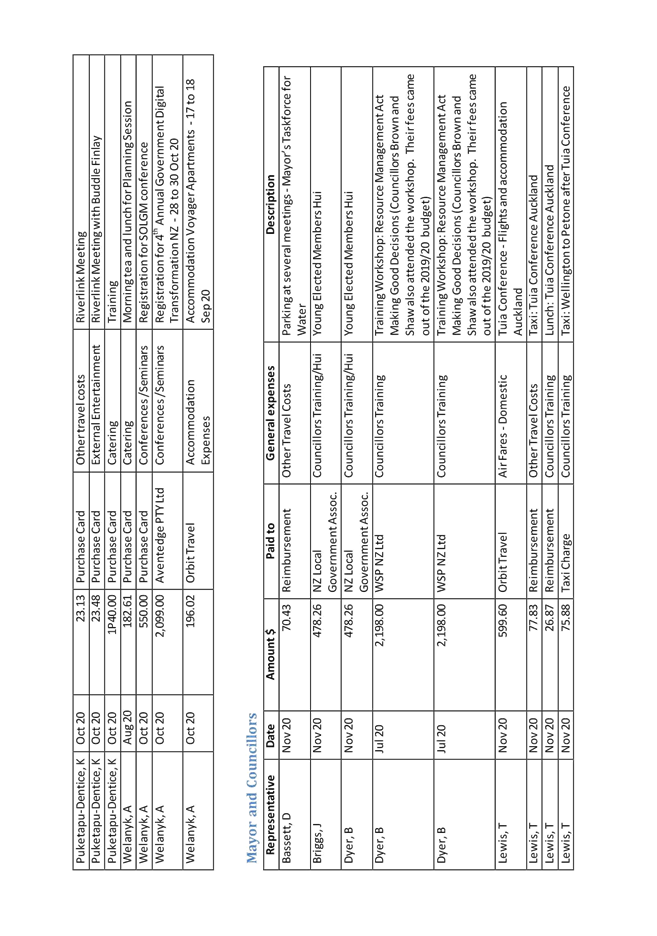

11. Sensitive Expenditure Policy Update and

Disclosures (21/577)

Report

No. ARSC2021/2/64 by the Financial Accounting Manager 161

Chair’s Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

12. Holidays Act 2003 Compliance (21/556)

Report

No. ARSC2021/2/84 by the Financial Transaction Services Manager 272

Chair’s Recommendation:

|

“That the recommendation contained in the report be

endorsed.”

|

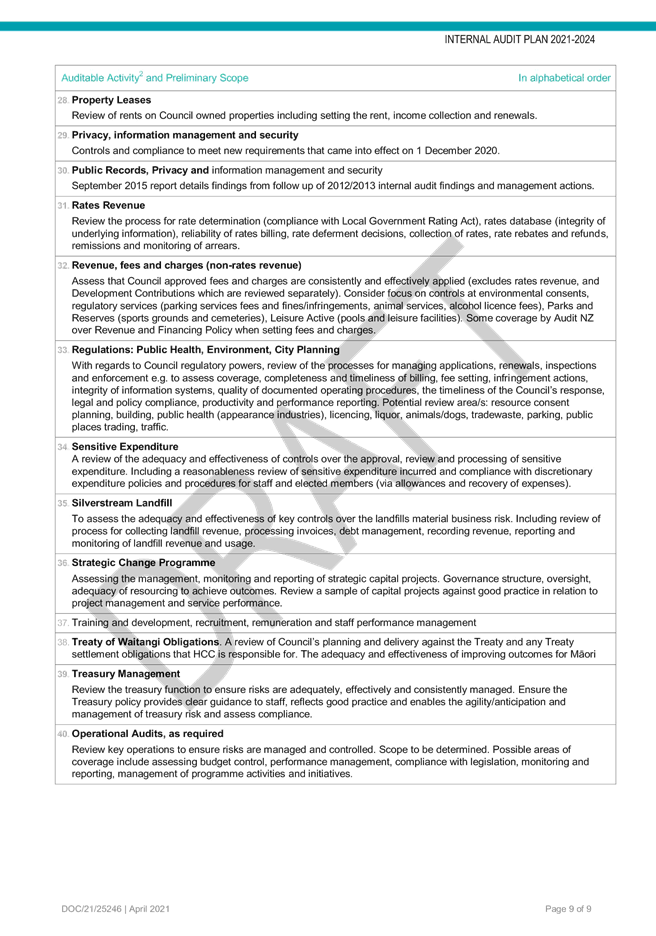

13. Internal Audit Charter and Internal Audit Plan

2021-2024

(21/467)

Report

No. ARSC2021/2/85 by the Risk and Assurance Manager 277

Chair’s Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

14. Legal Compliance and Litigation Risk Reporting (21/619)

Report

No. ARSC2021/2/98 by the Chief Legal Officer 294

Chair’s Recommendation:

|

“That the recommendations contained in the report be

endorsed.”

|

15. Seismic Performance Register (21/573)

Report

No. ARSC2021/2/86 by the Acting Facilities Manager 298

Chair’s Recommendation:

|

“That the recommendation contained in the report be

endorsed.”

|

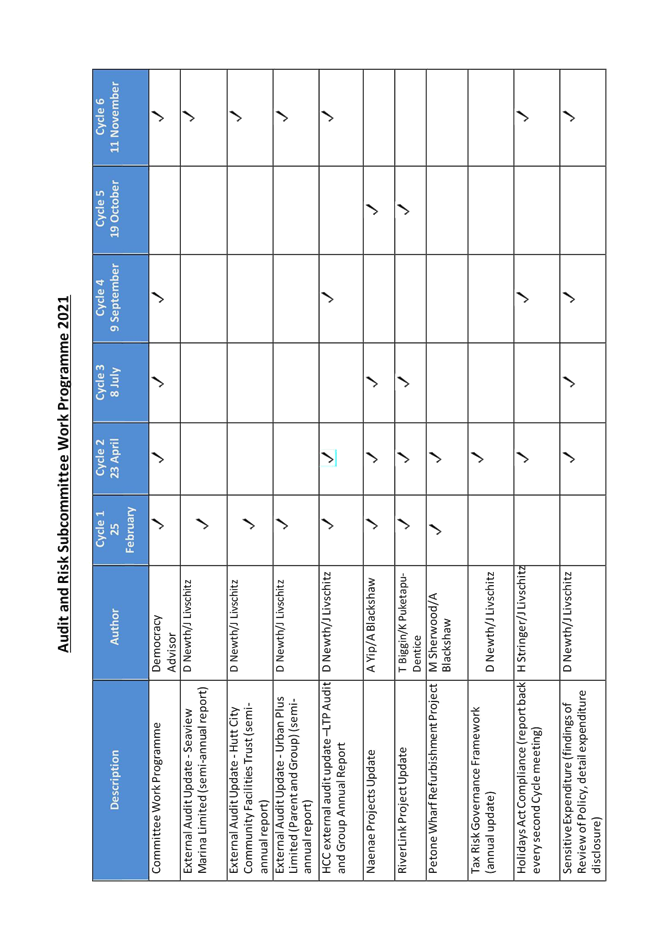

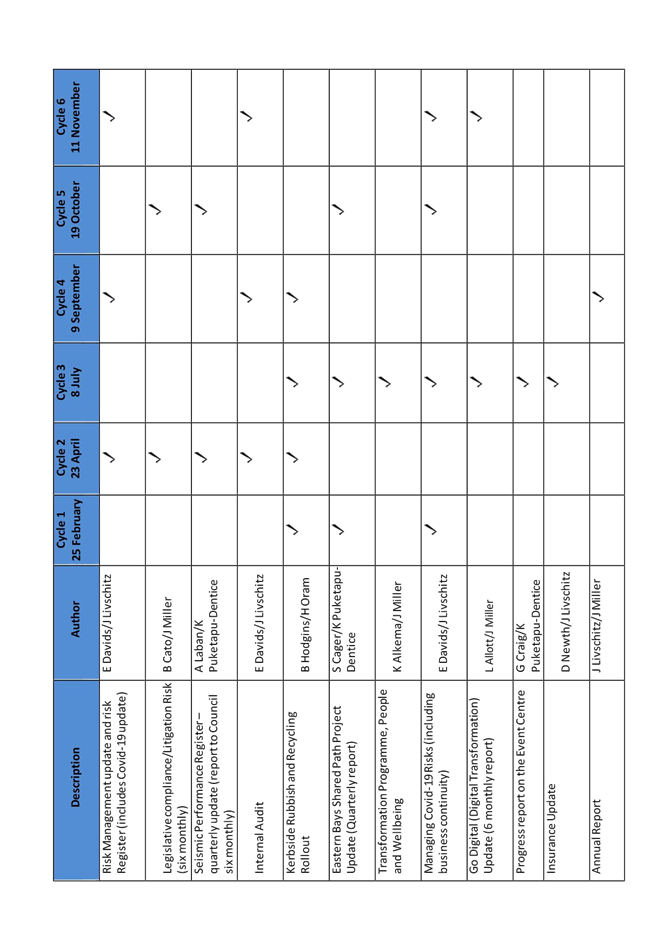

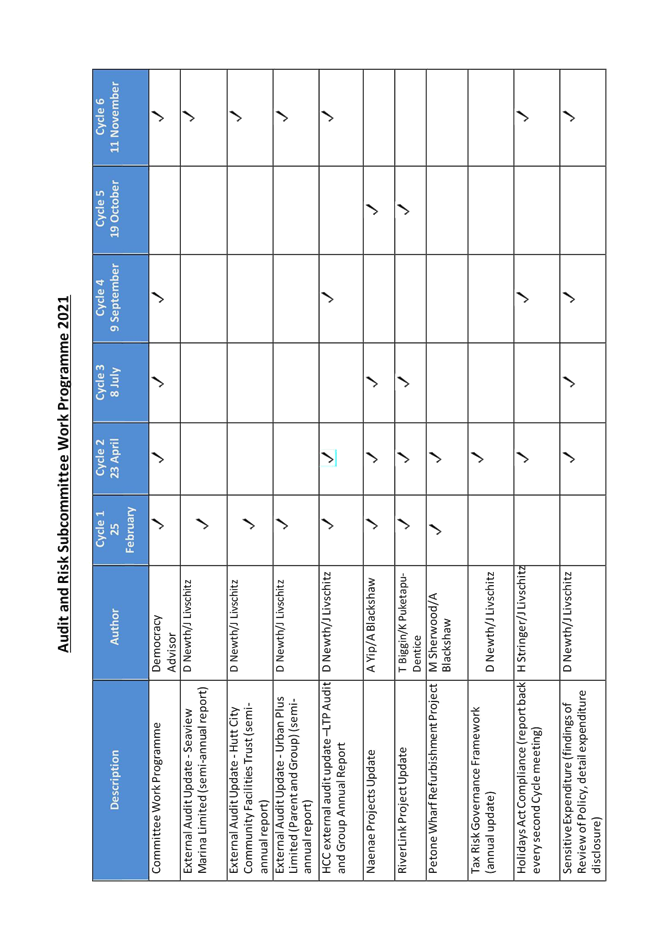

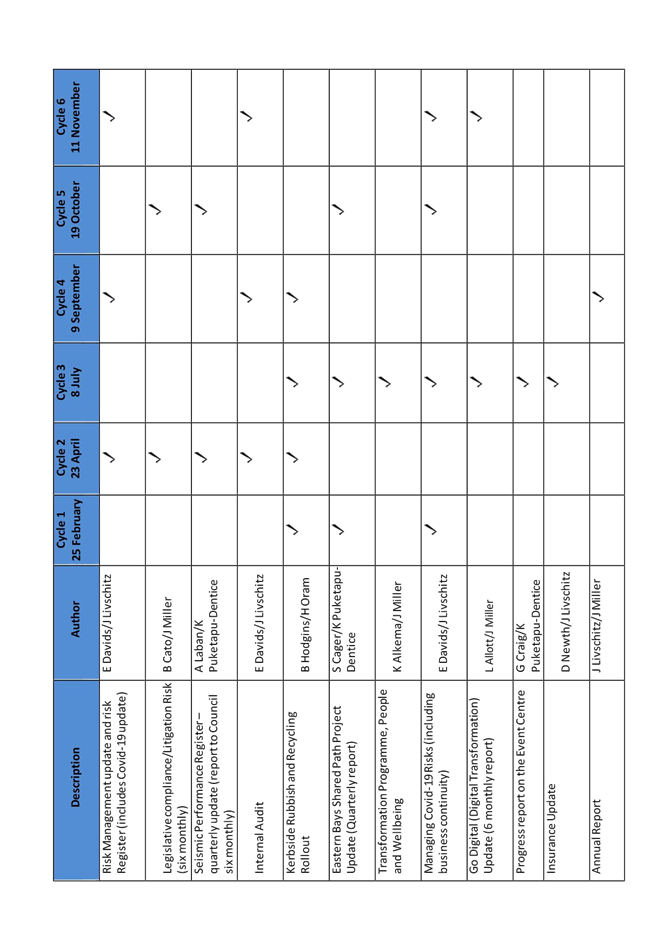

16. Audit and Risk Work Programme 2021 (21/581)

Report

No. ARSC2021/2/58 by the Committee Advisor 301

Chair’s Recommendation:

|

“That the recommendation contained in the work

programme be endorsed.”

|

17. QUESTIONS

With reference to section 32 of

Standing Orders, before putting a question a member shall endeavour to obtain

the information. Questions shall be concise and in writing and handed to the

Chair prior to the commencement of the meeting.

Toi Lealofi

DEMOCRACY ADVISOR

Audit and Risk

Subcommittee

Audit and Risk

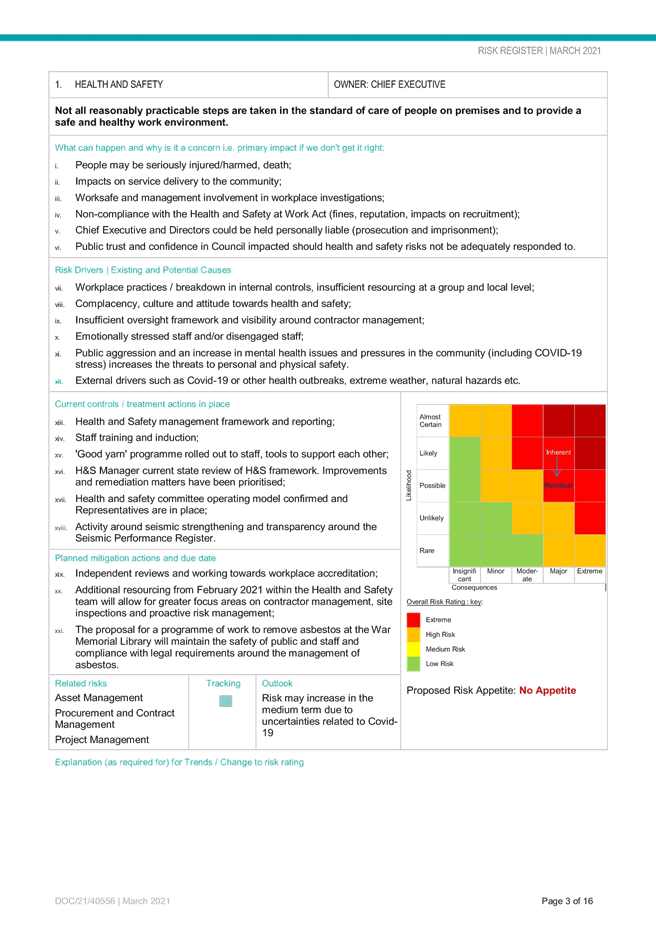

Subcommittee

11 March 2021

File:

(21/371)

Report no:

ARSC2021/2/79

Risk management

update, including the setting of risk appetite

Purpose

of Report

1. The purpose of

this report is to provide an update to the Audit and Risk Subcommittee on

activities underway to maintain and improve risk management at Hutt City

Council (Council).

2. This report

includes a proposal for the Subcommittee to review and endorse the proposed

‘Risk appetite statement’ ahead of it being submitted to Council

for approval. The ‘Criteria for assessing risk’ is also presented

for review and endorsement by the Subcommittee.

3. The

Council’s risk register to 31 March 2021 is also reported to the

Subcommittee.

|

Recommendations

That the Subcommittee:

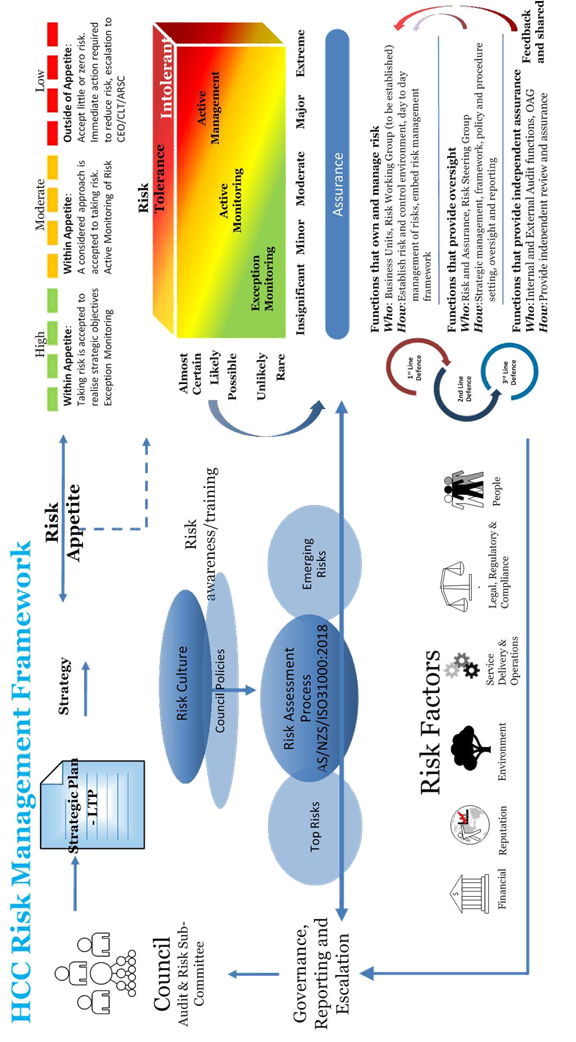

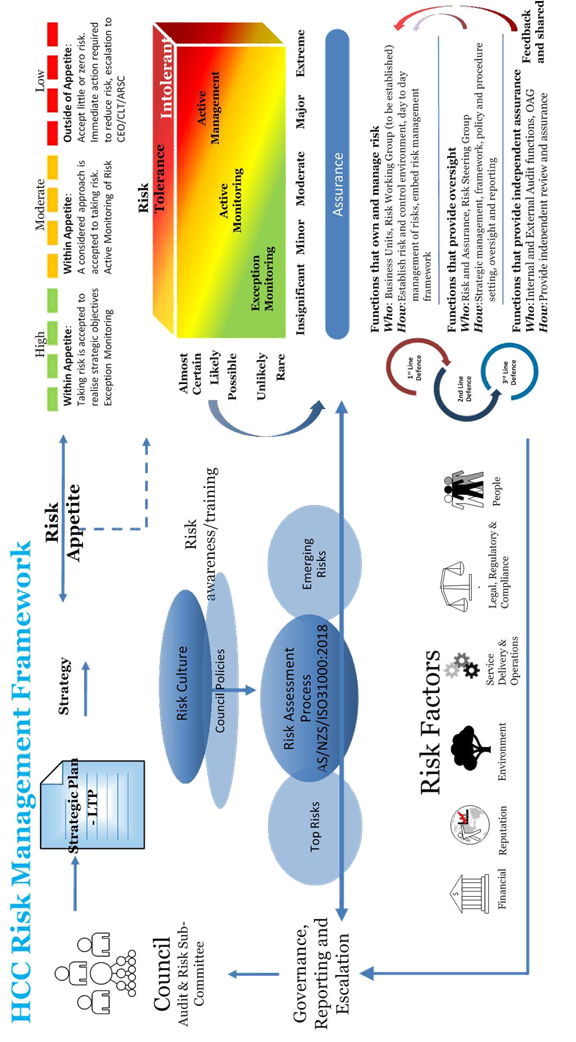

(1) notes and

receives the information in this report;

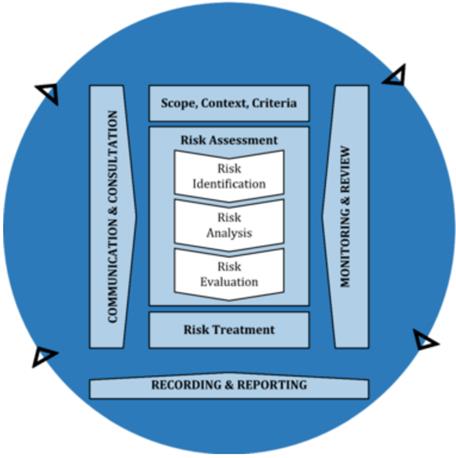

(2) notes the

risk management framework, as attached as Appendix 1 to the report.

(3) notes the

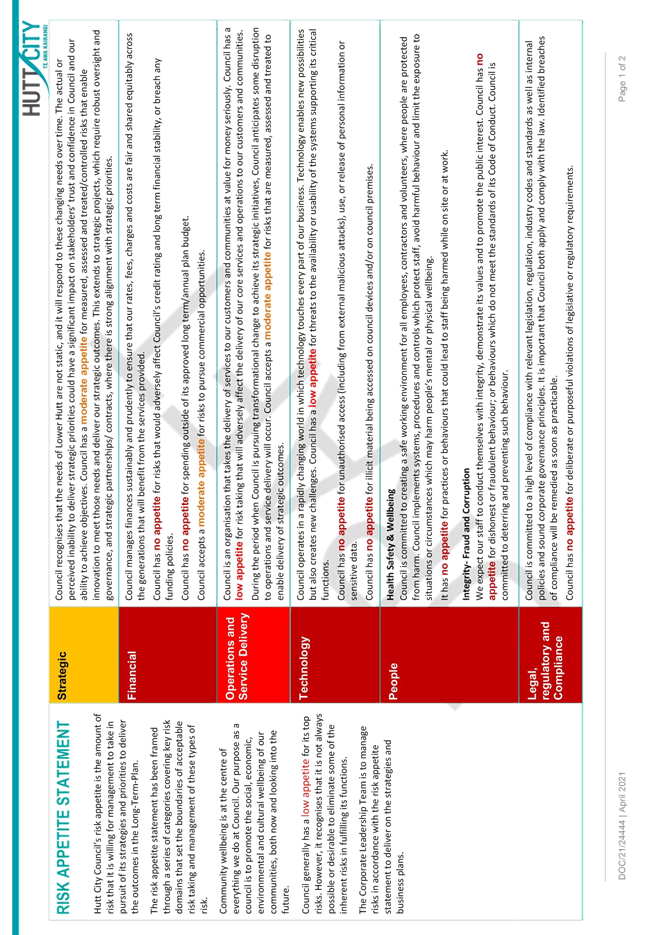

recommendation to develop ‘Risk appetite statement’;

(4) endorses

for approval by Council the draft ‘Risk appetite statement’ as

attached as Appendix 2 to the report. This recommendation will be considered

by Council on 1 June 2021;

(5) endorses

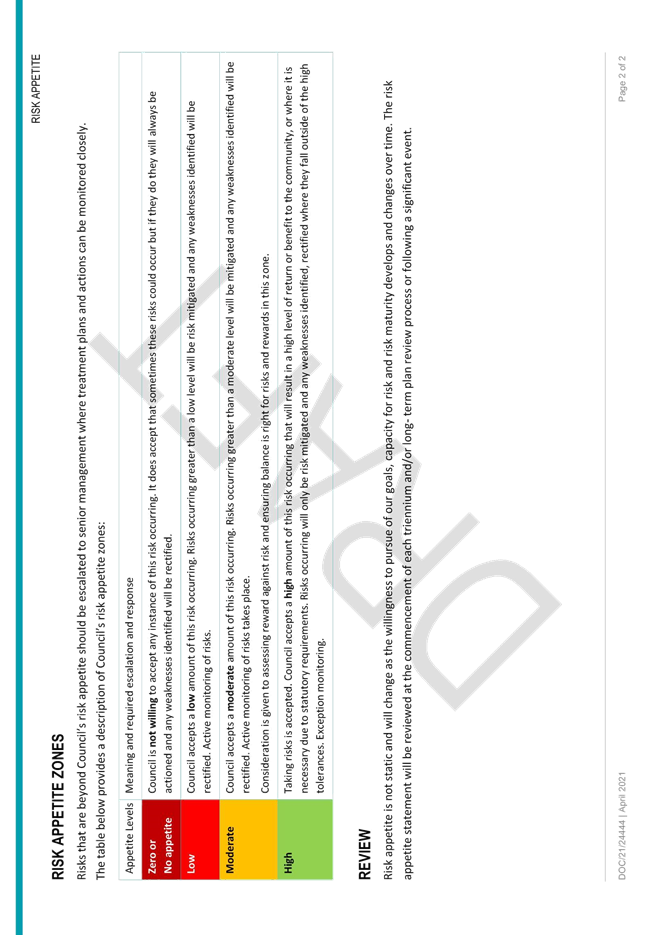

the ‘Roles and responsibilities for risk management at Hutt City

Council’ updated in respect of risk appetite aspects as attached as

Appendix 3 to the report;

(6) endorses

the updated risk rating assessment criteria as attached as Appendix 4 to the

report;

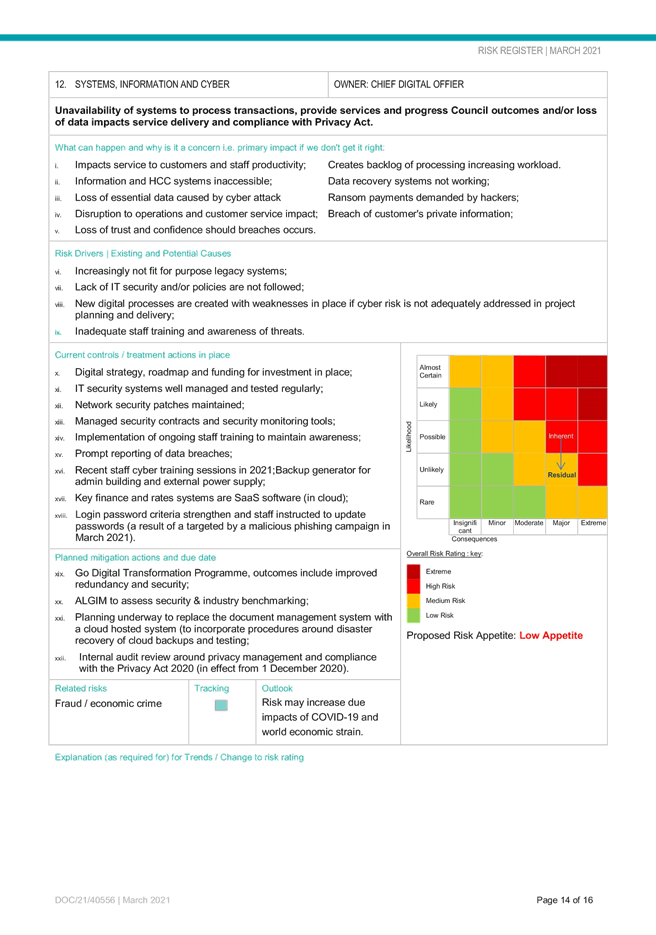

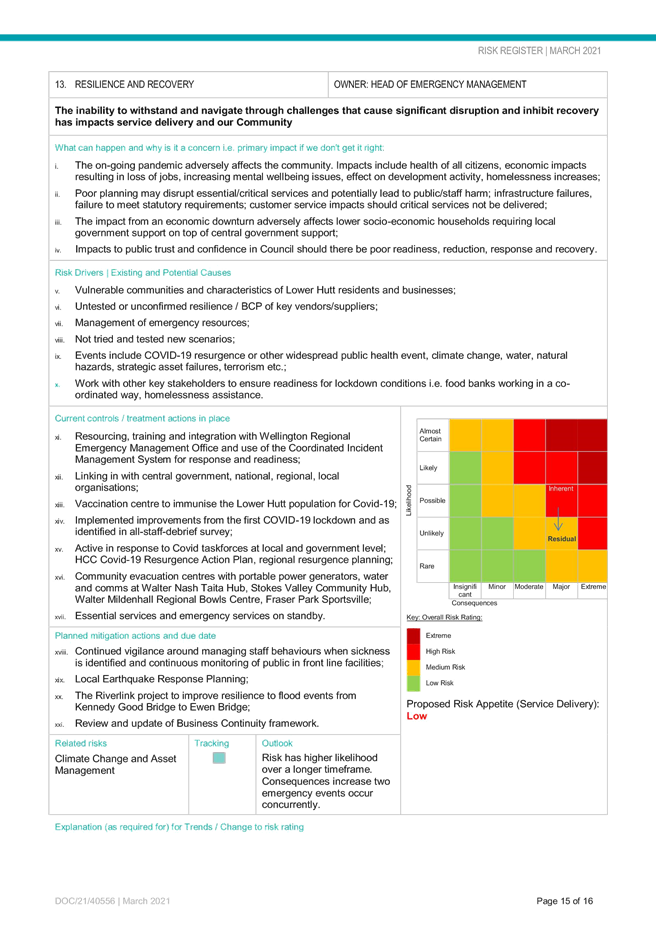

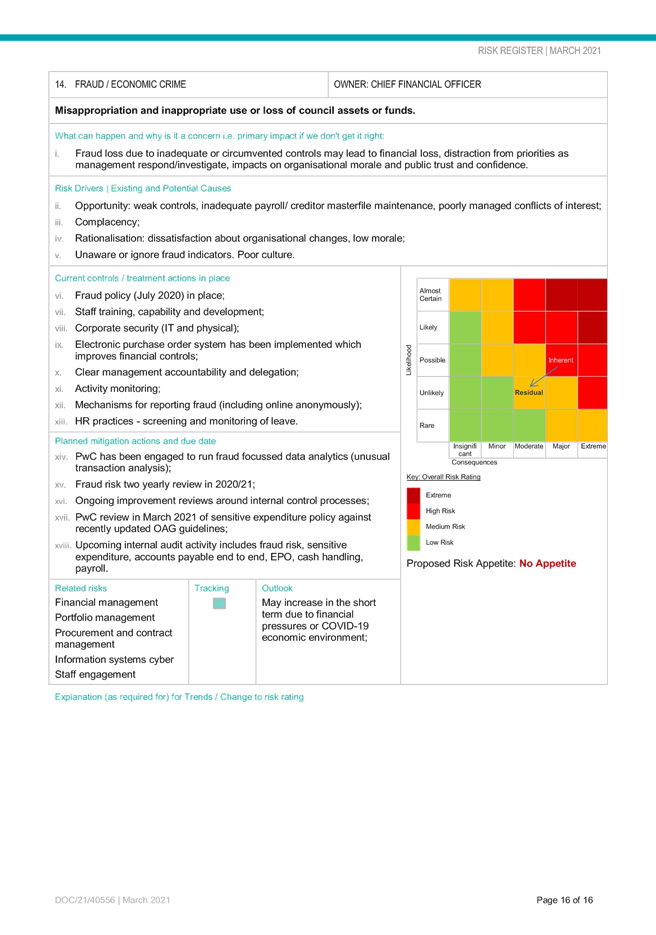

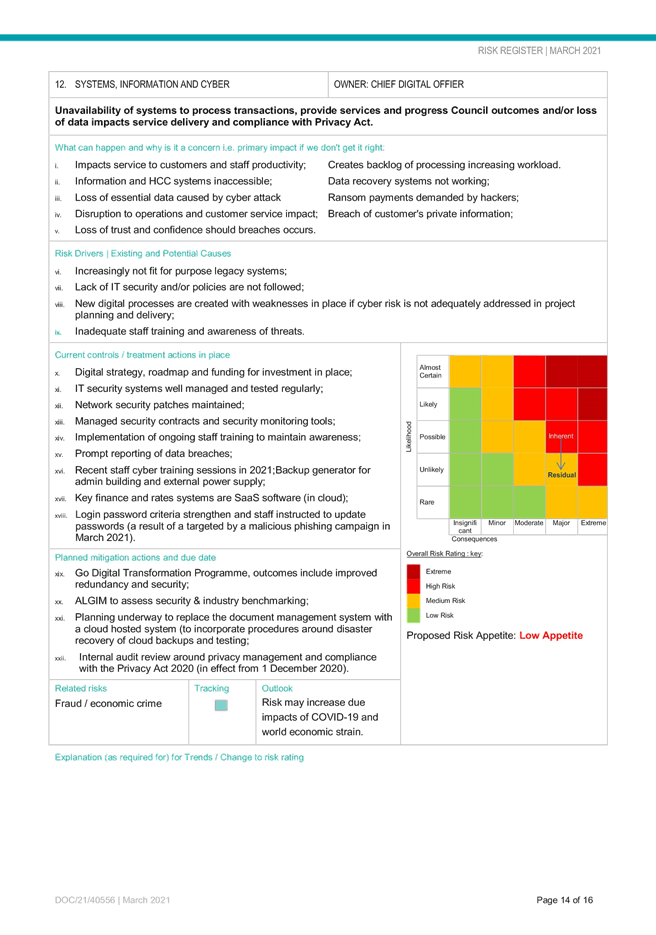

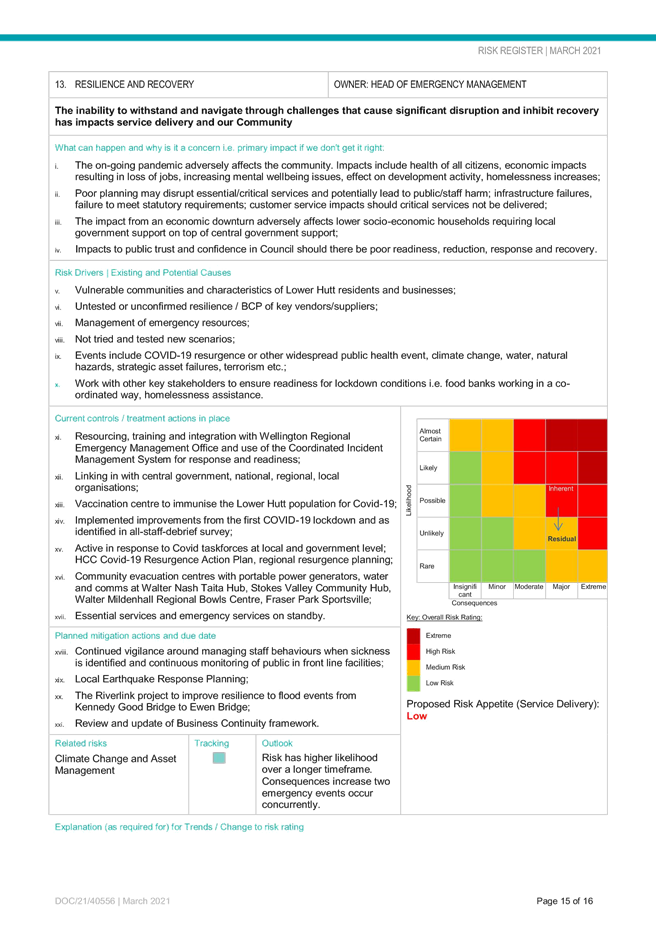

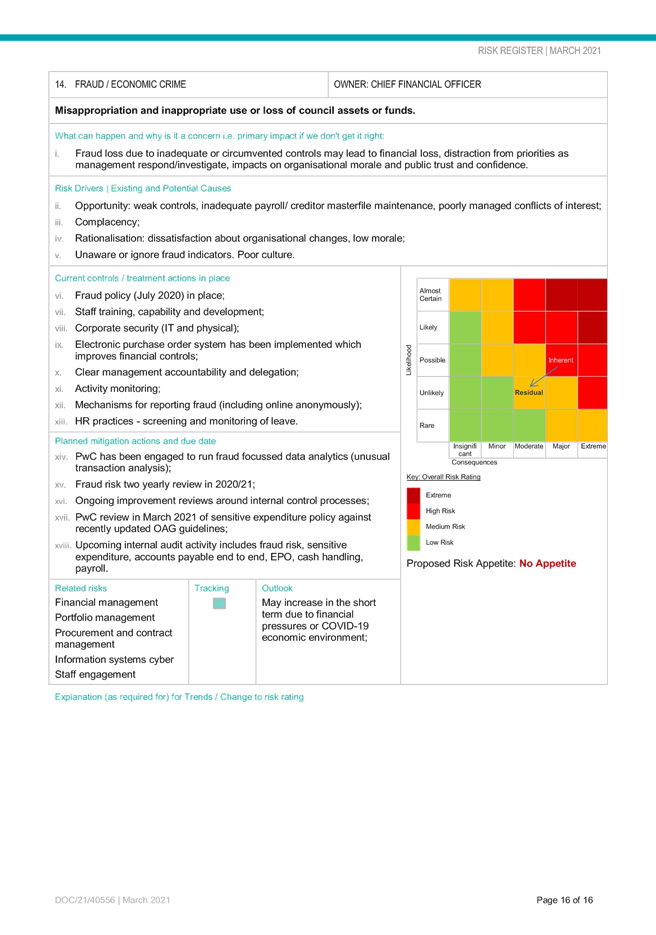

(7) notes the Risk Register as updated by the

Corporate Leadership Team, attached

as Appendix 5 to the report; and

(8) notes and

receives the Covid-19 risks update. Officers will update members at the

meeting if there are any changes to be reported during the meeting.

|

Background

4. The Risk and Assurance Manager provides a quarterly update

on the activities to maintain and improve Council’s risk framework. The

previous Risk Management Update was presented to the Audit and Risk

Subcommittee on 25 November 2020.

5. The risk management framework was previously updated in

March 2017. A review is currently underway. Updates so far include the risk

reporting from September 2020, the roles and responsibilities for risk

management and the establishment of the Risk Steering Group (the terms of reference for this cross council representation groups

were outlined to this Subcommittee on 17 September 2020).

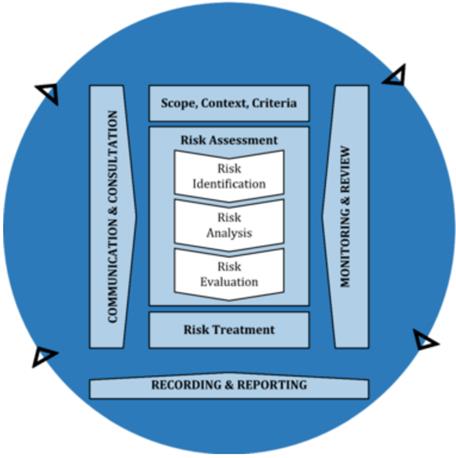

6. Attached as Appendix

1 is the risk management framework.

7. The proposed risk documents in this report have been reviewed by

external risk consultant, Cecilia Tse. Cecilia is an industry leader in legal,

risk and assurance management, with many years of experience supporting

organisations in their risk maturity journey. Cecilia has provided guidance in

their development and confirmed that these are in line with industry best

practice and recognised international risk management standards and guidance

(ISO 31000:2018). Cecilia will be attending the Subcommittee meeting and

be supporting the presentation of this report.

Setting risk appetite

8. Attached as Appendix 2 to this report is the draft ‘Risk

appetite statement’ for review and endorsement by the Audit and Risk Subcommittee ahead of submission to Council for

approval.

9. Setting

risk appetite is a key first step in the risk management process.

10. The key objectives for setting risk appetite:

§ Enables

the sitting Council to exercise appropriate oversight and governance by setting

boundaries for the business activities;

§ Expresses

the sitting Council’s attitude to risk to promote a risk aware culture;

§ Provides

a framework for making business/risk based decisions;

§ Empower

staff to take more calculated risk; and

§ Limit staff from taking excessive

risk.

11. Risk appetite outlines the

amount of risk Hutt City Council is willing to accept in pursuit of its

strategies, priorities and business plans.

12. Risk appetite is set by the

Council. Council, through the Audit and Risk Subcommittee, expects to have

oversight on how risks are managed within the parameters set, through regular

risk monitoring and other reporting.

13. Council is prepared to take

appropriate, controlled risks to achieve its strategic objectives.

14. Risk appetite provides

boundaries for activities. When applied, it reduces/limits staff from taking

excessive risks and empowers staff to take more risks to achieve goals.

15. Risk appetite can be expressed in a number of ways to ensure that it is

commonly understood and consistently applied across the programme. In line with

other local Councils, the proposed risk appetite is expressed in the form of

high-level qualitative statement across key risk categories that aim to

articulate Council’s attitude and level of acceptance of different risks.

16. The risk

criteria matrix, tabled in this report, provides quantitative measures in some

areas.

17. The key risk appetite areas have been chosen as they are important to

local councils. The Council’s top risks have also been considered in

preparing these.

18. Various other local authorities’ appetite statements were reviewed as

part of the process, which included Crown Infrastructure Partners, Porirua City

Council and Auckland Council. The proposed appetite statement for

Hutt City Council is in line with other local authorities in New Zealand.

19. The Risk Steering Group[1], with cross council representation, was involved in the initial development of the appetite statement.

20. It is

important that the Council (with some responsibilities delegated to the Audit

and Risk Subcommittee) monitors compliance with the risk appetite set. This

will form part of the future monitoring and reporting to ARSC.

21. Once set,

Council requires management to effectively communicate this risk appetite

statement to all staff and to ensure that business plans and activities are

aligned accordingly.

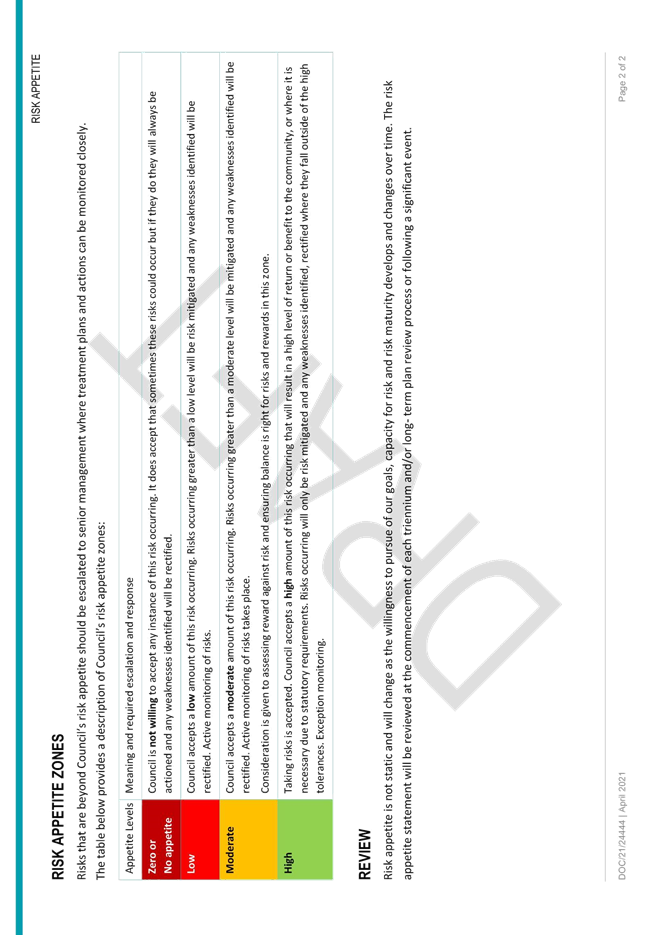

22. Attached as Appendix 3

to the report, the “Roles and responsibilities for risk management’[2] have been

updated for risk appetite. I.e. Council sets the risk appetite and ARSC

monitors to ensure the Corporate Leadership Team are managing risk within those

boundaries.

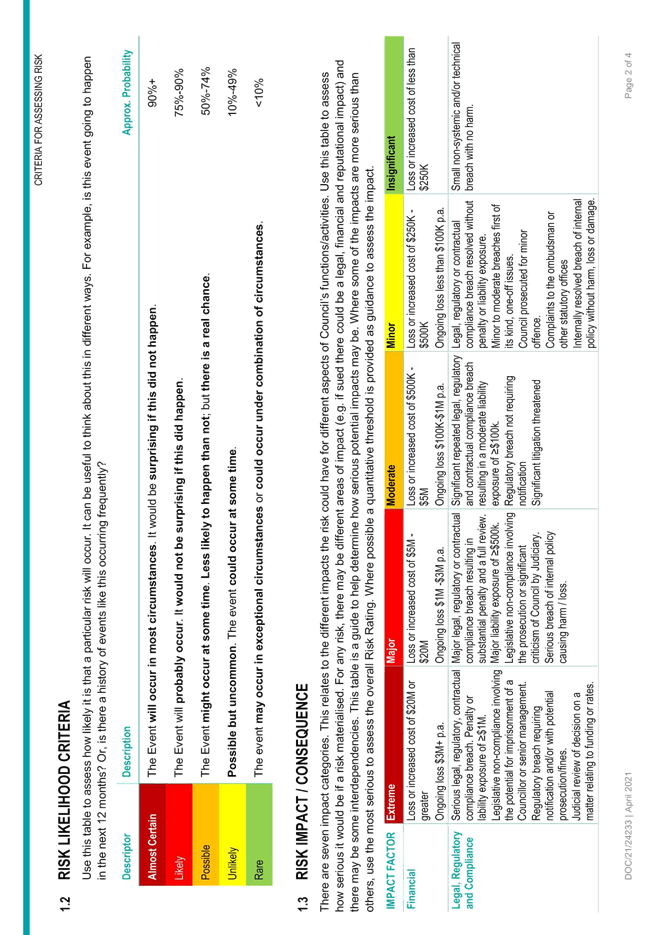

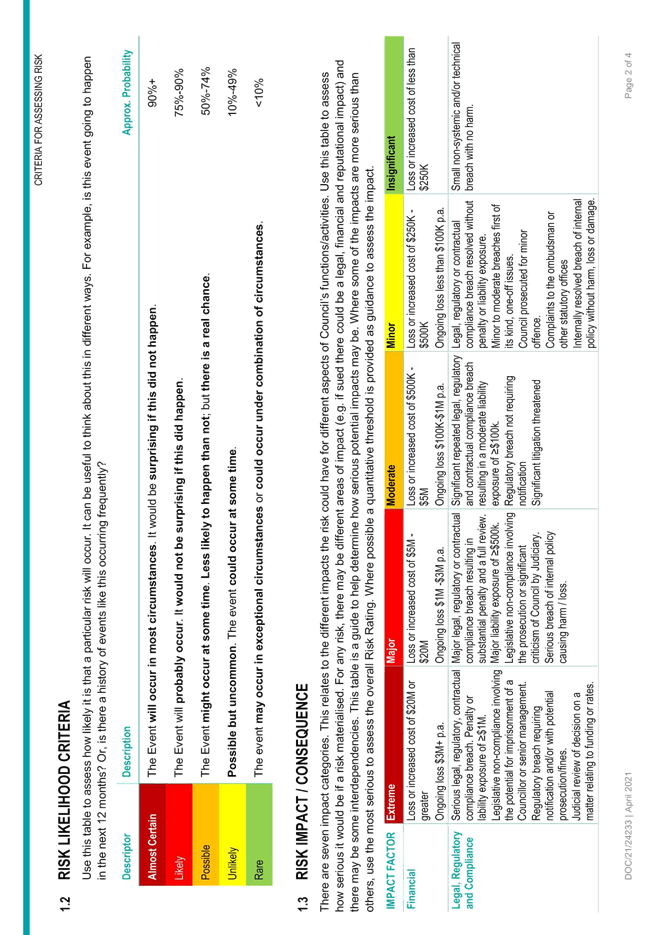

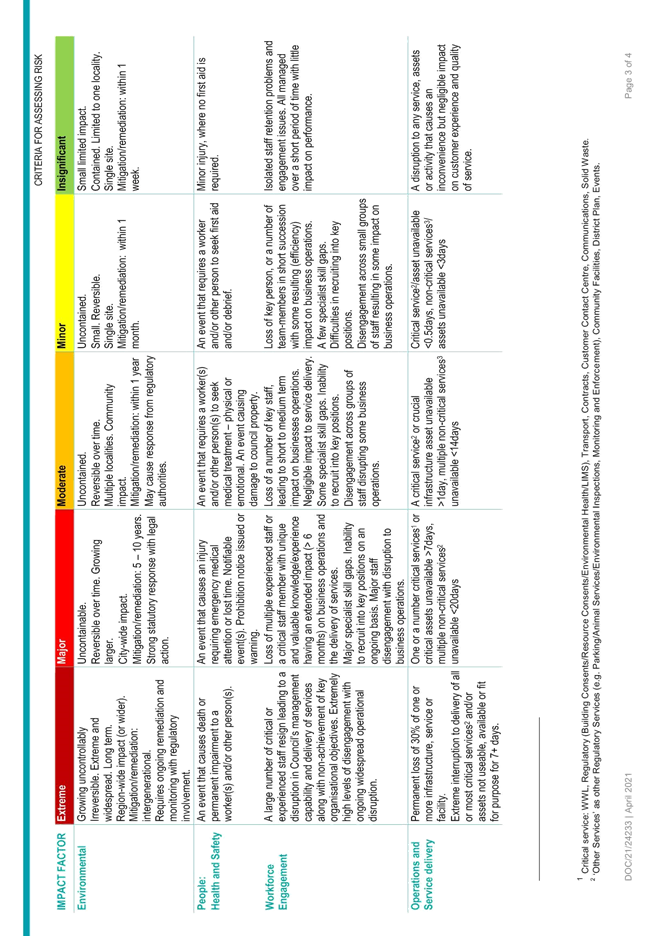

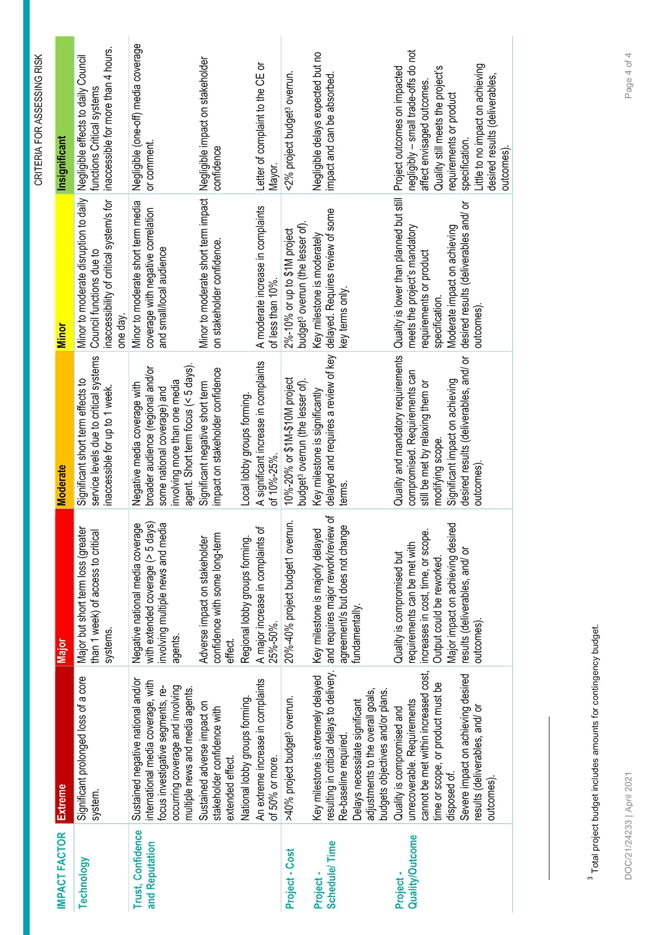

Criteria for Assessing Risk

23. Risk

criteria are used to assess risk. It provides a consistent way to discuss,

analyze, evaluate and rate risk, in terms of its level of severity. This allows

risk to be ranked and mapped relative to each other and against risk appetite.

24. The risk

criteria were last updated in March 2017.

25. Risk

management aids the understanding and proactive management of risk exposures

and opportunities that may have a potential effect on Council’s strategic

priorities. To do this, it requires:

§ Consistent

language so that risks can be considered in a consistent and strategic way;

§ A guide

outlining different levels of likelihood of a particular risk occurring; and

§ A guide

outlining different levels of impact that an event may have.

26. Risk analysis may be

influenced by any divergence of opinions, biases, perceptions

of risk and judgements. Having documented criteria provides a consistent way to

discuss, assess, evaluate and prioritise risk at Council.

27. Risk

analysis and risk evaluation is part of risk assessment in the risk management

process.

ISO

31000:2018 Risk Management - Guidelines

28. ‘Risk’ can be defined as the effect of uncertainty on objectives.

An ‘effect’ is a

deviation from the expected. It can be positive, negative or both, and can

address, create or result in opportunities and threats.

Risk is usually expressed in terms

of risk sources, potential events, their likelihood and consequence.

Likelihood is the chance of something happening

Consequence is the result or effect of a particular event occurring that

impacts objectives.

29. A number of other council’s criteria were considered in the

development of the new criteria. The proposed criteria has been tailored and

chosen as a good fit for Hutt City Council and the context Council operates in.

The risk factors selected represent impacts that are important to Council.

30. Early

input of the impact/consequence thresholds was sought from subject matter

experts for each risk area. These are the managers who are technical/function

leads for the individual risk factors.

31. The Risk Steering Group, with cross council representation, was

involved in the initial development of the risk criteria.

Summary of updates to the criteria for

assessing risk:

32. Thresholds for Likelihood criteria have generally been adjusted upwards to

broaden the bands and align with other local authorities and accepted practice.

Consequence/Impact criteria:

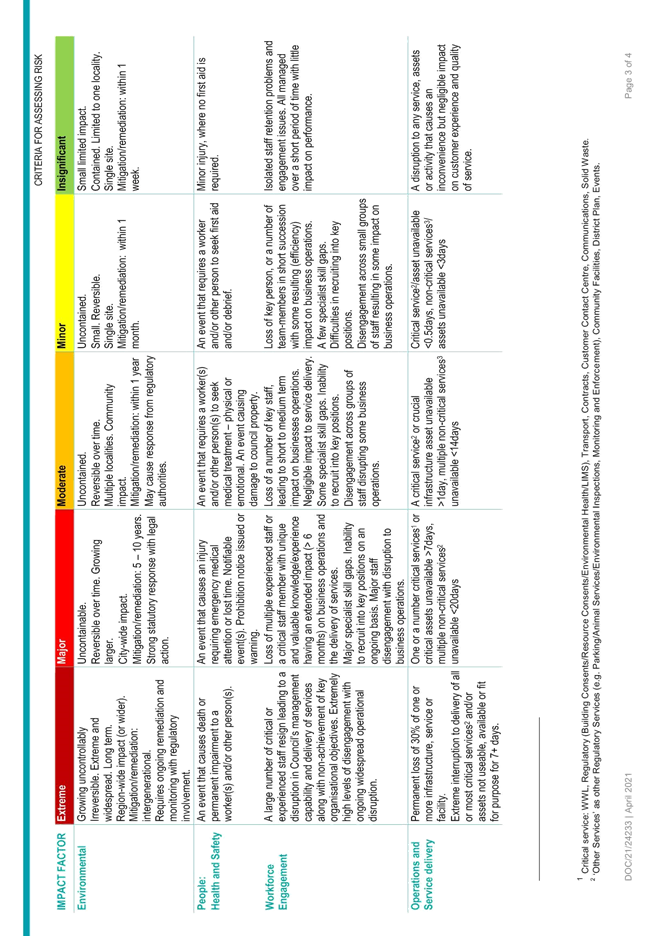

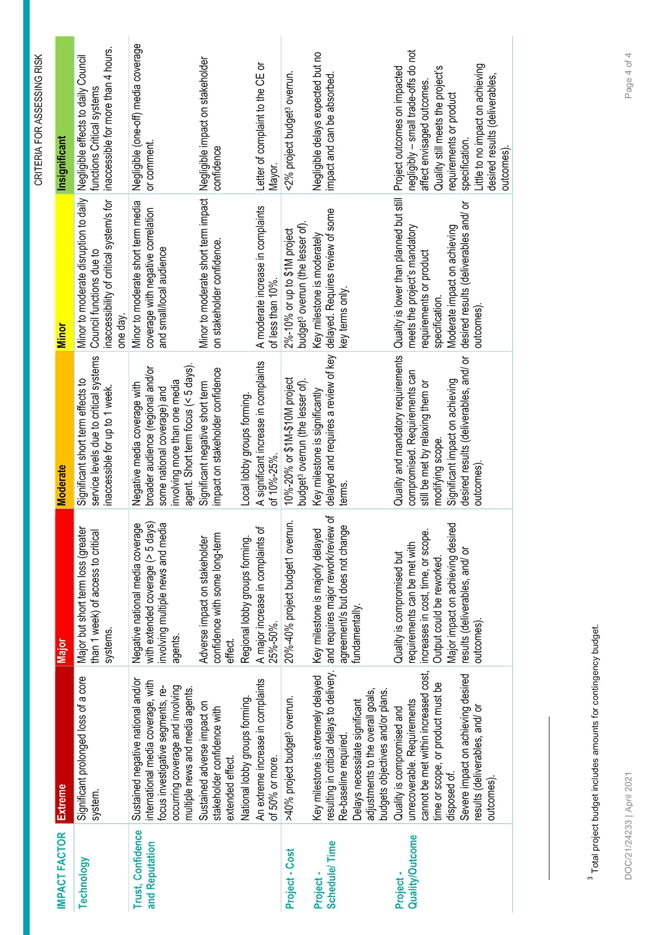

33. The impact

criteria have five levels. This approach is largely consistent with most other

councils.

34. Impacts for

Financial, People, Legal, Regulatory and Compliance, Service Delivery,

Environmental and Trust, Confidence and Reputation have been updated better

align to other local authorities and public sector impact criteria.

35. NEW

thresholds for assessing project risk are proposed.

36. The risk rating table, as set

out in Appendix 4 attached to the report, has a legend that outlines the

response action required for each risk level. The response actions have been

updated to better define the escalation requirements

and expected risk treatment.

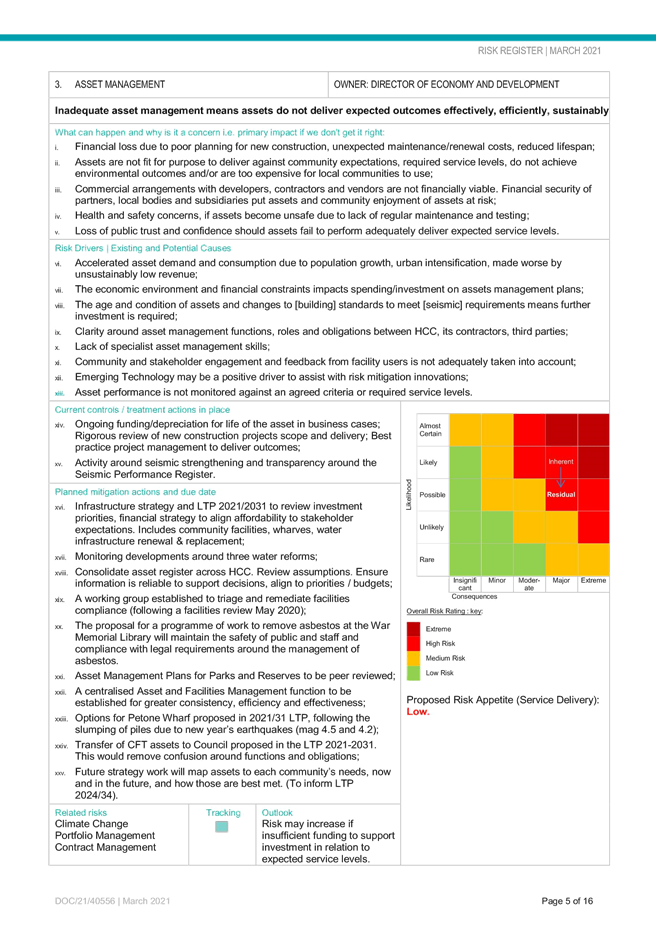

Council’s Risk Register

37. Attached as Appendix 5 to the report is

the risk register to 31 March 2021, as approved by the Corporate Leadership Team. The details the top risks at Hutt City Council.

38. The

risk registers were last put forward to Council’s Audit and Risk Subcommittee on

25 November 2020.

39. We

are reviewing top risk to ensure there is a focus on critical uncertainties and

effects that have a significant impact on Council objectives and operations.

The risk register is next due to be presented to this Subcommittee on 8 July

2021 and we expect a number of changes and refinements and rationalisations to

be made to top risks reported in the risk register. There are a number of

enhancements suggested by the risk consultant Cecilia Tse that will be taken up

in future risk registers.

40. The

risk register, as attached as Appendix 5, applies the updated risk criteria as

attached as Appendix 4.

41. The overall

risk ratings have remained unchanged. Mitigating actions have been separated

out between current and future controls. The residual risk is determined based

on current controls in place.

42. Individual meetings were held

with risk owners to update the risk register. The risk register has been

reviewed by the Risk Steering Group and a high-level review undertaken by the

external risk consultant, Cecilia Tse. The risks in the risk register are in

alignment to the top 10 risks identified by the Sector Manager Local Government

of the Office of the Auditor-General’s reflections on local

authorities’ approaches to managing risk.

43. Reporting of Top Risk is proposed, as opposed to the splitting out strategic

from operational risk. Risks included in the risk register provide a spot light

on the top risk. This is in line with organisations, such as Ministry of Social

Development, who won a risk management award for ‘Best Plain English; as

it removes any debate about whether a risk is strategic or operational.

44. A number of

previously reported risks have been rationalized to reflect this focus and will

be refined in future risks registers.

45. The

following risks, which were included in the last risk registered reported to

this subcommittee on 25 November 2020, are not captured under the risk register

for Top Risks. These will continue to be monitored via operational risk

registers by the respective business unit leads and escalated as required in

alignment with the risk assessment criteria set out in Appendix 4. This

includes:

a) The previously stated risk around Inadequate or

inconsistent systems or processes or internal controls, has been

rationalized and is impacts are captured by tops risks regarding procurement

and contract management, financial management and fraud/economic crime;

b) Insurance. Risk here continues to be managed through

our insurance lead, the Financial Accounting Manager who will provide an

Insurance Renewal Update to this Subcommittee on 8 July 2021. The last

Insurance Renewal Update (view) was

provided to this Subcommittee on 12 March 2020. Advice is provided by AON

insurance and Council is part of the Outer Wellington Shared Services risk

consortium;

c) The

potential withdraw of central government funding for the Healthy Families

initiative affects community's expectations of Council's support and services.

This continues to be tracked as an emerging risk.

46. Risk Appetite

is being put forward to this Subcommittee ahead of approval by Council at the

meeting on 1 June 2021. Until then, it is not proposed to apply the risk

appetite in the risk register, attached as Appendix 5.

COVID-19 Risks

47. An update

was provided to this Subcommittee on 25 February 2021 in the written report on Managing Covid-19 Risks and a comprehensive verbal update provided during that meeting.

Updates to this Subcommittee provide assurance that risk around Council’s

response to Covid-19 is being managed appropriately.

48. Hutt

City Council remains vigilant and ready to respond in the event of any resurgence of Covid-19.

49. Since the

update provided on 25 February 2021, on 28 February 2021 Auckland moved up

to Alert Level 3 and the rest of New Zealand to Alert Level 2. These alert

levels were moved back from 7 March 2021, with Auckland subsequently joining

the rest of the country in Alert Level 1 from 12 March 2021.

50. Council

continues to have a methodology in place for continuous service delivery to

seamlessly transition between Alert Levels 1, 2 and 3 and to manage and

minimise the risk of Covid-19.

51. Hutt

City Council is proud to be supporting the Ministry of Health’s efforts

to roll out the Covid-19 vaccine. This involves vaccinations being provided at

one of our centres to border workers’ household contacts and frontline

health and emergency workers. Five community centres are now in operation

across the region. A full site safety plan was submitted and approved prior to

the Walter Nash Centre being approved for use as a Covid-19 vaccine clinic, to

ensure the service could be provided safely for contractors, staff and other

facility users.

52. A

full update on Managing Covid-19 Risks will be provided to this Subcommittee on

8 July 2021.

53. The Chief Executive’s statement provided to each Council meeting and

the quarterly performance report to the Policy, Finance and Strategy Committee

also provides details on how Council is responding to Covid-19.

Options

54. Not applicable.

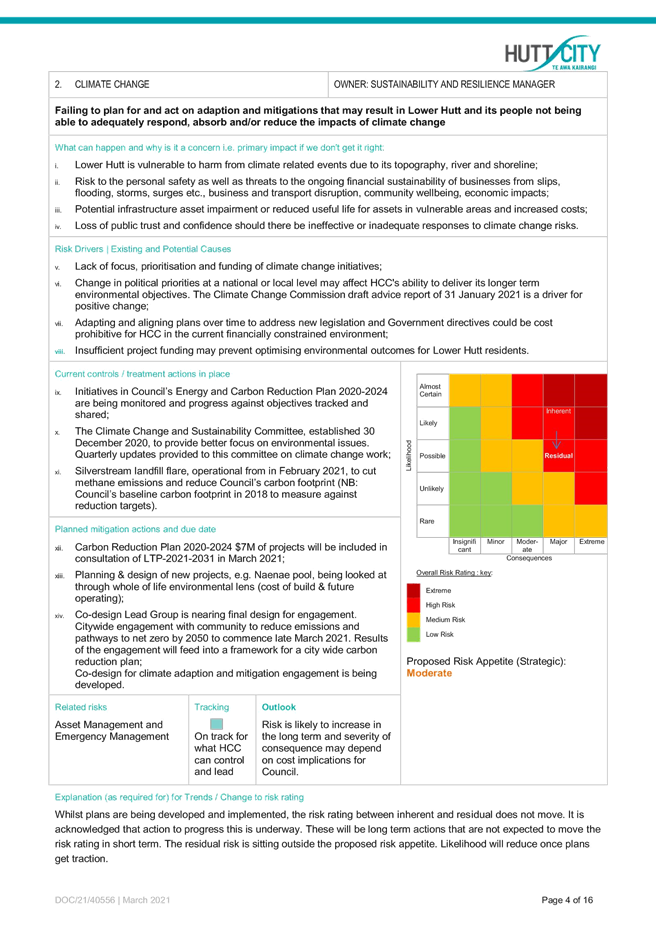

Climate

Change Impact and Considerations

55. The matters addressed in this

report have been considered in accordance with the process set out in

Council’s Climate Change

Considerations Guide.

56. The risk appetite statement for Strategy will have implications on future

actions/decisions associated with climate change and environmental risks.

57. The criteria

will be used to assess risk that has environmental implications.

Consultation

58. Not applicable.

Legal

Considerations

59. The risk appetite statement

for Compliance Risk will have implications on future actions/decisions.

60. The criteria will be used to

assess risk that has legal implications.

Financial

Considerations

61. The risk

appetite statement for Financial Risk will have implications on future

actions/decisions.

62. The criteria

will be used to assess risk that has financial implications.

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Appendix 1: Risk Management Framework

|

18

|

|

2⇩

|

Appendix 2: DRAFT Risk Appetite Statement - 2021

|

19

|

|

3⇩

|

Appendix 3: DRAFT Roles and Responsibilities for Risk

Management - 2021

|

21

|

|

4⇩

|

Appendix 4: Risk Assessment Criteria - 2021

|

25

|

|

5⇩

|

Appendix 5:Risk Register - Top Risk - March 2021

|

29

|

Author: Enid Davids

Risk and Assurance Manager

Approved By: Jenny Livschitz

Chief Financial Officer

|

Attachment 1

|

Appendix 1: Risk Management Framework

|

|

Attachment 2

|

Appendix 2 DRAFT Risk Appetite Statement - 2021

|

|

Attachment 3

|

Appendix 3: DRAFT Roles and Responsibilities for

Risk Management - 2021

|

|

Attachment 4

|

Appendix 4: Risk Assessment Criteria - 2021

|

|

Attachment 5

|

Appendix

5:Risk Register - Top Risk - March 2021

|

Audit and Risk

Subcommittee

Audit and Risk

Subcommittee

07 April 2021

File:

(21/574)

Report no:

ARSC2021/2/80

Kerbside Rubbish and

Recycling Implementation Project

Purpose

of Report

1. This report

provides an update on the project to implement the new kerbside rubbish and

recycling services with particular emphasis on risk management. This is the

second report to this Subcommittee following the initial report to the meeting

on 25 February 2021.

|

Recommendations

That the Subcommittee notes and

receives the report.

|

Update

2. A brief update of

the progress of the project is as follows:

· Multi-Unit

Developments have been visited and individual solutions determined. The

information has been sent to Waste Management Limited (WML) in preparation for

the roll-out.

· Meeting

held with Kainga Ora to work through possible roll-out issues and help develop

appropriate responses.

· Risk

mitigation planning workshop held to work out details for responding to worst

case scenarios.

· All

data sets for bin selection finalised and sent to WML for the roll-out.

· Bin

orders completed and first shipment due in late April. Note that this is a

three week delay due to shipping schedules affected by issues at Ports of

Auckland. This matter is further commented on under Risks and Issues.

· Assisted

service assessments have begun and have been programmed over April 2021.

There are 622 assessments to be made for either an assisted service or to

resolve a difficult access situation. WML and Council staff are jointly

conducting the assessments. Around 100 were completed as at 6 April 2021.

· Business

As Usual (BAU) processes have all been documented following workshops.

Dataprint New Zealand Limited has been contracted to make changes to the

existing Saber rates portal to accommodate new bin selections.

· Letters

sent to all Coast Road Wainuiomata residents outlining the solution and

measures being taken for this 80kmh road. A meeting was held with the

Wainuiomata Rural Resident’s Association to listen to concerns and get

feedback on the letter before sending.

· Letters

sent to all residents in private roads seeking a waiver for WML trucks to

access such roads. Note that if we do not get approval from all owners to

access a private road then residents will be required to wheel their bins to

the adjoining public road for them to be emptied.

· Truck

logos finalised and ordered.

· Information

booklet finalised and being printed.

· A

variety of communications planned for April/May to coincide with the

roll-out. This includes radio, newspaper and social media campaign.

· Bin

webpage (microsite) prepared and available to the public from 16 April

2021. This will include links to educational videos on recycling.

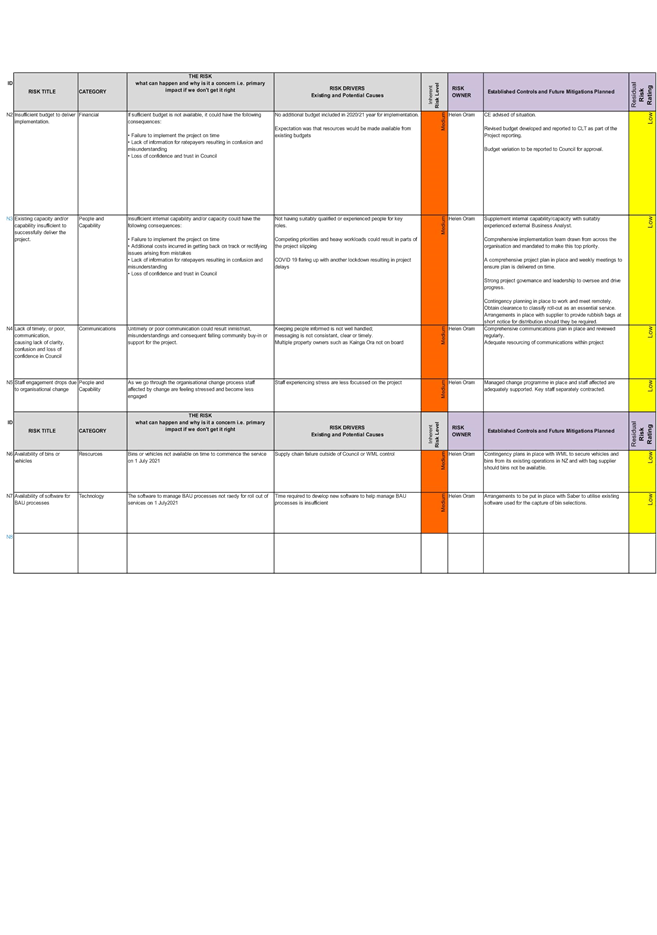

Risks

and issues

3. The following

table outlines the risks and issues, which are reported regularly as part of a

wider project update to the Corporate Leadership Team. The main risk to

the project has been, from the beginning, that of having sufficient resourcing

to have the service up and running within a tight timeframe.

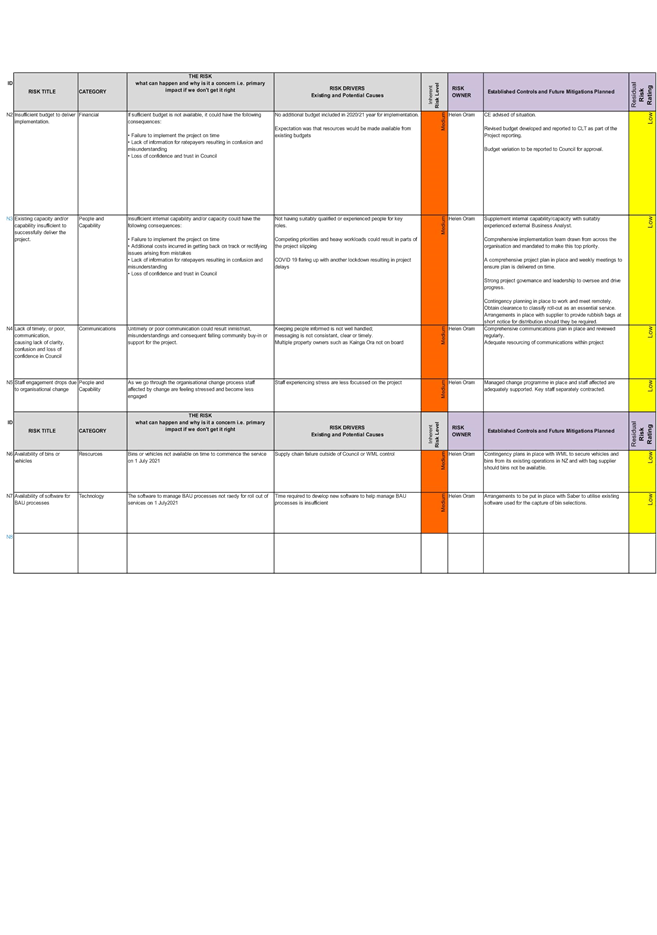

4. A

copy of the Risk Register is attached as Appendix 1 to the report.

|

Risk

|

High,

Med, Low

|

Risk

Mitigation

|

|

COVID-19

resurgance (or other pandemic) resulting in lockdown, restricts ability to

roll-out bins in time for start of service on 1 July.

|

Med

|

Obtain

clearance from MBIE to classify roll out as an essential service to enable

roll-out to commence or continue.

Arrangement

in place with rubbish bag supplier to provide bags at short notice for

distribution throughout the City should they be required.

|

|

Bins or

vehicles not available on time to commence the service on 1 July

|

Low

|

Contingency

plans in place with WML to secure vehicles and bins from its existing

operations in NZ and with bag supplier should bins not be available.

|

|

BAU software

and processes in place on time to commence the service on 1 July

|

Low

|

Arrangements

to be put in place with Saber, used for the initial bin capture process, for

its software to be made available for BAU.

|

|

Issue

|

High,

Med, Low

|

Issue

Mitigation

|

|

Possibility

of misinformation circulated from those with a vested interest.

|

Med

|

Provide

Council and the community with factual independent advice based on the

business case and sound data.

|

|

Increased

opposition to the new services generated through social media and other

means.

|

Med

|

Coordinated

information campaign is in place to ensure reasons for change are clearly

outlined and appropriately socialised.

|

|

Adequate

resourcing required to ensure roll-out occurs on time.

|

Med

|

Additional

people resources, either new or re-prioritised from existing resources,

assigned to the project.

Budget

variation sought.

|

|

Organisational

change programme impacts project through loss of key staff or staff

engagement generally.

|

Med

|

Managed

change programme in place. Key staff separately contracted.

|

|

Three week

delay in delivery of bins

|

Med

|

The

subcontractor Rotaform had built in a six week contingency.

Subsequent

shipments have been re-routed to bypass Auckland.

Additional

staff and resources on board for assembly and delivery.

Working

Saturdays will claw back a week.

|

Climate

Change Impact and Considerations

5. Council’s

decision to opt for a rates funded rubbish and recycling bin service took into

account climate change considerations such as the use of electric vehicles and

reduction in the number of trucks operating the same

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Appendix 1: Kerbside Rubbish and Recycling Risk

Register

|

49

|

Author: Bruce Hodgins

Strategic Advisor

Approved By: Helen Oram

Director Environment and Sustainability

|

Attachment 1

|

Appendix 1: Kerbside Rubbish and Recycling Risk

Register

|

Audit and Risk Subcommittee

Audit and Risk Subcommittee

06 April 2021

File:

(21/564)

Report no:

ARSC2021/2/81

Petone Wharf

Refurbishment Project

Purpose

of Report

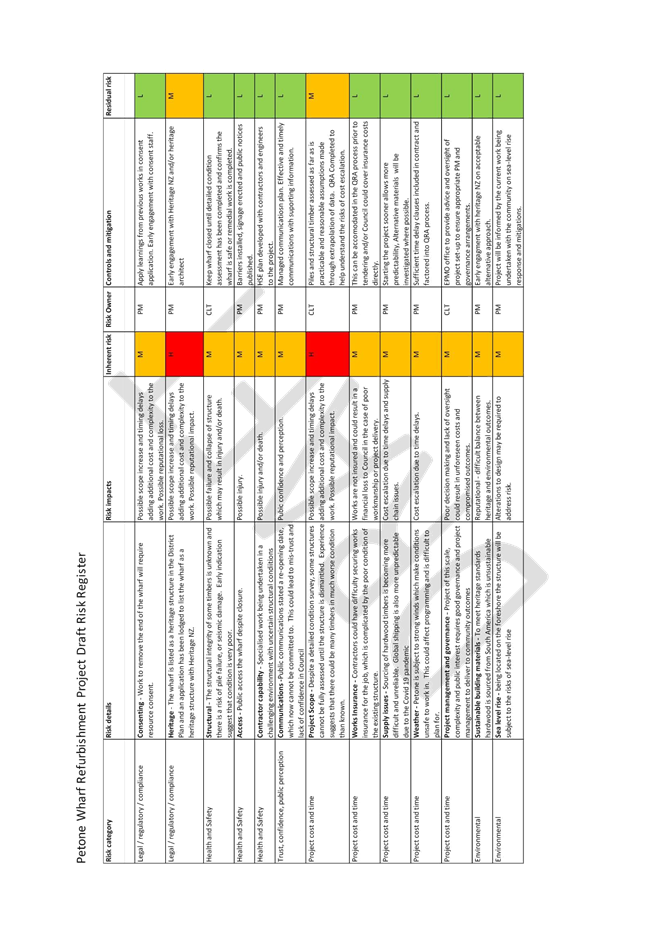

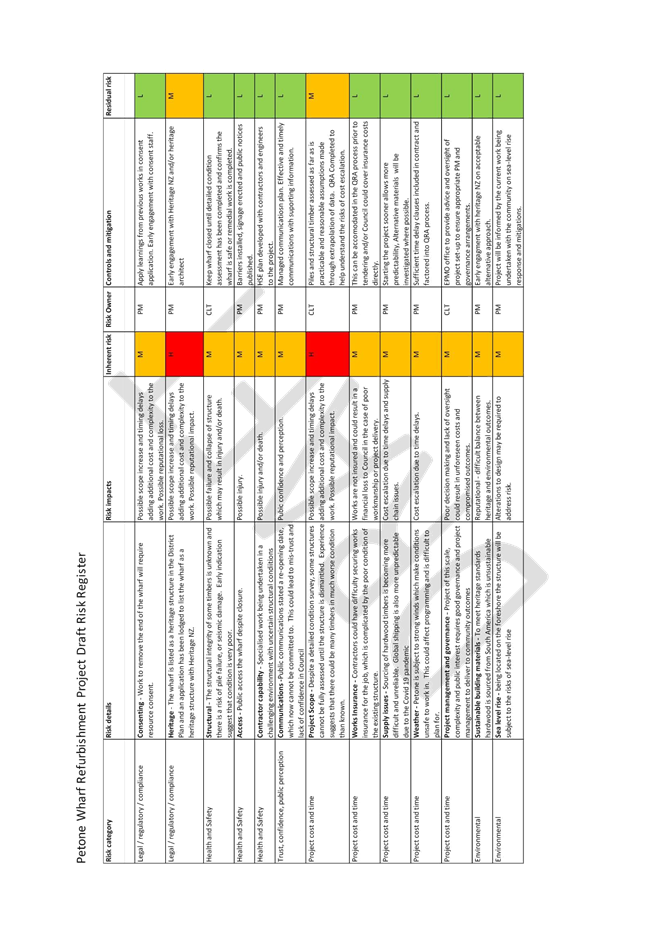

1. The

purpose of this report is to inform the sub-committee on the risk profile of

the proposed Petone Wharf refurbishment project and the way risks are and will

be managed, including lessons learned from previous wharf projects.

|

Recommendations

That the Subcommittee:

(1) notes

and receives the information contained in the report;

(2) notes

the draft Project Risk Register attached as Appendix 1 to the report; and

(3) notes

that a Quantitative Risk Analysis process is being carried out for the

project.

For the reasons to understand

the risks and implications of undertaking this project.

|

Background

2. A

summary history of Petone Wharf is included in a report to the Long Term Plan /

Annual Plan sub-committee meeting held on 10 February 2021 and an update was

presented in a report to the Audit and Risk sub-committee on 25 February

2021. Refer to following links:

http://infocouncil.huttcity.govt.nz/Open/2021/02/LTPAP_10022021_AGN_2879_AT_WEB.htm

http://infocouncil.huttcity.govt.nz/Open/2021/02/ARSC_25022021_AGN_2886_AT_WEB.htm

3. Several

structural piles were damaged during two minor earthquakes in December 2020 and

January 2021, resulting in closure of the wharf to the public and commencement

of emergency works.

4. The

aim of the works was to repair the damage and complete some planned maintenance

work ahead of schedule. This work is now complete.

5. Concurrently

Calibre Consulting Limited (Calibre) has been carrying out a detailed condition

assessment on the structure of Petone and other wharf structures. The

report is due back on 8 April 2021.

6. Preliminary

observations suggest that there are a number of piles on the wharf head that

are in very poor condition and we are likely to receive the recommendation that

the wharf should remain closed until these piles are repaired.

7. The

Council is consulting, through the Long Term Plan (LTP) process, on a

recommendation to bring forward the full refurbishment of Petone Wharf to

address these maintenance concerns in the short term.

Discussion

8. The

Petone Wharf currently poses potential health and safety risks related to the

structural integrity of the piles and supports. This risk is currently being

managed through closure of the wharf, completion of emergency works and

commissioning of a detailed engineering condition survey.

9. The

proposed Petone Wharf refurbishment project holds inherent risks to Council,

most notably that of financial uncertainties and reputational risk. These

are recorded in the table in appendix 1 and discussed in more detail below.

10. Whilst

we are currently undertaking detailed condition assessment of the structural

timbers on Petone Wharf, there is still a lot of work that cannot be identified

until the concrete deck is removed and deck beams are exposed and/or timbers

are dismantled. Damage by Teredo Worm for example impacts on the internal

part of the timber (particularly the piles) and often cannot be seen from the

outside. Internal rotting also can sometimes look solid from the outside

of the timber. This means that there is a high likelihood of structural replacements

needed that cannot be accurately planned for.

11. The

main learning from the Days Bay and Rona Bay refurbishments is to adopt a

‘worst case’ approach in terms of the number of pile and beam

needing replacement. Both Days and Rona Bay projects required a budget

increase, despite a contingency a budget of 25% in the contract, which was due

mainly to an underestimate of the number of piles and beams requiring

replacement. The condition of beams which from the underside looked to be

in reasonable condition but once the deck was removed were found to be in poor

condition in sections on top where rainwater had seeped in from the deck.

12. The

difficulty in assessing the condition of the piles and the delays due to

inclement weather were also factors which contributed to the cost increases.

13. The

total project cost for Rona Bay Wharf refurbishment was $4.2M against a budget

of $3.9M. Total forecasted spend for Days Bay wharf is $4.6M including an

approved budget adjustment of $700,000. The original budget was $3.9M.

14. Calibre

has considered these learnings when assessing the scope of the Petone Wharf

refurbishment for the likely type and quantity of works along with the time

that it will take. In addition Calibre will take a highly conservative

approach to pile upgrades in the knowledge that there is some likelihood of

damage between the high and low water marks to piles due to Teredo worm.

15. Additionally

officers are undertaking a Quantitative Risk Assessment process in order to

provide a ‘worst case’ cost, accommodating all the risk factors and

their likelihood. This process can begin once we have received the

condition assessment and scope of work. This will provide some security

and predictability around these works, reducing the risk factor.

16. While Council will not receive the detailed

condition assessment until April 2021 an initial rough order cost estimate of

$14M has been provided by engineers based on predicted condition and knowledge

from recently completed works. Due to the high level of uncertainty and risk a

budget estimate of $15M to $20M is currently being used for the draft LTP

consultation. An update will be reported to the LTP subcommittee on 20

May 2021.

17. The

other top risks associated with this project are:

a. Health and

Safety – Given the structural uncertainties associated with the wharf

there is the risk of further loss of piles and localised structural

failure. This risk is low and managed through closure of the wharf.

Contractors completing the repairs will set up procedures to keep staff safe

during works, which will be approved by a qualified engineer.

b. Weather –

Petone is subject to strong southerly and north-westerly winds which make

conditions unsafe to work in. This could affect programming and is

difficult to plan for. An assessment of non-work days will be made based

on previous year’s weather information.

c. Supply

– The work is reliant on supply of large hardwood timbers, generally from

South America. These are becoming more difficult to source and questions are

being raised about the ethics and sustainability of this practice. This

will be managed by investigating alternative wood sources, such as Australia

and alternative products including concrete or composite materials.

d. Heritage –

Petone Wharf is a heritage structure under the District Plan and has been

nominated for Heritage status with Heritage New Zealand. This could add a

level of complexity to the project increasing time and costs.

e. Communications

- Previous communication stated a completion date for re-opening. This

commitment cannot now be met and could lead to loss of trust. This is

being managed through a communications plan supported by evidence and

information. This includes early communication to the Chair of the Petone Community

Board and other key stakeholders and signage on-site.

18. If

the project is approved by Council (June 2021) and budget brought forward,

project updates will be provided to the Audit and Risk Sub-committee on project

initiation and then six (6) monthly until completion.

Options

19. There

are no options of this report.

Climate

Change Impact and Considerations

20. The

matters addressed in this report have been considered in accordance with the

process set out in Council’s Climate Change

Considerations Guide.

21. The

proposed project includes sourcing of timbers from South America to meet

heritage requirements which raise sustainability and carbon emissions concerns.

Alternative acceptable materials and or sourcing will be explored during

project initiation.

22. Being

located on the foreshore the project will be subject to sea level rise

considerations which will need to be addressed through project scoping

Consultation

23. In 2017, as part of the annual plan consultation, Council engaged

with the community over the future of all four wharves. Additionally public

meetings were held in Petone and Eastbourne and wider consultation was carried

out. As a result the decision was made to refurbish Petone Wharf, including the

removal of 48m off the outer end. As referenced earlier, the current decision

on the wharf is also included in the draft LTP 2021-24, which is currently

being consulted on.

Legal

Considerations

24. There

are no legal considerations at this time.

Financial

Considerations

25. The following tables set out the proposed

changes to budget for the Petone Wharf Project which is currently being

consulted on.

Table 1: Operational budgets

|

Petone Wharf

|

2020/21

|

2021/22

|

2022/23

|

2023/24

|

2024/25

|

2025-2031

|

Total

|

|

Annual Plan

2020/21

|

|

|

|

|

|

|

$0

|

|

LTP

2021-2031

|

|

$0.5M

|

|

|

|

|

$0.5M

|

|

Variance

|

|

$0.5M

|

|

|

|

|

$0.5M

|

Table 2: Capital budgets

|

Petone Wharf

|

2020/21

|

2021/22

|

2022/23

|

2023/24

|

2024/25

|

2025-2032

|

Total

|

|

Annual Plan

2020/21

|

|

$0.8M

|

$0

|

|

|

$8M

|

$8.8M

|

|

LTP

2021-2031

|

$0.45M

|

$7.05M

|

$7-12M

|

|

|

|

$14.5M-

$19.5M

|

|

Variance

|

$0.45M

|

$6.25M

|

$7-12M

|

|

|

|

$5.7M

- $10.7M

|

26. Updated cost estimates and cost risks will be reported to the LTP/AP

Subcommittee on May 20 once all additional information has been received.

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Appendix 1: Draft Project Risk Register

|

55

|

Author: Janet Lawson

Reserves Asset Manager

Author: Marcus Sherwood

Head of Parks and Recreation

Author: Aaron Marsh

Team Leader Parks

Reviewed By: Jenny Livschitz

Group Chief Financial Officer

Approved By: Andrea Blackshaw

Director Neighbourhoods and Communities

|

Attachment 1

|

Appendix 1: Draft Project Risk Register

|

Audit and Risk Subcommittee

Audit and Risk Subcommittee

09 April 2021

File:

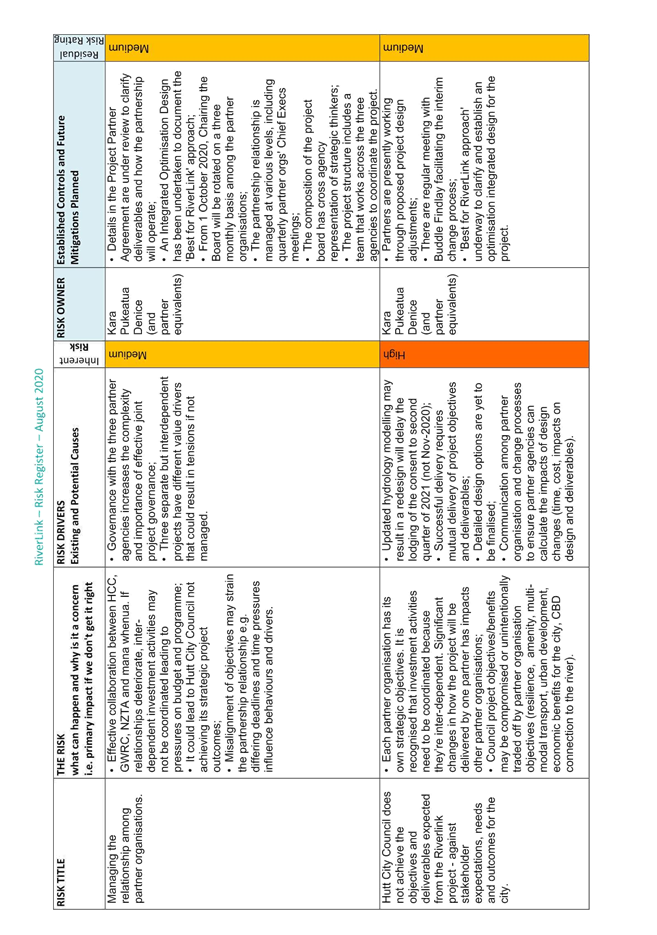

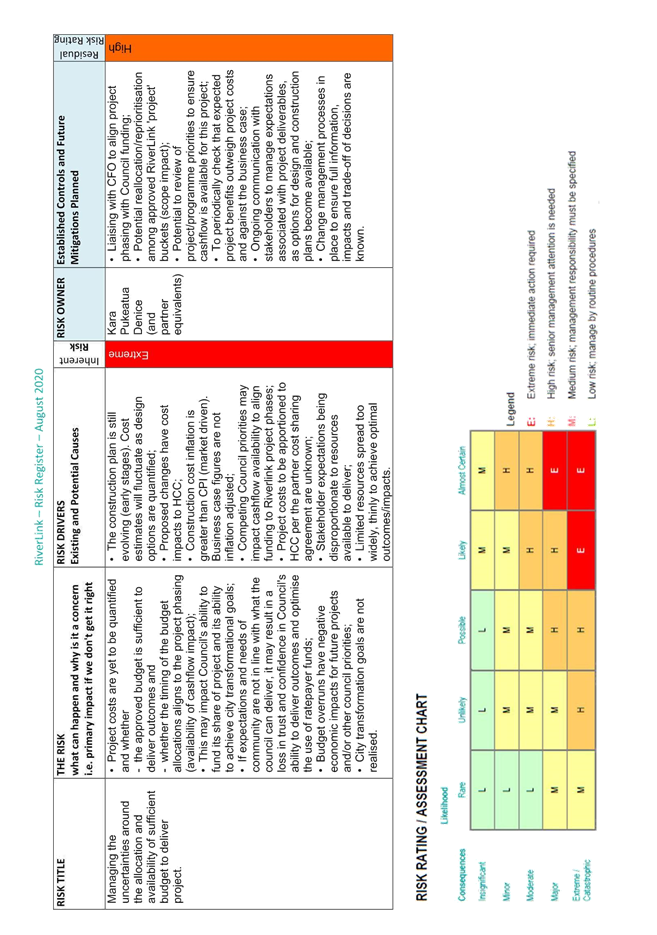

(21/587)

Report no:

ARSC2021/2/82

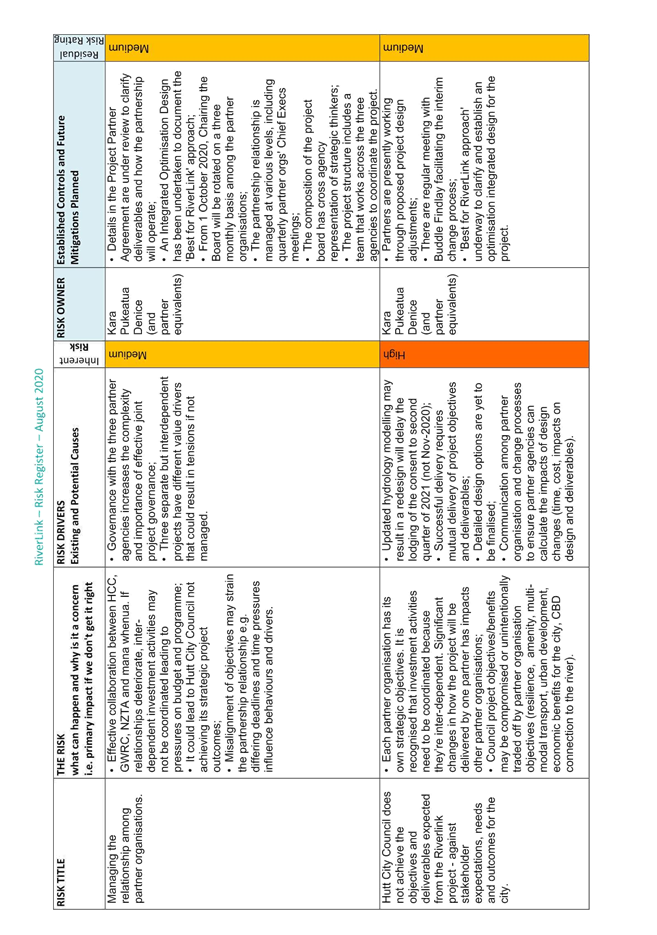

RiverLink Project

Update

Purpose

of Report

1. The

purpose of this report is to update the Subcommittee on the RiverLink Project

(the Project) since the last report dated 5 February 2021.

|

Recommendations

That the Subcommittee:

(1) receives

and notes the information contained in the report;

(2) notes

the updated Project Risk Register attached as Appendix 1 to the report; and

(3) notes

that initial cost estimates for the RiverLink project have been received and

are currently being reviewed by the project office and project partner

representatives

|

Project Update

2. The consultant team have been progressing towards a 31

May 2021 submission date for the resource consent application. There are

some concerns about the quality of the resource consent application. The

consultant team have noted this concern to the RiverLink Project Partner Board

who has agreed to an extended resource consent submission date of 30 June 2021.

3. The extended resource consent submission deadline from

31 May to 30 June 2021 is of low risk to Hutt City Council (HCC). However, Waka

Kotahi has funding and construction deadlines and Greater Wellington Regional

Council (GWRC) has a very strong desire to address the flooding risk to Hutt

City as soon as possible.

4. In considering the extended resource consent

submission deadline the RiverLink Project Partner Board agreed that producing a

high quality resource consent application was priority one as it would mitigate

risks around a protracted approval process.

5. In parallel with finalising the resource consent submission,

other work is required to achieve milestones associated with the delivery of

the Project. All three partner organisations have gaps in their client-side

teams which is making progress on this aspect of the Project slower. This could

compromise the milestones that Waka Kotahi needs to achieve under their New

Zealand Upgrade Programme (NZUP). Funding approvals from the Waka Kotahi Board

is scheduled for late May 2021.

6. The RiverLink Project Partner Board is currently

seeking a Project Director –Delivery to fill this capability and capacity

gap. It is anticipated that the Project Director – Delivery would build a

small team to work in conjunction with project office established for the

consenting phase of the Project.

7. An

independent Quantity Surveyor has been working on cost

estimates for the whole project. These cost estimates and the apportionment

between partners arrived with the project team on 16 and 17 March 2021.

8. The project partners have agreed in principle to a ‘hybrid

alliance’ delivery model for RiverLink. The commercial framework and

memorandum of understanding are currently under development. A workshop with

HCC and GWRC Councillors on the proposed hybrid alliance delivery model took

place in March 2021.

Project Governance

9. The Project

Governance structure is shown on the proceeding page.

10. The Project is overseen by

the RiverLink Project Partner Board which includes two representatives each

from the three partner entities (Greater Wellington Regional Council, Hutt City

Council and Waka Kōtahi New Zealand Transport Agency).

11. The CEO Relationships Board

provides a further layer of oversight for the project and provides a forum for

strategic and relationship matters and issues within each of the respective

organisation to be identified and addressed.

12. The Project

will also be reporting into the recently created internal Hutt City

Council Major Projects Board.

13. A paper will be prepared for

approval by Council which sets out the appropriate project governance process,

delegations and reporting lines as the Project transitions into the delivery

phase.

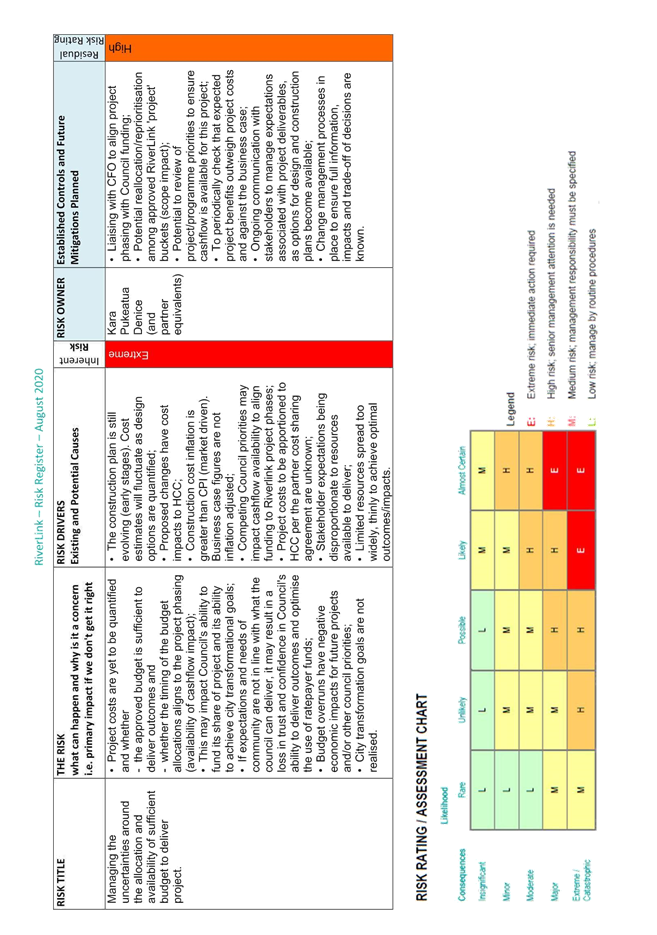

Risk

14. The Project Risk Register is attached as Appendix 1 to the

report and will be updated ahead of the next

subcommittee meeting to align with the project delivery decisions taken. The key risks are as follows:

a. Failure

to meet NZUP milestones compromising Waka Kotahi funding approvals

b. Managing

the relationship among partner organisations

c. Hutt

City Council does not achieve the objectives and deliverables expected from the

Project - against stakeholder expectations, needs and outcomes for the city.

d. Managing

the uncertainties around the allocation and availability of sufficient budget

to deliver project

Project Milestones

|

Milestone

|

Date

|

|

Submission of

resource consent application

* best estimate at this point in time

|

31 May 21 – Delayed to 30 June 2021

|

|

Design/construction contract awarded

|

First quarter 22

|

|

Construction start on site

|

Last quarter 22

|

|

Construction completion (Melling interchange 1st,

followed by stopbanks, landscaping and regeneration)

|

2026-27

|

Financial

Considerations

15. As a part of the 2018-2028

LTP, Council agreed to a budget of $57M (all numbers are inflated) for the

design, consenting and delivery of the RiverLink Project. An increase of $64.5M is being sought as a part of the draft 2021-2031 LTP. This

brings the total budget from $57M to a proposed $121.5M.

16. The

increased capital investment includes:

a. Further

property purchases

b. Upgrades to the

local transport network including connections with Melling Bridge

c. Cost increases

associated with the pedestrian bridge and the river edge / promenade

construction and enhancements

d. Provision of

project contingency

e. Project

delivery costs

17. Co-funding

from Waka Kōtahi (for roading projects) and revenue from the sale of surplus

land in later years is expected to be $27.5M.

18. Table 1

below shows the budget in the draft LTP 2021-2031. The public consultation on

the draft LTP is occurring from 6 April 2021 to 6 May 2021. The final LTP

2021-2031 is scheduled for adoption by the Council on 30 June 2021.

19. In line

with the Council’s Revenue and Financing Policy, Council’s share of the capital expenditure will be funded from

borrowing and rates.

Table 1: 2021/31 Draft LTP Budget

for RiverLink

|

Financial year

$m

|

2020/21

|

2021/22

|

2022/23

|

2023/24

|

2024 /25

|

2025-2031

|

Total

|

|

Draft LTP 2021-2031

|

2.72

|

10.90

|

25.09

|

23.67

|

20.79

|

38.32

|

121.49

|

20. Next steps

for cost estimates:

a. Cost

workshops with the Quantity Surveyor and partner organisations.

b. An

independent expert is to be engaged to review the cost estimates produced by

the Quantity Surveyor.

c. A fully

costed budget plan is likely to be available by early May.

Partners and Stakeholders

21. A high level external

stakeholders and partners list has been developed:

· Partners

o Greater Wellington Regional

Council

o Hutt City Council

o Waka Kōtahi

· Iwi Partners

o Taranaki Whānui

o Ngāti Toa

· Stakeholders

o Waka Kōtahi (co-funding of

specific transport initiatives)

o Residents and business alongside

the river edge

o Hutt City rate payers and

residents

o General public regional/national

o Community boards

o Local Schools

o Media

Climate

Change Impact and Considerations

22. The Project seeks to ensure

greater resilience for Hutt City against flooding and the effects of climate

change. The designs for the Project have taken into account climate change

modelling for the Hutt River / Te Awa Kairangi.

Consultation

23. Extensive community

engagement has been undertaken since 2016 on the Project with open days,

workshops, online and printed media. In November 2020 and February 2021 the

project office undertook open days in order to inform the resource consenting

process. Over 400 people participated in the open days.

24. The request for a further increase

in the RiverLink Project budget (noted at para 15 above) has been included in

the consultation document for the Long Term Plan which commenced on 6 April

2021 and closes on 6 May 2021.

Legal

Considerations

25. The only legal agreement HCC

has entered into is the RiverLink Project Partner Agreement which sets out each

partner’s responsibilities and requirements for the partnership.

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Appendix 1: Riverlink Risk Register - February 2021

|

62

|

Author: Tom Biggin

Project Manager Riverlink

Approved By: Kara Puketapu-Dentice

Director Economy and Development

|

Attachment 1

|

Appendix 1: Riverlink Risk Register - February 2021

|

MEMORANDUM 66 23

April 2021

Our Reference 21/565

Our Reference 21/565

TO: Chair

and Members

Audit and Risk Subcommittee

FROM: Allen

Yip

DATE: 06

April 2021

SUBJECT: Naenae Projects Update April 2021

|

Recommendation

That the Subcommittee receives and notes the information.

|

Purpose

of Memorandum

1. To provide an

update the Subcommittee on the progress and management of the Naenae Project

(pool and town centre development) since the last report on 25 February 2021.

Project Update

2. Following

completion of the Quantitative Risk Analysis, the Long Term Plan Subcommittee

agreed with the Project Board’s recommendation to include the new project

cost estimate of $68M to be included in the draft Long Term plan (LTP), along

with the original $54M option. This is currently out for consultation

with submissions to close in May 2021, and the decisions on the options adopted

will be made in late June 2021.

3. The new project

cost estimate factors in escalating costs in construction resulting from global

supply chain disruption, increased demand for skilled labour, potential site

issues that may be discovered during construction (including allowing for

potential asbestos removal), and the inclusion of improved technology that

would support Council’s sustainability objectives in reducing the

operating costs of the new facility. The original cost estimate would

deliver a pool with lower levels of facility and services.

4. The

project’s focus at this stage is:

a. Project Planning and

documentation

b. Procurement of the

specialist services and demolition contractors

5. The procurement

process for the Multi-Disciplinary Design Team commenced in February 2021, with

an appointment expected in April 2021.

a. This was done by a

selected tender process due to the specialised nature of the project and the

limited number of firms that would meet the qualification standards.

b. We received three very

good quality responses.

c. Following an initial

evaluation all three were interviewed

d. The assessment criteria

included:

i. Methodology

ii. Capability &

Capacity

iii. Innovation &

Sustainability

iv. Price

e. Following this

process, we have been able to identify a preferred respondent.

Negotiations are currently underway, but expect to conclude by the mid-April

2021, with an appointment able to be announced by the end of the April 2021.

6. Other

project procurement activities include:

a. Appointment of a

Heritage Architect (Ian Bowman)

b. Invitations for

Registrations of Interest for Quantity Surveyor

c. Invitations for Requests

for Proposal for Asbestos Survey

d. Advance Notice for

Demolition Contractors issued to market

7. The project team

are looking to programme physical works on site, the first being the relocation

of an electricity substation that is currently housed within the pool.

This substation services the pool and Hillary Court. It must be moved

before the main demolition work commences. The project team and

Wellington Electricity are working together to progress this.

8. The Crown

Infrastructure Partners (CIP) co-funding of $27M creates some obligations from

the project, including monthly reporting and meeting our agreed

timelines. The monthly reports are being submitted on time. And

while we are experiencing delays in the timelines, we are in constant

communication with CIP about this, and demonstrating to them that we are making

progress.

9. The Naenae

Community Advisory Group (CAG) held its initiation meeting on 11 March 2021.

The group were given an update on the project, and discussed and agreed on some

aspects of how they will operate. The next meeting (date TBC) will focus

on prioritising the recommended work programme for the spatial plan.

Financial considerations

10. The Long Term Plan

Subcommittee noted that the Project Board’s preferred option was for a

capital investment cost of $68M for Naenae Pool. However this will not be

confirmed as the project budget until the conclusion of the LTP consultation

process.

11. The project budget has a

significant influence on the design process, so this this uncertainty will be factored

in when the design process commences in late April 2021.

Risk

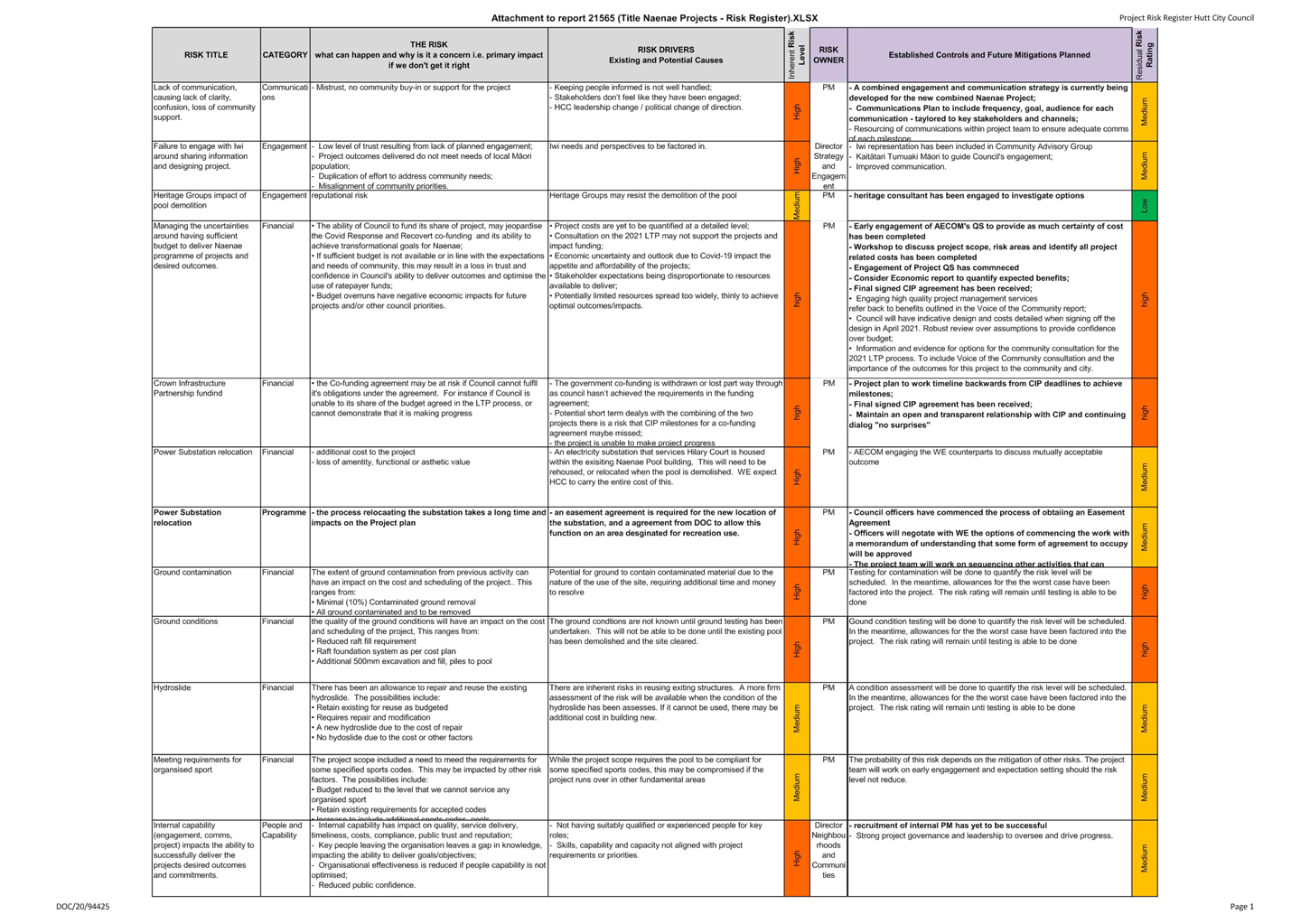

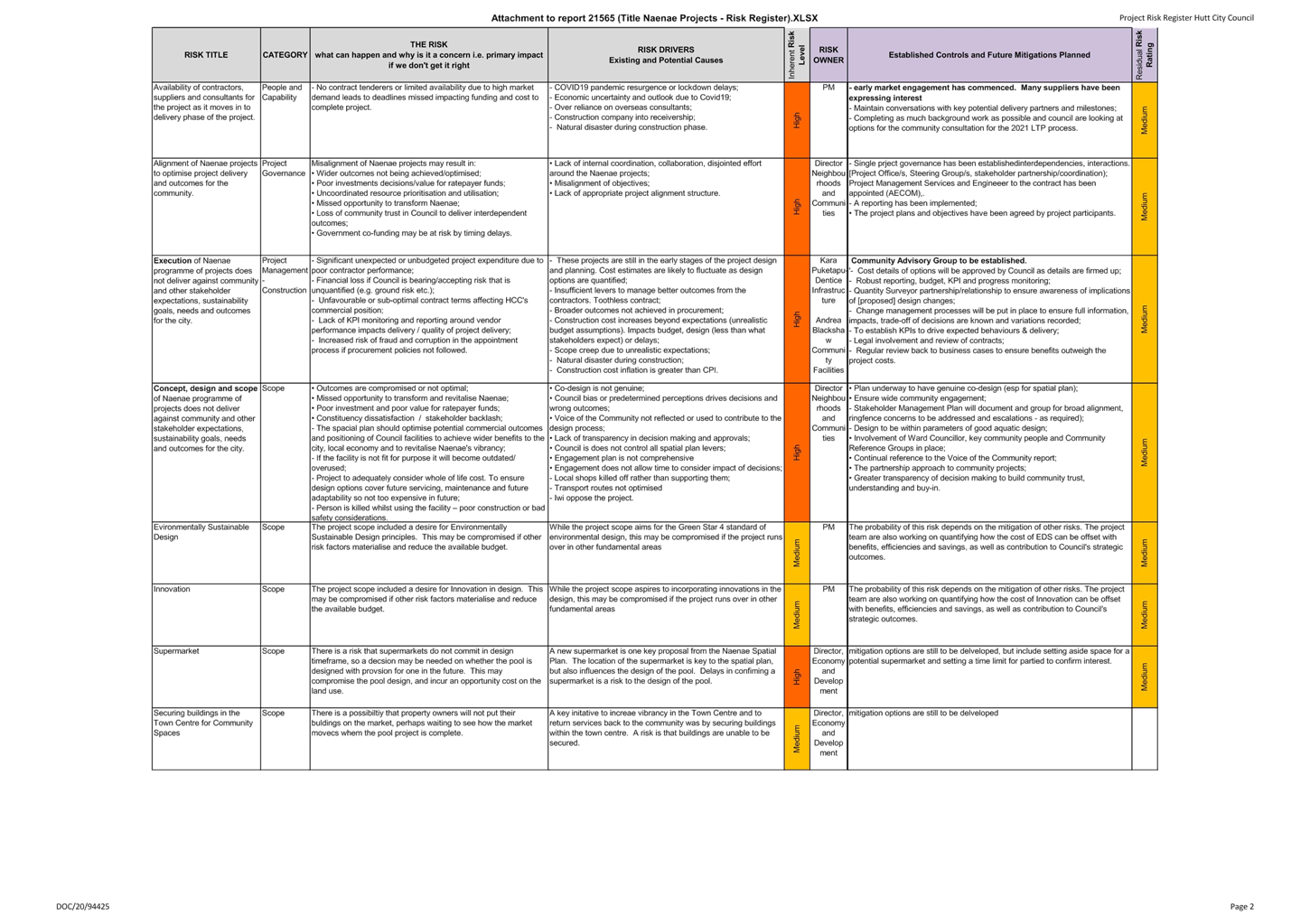

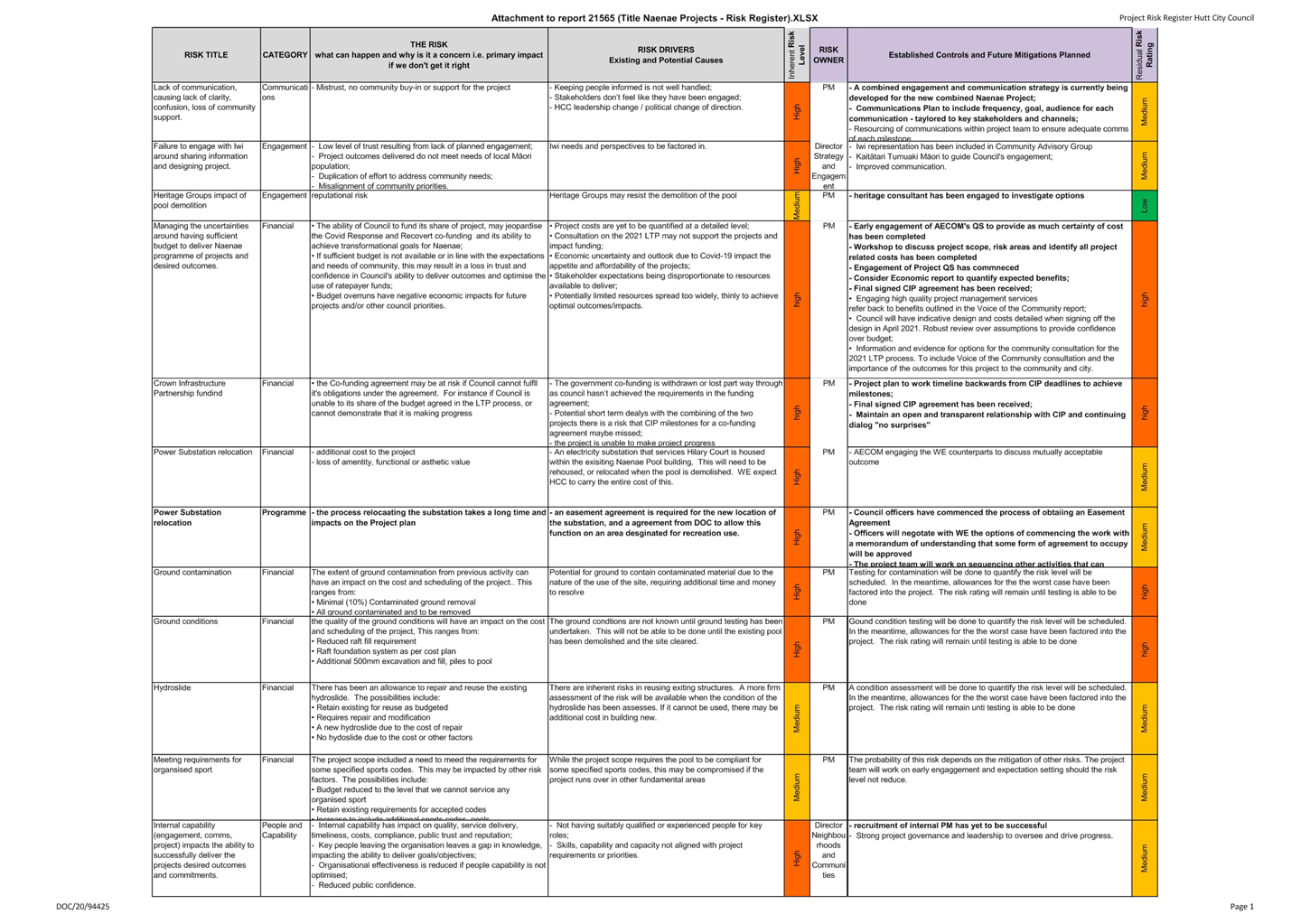

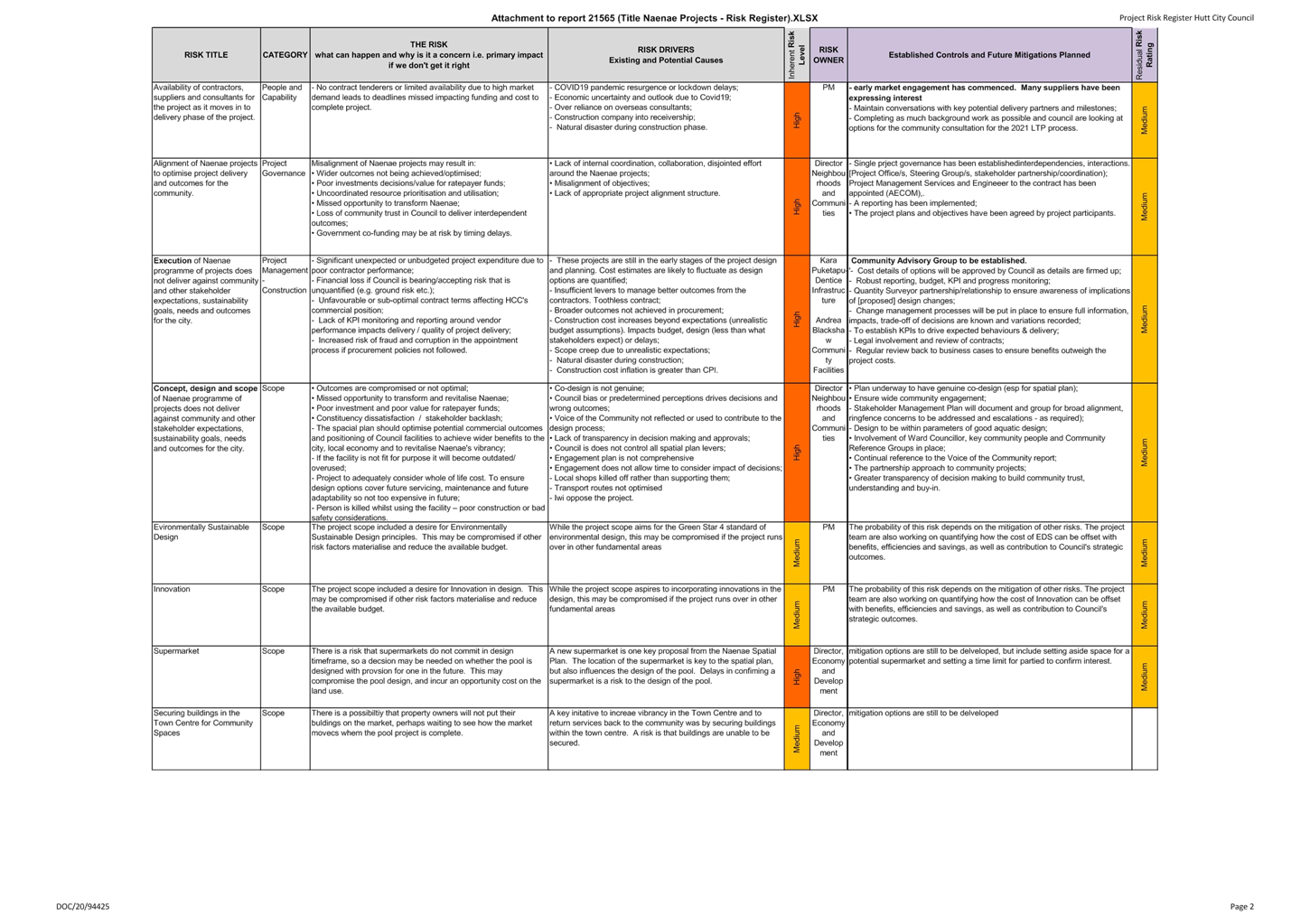

12. The updated Project Risk

Register is attached as Appendix 1 to the report.

The key risks at this stage are:

a. While

the project budget will be certain when the LTP consultation process is

complete, the uncertainty around project cost will remain. The risk

will be reviewed as each new phase of the project brings more certainty.

b. Uncertainty about ground conditions and

contamination, which will not be known until testing is able to be done. The

project team has prioritised the demolition which will allow the testing.

The risk based approach to costing will ensure sufficient provision to address

this.

13. A risk workshop was scheduled

to be held on 15 April, which signifies the commencement of the first design

phase. This will be run by AECOM (project managers and engineers to the

project) and include Council officers.

Climate Change Impact and

Considerations

14. The matters addressed in this

report have been considered in accordance with the process set out in

Council’s Climate Change Considerations Guide.

15. While all Council projects

will be delivered in a way that supports Council’s Guidelines, the cost

option chosen may have an impact on the actual Environmentally Sustainable

Design and Innovation options.

16. Sustainability and impact on

the environment will be a key driver in the design process.

Consultation

17. The two investment options

for the project are part of the LTP consultation process.

Legal Considerations

18. At the conclusion of the Long

Term Plan process the Project Board will seek delegated authority to make

project decisions that are within the agreed project budget and scope.

19. Where decisions are required

outside this, the Board will report to the Communities Committee and on risks

to the Audit and Risk Subcommittee.

Appendices

|

No.

|

Title

|

Page

|

|

1⇩

|

Appendix 1: Naenae Projects - Risk Register

|

67

|

Author: Allen

Yip

Strategic Projects Manager

Approved By: Andrea Blackshaw

Director Neighbourhoods and Communities

|

Attachment 1

|

Appendix 1: Naenae Projects - Risk Register

|

Audit and Risk Subcommittee

Audit and Risk Subcommittee

01 April 2021

File:

(21/560)

Report no:

ARSC2021/2/83

External Audit Update

- Hutt City Council

Purpose

of Report

1. To provide an

update on the Audit NZ management report on the audit for the Group Annual

Report 2019/20.

2. To provide an

update on the Audit NZ management report on the audit of the Long Term Plan

2021-2031.

3. The Audit New

Zealand Audit Director will attend the Subcommittee meeting.

|

Recommendations

That the Subcommittee:

(1) notes

the Audit New Zealand management report on the audit of the Group Annual

Report for the year ended 30 June 2020, attached as Appendix 1 to the report;

and

(2)

notes the Audit NZ management report on the audit of the Long Term

Plan 2021-2031, attached as Appendix 3 to the report.

|

Update on the audit of the Group

Annual Report 2019/20

4. The Group Annual

Report 2019/20 was finalised and adopted by Council on 21 December 2020 and the

Audit NZ audit opinion issued. This was ahead of the statutory deadline of 31

December 2020.

5. There were audit

issues and delays in finalising the Wellington Water Ltd audit which impacted

all shareholder Council’s in the Wellington region. This was largely in

relation to Wellington Water performance reporting information.

6. Whilst an

unmodified audit opinion was issued on the Hutt City Council (HCC) financial

statements, there was a modified opinion issued on certain performance

information relating to the Department of Internal Affairs mandatory

performance measures for Council’s water activities. This was due to

significant issues identified with the Wellington Water underlying systems and

information.

7. An improvement

plan has been developed by Wellington Water to address these matters, with

implementation underway in 2020/21. It is expected the audit issues will not

however be fully resolved before 30 June 2021. As a result the Hutt City

Council audit opinion is expected to be impacted in a similar manner. Officers

are working proactively with Wellington Water and Audit NZ to plan ahead for

the next audit and manage the risks related to the performance reporting

issues. It is important to note that this impacts all Wellington Water

shareholder Councils.

8. The Audit NZ

interim management report for the year ended 30 June 2020 was reported to the

Audit and Risk Subcommittee on the 17 September 2020. It was noted in the

report that there had been good progress achieved in closing out long-standing

audit recommendations. The table that follows provides a summary of all the

items reported as closed.

Table 1: Summary of audit recommendations previously

closed out

|

|

Audit

NZ recommendation

|

First

raised by ANZ

|

Date

reported as closed per ANZ

|

|

1.

|

Information

and communications Technology Policies require review

|

2016/17

|

Dec

2019

|

|

2.

|

Lack

of formal documentation of cost allocation percentages

|

2016/17

|

Dec

2019

|

|

3.

|

Revenue

from the pools and Dowse – reconciliation process

|

2015/16

|

Dec

2019

|

|

4.

|

Creditor

and payroll Masterfile changes

|

2018/19

|

July

2020

|

|

5.

|

Process

for reviewing policies

|

2017/18

|

July

2020

|

|

6.

|

Annual

review of network access rights not performed

|

2016/17

|

July

2020

|

|

7.

|

Financial

delegations policy and related controls

|

2015/16

|

July

2020

|

|

8.

|

Property,

plant and equipment – policy and procedure improvements

|

2014/15

|

July

2020

|

9. The final Audit NZ

management report for the Group Annual Report 2019/20 was received by HCC on 14

April 2021. A summary of the audit findings are presented in table 2 that

follows. Table 3 provides information on audit recommendations that were closed

out through the final audit process. The full detailed report is available in

Appendix 1.

Table 2: Summary of audit recommendations after final audit

|

Improvement

recommendation by category

|

Number

|

Commentary

|

|

In progress to be implemented/ resolved

|

1

|

Network and payroll passwords settings can be

improved

|

|

Limited progress in addressing

|

2

|

IT Disaster Recovery Plans require testing. High

level of manual adjustments in reporting “number of new

dwellings”.

|

|

New recommendations

|

3

|

Wellington Water performance reporting issues.

Non-compliance with mandatory performance measure guidance. Approval of the

Chief Executive’s and Mayor’s expenditure.

|

|

Total

|

6

|

|

Table 3:

Summary of audit recommendations closed out at final audit

|

|

Audit

NZ recommendation

|

First

raised by ANZ

|

Date

reported as closed per ANZ

|

|

1.

|

Accuracy

and reliability of Rating Information Database data

|

2018/19

|

Apr

2021

|

|

2.

|

Performance

reporting source of information not disclosed appropriately

|

2018/19

|

Apr

2021

|

|

3.

|

Outdated

Procurement Policy

|

2017/18

|

Apr

2021

|

|

4.

|

Sensitive

expenditure

|

2016/17

|

Apr

2021

|

|

5.

|

Independent

review of journals

|

2015/16

|

Apr

2021

|

|

6.

|

Documented

procedures for key systems

|

2014/15

|

April

2021

|

10. Approval of the Chief

Executive’s and Mayor’s expenditure: The audit report comments that

the Council “should consider the appropriateness of the current

approval process and consider updating the process to include the Mayor’s

expenditure being approved by the independent Chair of the Audit and Risk

Committee”. Officers can confirm that this audit recommendation has

been agreed to and is now in place.

Update on the audit of the Long Term

Plan 2021-2031(LTP)

11. The engagement letter for the

audit of the consultation document and Long Term Plan 2021-2031 was reported to

the Audit and Risk Subcommittee on 25 February 2021. The audit plan noted that

the main focus areas for the audit include:

o Impact

of the economic downturn caused by Covid-19 on Council’s forecasts

o Financial

strategy and infrastructure strategy

o Assumptions

o Quality

of asset-related forecasting information.

12. The first stage of the audit

was successfully completed and the audit opinion issued on the 31 March 2021.

The next stage of the audit will be completed in June 2021 when the final LTP

Council decisions are progressed and the LTP adopted. The Audit NZ

management report on the first stage of the audit is attached as Appendix

3.

13. An unmodified audit report

was issued by Audit NZ. There were three emphasis of matter paragraphs in the

audit report drawing attention to the disclosure in the Consultation Document

(CD) on the following:

1. Uncertainty over three

waters reforms (all councils across New Zealand received this audit point )

2. Uncertainty over the

delivery of the capital programme (many councils across New Zealand received

this audit point)

3. Uncertainty over the

three waters forecasts (all Wellington Water shareholder councils were impacted

by this audit point).

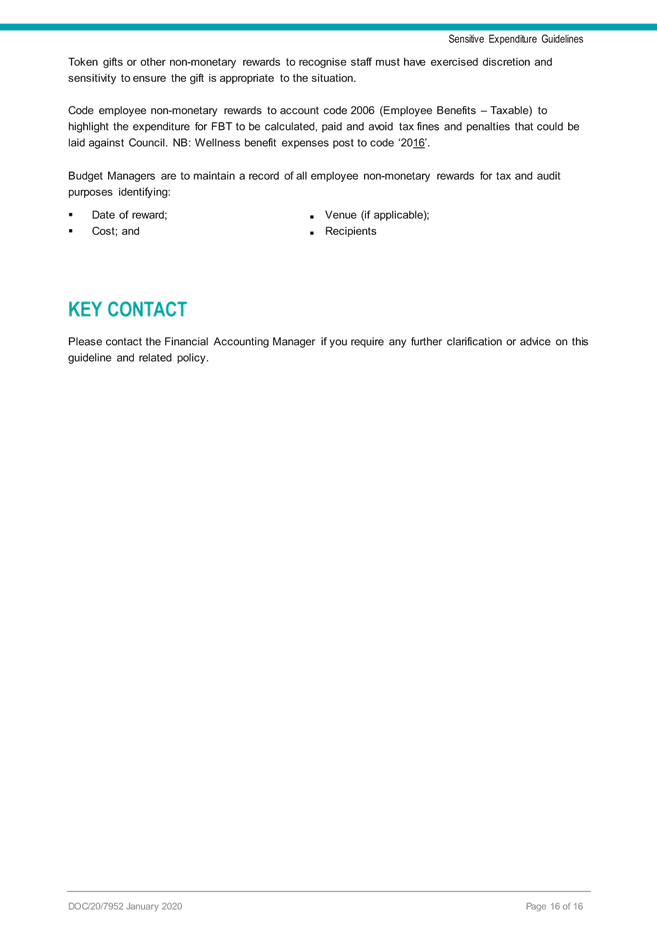

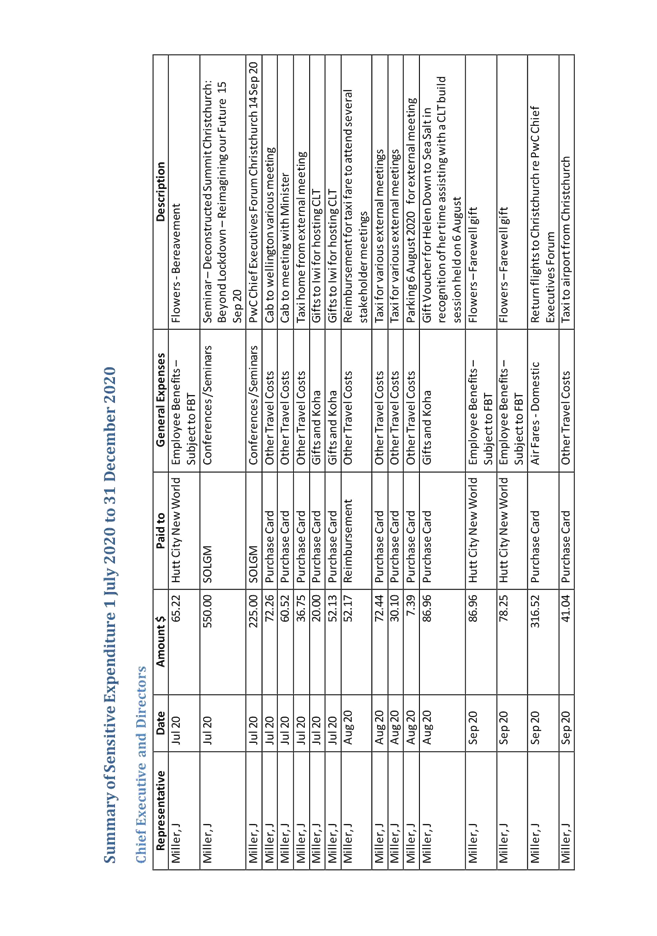

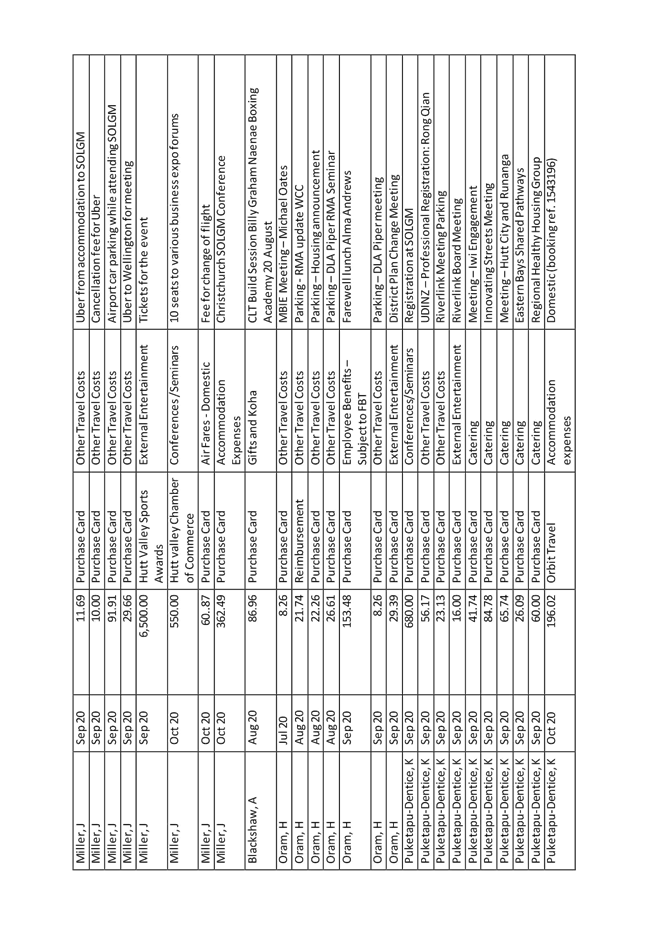

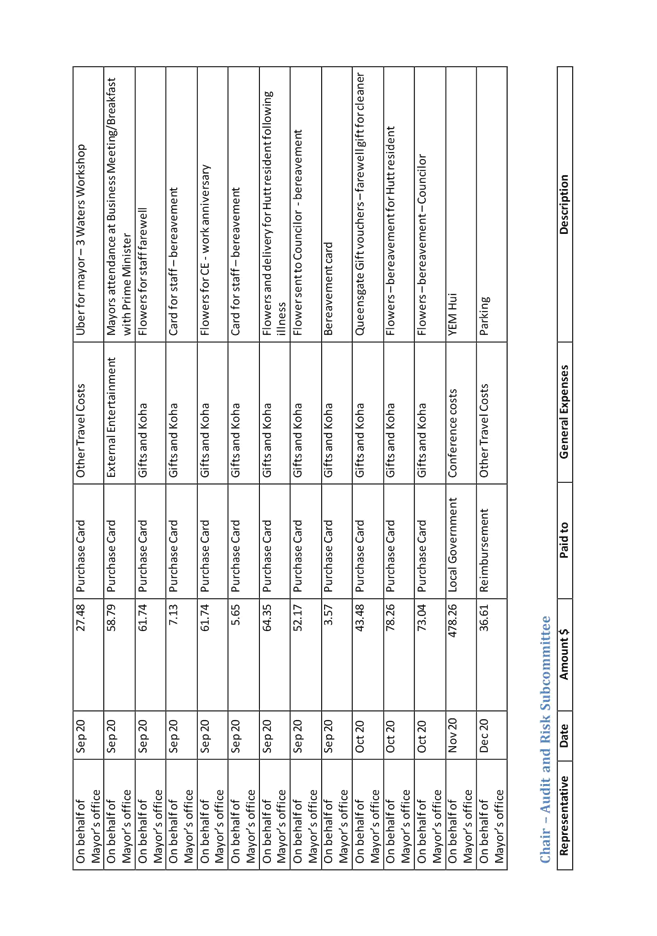

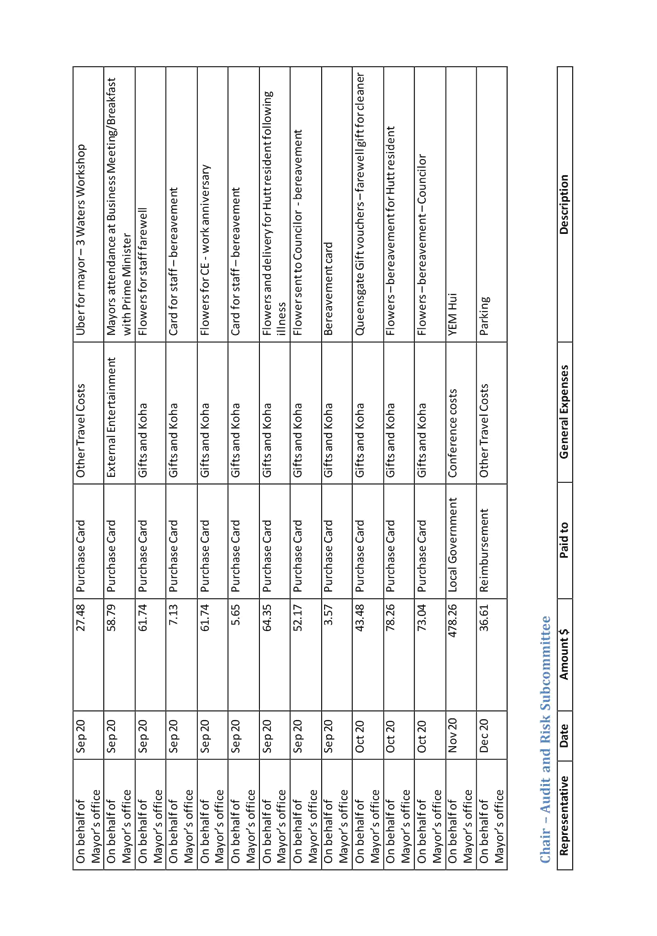

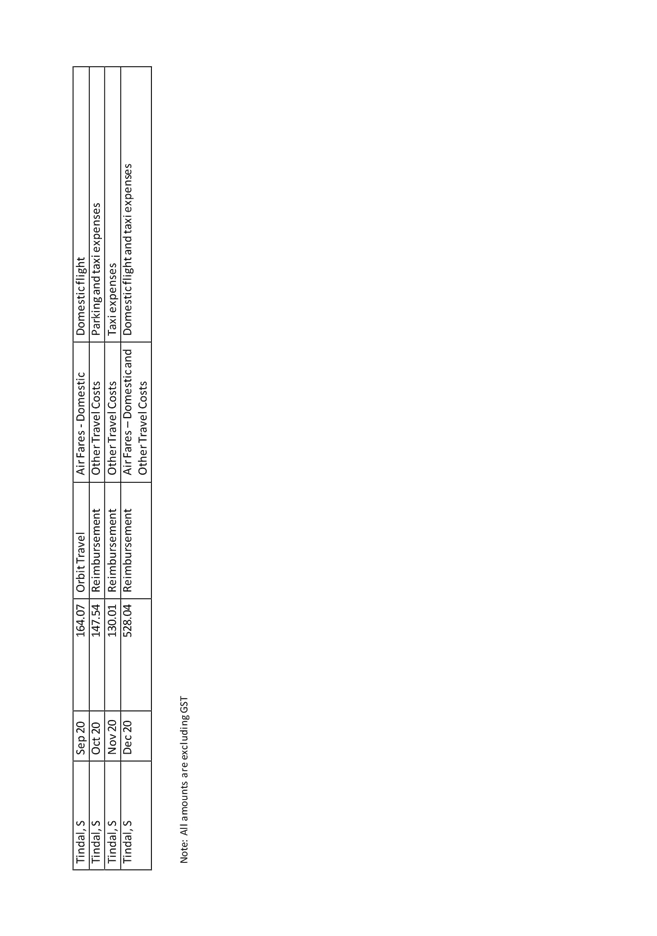

14. There is a range of positive